The Asian Bankers Association (ABA), in collaboration with LexisNexis® Risk Solutions, held a webinar on “De-risking KYC in Evolving Regulations” on 26 August 2025 gathering over 475 registrants from 32 different countries. The session featured Vijay Nagarajan, Director, Payments Market Planning (International), Payments Efficiency at LexisNexis Risk Solutions, as the keynote speaker, and was moderated by Julia Chin, Director at JFourth Solutions. The discussion explored the evolving landscape of Know Your Customer (KYC) compliance, the impact of changing regulations, and how technology is shaping the future of financial crime prevention.

The Asian Bankers Association (ABA), in collaboration with LexisNexis® Risk Solutions, held a webinar on “De-risking KYC in Evolving Regulations” on 26 August 2025 gathering over 475 registrants from 32 different countries. The session featured Vijay Nagarajan, Director, Payments Market Planning (International), Payments Efficiency at LexisNexis Risk Solutions, as the keynote speaker, and was moderated by Julia Chin, Director at JFourth Solutions. The discussion explored the evolving landscape of Know Your Customer (KYC) compliance, the impact of changing regulations, and how technology is shaping the future of financial crime prevention.

Presentation Highlights

In his presentation, Vijay Nagarajan emphasized that compliance and KYC processes are growing increasingly complex, driven by global regulatory changes, evolving criminal tactics, and the need for financial inclusion. He explained that banks today face a dual challenge: on one hand, regulators demand more rigorous due diligence and monitoring; on the other, there is pressure to keep services accessible and efficient, particularly for underserved populations.

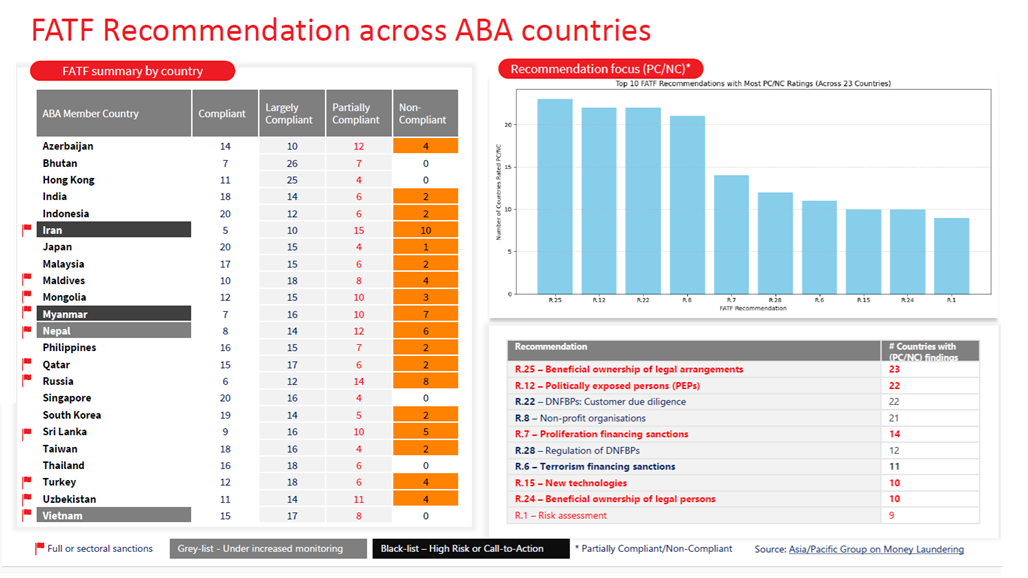

Vijay illustrated how regulatory bodies such as FATF continue to refine their frameworks, with Recommendation 1 urging proportionate, risk-based approaches. This shift requires banks to tailor their compliance strategies to match their risk profiles rather than adopt a one-size-fits-all model. For example, higher-risk clients may warrant continuous monitoring, while lower-risk clients can be handled with simplified due diligence.

A major theme was the growing intersection between fraud and money laundering risks. Criminals exploit gaps between siloed compliance systems, often using synthetic identities, complex trade networks, or digital channels to obscure illicit flows. Vijay highlighted the importance of integrated approaches that combine fraud prevention and AML monitoring into a single view of customer and transaction risk.

The session also covered beneficial ownership (UBO) transparency. Vijay noted that corporate ownership structures have become increasingly opaque, often layered across multiple jurisdictions. Rigid “four-level” verification rules, while common, are not always effective or feasible. Instead, banks should apply a risk-based approach, considering red flags such as complex shareholding, adverse media, or political exposure. Tools like Bankers Almanac, he explained, can significantly reduce the compliance burden by mapping out global ownership networks and cross-verifying entities from trusted sources.

Finally, Vijay turned to the role of technology. He outlined a spectrum of innovations: workflow tools to boost efficiency, APIs to enable proactive monitoring, agentic AI to support compliance queries, and generative AI to automate report generation. However, he cautioned that these tools require trusted data sources, robust governance, and human oversight. Without safeguards, institutions risk “hallucinations” or misinterpretations that could compromise compliance quality.

Panel Discussion

The moderated discussion with Julia Chin expanded on these points, focusing on the practical challenges banks face in implementing compliance strategies across Asia-Pacific. Julia noted that regional fragmentation is a persistent issue—different countries have varied priorities, from financial inclusion in India, to remittance oversight in Malaysia, to trade finance monitoring in Singapore and Hong Kong. This divergence creates operational inefficiencies and higher costs for banks with cross-border footprints.

On UBO verification, Julia and Vijay agreed that compliance teams should avoid treating ownership checks as a box-ticking exercise. Customer declarations are often unreliable, and rigid rules fail to reflect the nuances of business models. Instead, a risk-based approach, supported by verified data sources, can provide better assurance without unnecessary de-risking.

The conversation also touched on the cost of compliance and its impact on financial inclusion. Julia observed that smaller banks and those in gray-listed jurisdictions often resort to de-risking because compliance costs outweigh potential returns, which inadvertently excludes vulnerable populations from the financial system. Vijay responded that perpetual KYC and trigger-based monitoring, enabled by AI and digital identity systems, could help reduce costs and improve agility.

Looking at the future of compliance, both speakers emphasized collaboration as a necessity. Criminal networks cooperate seamlessly across borders, exploiting regulatory gaps. In contrast, regulators, banks, and technology providers often work in silos. Breaking down these silos and fostering greater industry cooperation, they argued, is essential for building trust in the financial system.

Key Takeaways

- Regional regulatory fragmentation remains a challenge - banks must harmonize compliance strategies across jurisdictions while meeting local priorities.

- UBO verification should be risk-based, leveraging trusted data and technology to cut through complex ownership structures.

- AI, APIs, and automation are transforming compliance, enabling perpetual and trigger-based KYC while requiring strong oversight and governance.

- Balancing compliance costs with financial inclusion is critical - industry collaboration can prevent harmful de-risking and strengthen financial integrity.

ABA members also received a copy of the presentation.

A video recording of the webinar can be viewed at the ABA YouTube HERE.