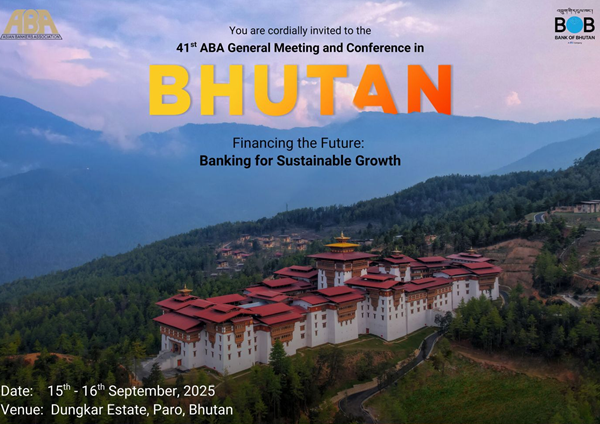

41st ABA Conference in Paro

"Financing the Future: Banking for Sustainable Growth"

September 15-16, 2025, Dungkar Estate, Paro, Bhutan

Summary Report of the Proceedings

Introduction

Some 150 bankers from Asia-Pacific, the Middle East and other regions – composed mainly of members of the Asian Bankers Association (ABA) led by ABA Chairman Mr. Daniel Wu, Vice Chairman of CTBC Financial Holding from Taiwan gathered in Paro, Bhutan on September 15-16, 2025 for the 41st ABA General Meeting and Conference.

Some 150 bankers from Asia-Pacific, the Middle East and other regions – composed mainly of members of the Asian Bankers Association (ABA) led by ABA Chairman Mr. Daniel Wu, Vice Chairman of CTBC Financial Holding from Taiwan gathered in Paro, Bhutan on September 15-16, 2025 for the 41st ABA General Meeting and Conference.

Held at the Dungkar Estate and hosted by Bank of Bhutan under the chairmanship of Mr. Thinley Namgyel, the 2025 ABA Conference was significant as it was the first time that the ABA conducted its annual gathering of members in Bhutan.

Focusing on the theme “Financing the Future:

Banking for Sustainable Growth”, the two-day event was designed to provide another valuable platform for ABA members to meet and network with each other, as well as to exchange views with invited experts on:

(a) current trends and developments in the regional and global markets that are expected to have a significant impact on the banking and financial sector of the region, and (b) how industry players can address the challenges - and take full advantage of the opportunities - presented by these developments.

Opening Ceremony

The Conference was officially opened with the traditional Bhutanese lighting ceremony officiated by the special guests from the country’s regulatory authorities and representatives from the ABA and the Bank of Bhutan.

In his Welcome Remarks, Bank of Bhutan Chairman Mr. Thinley Namgyel said that the ABA Conference marks the fruition of a vision laid out by His Majesty the King of Bhutan, which is “Bhutan’s journey towards innovation, sustainable development and technological advancements that are crucial in defining Bhutan’s future.”

He cited the establishment of Gelephu Mindfulness City (GMC) – a special administrative region - as the king’s recognition of the need to balance progress with sustainability., adding that the GMC was established to create a vibrant economic hub by providing a conducive business environment. “It is a Mindfulness City, encompassing conscious and sustainable businesses, inspired by Buddhist spiritual heritage, and distinguished by the uniqueness of the Bhutanese identity. Therefore, it is only fitting that Bhutan plays the host to this year’s conference with the theme Financing the Future: Banking for sustainable growth.

He cited the establishment of Gelephu Mindfulness City (GMC) – a special administrative region - as the king’s recognition of the need to balance progress with sustainability., adding that the GMC was established to create a vibrant economic hub by providing a conducive business environment. “It is a Mindfulness City, encompassing conscious and sustainable businesses, inspired by Buddhist spiritual heritage, and distinguished by the uniqueness of the Bhutanese identity. Therefore, it is only fitting that Bhutan plays the host to this year’s conference with the theme Financing the Future: Banking for sustainable growth.

He pointed out that banks have become the foundation needed to set up infrastructure and industry across the world, having the responsibility of driving the economic progress of the country in a sustained manner. “Your presence here is an indication of your support as well as your interest in the financing and functioning of the Future of Banking for Sustainable Growth,” he told the ABA delegates.

Mr. Namgyel said that the ABA Conference in Bhutan provides an opportunity for Bank of Bhutan to renew its pledge to further strengthen the position of the Bank through consistent innovation and dedication. “We, at the Bank of Bhutan believe in “Banking for sustainable growth” and will continue to contribute in Nation Building process in the future as it has done in the past. It is a commitment to the future for Bhutan to thrive and find its place in the global stage where we dare to think differently, working together for global impact.”

Welcome Remarks

ABA Chairman Mr. Daniel Wu in his Welcome Remarks said that holding the Conference in Bhutan marks a historic milestone since it is the very first ABA Conference held in the Kingdom. He expressed ABA’s heartfelt thanks to the Bank of Bhutan, especially Chairman Mr. Thinley Namgyel, for hosting the delegates and for their generous support and warm hospitality.

ABA Chairman Mr. Daniel Wu in his Welcome Remarks said that holding the Conference in Bhutan marks a historic milestone since it is the very first ABA Conference held in the Kingdom. He expressed ABA’s heartfelt thanks to the Bank of Bhutan, especially Chairman Mr. Thinley Namgyel, for hosting the delegates and for their generous support and warm hospitality.

Chairman Wu also extended his deepest gratitude to the Special Guest of Honor, His Excellency Finance Minister Lyonpo Lekey Dorji, and to the Keynote Speaker Ms. Sonomi Tanaka of the ADB, for gracing the event with their presence, adding that their participation is a true testament to the importance of the gathering.

He pointed out that, different from Asian Development Bank (ADB) and the International Monetary Fund (IMF) which primarily engage at the sovereign and macroeconomic level, the ABA is a unique platform—not a multilateral bank, but a peer-driven network of financial institutions. What sets the ABA apart is its focus on practical knowledge exchange and cross-border cooperation among bankers. “Our strength lies in building direct linkages and fostering collaboration that makes a tangible impact on our institutions and communities,” he noted.

Chairman Wu stated that hosting the Conference in Bhutan—known for its inspiring model of Gross National Happiness—offers members more than just scenic beauty. “It gives us the chance to understand Bhutan’s economic potential, its people, and its values. I hope this visit inspires more members to consider hosting future ABA gatherings as we continue building our community,” he concluded.

Keynote Speech

In her Keynote Speech, Ms. Sonomi Tanaka, Country Director for the Bhutan Resident Mission of the Asian Development Bank, examined the challenges and opportunities shaping Asia-Pacific’s banking evolution, and underscored the transformative role of digital innovation and ADB’s strategic support initiatives. Among the critical challenges she identified included: (a) escalating digital threats demanding robust defense mechanisms and regulatory frameworks; (b) Uneven preparation across markets for emerging financial technologies and services; (c) persistent gaps in access to banking services across rural and underserved populations; and (d) urgent need for sustainable finance solutions addressing environmental challenges.

In her Keynote Speech, Ms. Sonomi Tanaka, Country Director for the Bhutan Resident Mission of the Asian Development Bank, examined the challenges and opportunities shaping Asia-Pacific’s banking evolution, and underscored the transformative role of digital innovation and ADB’s strategic support initiatives. Among the critical challenges she identified included: (a) escalating digital threats demanding robust defense mechanisms and regulatory frameworks; (b) Uneven preparation across markets for emerging financial technologies and services; (c) persistent gaps in access to banking services across rural and underserved populations; and (d) urgent need for sustainable finance solutions addressing environmental challenges.

On the other hand, she pointed out transformative opportunities in various area, including: (a) digital finance which involves revolutionary payments systems and fintech solutions democratizing financial access; (b) green finance, consisting of sustainable investment vehicles driving climate-resilient economic development; and (c) regional integration, which requires deeper cross-border collaboration unlocking new pathways for inclusive growth.

Ms. Tanaka also described the ongoing digitalization program in Bhutan. The country has completed its Financial Market Development Program for 2019-2021, which involved Data Warehouse Infrastructure (advanced information storage systems enabling sophisticated management decision-making for RMA); Digital Regulatory Framework (E-money regulations, comprehensive credit information systems, and BASEL-aligned supervisory frameworks); and Green Taxonomy Development (Environmental classification system supporting sustainable finance initiatives and green investment decisions).

Bhutan has also set in place the Banking Reform Program for 2025-2028, which consists of three major components, namely: (a) Cybersecurity Guidelines, which include comprehensive security frameworks protecting digital financial infrastructure; (b) Risk-Based Supervision, which comprises advanced supervisory methodologies enhancing regulatory effectiveness; and (c) Digital Regulatory Tools, which involve innovative regulatory technology solutions streamlining oversight processes.

Ms. Tanaka concluded with a call to collaborative action to develop financial resilience and stability, expand digital inclusions, build sustainable and green finance ecosystems, and enable seamless cross-border connectivity.

Special Address

His Excellency Honorable Lyonpo Lekey Dorji, Minister of Finance of Bhutan, in his Special Address noted that over the past few decades, the country’s financial sector has evolved from a small, traditionally bank-centered system into a more diversified ecosystem - now encompassing banks, insurance companies, and nonbank financial institutions. He pointed out that a central focus has been financial inclusion: ensuring access to financial services not only in the country’s urban centers, but also in the remote and rural communities where much of our population resides, adding that mobile banking, branchless banking, and digital payment solutions have played a critical role in narrowing this gap.

His Excellency Honorable Lyonpo Lekey Dorji, Minister of Finance of Bhutan, in his Special Address noted that over the past few decades, the country’s financial sector has evolved from a small, traditionally bank-centered system into a more diversified ecosystem - now encompassing banks, insurance companies, and nonbank financial institutions. He pointed out that a central focus has been financial inclusion: ensuring access to financial services not only in the country’s urban centers, but also in the remote and rural communities where much of our population resides, adding that mobile banking, branchless banking, and digital payment solutions have played a critical role in narrowing this gap.

The Finance Minister said that Bhutan’s financial institutions are embracing digital transformation, investing in core banking upgrades, mobile applications, and digital wallets, pointing out that these innovations are designed to improve convenience for customers, increase transparency, and strengthen operational efficiency.

“Importantly, all these reforms and innovations are guided by Bhutan’s unique development philosophy of Gross National Happiness (GNH). Unlike many countries where financial growth is measured purely in profit terms, Bhutan’s approach places equal weight on social equity, sustainability, and long-term well-being,” the Minister said.

He also informed the delegates that regulatory bodies such as the Royal Monetary Authority (RMA) have taken proactive steps to modernize financial regulations, encouraging innovation while safeguarding stability. Initiatives like the Druk Nguldrel Lamtoen - 2030 (A Roadmap for a Progressive, Agile, and Resilient Central Bank Enabling Bhutan’s Economic Transformation) and the push towards a cashless economy highlight Bhutan’s forward-looking policy environment, he stressed.

“Of course, challenges remain: building digital literacy, ensuring cybersecurity, and addressing the skills gap in advanced technologies. Yet, these challenges are also opportunities for collaboration and innovation—especially with regional partners through platforms like the ABA,” the Minister said.

To achieve truly sustainable banking, regional and international cooperation is vital. Climate change and sustainability challenges do not respect borders, he pointed out, stating that Bhutan, through its policies and partnerships, stands ready to contribute to and learn from such collaboration.

The Minister urged the banking sector to align business practices with national sustainability goals, including building capacity to manage climate and environmental risks. He said that banking and finance are not only about numbers and balance sheets - they are about the kind of future we envision for the next generation. “Together, with policymakers, regulators, financial institutions, and the private sector, we can ensure responsible banking—a future that is greener, fairer, and more resilient,” he remarked.

“This conference is more than a gathering; it is a catalyst. By bringing together thought leaders and innovators from across Asia, it offers Bhutanese institutions the chance to learn, to connect, and to co-create. For Bhutan, membership in the Asian Bankers Association is more than symbolic. It gives us access to a community of innovators, best practices, and collaborative opportunities that directly support our 10x strategy—from building digital capacity to forging new cross-border partnerships. In many ways, the ABA is a catalyst that can help Bhutan leapfrog traditional barriers and position our financial sector for exponential growth,” the Minister concluded.

Press Conference

A Press Conference was convened immediately after the Opening Ceremony with the participation of key officers of ABA and Bank of Bhutan led by ABA Chairman Mr. Daniel Wu, Bank of Bhutan Chairman Mr. Thinley Namgyel, Bank of Bhutan Chief Executive Officer Mr. Tshering Tenzen, and ABA Secretary-Treasurer Dr. Darson Chiu.

A Press Conference was convened immediately after the Opening Ceremony with the participation of key officers of ABA and Bank of Bhutan led by ABA Chairman Mr. Daniel Wu, Bank of Bhutan Chairman Mr. Thinley Namgyel, Bank of Bhutan Chief Executive Officer Mr. Tshering Tenzen, and ABA Secretary-Treasurer Dr. Darson Chiu.

During the Press Conference, the ABA and Bank of Bhutan officers fielded questions from invited representatives of both local and international media about the Conference, the ABA and Bank of Bhutan.

Mr. Namgyel said that hosting the ABA Conference in Bhutan reflects the country’s aspirations for financial innovation and sustainability. He added that Bhutan’s 10X strategy and the Gelephu Mindfulness City (GMC) as key initiatives that align with global banking priorities.

Mr. Tenzen said that the Conference allows Bhutan to exchange ideas with distinguished leaders from across Asia while also building lasting partnerships. It also aligns with Bhutan’s efforts to accelerate digital transformation, strengthen financial inclusion, and promote a future-ready economy.

ABA Chairman Mr. Wu highlighted ABA’s role in supporting financial sector. For instance, the ABA facilitates knowledge exchange and capacity building by connecting Bhutan’s banks with peers across the region, ensuring best practice in areas such as digital banking, risk management, and sustainable finance. The ABA can also support policy dialogue on how to design a regulatory environment that encourages innovation while ensuring financial stability. Furthermore, it can help foster partnerships and investment opportunities that are aligned with Bhutan’s development priorities.

For his part, ABA Secretary-Treasurer Dr. Chiu said that the theme and sessions of this year’s conference reflect the urgent priorities facing the financial sector, such as the evolving role of banks in society.

Host Bank Session

As in previous Conferences, Bank of Bhutan organized a Host Bank Session on the morning of Day One. Focusing on the theme “Bhutan’s Next Chapter: Mindfulness, Innovation and the Role of the Private Sector”, the session provided an introduction on the Gelephu Mindfulness City (GMC), its transformation agenda, and its objective to be a global hub for wellbeing, wisdom, and sustainable innovation. It stressed that at the heart of the transformation is the private sector – entrepreneurs, investors, creators, and builders who can help shape and deliver this vision.

Invited speakers discussed how the private sector can engage and co-create with GMC agenda; the opportunities in AI and digital infrastructure to power ethical, efficient services; and payment and fintech systems to connect Gelephu to the region and the world. They also shared what’s needed to make this happen, such as enabling policies, capital, innovation ecosystems, and shared purpose.

Moderated by Dasho Karma Yonten, Head, Office of Performance Management, His Majesty’s Secretariat; the session featured as speakers Mr. Hobeng (“HB”) Lim, Managing Director (Financial Services), Gelephu Mindfulness City; Mr. Mike Kayamori, Chief Executive Officer, Oro Bank, DK Bank; Mr. Ujjwal deep Dahal, Chief Executive Officer, Druk Holding and Investments; and a representative from Gelephu Mindfulness City.

ABA Policy Advocacy Committee Meeting

Chaired by Mr. Austin Chiang, Chief Strategy Officer at CTBC Bank Co., , the meeting of the ABA Policy Advocacy Committee considered position papers prepared and presented by representatives of ABA member banks and knowledge partners on policy issues of current concern to the banking sector.

Ms. Rachael Kao, President, CTBC Financial Holding Co., Ltd., presented a summary of a paper sharing the Bank’s experience, practices and insights, along with other relevant information, on “Ethical Banking and Corporate Governance”.

In her paper, Ms. Kao noted that customer trust in banks has been declining, particularly among younger and digitally native customers who expect banks to act with fairness, fee transparency, customer care, and social responsibility. In addition, from an investors’ perspective, ethical banking is increasingly seen as a critical factor in risk management and long-term value creation. Lastly, from a regulatory perspective, authorities are tightening corporate governance and ethical banking standards to prevent financial misconduct, enhance industry stability and customer protection, through elevated reporting requirements, accountability requirement on board and management team.

To help ABA members address these issues, Ms. Kao shared CTBC’s experience and practices in the following areas: (a) Strengthening customer trust through stronger ethical banking principles and governance reform; (b) Balancing shareholder value with social responsibility, financial inclusion, and ESG principles; and (c) strengthening board accountability and corporate governance to prevent misconduct and strengthen ethical banking practices.

Mr. Reginaldo Cariaso, President and CEO of Rizal Commercial Banking Corporation (RCBC) presented a paper sharing the experience and best practice of his organization on “Open Banking and Customer Data Privacy Protection”.

Mr. Cariaso’s paper outlines RCBC’s open banking strategy and the role of Application Programming Activities (APIs) as key enablers alongside the bank’s data governance structure to ensure data security. It stresses the importance of expanding comprehensive governance and operational models, guided by transparency, explicit consent, and a multi-layered security architecture. As the industry moves forward, maintaining the delicate balance between digital innovation and ensuring the utmost protection of the bank’s customers’ most sensitive date will be the key to success in this new environment, the paper concludes.

Mr. Shirish Pathak, Managing Director of Fintelekt Advisory Services, presented a paper sharing his organization’s experience and insights, along with other relevant information on “Money Mule Account Issue in Banking”. The paper essentially discussed strategies to reduce vulnerabilities, strengthen defenses, and enhance regional cooperation against money mule activities.

Mr. Pathak’s paper also explored the key trends and the compliance tools available with banks. It maintained that the fight against money mule accounts in Asia will require not just technological sophistication but harmonious efforts among banks, regulators, and law enforcement agencies. By aligning detection strategies and technology, regulatory frameworks, and public awareness campaigns, the region can significantly reduce the operational space for mule networks, reinforcing trust in its rapidly evolving banking ecosystem.

Mr. Pathak’s paper also explored the key trends and the compliance tools available with banks. It maintained that the fight against money mule accounts in Asia will require not just technological sophistication but harmonious efforts among banks, regulators, and law enforcement agencies. By aligning detection strategies and technology, regulatory frameworks, and public awareness campaigns, the region can significantly reduce the operational space for mule networks, reinforcing trust in its rapidly evolving banking ecosystem.

Committee Chairman presented a summary of the Paper on “Financing the future: Cyber Protection – The essential risk management tool” prepared by Mr. Chris Baker, Regional Head of Cyber Asia for Munich Re, considered a global leader in Cyber (re)insurance. Among the highlights of the paper as presented by Mr. Austin are the following:

- Cybercrime is one of the most disruptive risks of the digital era;

- It is estimated that the global cost of cybercrime will reach US$10.5 trillion in 2025

- Financial services remain one of the most attractive targets for cybercriminals.

- Ransomware, phishing, and supply chain attacks continue to dominate

- The financial sector remains particularly attractive to cyber criminals for several reasons: (a) direct access to money; (b) vast personal data; (c) complex, interconnected systems; (d) high transaction volumes; (e) reputation at stake; (f) regulatory pressure

- Cyber insurance has evolved beyond being a simple risk transfer tool; it now plays an increasingly strategic role in banking.

- Coverage spans breach response, regulatory fines, business interruption, and third-party liability.

- While cyber insurance cannot eliminate risk, it offers essential protection through financial support, expert resources, and regulatory coverage

- Extending cyber covers to SMEs and individuals also creates unique opportunities to differentiate services and strengthen customer trust

Mr. Chiang also mentioned that Munich Re is offering interested ABA member banks to take advantage of its underwriting and cyber analytics capabilities, helping their businesses and customers safeguard their digital environment The Committee further exchanged views on possible issues for future policy advocacy work of the Association, followed by a consideration of a short-list of policy issues to be pursued from among those suggested by the Committee.

ABA Election Committee Meeting and ABA Advisory Council Meeting

The ABA Election Committee convened on September 15, 2025 to review the results of the canvassing of votes conducted earlier by the ABA Secretariat as part of the election of the ABA Board members who will serve for the term 2026-2027. Based on the canvassing results, the Committee thereafter prepared a list of member banks eligible for seats in the incoming Board.

This was immediately followed by the ABA Advisory Council Meeting, which discussed policy issues of current concern to the Association, including the possible candidates for the position of new ABA Chairman and two new ABA Vice Chairmen to be recommended to the newly-elected Board members, as well as possible host and venue of the 2026 and 2027 ABA General Meeting and Conference.

Conference Proper Plenary Sessions

The Conference Proper was held on November 10 which consisted of four plenary sessions addressing the following topics of current interest to the banking industry.

Plenary Session 1

This first session focused on the topic “Digital Transformation in Sustainability Banking.” Invited panelists noted that digital transformation is reshaping banking by enhancing financial inclusivity and promoting sustainable behaviors.

They stressed that by leveraging digital identity technologies, financial institutions can provide accessible services to under-banked populations, inbound immigrants, and outbound overseas workers, noting that concurrently, innovative solutions like carbon footprint tracking tools and platforms for sustainable investments empower customers to make environmentally conscious financial decisions.

The session noted that the integration of digital banking with sustainability initiatives not only addresses access challenges but also fosters a culture of environmental responsibility, contributing to a resilient and sustainable future in the banking sector. The speakers agreed that this involves integrating principles into banking operations and financial products to promote responsible and sustainable development, while also generating profit.

Moderated by Mr. Reginaldo Cariaso, President and CEO, Rizal Commercial Banking Corp., the session featured the following panelists: (a) Dr. Ashish Kakar, Research Director, IDC Financial Insights; (b) Mr. Agustinus Nicholas L. Tobing, Security Assurance Country Lead, Indonesia and Vietnam, Amazon Web Services (AWS) Indonesia’ and (c) Mr. Abhisheik Vishwakarma, President & CEO – Analytics Division, CARE Analytics and Advisory Private Limited.

Plenary Session 2

Plenary Session 2 addressed the topic “Enhancing Customer and Employee Experience Through Technology”, stressing that the integration of technology plays a pivotal role in enhancing both customer and employee experiences in the banking sector. Invited speakers shares innovative practices in customer experience, focusing on hyperpersonalization, seamless omnichannel experiences, and conversational banking.

Discussion likewise extended to the use of AI to enhance employee experience and productivity, highlighting for instance the use of AI copilots that streamline staff training on business and customer service, enhance decision-making efficiency, and accelerate complex analyses. The speakers agreed that by leveraging AI-driven solutions, financial institutions can not only improve service delivery but also foster a more efficient and rewarding work environment for employees.

Moderated by Mr. Frederic Cabay, Managing Director/Global Co-Head of Financial Institutions, MUFG Bank, Ltd., the session included the following line-up of panelists: (a) Mr. Rajan Narayan, CEO, Cyberbeat Pte. Ltd.; (b) Ms. Sunita Kannan, Global AI Strategy Lead, Microsoft; (c) Mr. Kher Tean Chen, Managing Partner and General Manager, IBM Consulting, Great China Group and Korea; and (d) Mr. Dorji Nima, Chief Operating Officer, Druk Holding and Investment.

Plenary Session 3

This session tackled issues surrounding “Innovations in Cross-Border Payments.” The speakers agreed that the crossborder payments landscape is undergoing a significant transformation, driven by emerging technologies that promise to enhance efficiency, security, and accessibility. They explored cutting edge innovations shaping the future of international transactions, including blockchain, Web 3.0 decentralized finance, central bank digital currencies (CBDCs), and Regulatory Technology (RegTech) solutions.

Discussions during the session noted that as financial institutions, fintech firms, and regulatory bodies navigate this evolving ecosystem, pilot projects and technology maturity assessments provide critical insights into real-world applications. There was a sharing of experiences among the speakers, discussing both the opportunities and challenges in integrating these advancements, which the speakers said enable financial institutions and banks especially in emerging economies to apply them in their crossborder payment business and catch up with industry peers.

Moderated by Mr. Mohamed Shareef, CEO and Managing Director, Bank of Maldives, the session featured the following as panelists: (a) Mr. Eric Tan, Senior Director, Head of Banks & Remitters, Visa Direct, Asia Pacific; (b) Mr. Rajendra Theagarajah, Chairman Emeritus & Member, ABA Advisory Council; (c) Mr. Amar Lkhagvasuren, Chief Executive and Secretary-General, Mongolian Bankers Association; and (d) Mr. Tandin Tshewang, Financial Controller, ORO BANK.

Plenary Session 4

Plenary Session 4 addressed the topic “Adapting Regulations for a Changing Financial Landscape”. Discussions during the session noted that as financial ecosystems become more complex, regulatory frameworks must evolve to balance innovation, consumer protection, and financial stability.

The invited speakers examined how regulators can support banking transformation through progressive policies, including the development of regulatory sandboxes, open banking frameworks, and cross-border compliance standards.

The session also discussed harmonization of financial regulations across jurisdictions, the role of technology in regulatory compliance, and how banks can navigate shifting policies while fostering innovation. The panelists share regulatory innovations for new technology implemented in other regions, including those touching on the role of CBDCs and digital assets, as well as evolving regulations for ESG integration and reporting, sustainable financing, and investment.

The session was moderated by Mr. Oliver Hoffmann, Managing Director, Head of Asia, Erste Group Bank AG, Hong Kong Branch, and featured the following panelists: (a) Ms. Ee Ling Ooi, Business Development Manager – Asia Pacific, Oberthur Cash Protection; (b) Mr. Damith Pallawatte, Managing Director/CEO, Hatton National Bank; (c) Ms. Ugyen Choden, Deputy Governor, Royal Monetary Authority of Bhutan; and (d) Mr. Dorji Phuntsho, CEO, Royal Securities Exchange of Bhutan.

39th ABA General Meeting Proper

During the 41st ABA General Meeting Proper, members were presented by Outgoing ABA Chairman Mr. Daniel Wu with: (a) the ABA Chairman’s Report summarizing the activities of ABA since the last General Meeting held in 2024 in Taipei, Taiwan, and (b) the results of the election of new Board Members who will serve the term 2026-2027.

During the 41st ABA General Meeting Proper, members were presented by Outgoing ABA Chairman Mr. Daniel Wu with: (a) the ABA Chairman’s Report summarizing the activities of ABA since the last General Meeting held in 2024 in Taipei, Taiwan, and (b) the results of the election of new Board Members who will serve the term 2026-2027.

Chairman’s Report

In his Chairman’s Report, Mr. Wu noted that over the past year, despite the limitations caused by geographic distance, resource availability, and the developments in the global market environment and the geo-political situation, the ABA had continued to undertake activities to further enhance the value of the Association to its members and the Asian banking sector.

Chairman Wu proceeded to summarize activities undertaken in the following areas: (a) Preparations for the 41st ABA General Meeting and Conference; (n) Policy Advocacy; (c) Professional Development Program; (d) Information Exchange and Publications; (e) Membership recruitment efforts; and (f) ABA’s Financial Condition.

Election of New ABA Board Members

The ABA General Membership also finalized the election of the new members of the Board of Directors who would serve for the next two years from 2026 to 2027. Outgoing ABA Chairman Mr. Daniel Wu formally presented the following list of member banks - composed of 21 entities from 14 countries - which were voted into the Board for the next term:

Azer-Turk Bank Azerbaijan

Bank of Bhutan Bhutan

State Bank of India India

EN Bank Iran

Bank Pasargad Iran

Bank Shahr Iran

MUFG Bank, Ltd. Japan

Mizuho Bank Ltd. Japan

Sumitomo Mitsui Banking Corp. Japan

Bank of Maldives Maldives

Myanma Tourism Bank Myanmar

Rizal Commercial Banking Corp. Philippines

Int’l Bank for Economic Cooperation Russia

Hatton National Bank Ltd. Sri Lanka

Bank of Taiwan Taiwan

CTBC Bank Taiwan

First Commercial Bank Taiwan

Mega International Commercial Bank Taiwan

Bangkok Bank Thailand

Vietnam Bank for Industry and Trade Vietnam

Erste Group Bank (HK) Austria

The new Board thereafter elected Mr. Thinley Namgyel, Chairman of Bank of Bhutan, as ABA Chairman for 2026-2027, and Mr. Mohamed Shareef, Chief Executive Officer of Bank of Maldives, and Mr. Damith Pallewatte, Managing Director and CEO of Hatton National Bank, as the two new Vice Chairmen for the next term.

Turnover Ceremony

During the Turnover Ceremony held as part of the Farewell Dinner program on 16 September, Outgoing ABA Chairman Mr. Daniel Wu first delivered his Valedictory Address. In his Address, Mr. Wu said that he and CTBC Bank have always strongly supported the ABA’s vision of promoting cooperation among banks in the region and advancing the interests of the Asian banking sector, adding that they remain deeply committed to its mission of providing a forum for meaningful exchange of information and effective networking among members.

During the Turnover Ceremony held as part of the Farewell Dinner program on 16 September, Outgoing ABA Chairman Mr. Daniel Wu first delivered his Valedictory Address. In his Address, Mr. Wu said that he and CTBC Bank have always strongly supported the ABA’s vision of promoting cooperation among banks in the region and advancing the interests of the Asian banking sector, adding that they remain deeply committed to its mission of providing a forum for meaningful exchange of information and effective networking among members.

More importantly, he said that CTBC Bank believes in ABA’s unique ability to cultivate long-term relationships and friendships, which form the true binding force that enables our Association to grow stronger year after year. He concluded by urging all member banks to extend to the new leadership of ABA the same unwavering support and cooperation they have so generously given him and CTBC Bank.

The Incoming ABA Chairman Mr. Namgyel and incoming Vice Chairman Mr. Shareef then took their respective Oath of Office, with ABA Advisory Council Member and ABA Chairman Emeritus Mr. Rajendra Theagarajah administering the oath-taking ceremony. The second newly-elected Vice Chairman Mr. Pallewatte was unable to join the Bhutan Conference due to unexpected circumstances.

The oath-taking was then followed with the symbolic turnover of the ABA flag from the Outgoing Chairman Mr. Wu to the Incoming Chairman Mr. Nyamgel to symbolize the transfer of the mantle of leadership of the Association.

The oath-taking was then followed with the symbolic turnover of the ABA flag from the Outgoing Chairman Mr. Wu to the Incoming Chairman Mr. Nyamgel to symbolize the transfer of the mantle of leadership of the Association.

Mr. Nyamgel thereafter delivered his Acceptance Speech. He said that the ABA Chairmanship carries with it enormous responsibility and challenges. “Recognizing that the ongoing changes and uncertainties in the world market continue to have a significant impact on the region’s financial sector, I realize I have a daunting task ahead of me. As we’ve heard from our speakers during the past two days, the banking sector has entered a period of many new challenges and opportunities. A number of developments taking place in many of the advanced economies are having significant implications on Asia’s financial markets and the global economy as a whole.”

Mr. Nyamgel expressed his hopes that during his term, ABA will continue to play a crucial role in the further development of the Asian banking sector. “Together, we will do our best to make ABA an even more effective forum for advancing the cause of the banking sector and for promoting regional economic cooperation. I believe we are in a position to do just that, given the vast and rich resources our membership can provide.”

Distinguished Service Awards were presented to Outgoing Chairman Mr. Daniel Wu and Outgoing Vice Chairman Mr. Mostafa Beheshti Rouy from Bank Pasargad of Iran for their outstanding accomplishments in pursuing the objectives of the ABA and promoting the interests of its members during their two-year tenure amidst extraordinary challenges and difficulties in the market environment.

Distinguished Service Awards were presented to Outgoing Chairman Mr. Daniel Wu and Outgoing Vice Chairman Mr. Mostafa Beheshti Rouy from Bank Pasargad of Iran for their outstanding accomplishments in pursuing the objectives of the ABA and promoting the interests of its members during their two-year tenure amidst extraordinary challenges and difficulties in the market environment.

A Plaque of Appreciation was also presented to Bank of Bhutan for hosting the 41st ABA General Meeting and Conference in Paro, Bhutan, and for the excellent arrangements made for the gathering and for their warm and generous hospitality to the delegates.

64th & 65th ABA Board of Director Meeting

The ABA also convened the 64th and 65th ABA Board of Directors' meetings during which they discussed internal policy issues and took action on a number of important matters.

64th Board of Directors’ Meeting

The 64th Board of Directors’ Meeting held on September 15 reviewed the activities of the Association since the last Board meeting held in Taipei, Taiwan in November 2024, including membership recruitment and the financial condition of the ABA, as well as deliberated on a number of issues that are expected to have a significant impact on the development and growth of the Association in the foreseeable future.

The 64th Board of Directors’ Meeting held on September 15 reviewed the activities of the Association since the last Board meeting held in Taipei, Taiwan in November 2024, including membership recruitment and the financial condition of the ABA, as well as deliberated on a number of issues that are expected to have a significant impact on the development and growth of the Association in the foreseeable future.

Among others, the Board noted and endorsed the following:

- Minutes of the 63rd ABA Board Meeting held in November 2024 in Taipei

- The Secretary-Treasurer’s Report summarizing the activities of ABA since the last Board Meeting held in November 2024 in Taipei

- The Financial Reports for the whole of 2024 and for the first eight months of 2025

- The membership applications of Myanma Tourism Bank as Regular Member, and of BPC as Associate Member.

- The election of member banks to serve the Board for 2026-2027.

The Board also endorsed the following recommendations of the ABA Advisory Council:

- To defer the proposal to raise the membership fee until such time that members have fully recovered from the lingering adverse impact of the pandemic and current challenges in the global market environment

- To request Board members to actively help in recruiting more members, especially those from countries where there are a few or no members at all, particularly from the Middle East.

Furthermore, the Board approved and adopted the following policy papers discussed and finalized by the ABA Policy Advocacy Committee on 15 September:

- “Ethical Banking and Corporate Governance” prepared by CTBC Financial Holding

- “Open Banking and Customer Data Privacy Protection” prepared by Rizal Commercial Banking Corporation

- “Money Mule Account Issues in Banking” prepared by Fintelekt Advisory Services

- “Financing the future: Cyber Protection – The essential risk management tool” prepare by Munich Re

65th ABA Board of Directors’ Meeting

The 65th ABA Board of Director’s Meeting was convened by the newly-elected Board of Directors on September 16. During Part One of the meeting, which was chaired by the outgoing ABA Chairman Mr. Daniel Wu, the Board first elected from among themselves the new Chairman and two Vice Chairmen who will serve for the term 2026-2027.

The 65th ABA Board of Director’s Meeting was convened by the newly-elected Board of Directors on September 16. During Part One of the meeting, which was chaired by the outgoing ABA Chairman Mr. Daniel Wu, the Board first elected from among themselves the new Chairman and two Vice Chairmen who will serve for the term 2026-2027.

Thereafter, Part Two of the Board Meeting was held with the newly-elected ABA Chairman Mr. Thinley Namgyel presiding, and discussed and decided on the following items:

Thereafter, Part Two of the Board Meeting was held with the newly-elected ABA Chairman Mr. Thinley Namgyel presiding, and discussed and decided on the following items:

- Adopted its 2026-2027 Work Program outlining activities over the next two years in the area of policy advocacy, information exchange, training and professional development, strengthening relationship with other regional and international organizations, and membership expansion.

- Approved the Proposed ABA Budget for 2026

- Formally accepted the offer of Bank of Maldives to host the 42nd ABA General Meeting and Conference in Maldives in 2026 at a date and venue to be advised later, as well as the offer of Hatton National Bank to host the 43rd ABA General Meeting and Conference in 2027 at a date and venue to be announced at an appropriate time

- Approved the creation of a Planning Committee Meeting to meet and discuss preparations for the 42nd ABA General Meeting and Conference in the early part of 2026.

- Approved the Board’s Resolution to present a Plaque of Appreciation to Bank of Bhutan as host of this year’s 41st ABA General Meeting and Conference

- Approved the Resolution for a Vote of Thanks to be presented to Outgoing Chairman Daniel Wu and Outgoing Vice Chairman Mostafa Beheshti Rouy in appreciation of their demonstrated leadership during their tenure.