The Confederation of Asia-Pacific Chambers of Commerce and Industry (CACCI), ABA's parent organization, and Japan Chamber of Commerce and Industry (JCCI) held a webinar on on “Current Japanese Economy Status and Business Opportunities” on 23 May 2025.

Moderated by Dr. Darson Chiu, CACCI Director-General, the 60-minute webinar featured Mr. Kengo Nakayama, Senior Economist, Corporate Planning Division, Economic Research Office at MUFG Bank, Ltd., and Mr. Takeo Nakajima, Director-General, Innovation Department at Japan External Trade Organization (JETRO).

Mr. Peter McMullin AM, CACCI President delivered the Opening Remarks of the session, followed by Mr. Tetsuya Matsuoka, Deputy General Manager, International Division at Japan/ Tokyo Chamber of Commerce and Industry (JCCI/ TCCI) who delivered the Welcome Remarks.

Summary

Mr. McMullin warmly welcomed participants from across the region during his Opening Remarks. He highlighted CACCI’s representation of 27 countries in the Asia-Pacific and emphasized Japan's significant role within this network.

Mr. McMullin underscored CACCI’s current strategic priorities—sustainability, entrepreneurship, and trade—collectively termed the “SET Agenda.” He noted that these themes are central to CACCI’s efforts to foster regional cooperation and economic development.

He closed his remarks with enthusiasm for the webinar’s content and the potential for it to deepen connections and collaboration among regional stakeholders.

In his Welcome Remarks, Mr. Matsuoka addressed the complex global economic environment, citing key challenges such as geopolitical risks, inflation, protectionist trade policies, and supply chain shifts.

He emphasized that although Japan's economy is gradually improving, uncertainty remains—particularly due to unpredictable international trade dynamics. Nevertheless, he noted a strong uptick in foreign direct investment (FDI), which reached a record ¥50.5 trillion (approx. US$350.6 billion) by the end of 2023, with strong interest in manufacturing, green technology, and startups.

Mr. Matsuoka highlighted Japan’s transformation from a passive investment destination into a proactive partner for economic growth. He mentioned the Japanese government’s goal to double FDI to ¥100 trillion by 2030 and emphasized Japan’s tourism boom, with record-breaking visitor numbers in 2024.

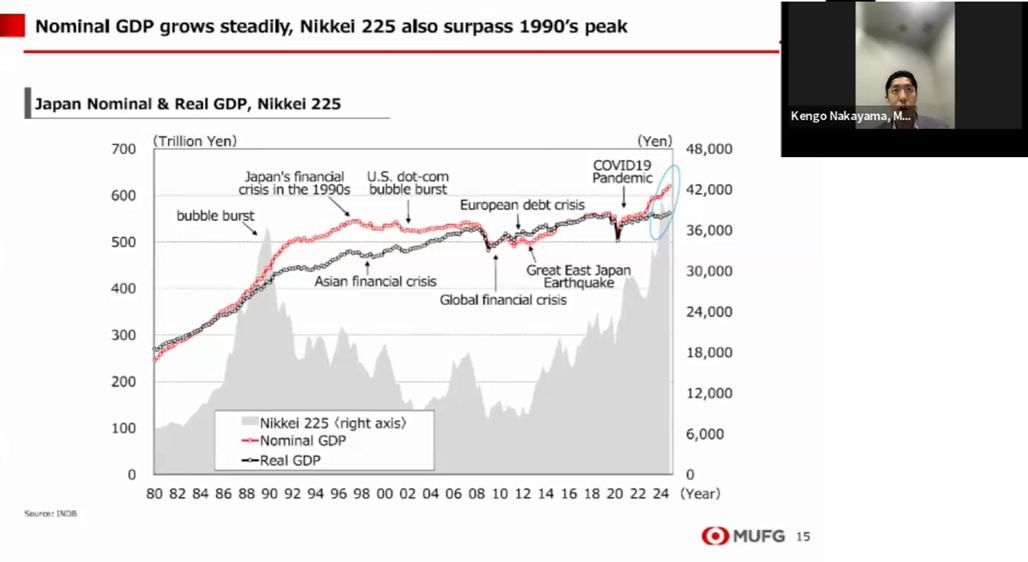

In his presentation, Mr. Nakayama provided a detailed overview of Japan's economic recovery and outlook.

As of early 2025, Japan’s real GDP grew by 1.6% year-on-year—an encouraging figure compared to its potential growth rate of below 1%. However, concerns loom over the rest of the year, particularly due to external risks like rising U.S. tariffs, which are expected to negatively affect exports, especially in key sectors such as automotive manufacturing.

MUFG forecasts a slowdown in GDP growth to 0.8% for the full year 2025, largely due to weakening external demand and declining capital investment.

Mr. Nakayama also analyzed internal structural challenges. On the demand side, Japan's recovery has been driven mainly by exports, with personal consumption and private investment remaining subdued. Consumer sentiment is constrained by inflation—driven by food, energy, and a weak yen—despite wage growth.

On the supply side, labor shortages persist, caused by demographic shifts and a decline in labor force participation, especially among older workers. In addition, working hours have declined due to labor reforms and mandatory leave, which, while improving work-life balance, have limited labor supply growth.

Looking ahead, Mr. Nakayama emphasized that Japan faces two major headwinds: prolonged inflation and disruptive U.S. trade policies. Inflation remains above the Bank of Japan’s 2% target but is driven by volatile items like food and energy, with structural challenges limiting broad-based price increases. Moreover, global volatility caused by aggressive U.S. tariff policies—especially under a potential second Trump administration—could suppress Japanese exports and capital investment further. Nonetheless, positive signs include rising wages and nominal GDP growth. If these trends solidify, they could help shift Japan into a more sustainable growth phase.

Key Takeaways:

- GDP Outlook Weakened: Despite a 1.6% growth in early 2025, MUFG forecasts Japan's real GDP growth will slow to 0.8% due to declining exports and external policy uncertainties.

- Labor & Consumption Challenges: Persistent labor shortages and subdued personal consumption hinder recovery, with inflation and demographic shifts straining supply and demand.

- External Risks Intensifying: U.S. tariff policy and global economic uncertainty pose significant downside risks to Japan’s export-led economy and investment outlook.

For his part, Mr. Nakajima provided a Comprehensive overview of Japan's growing attractiveness as a destination for FDIs, particularly in the context of innovation.

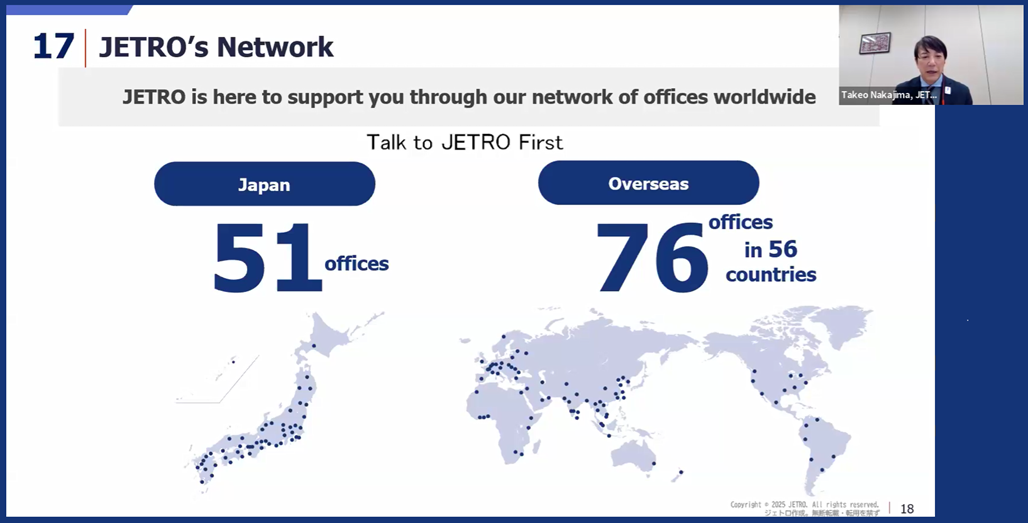

Emphasizing JETRO’s role in connecting Japanese and global economies, Mr. Nakajima detailed how Japan has evolved into a proactive and open partner for foreign investors. The agency’s four strategic pillars—innovation, overseas expansion of Japanese companies, promotion of agricultural exports, and economic research—support an integrated approach to global economic engagement.

Mr. Nakajima pointed out that Japan's FDI stock has more than doubled in the past decade, with a notable increase in investment from Asia, driven by sectors like semiconductors, life sciences, and green tech. He explained that Japan's large and wealthy consumer base, reliable infrastructure, and geopolitical stability make it an attractive alternative in a turbulent global landscape.

He also addressed challenges such as labor shortages but underscored the country’s consistent corporate profitability and its rise in global FDI confidence rankings, now fourth globally and first in Asia according to the 2025 Kearney Index.

JETRO supports foreign companies not only in establishing operations in Japan but also in forging business partnerships and entering collaborative innovation ecosystems. Mr. Nakajima highlighted recent success stories across Japan’s regional industry clusters, from Hokkaido to Kyushu, and emphasized JETRO’s ability to provide tailored support through its domestic and international offices.

He concluded by inviting interested parties to connect with JETRO for customized assistance in entering the Japanese market.

Key Highlights:

- Japan’s FDI stock has grown from ¥23.8 trillion in 2014 to ¥53.8 trillion in 2023, with Asian investors accounting for a growing share.

- Foreign investors cite Japan’s market size, stability, and advanced infrastructure as key advantages.

- JETRO offers hands-on support for foreign firms, including matchmaking, local introductions, and regional investment facilitation across Japan.

The Panel Discussion, explored Japan’s evolving role in global investment and its economic resilience amid geopolitical challenges. Mr. Nakajima emphasized that Japan's rise in inward foreign direct investment (FDI) is not due to any single policy shift but the result of global companies seeking a stable and reliable economic base.

He attributed Japan’s appeal to its political and financial stability, affordable operating costs due in part to a weaker yen, and its strong existing ties with Asian economies. These factors have made Japan an increasingly attractive destination for investors from Asia and beyond.

In discussing the challenges to further boosting FDI, Mr. Nakajima identified Japan’s ongoing labor shortage as a major obstacle. He noted that foreign investors often find it difficult to scale operations due to insufficient local workforce availability. While Japan presents opportunities for skilled foreign professionals—especially in high-demand areas like AI, quantum computing, and autonomous vehicle technology—it does not currently offer generous incentive schemes compared to regional competitors like Vietnam.

This lack of incentives, combined with labor constraints, limits Japan’s competitiveness in attracting large-scale foreign projects.

The conversation also highlighted Japan’s need for greater international collaboration to address talent shortages and accelerate technological transformation. Mr. Nakajima encouraged skilled professionals from Asia, particularly those with engineering and advanced tech expertise, to consider Japan as a viable destination for work and innovation.

The panel underscored Japan’s dual approach: leveraging its strong global connections and economic stability to draw FDI, while gradually opening to foreign talent to address demographic and technological challenges.

Taking this opportunity, I would like to once again extend mysincere appreciation to Mr. Nakayama, and Mr. Nakajima for their very comprehensive and excellent presentations regarding Japan's business and encouraged CACCI members and friends to maintain their engagement in CACCI activities.

The presentation files can be downloaded HERE.