The Asian Bankers Association (ABA) and LexisNexis Risk Solutions, an ABA Associate Member, held a very successful webinar on Evolving Online Fraud: Insights from the APAC Cybercrime Report on 27 June 2025 that gathered over 480 registrants from 32 countries and regions.

The Asian Bankers Association (ABA) and LexisNexis Risk Solutions, an ABA Associate Member, held a very successful webinar on Evolving Online Fraud: Insights from the APAC Cybercrime Report on 27 June 2025 that gathered over 480 registrants from 32 countries and regions.

Moderated by ABA Deputy Secretary Mig Moreno, the session featured Thanh Tai Vo, Director of Market Planning for Fraud & Identity (APAC), who presented findings from the APAC Cybercrime Report. The discussion later expanded into a panel joined by Konstantin Poptodorov (LexisNexis, ANZ) and Paul Warrant-Tape (IDVerse), offering diverse perspectives on digital fraud prevention and regional developments.

Hereunder is a summary of the session:

SUMMARY

(1) Thanh Tai Vo’s presentation

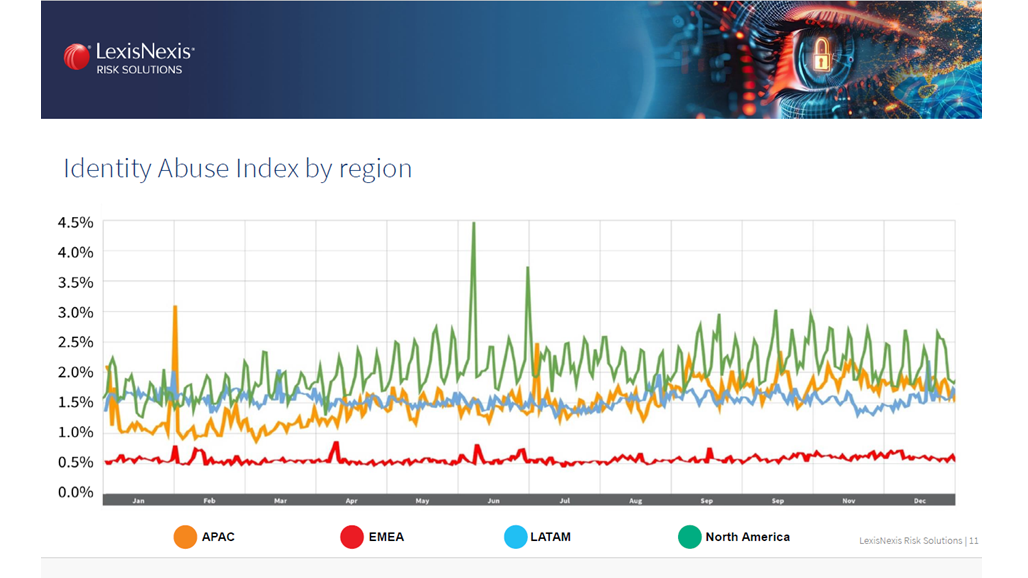

Thanh Tai Vo opened with a deep dive into the evolving fraud landscape, highlighting insights drawn from over 104 billion global transactions in 2024. He revealed that while fraud attack rates appeared to stabilize in some areas, fraudsters are adapting quickly—especially by using generative AI in new account fraud and scams.

The data indicate a shift in fraud tactics, with mobile channels being a primary vector, particularly through mobile apps and browsers, which remain the most exploited platforms for attacks.

Vo emphasized that APAC remains a hotbed for sophisticated scams, including authorized payment fraud, investment scams, and AI-driven deepfake attacks. Countries like Japan, Singapore, Hong Kong, and Australia are witnessing rising fraud rates, with local nuances such as impersonation scams in Japan and social engineering scams in Singapore.

He pointed out that inconsistencies in fraud definitions across jurisdictions complicate accurate classification and prevention strategies in the region. He also discussed how layered, adaptive fraud prevention mechanisms are more effective, citing a case where real-time fraud detection successfully blocked a series of fraudulent crypto transactions without disrupting legitimate customer behavior.

Vo stressed the importance of connecting transaction patterns with digital intelligence to identify both known and emerging fraud threats. AI tools, behavioral biometrics, and coordinated efforts across sectors were highlighted as crucial to this defense.

In conclusion, the session underlined that technology alone is not sufficient. Instead, a multi-pronged approach involving regulation, cross-industry collaboration, and public education is vital. As AI and cybercrime-as-a-service continue to evolve, organizations must ensure that their defenses are not only reactive but proactive, intelligent, and scalable across the digital ecosystem.

Key Takeaways:

- Fraudsters are leveraging AI and deepfake technologies to bypass identity checks and simulate legitimate activity, especially in new account origination.

- Mobile platforms remain the most exploited channels for attacks, requiring more robust risk assessments and layered fraud prevention strategies.

- Regulatory and institutional collaboration, coupled with public education, is essential to tackle the growing threat of authorized payment scams and digital impersonation.

(2) Panel discussion

The panel discussion opened with Paul Warren-Tape highlighting the accelerating threat landscape due to generative AI. He emphasized the growing accessibility of tools that enable criminals to fabricate convincing identity documents and deepfakes. With fraudulent artifacts becoming cheaper and easier to produce, Paul warned that banks must adopt sophisticated document verification and biometric technologies early in the onboarding process to prevent cybercriminals from entering financial ecosystems.

Vo and Paul continued by discussing the double-edged nature of AI, which benefits both fraudsters and defenders. Paul stressed that cybercriminals exploit their regulatory freedom and speed, while financial institutions are slowed down by compliance hurdles.

He called for urgent awareness-building and faster deployment of anti-fraud technologies. Tai Vo added that effective fraud prevention must be multilayered—considering device behavior, user stress patterns, and real-time detection of known fraudulent identities.

Konstantin Poptodorov elaborated on Australia’s relatively lower fraud rates in APAC, attributing this to its advanced legislative framework—especially the mandatory scam codes targeting telcos, social media, and banks. However, he acknowledged that like most of APAC, Australia still lacks mandatory strong authentication for online payments.

On liability models, he noted that Australia is unlikely to adopt the U.K.'s reimbursement approach anytime soon, preferring institutional accountability through regulatory compliance instead.

Paul and Konstantin then analyzed why APAC is such a lucrative region for fraud: high digital connectivity, large transaction values, high trust in digital platforms, and fast-paced consumer behavior. All these factors create fertile ground for cybercrime. They stressed that fraud prevention must begin well before a transaction occurs, covering all customer entry points and behavioral cues to catch anomalies.

As the session closed, panelists emphasized cross-sector collaboration, real-time intelligence sharing, ethical AI usage, and the cultural shift needed inside financial institutions. They rejected the idea of tolerating fraud as a cost of doing business, warning that the human impact on victims is often underestimated. Thanh Tai Vo’s closing advice: be skeptical online, verify independently, and think before clicking.

Key Takeaways:

- Deepfakes and AI-powered fraud are rising rapidly, now accounting for over 60% of digital fraud attempts.

- Multilayered fraud prevention, including behavioral analysis and real-time data intelligence, is essential.

- Banks must shift culturally, technologically, and operationally to remain ahead of cybercriminals and adapt to evolving threats.

ABA members received the presentation file and the LexisNexis® Risk Solutions APAC Cybercrime Report.

The video recording of the webinar is available at the ABA YouTube channel HERE.