Here we present the summary of the presentations.

SUMMARY

(1) Atif Ikram Sheikh, FPCCI President

The main presentation was delivered by FPCCI President Atif Ikram Sheikh, who provided a comprehensive overview of Pakistan’s macroeconomic landscape and investment environment. He noted that Pakistan is on a positive growth trajectory, with the IMF forecasting a 2.5% GDP growth in 2024, driven by agriculture (+6.4%) and manufacturing (+3.3%), while services now contribute 58% to GDP. Exports are also on the rise, growing 11% year-on-year, with FDI inflows primarily from China, the UK, USA, UAE, and Switzerland.

Mr. Atik reported that Pakistan offers compelling investment advantages, including its geostrategic position linking Central Asia, the Middle East, and East Asia through initiatives like the Belt and Road Initiative and the China-Pakistan Economic Corridor (CPEC). He added that the country also boasts a young, digitally literate workforce—64% of its population is under 30. With liberal investment policies allowing 100% foreign ownership and legal protections under the Investment Promotion and Protection Acts, Pakistan has created a favorable climate for international investors.

Key sectors identified by Mr. Atif for foreign investment include agriculture and food processing, logistics, textiles, automobiles, information technology, housing and construction, tourism, and renewable energy. Special Economic Zones (SEZs), particularly those under CPEC, offer incentives like customs exemptions and tax holidays. Additionally, initiatives like the Special Investment Facilitation Council (SIFC) and the FPCCI provide streamlined support and one-window services to ease market entry and business operations, he added.

Key Takeaways:

- Pakistan offers 100% foreign ownership, tax incentives, and a young workforce in a strategic regional hub.

- Eight key sectors—ranging from agriculture to IT—are prioritized for investment with dedicated SEZ support.

- The SIFC and FPCCI act as facilitators, providing one-window support for foreign investors.

(2) Malik Sohail Hussein, FPCCI’s Coordination Chairman

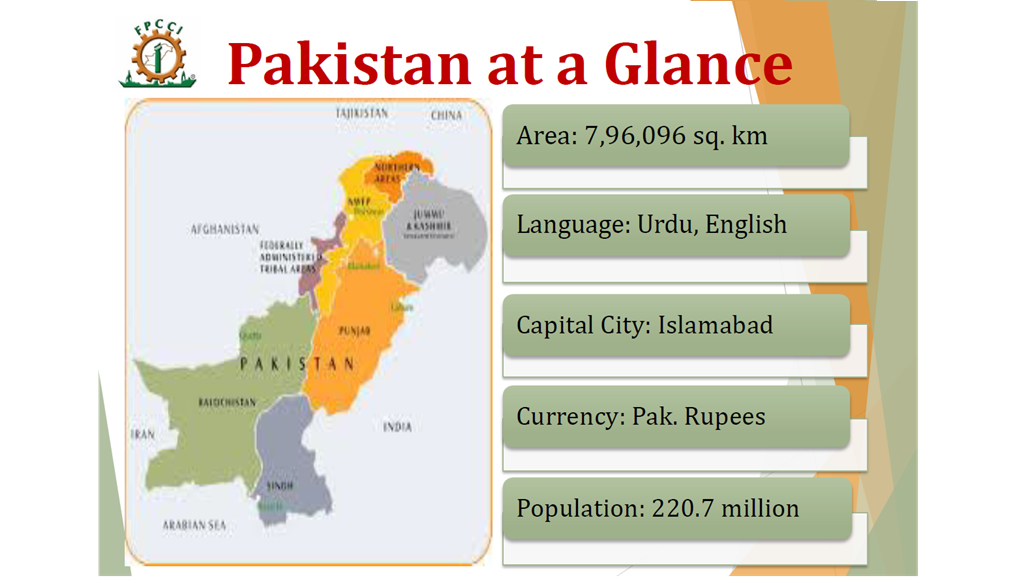

Mr. Sohail Hussein presented a detailed and optimistic overview of Pakistan’s economic and investment landscape. Emphasizing the country’s large and youthful population of over 220 million, he highlighted Pakistan’s strategic location as a trade gateway between South Asia, Central Asia, the Middle East, and China. Pakistan’s economy is growing at a projected rate of 2.5% in 2024, with the services sector comprising 58% of GDP, followed by agriculture and industry.

He noted an 11% rise in exports, with key sectors including textiles, IT services, food, and sports goods. Inflation is under control and foreign investment is increasing from countries such as China, the UK, and the USA. Hussein underscored the significance of the recent Mines and Minerals Conference, which attracted participants from 98 countries and led to significant agreements, including the landmark Reko Diq project.

He stressed Pakistan’s welcoming investment climate, including 100% foreign ownership in most sectors, legal protections for investors, and the ability to repatriate profits freely. Special Economic Zones offer tax breaks and duty-free imports, with opportunities in sectors such as agriculture, IT, logistics, tourism, renewable energy, and healthcare.

Mr. Malik pointed out that the country’s trade advantages are further supported by its GSP+ status with the EU and participation in the Belt and Road Initiative. He also highlighted FPCCI’s active role in facilitating investments through the Special Investment Facilitation Council (SIFC), provincial investment boards, and one-window operations led by the Prime Minister. He emphasized FPCCI’s ongoing support for foreign investors, its collaboration with international chambers like CACCI and ICCIA, and its active global outreach through roadshows and delegations, including an upcoming visit to the USA.

Mr. Malik also elaborated on FPCCI’s best practices in chamber management, digital transformation, policy advocacy, business support, and global networking efforts that help integrate Pakistani businesses into the international trade ecosystem.

Key takeaways:

- Pakistan offers 100% foreign ownership, tax breaks, and special investment zones with no capital restrictions, making it highly investor-friendly.

- Key sectors for investment include agriculture, IT, logistics, minerals, tourism, and healthcare, backed by a growing economy and trade incentives.

- FPCCI actively supports foreign investors through the Special Investment Facilitation Council, global networking, and investment facilitation services.

(3) Q&A session

Moderated by Mr. Mig Moreno, CACCI Deputy Director General, the Q&A session provided deeper insights into Pakistan’s investment landscape and sectoral strengths. Mr. Malik shared that the UK and Switzerland are primarily investing in Pakistan’s energy sector, infrastructure, construction, education, tourism, healthcare, and food and agriculture.

On the question of repatriation of profits, Mr. Atif emphasized that foreign investors are protected by a sovereign guarantee from the government and supported by the Special Investment Facilitation Council (SIFC), with additional facilitation from FPCCI. In response to interest in renewable energy and electric vehicles (EVs), Mr. Malik highlighted Pakistan’s commitment to green energy, noting active participation from Chinese, Korean, and U.S. companies. Sheikh added that Pakistan has a current generation capacity of 45,000 MW—well above the domestic requirement of 30,000 MW—creating a surplus they plan to export in the future.

Addressing law and order concerns, Mr. Atif assured participants that the country’s industrial and business environment is peaceful and increasingly welcoming to international visitors and investors. On the matter of recent U.S. tariff hikes, he clarified that due to Pakistan’s limited imports and strong export orientation, especially in textiles, the impact would be minimal.

Lastly, Mr. Malik identified five key sectors poised for growth over the next three years: mines and minerals, tourism (including health and religious tourism), agriculture, IT, and construction and housing, citing Pakistan’s untapped natural wealth, scenic geography, and food production potential.

Key Takeaways:

- UK and Switzerland invest heavily in energy, infrastructure, and hospitality sectors in Pakistan.

- Pakistan offers sovereign guarantees and facilitation for repatriation and investment security.

- Mines & minerals, tourism, agriculture, IT, and construction are the top growth sectors for the next three years.

Copies of the presentations were sent to participants.

The video recording of the webinar can be viewed at the CACCI YouTube HERE.