The webinar on Prioritizing AML/CFT Training held on February 3rd 2021 was the first of the 2021 Webinar Series jointly organized by the Asian Bankers Association and Fintelekt Advisory Services, Ltd..

With more than 450 participants from all over Asia and beyond, the webinar was moderated by Arpita Bedekar, Director – Strategy and Planning, Fintelekt Advisory Services and featured as speakers Sarwar MAQ Chowdhury, Independent Consultant from Bangladesh, Kevin Gomez, Head – AML/KYC and MLRO, IDFC First Bank India, and Shirish Pathak, Managing Director, Fintelekt Advisory Services.

Fintelekt-ABA Webinar on Prioritizing AML/CFT Training: Key Takeaways

The speakers discussed means and techniques to provide effective and relevant AML training across the organisation, meeting regulatory expectations and demonstrating a compliance culture, evolution of the AML compliance profession and future roadmap, and issues around talent management and expanding the resource pool.

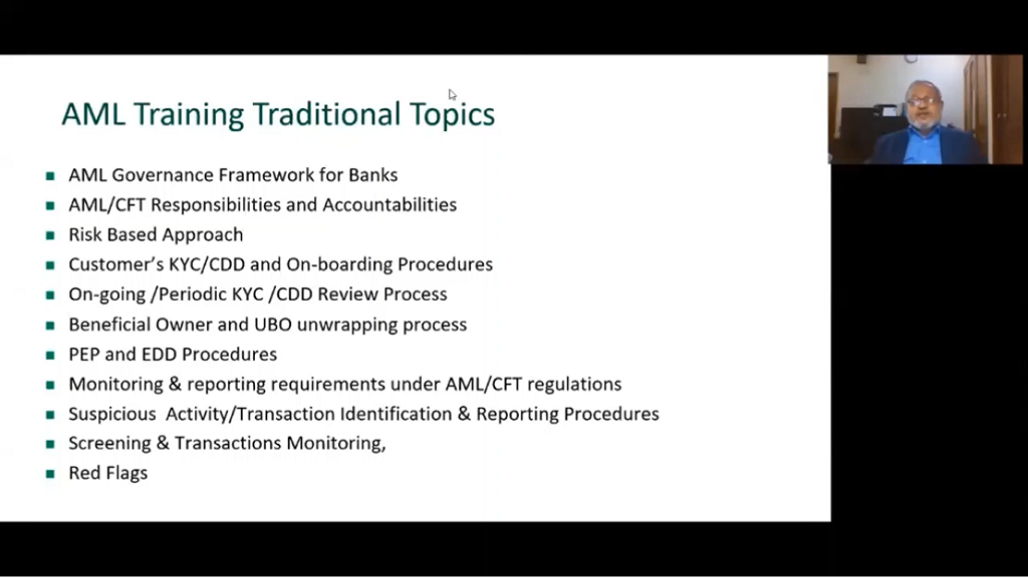

(1) The highlights from Chowdhury MAQ Sarwar’s presentation on Effective & Relevant AML Training Across the Organization were as follows:

- Proper AML training not only needs to be comprehensive, up-to-date, and participatory, but also needs to be performed regularly for every single employee having an AML role not just customer facing employees.

- While a large population of employees need AML training, curriculum should be tailor made to develop the essential skills necessary to perform different roles in the front, middle and back offices.

- AML training should be relevant to the actual issues and pain points which that particular institution is experiencing.

- The training should cover all aspects including what to do once potentially suspicious or illegal activity is identified, who is responsible for what within the institution, what should be recorded, and consequences for non-compliance and potential penalties.

- To make training more effective, the use of technology, small discussion groups of trainers, visual information such as videos and other graphical representations is recommended.

“Changing the tick box attitude of having everyone successfully completing AML training needs to change to making trainees believe it is of benefit to them and that it will make their jobs easier and more productive.” – Chowdhury MAQ Sarwar

(2) Kevin Gomez, Head – AML/KYC and MLRO, IDFC First Bank spoke on Prioritizing AML Training and emphasized that a lack of AML training and enforcement failures result in monetary fines/ penalties as well as reputational/operational/legal damage.

- Training should be provided at all levels, including not only the three lines of defense but also to board members, executive directors, external consultants, or contractors.

- AML training challenges that organisations face include churn or attrition, differing audiences and training needs across the organisation, the need for systematic record keeping and providing management information, low attention spans of learners, and cost constraints. The Covid-19 pandemic has further brought in challenges due to the lack of face-to-face contact.

- Multiple types of training methods must be employed to improve learning, retention and facilitate exchange of ideas – such as online, in-house, external, on-the-job, through the use of informational material, at the time of induction, etc.

- Training content should include the vulnerabilities, ML/FT typologies (i.e. methods, trends and techniques), red flag indicators & sanitized case studies and be presented using innovative methods that include the use of infographics, videos and doodles.

“To put in place a top-down approach, there needs to be a culture built into the system whereby organisations are able to acknowledge and recognize the need for AML/CFT compliance.” – Kevin Gomez

(3) Shirish Pathak, Managing Director, Fintelekt Advisory Services made a presentation on the Evolving Role of the Compliance Professional.

- Shirish spoke about the approaches that regulators internationally and at a country level are taking including mandating enterprise-wide AML/CFT risk assessments, a higher focus on beneficial ownership norms, higher scrutiny of trade transactions, a move towards non face-to-face KYC and due diligence, countering cyber fraud and cryptocurrency risks, and an increasing focus on fighting trafficking in humans and wildlife/environment products.

- In this dynamic environment, compliance professionals need to continuously develop their ability to deal with uncertainty and at the same time acknowledge and accept that their own role is changing.

- Compliance professionals need to view the bigger picture and understand and implement controls and measures not just across various functions and departments within the bank, but also factor in a deep understanding of risks across the entire supply chain of third parties that the bank associates with, in terms of customers, correspondent banks, and sources of capital.

- It is advisable to implement a strong and demonstrable training program across all levels within the institution proactively, and not wait until the regulator slaps a penalty on the institution.

- Continuous, practical, peer-generated and role-specific learning which is provided to employees all across the organisation will be the key to minimizing AML/CFT risks.

“If you work at an under-supervised or under-trained institution and are happy with that, think again – your institution is probably already a target for money launderers and criminals – and you are therefore at significant risk. Now is the time that you implement robust AML/CFT measures, including training!” – Shirish Pathak

(4) Launch of the AML/CFT Learning Platform at the Fintelekt Academy

During the webinar, Fintelekt announced the launch of its new AML/CFT learning platform – Fintelekt Academy – with an aim to truly democratise AML/CFT learning and continually serve the global compliance community with AML/CFT content across the spectrum of the discipline.

Registration on Fintelekt Academy is free and more than 80% of the content is free to view. Visit https://fintelekt.academy/register/

(5) Webinar’s video, presentation files and Certificate of Participation

We would like to share with all registered participants the following resources presented during the session:

Webinar’s video and presentation files:

The recording of the webinar and the slides are available at the Fintelekt’s new learning platform Fintelekt Academy (www.Fintelekt.academy) upon completing a FREE registration.

Participation Certificates:

Participation Certificates are available to participants who upgrade to Premium membership on Fintelekt Academy upon completion of a multiple-choice assessment.

Paid membership on the learning platform will be available to ABA members for US$95 annual subscription – representing a 24% discount from the standard annual subscription of US$125 for ABA non-members.

Paid members of the Fintelekt Academy can also apply for Certificates of Participation in future Fintelekt-ABA webinars, at NO EXTRA COST for one year.

Leave a Reply