The Asian Bankers Association (ABA) and Taiwan Ratings Corporation (a member of ACRAA – Association of Credit Rating Agencies in Asia , an ABA Knowledge Partner) would like to invite ABA members to view the video recording of the S&P Global’s webinar on Digital Assets: Institutional Crypto Staking held on 11 April 2025.

INTRODUCTION

As Bitcoin and crypto assets enter mainstream financial markets, commercial bankers need to educate themselves and understand the upcoming series of digital assets’ operations that will affect banks. The issue of staking and its blockchain process is very relevant to commercial banks’ deposit operations.

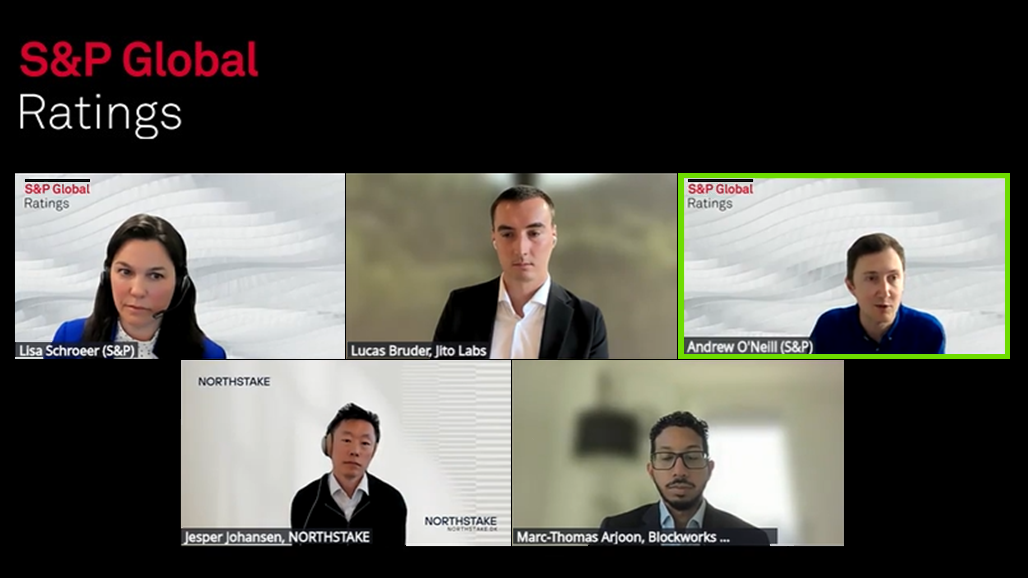

The video recording shows leading digital asset analysts and industry leaders in a live interactive webinar on institutional staking of digital assets.

(1) Key discussion points:

- Background on staking,

- Regulatory and policy considerations,

- Technical and operational considerations,

- Implications of staking in crypto exchange-traded funds, and

- Impact of institutional staking on crypto ecosystems.

(2) Panel of Experts:

Lucas Bruder, CEO, Jito Labs

Jesper Johansen, CEO, Northstake

Marc-Thomas Arjoon, Analyst, Blockworks Research

(3) S&P Experts:

Andrew O'Neill, Managing Director Digital Assets, S&P Global Ratings

Lisa Schroeer, Managing Director Americas Public Finance, S&P Global Ratings as Moderator

To view the video recording of the webinar, please register first here: Digital Assets: Institutional Crypto Staking | S&P Global.

About S&P Global

S&P Global Inc. is an American publicly traded corporation headquartered in Manhattan, New York City. Its primary areas of business are financial information and analytics. It is the parent company of S&P Global Ratings, S&P Global Market Intelligence, S&P Global Mobility, S&P Global Sustainable1, and S&P Global Commodity Insights, CRISIL. It is also the majority owner of the S&P Dow Jones Indices joint venture. "S&P" is a shortening of "Standard and Poor's".

S&P Global Inc. is an American publicly traded corporation headquartered in Manhattan, New York City. Its primary areas of business are financial information and analytics. It is the parent company of S&P Global Ratings, S&P Global Market Intelligence, S&P Global Mobility, S&P Global Sustainable1, and S&P Global Commodity Insights, CRISIL. It is also the majority owner of the S&P Dow Jones Indices joint venture. "S&P" is a shortening of "Standard and Poor's".