ABA Position Paper on Promoting Cooperation In Crisis and Disaster Preparedness and Recovery

Maintaining the Spotlight on AML/CFT in the Post-Covid19 World

Paper Objective: To share the experience of RCBC Bank in the area of crisis management and in the implementation of its Disaster Preparedness and Recovery Plan during this COVID-19 pandemic.

Introduction

- Guidelines from Inter-Agency Task Force (IATF) on whether these industries were allowed to operate or not

- Prospects for demand/supply bottlenecks

- Industry developments

- Outlook/forecast by associations/groups in the industry

- Severely impacted: not allowed to operate.

- Moderately impacted: allowed to operate; moderate/low demand

- Least impacted: allowed to operate; high demand.

Liquidity:

Relief for Banks and MSMEs:

- Temporary reduction of term spreads on peso rediscounting loans relative to the overnight lending rate to zero.

- MSME loans allowed as part of banks’ compliance with RR.

- Temporary reduction in the credit risk weights of MSME loans that are in current status.

- Assignment of lower risk weight for MSME exposures that are covered by government guarantees.

Credit:

- Bayanihan to Heal as One Act or Bayanihan 1 (signed into law March 24, 2020) – 30-day grace period for loans falling due within the ECQ period.

- Bayanihan to Recover as One Act or Bayanihan 2 (signed into law September 11, 2020) – 60-day grace period for loans falling due on or before December 31, 2020.

- Set interest rate cap to no more than 2% a month or 24% annually for credit card effective November 3.

Capital infusion:

- Department of Finance (DOF) will increase capital of government banks – Land Bank of the Philippines (LBP) and Development Bank of the Philippines (DBP)

- By Php74.5 billion to buy loans from smaller banks so these banks can lend more to small and medium scale businesses;

- Another Php15.5 billion standby fund

RCBC Bank’s Business Continuity Program:

(5) RCBC has a comprehensive Crisis Management Framework in place that is meant to prepare the bank for an event-led disruption in operations. The Crisis Management Team (CMT)2, headed by the President oversees the crisis management framework, and responsible for synchronizing all efforts in the Bank, to limit losses and to recover operations as fast as possible. The bank has a dedicated “Business Resiliency Unit” under the Risk Management Group, to ensure readiness for any disaster/crisis. The unit coordinates with all the groups to build a bankwide Business Continuity Plan (BCP), identifying critical products and services and required operational support for continuity of operations. The BCP details resources needed – such as people, process, IT systems, and other equipment; as well as contingency procedures to guide the units on how to respond, recover, resume, and restore operations following the disaster/crisis.

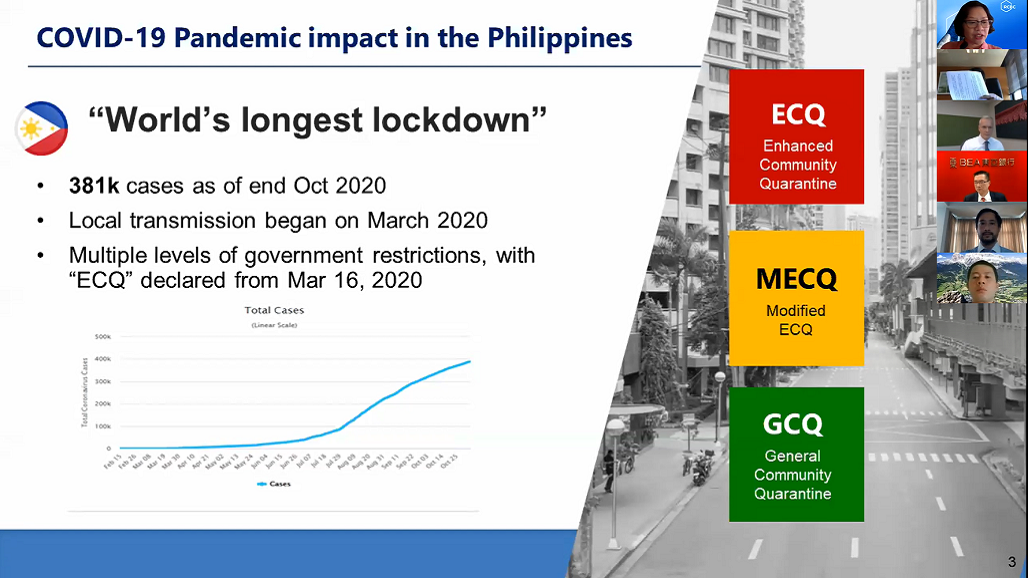

(6) As early as January 2020, the bank activated its Pandemic and Infectious Disease Plan3 as part of the Business Continuity Enterprise Plan. It defined control operations and precautionary measures needed at each stage of a pandemic, mostly based on the experience with 2004 SARS Outbreak and 2009 H1N1. As the Enhanced Community Quarantine was lifted, the “new normal” under a “General Community Quarantine” meant a transitory environment that required the Bank to prepare a Business Recovery Plan. This plan would be the guide on how to operate during the transition toward recovery and thrive in the new normal.

Disaster Preparedness:

(7.a) Clustering – To ensure continuity of business operations the organization created clusters. Each cluster operates independently and split-site operations were established. For identified work-from-home/ mobile workers, there would be an agreed cycle (ie two weeks) of reporting at the office or on-site and work-from-home. The rotation was supplemented with a “No crossover” policy between sites, floors, branches and virtual meetings were observed in lieu of physical gatherings.

(7.b) Health and safety protocols – Identified as an essential industry, the Bank had to ensure that operations were in line with health protocols to protect both employees and customers. Protective equipment and resources were deployed to the employees: washable facemasks, and face shields, sanitizers, hand gloves and vitamin C, etc. Signs and posters were placed in common areas to remind everyone of the required safety protocols including social distancing and proper cough hygiene. Acrylic panels were used in the Branches and other customer facing offices. Prescribed health protocols were institutionalized in all bank premises. Upon entry all personnel and clients are required to have their body temperature checked using a thermal scanner. To ensure that the workplace remains safe, non-essential visitors, such as messengers, are not allowed to enter. Deliveries and documents would have to pass through staging area to limit movement in the Bank premises.

(7.c) Employee Health Protocols – In coordination with the Bank’s health insurance partner, employees were given access to a hotline for tele-consultation for medical assessment, COVID-19 related medical inquiries and scheduling of COVID-19 tests. Daily health checklists and updates on tracking and tracing of the health condition of the employees supported the Bank’s thrust to keep the organization safe. Guided by the definitions from World Health Organization and Philippine’s COVID-19 Inter-Agency Task Force for the Management of Emerging Infectious Diseases, employees properly reported those with COVID-19 symptoms, those who had close contact with a COVID-19 positive or suspected COVID-19 positive. These protocols helped protect those reporting for work, but more importantly helped the employees navigate through the worry of how to work with COVID.

(8) Defend against loan defaults – As governments sought to contain the pandemic crisis with lockdowns and quarantines, and the economy declining, the risk of deterioration in portfolio quality was high. During the quarantine, loan account officers continued to stay in touch with the customer. Lending officers were also given supplementary training to prepare for more intensive credit assessment and collection. The objective was to provide immediate relief to customers through payment holidays while giving time for the Bank to assess impact and help the customers recover. The bank assessed the impact of the strict quarantine measures on the industries where the bank’s borrowers are in and the ability of these industries to recover, given available variables – specific restrictions on operating capacities of certain industries, health and safety protocols mandated by the government, and demand /supply factors. This allowed the bank to assess the risks in our portfolio and became the basis for the various sensitivity analysis for the initial impact assessment of crisis to the portfolio.

(10.) Streamline operations – The priorities were clear and the direction was to tighten overall spending. The quarantine accelerated the shift to digital channels. A review of branch operations and re-engineering of the processes would lead to streamlining parts of the business and repetitive manual tasks were automated through robotic process operations.

(11) The organization needed to adapt to new priorities and this required learning new ways of doing things. All corporate lending officers had to be re-trained on collection and refinancing, to engage customers on the payment holidays mandated by the government and the Bank’s credit relief programs. Branch sales personnel, faced with the challenge of servicing customers in quarantine, needed to improve their proficiency on the Bank’s digital products to migrate their customers to digital platforms.

(12) Go Digital – The bank’s Digital plan was set in motion in 2019 with the re-launch of the RCBC online retail mobile app. The pandemic accelerated the acceptance and use of the new mobile app with the expanded array of features: the ability to open Time Deposit accounts, make payments through QR Codes, transfer funds via Instapay and Pesonet, send cash through remittance centers, and deposit checks without visiting the branch, get cash without ATM card, and convert card purchases to installments. Moreover, new features such as opening trust accounts, investments and foreign exchange transactions are in line to be added into the mobile app.

(13) Financial Inclusion: The Bank’s strategies incorporate a long term view, particularly in nation building. RCBC responds to the needs of the unbanked and underserved Filipinos, also in support of BSP’s advocacy for financial inclusion.

(13.a) Rizal MicroBank – the bank’s thrift bank subsidiary offers traditional and digital products and services to micro and small business enterprises.

(13.b) Diskartech – the bank launched a mobile-based application which is the country’s first financial inclusion accelerator app to serve unbanked and underserved Filipinos.

(13.c) ATM Go – handheld ATM terminals which was instrumental to the government’s distribution of Social Amelioration Program (SAP). The government has partnered with RCBC to help distribute cash assistance to families greatly affected by the ECQ in provinces and remote locations where there are no bank branches.

Christina Alvarez

Senior Vice President

Corporate Planning Group

Rizal Commercial Banking Corp.