The Asian Bankers Association (ABA) and LexisNexis Risk Solutions, an ABA Associate Member, would like to thank you for participating in the webinar on “Bringing Certainty to Cross-Border Payments Screening” held on 7 October 2025. The webinar gathered 289 registrants from 35 countries.

The Asian Bankers Association (ABA) and LexisNexis Risk Solutions, an ABA Associate Member, would like to thank you for participating in the webinar on “Bringing Certainty to Cross-Border Payments Screening” held on 7 October 2025. The webinar gathered 289 registrants from 35 countries.

The 60-minute session featured Rohit Mittal, Director, Market Planning, Financial Crime Compliance at LexisNexis® Risk Solutions who discussed cross-border issues affecting banks. The discussion later expanded into a panel joined by Michael P. Magbanua, Senior Vice-President and Group Head, Corporate and Digital Operations at Union Bank of the Philippines.

Hereunder is a summary of the session:

(a) Summary of Rohit Mittal’s featured presentation

The session explored how banks can improve accuracy, efficiency, and compliance in screening cross-border payments amid growing sanctions complexity. Mr. Mittal explained how global geopolitics continues to reshape financial crime compliance, with sanctions from the U.S., EU, and UK expanding due to conflicts such as Russia–Ukraine and unrest in the Middle East. Asia-Pacific institutions face increasing exposure, given regional trade ties with heavily sanctioned countries like North Korea, Iran, and Myanmar.

Mr. Mittal noted that digital transformation and fintech innovation have accelerated instant cross-border payments, bringing both opportunities and heightened regulatory challenges. Banks must now ensure real-time sanctions compliance without compromising customer experience. Success depends on access to comprehensive and up-to-date data sources that meet both local and international standards.

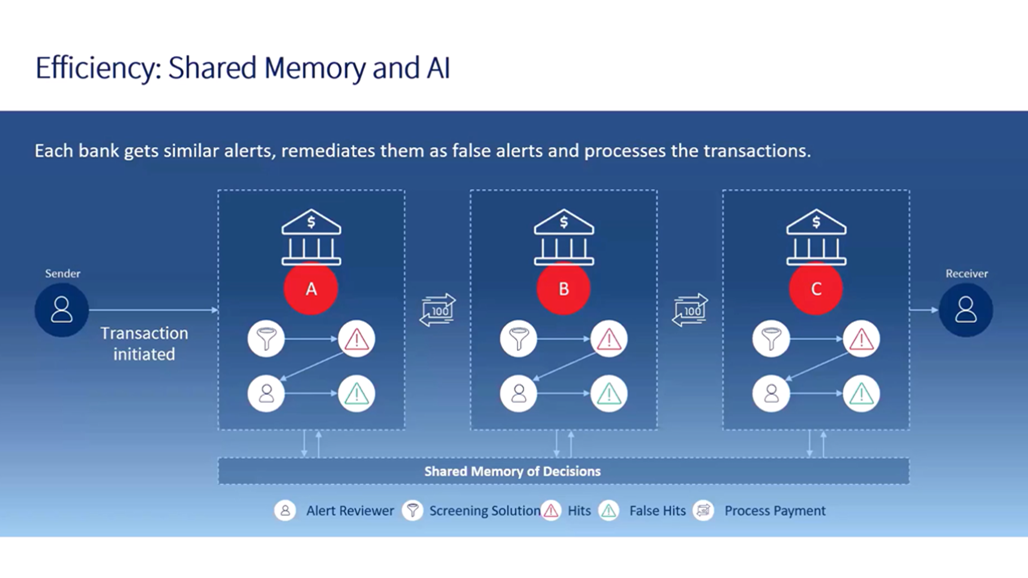

He presented a four-pillar framework for effective sanctions screening: effectiveness, efficiency, explainability, and ease of integration. Effectiveness relies on accurate multilingual tools capable of handling transliterations and complex sanction regimes; efficiency is achieved through AI-driven matching that minimizes false positives; explainability ensures transparent, auditable decision-making; and integration connects compliance platforms seamlessly across systems. Emerging technologies such as AI and shared learning models are transforming trade and payment screening by automating risk detection and enhancing accuracy.

Mr. Mittal concluded that technology must be paired with strong governance—management commitment, regular risk assessments, and continuous staff training. He cited LexisNexis® Risk Solutions’ Firco Continuity as a proven tool used by leading global banks to improve sanctions screening and reduce false positives.

Key Takeaways:

- Expanding global sanctions and geopolitical risk are increasing compliance demands on Asia-Pacific banks.

- AI and automation improve screening accuracy and reduce false positives when paired with transparency and explainability.

- Effective compliance rests on four pillars—effectiveness, efficiency, explainability, and integration—supported by strong governance and training.

(b) Summary of panel discussion with Rohit Mittal and Michael P. Magbanua

The discussion between Mr. Mittal and Mr. Magbanua highlighted how financial institutions can balance innovation, compliance, and operational efficiency in cross-border payments. Mr. Magbanua opened by noting that the Philippines’ recent removal from the FATF gray list was achieved through close cooperation between regulators and banks, under the guidance of the BSP and AMLC. The experience reinforced the need for continuous improvement, benchmarking against international standards, and strong public-private collaboration.

When asked how compliance can evolve from a cost center to a value driver, Mr. Magbanua explained how Union Bank turned regulatory restrictions into opportunities. By promoting digital payments and leveraging systems such as Instapay and Pesonet, the bank enhanced transaction transparency, safety, and customer convenience. The conversation also covered corruption risk indicators, emphasizing the need to identify high-risk transactions, politically exposed persons, and tax haven jurisdictions through reliable global data sources like LexisNexis Risk Solutions.

Addressing the challenge of balancing transaction speed with compliance, Mr. Magbanua shared how Union Bank uses AI tools to structure SWIFT messages and accelerate payment investigations. This automation reduces false positives and enhances both accuracy and turnaround time. He also discussed the implementation of the new Anti-Financial Account Scamming Act (AFASA), which targets mule accounts, noting that Union Bank employs advanced detection systems and participates in industry-wide data sharing to fight financial crime.

Both speakers concluded that the future of cross-border payments will rely on intelligent use of AI to improve screening precision and deeper collaboration between banks, regulators, and fintechs to strengthen trust and resilience in the financial ecosystem.

Key Takeaways:

- The Philippines’ FATF gray list exit underscores the importance of regulatory–bank cooperation and global AML alignment.

- AI and automation enhance accuracy and speed in payment investigations, reducing false positives.

- Collaboration among banks, regulators, and fintechs is vital to ensuring secure and efficient cross-border payments.

ABA members can download the presentation file from the ABA website HERE.

The video recording of the webinar is available at the ABA YouTube channel.