Photo by Diptendu Dutta/AFP/Getty Images

(Photo: A rickshaw puller poses with his smartphone as he uses it for Paytm transactions in Siliguri. Driven by a desire to increase financial inclusion, governments have successfully accelerated the growth of fintech financing in the region, resulting in a surge in fintech investment.)

Note: This is the fourth article in a special series focusing on topics related to fintech.

Singapore – The emergence of fintech brings to market new solutions to increase efficiency and financial inclusiveness in the areas of payments, lending, broking, trading, capital-raising, and personal financial management, among others.

The role of managing the development of fintech in any market typically falls to the government and financial regulators, who have played either a supporting or inhibiting role for new entrants. In Asia, we have seen that many governments and regulators, recognizing the benefits emanating from fintech, have made fintech development an explicit policy objective in recent years.

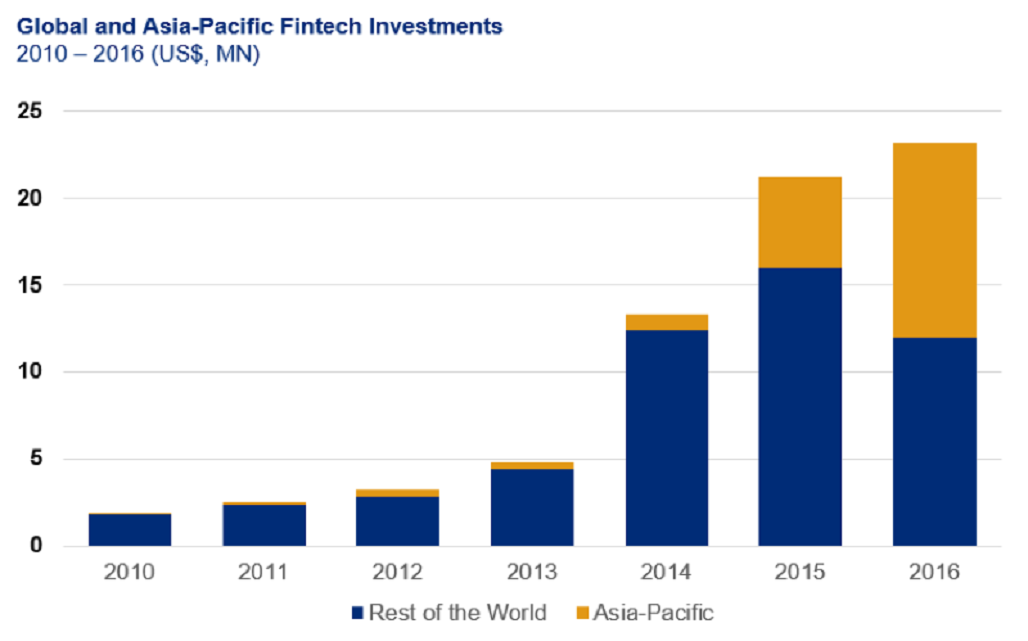

Driven by a desire to increase financial inclusion for significantly “unbanked” or “underbanked” populations, governments have successfully accelerated the growth of fintech financing in the region, resulting in a surge in fintech investment.

Source: APRC analysis on CB Insights data

However, this rapid growth in fintech has the potential to expose systemic risks for the banking sector and the broader economy. So while governments in the region need to continue nurturing their fintech sectors, they must also manage the associated risks.

Supporting Growth: The Role of Regulators and Governments

There are three main actions that regulators and governments in Asia must take to ensure the smooth development of a thriving fintech landscape, according to an upcoming report.* They are to (a) provide innovation support; (b) ensure a conducive investment environment; and (c) enhance digital and financial infrastructure.

Support Innovation

Design regulations to allow experimentation. New entrants must be allowed to test their business ideas with real customers and better understand relevant regulatory boundaries. Meanwhile, adequate oversight from regulators and policymakers during this process must also allow for more learning regarding new fintech entities before actual regulations are mandated for their products and services.

Design regulations to allow experimentation. New entrants must be allowed to test their business ideas with real customers and better understand relevant regulatory boundaries. Meanwhile, adequate oversight from regulators and policymakers during this process must also allow for more learning regarding new fintech entities before actual regulations are mandated for their products and services.

The art of post-sandbox regulatory approval. The process of final regulatory approval before the “go-live” of any fintech company is another area of increasing importance. This final stage is currently a site of significant uncertainty among fintech professionals, who undertake a highly iterative process going through multiple rounds of review with the regulator teams. Dedicated teams of financial regulators need to manage “final-stage” fintech approvals and licensing and work closely with teams who run the regulatory sandboxes to ensure more regulatory certainty.

Invest

Governments and regulators must facilitate the right investment environment for fintech companies to pave the way for enhanced access to capital.

Improving the investment ecosystem. In China, for example, the government has maintained a laissez-faire approach to private fintech investors, choosing not to interfere by providing benefits or subsidies such as tax breaks. Elsewhere, in 2018, the Australian government revised and expanded its investor tax incentive scheme to support fintech startups; Singapore and Hong Kong have also maintained tax incentives for fintech investors.

A measured approach. Where necessary, governments often channel funds into the fintech sector through a mix of development grants and direct investment. While direct government investment is important, it needs to be done in a way that does not compromise the free market and does not prematurely select winners and losers. The best approach is for governments to identify the gaps in funding but take a passive investor approach to avoid government crowding-out effects.

Infrastructure

Telecommunications and Internet coverage. In larger developing markets, many fintech applications focus on extending financial services to unserved and underserved sectors of the population. In this regard, mobile networks become the key financial services distribution channel. Countries such as India and Brazil see high levels of fintech adoption in payments, credit and savings services, driven by a strong foundation of broad mobile coverage.

Centralized payments system. Increasingly, governments are recognizing the importance of an e-payment infrastructure in developing a conducive fintech environment and broadening the digital economy. However, setting up a national payment infrastructure is not without practical challenges. Launched in April 2016, India’s Unified Payments Interface (UPI) was seen by many as a success—many major international and local firms use the system as their payment infrastructure (such as Jet Airways and WhatsApp), resulting in the steady growth of UPI transactions. However, more than 90 percent of UPI transactions remain peer-to-peer, and the system has not been able to scale up commercial transactions, reducing its economic value.

Data-sharing capabilities. Fintech products and services are limited without a supporting framework to ensure data is accessible to fintech companies. The wealth of financial and behavioral data owned by incumbents is both a major competitive advantage and a huge barrier to entry. As such, governmental intervention and any regulatory imperative to share this data across platforms catalyzes the development of fintech companies. There are, however, technical challenges and liability issues related to data sharing. Conforming to universal data standards will be costly, and scaling this framework will also run into challenges. Further, regulators and governments need to understand the importance of metadata to increase traceability and address any liability issues that may arise when data is shared between traditional banks and fintech entrants.

Protecting Stability: Regulatory Reforms for Risk Management

A fintech regulatory program needs clear goals of ensuring financial stability, coordination among cross-sector regulators, and strong customer protection and empowerment.

Maintaining Financial System Stability. While there are currently no compelling signs of fintech financial instability risks materializing, certain emerging (macro-prudential) risks can escalate. For example, fintech may gain prominence through indirect network effects between highly connected entities in the form of market infrastructure, to the extent that the importance and prevalence of network complexity and associated contagion effects could be significant. Regular review of the regulatory framework is necessary to monitor growth and product evolution.

Regulating Cross-Sector Institutions. Fintech growth has necessitated a new supervisory system that can address financial stability risks. The same traditional regulatory framework cannot be applied universally across banking, nonbanking, or fintech companies, as standalone and uncoordinated regulations could lead to fragmentation. This can result in businesses easily and quickly moving jurisdictions to take advantage of and arbitrage the traditional regulatory framework. One approach to overcoming this is activity-based regulation, where regulators move away from regulating entities and regulate the actual financial activities those entities are performing.

Empowering and Protecting Consumers. Regulators have taken aggressive steps to protect data privacy. For example, the General Data Protection Regulation was approved by the EU Parliament after years of preparation and debate. It is a progressive first step toward protecting consumers and stakeholders globally who have been monitoring this new regulation and adopting it across other jurisdictions. In addition, regulators need to increase international collaboration on cybersecurity and must aim to standardize key cybersecurity rules.

Separately, innovative financial products and services often create opportunities of misconduct, as technology can magnify the potential of unlawful actions that were once subjected to intense regulatory detection. Perhaps an even more important issue is that of machine misconduct, which arises when over-reliance on automated decision-making processes can result in systematic errors and/or conceal biases, such as discrimination based on race, religion, or geographic locations.

Looking Ahead

Increasing Internet and smartphone penetration means that fintech can become a vehicle for financial inclusion across the Asia-Pacific; and fintechs can aid in the formalization of money and dramatically shrink gray economies. Facilitating innovation and efficiencies in the sector will spur the emergence of adjacent digital sectors as well, such as advanced analytics and AI.

Governments and regulators in the region have a pivotal role to play in developing fintech services: They must become both incubators and protectors of the sector.

*A more detailed report on the subject from Oliver Wyman will be published soon.

Related themes: Disruption Investment Regulation

Tancho Fingarov

Tancho Fingarov

Principal at Oliver Wyman

Tancho Fingarov is a principal with Oliver Wyman. He is part of the firms’ Financial Services and Public Policy practices. As part of his work, he focuses on management of IR, FX and liquidity risk.

Corporate Interest Rate and Forex Risk in Times of Volatility

Peter Reynolds

Peter Reynolds

Partner, Finance and Risk Practice at Oliver Wyman

Peter Reynolds is a partner in the Finance and Risk practice based in Oliver Wyman’s Hong Kong Office, where he recently moved after 10 years in New York. Peter has worked in-depth with major financial institutions across the U.S., Europe and Middle East and has led Oliver Wyman’s Capital Markets risk team in the U.S.

This article was published in Brink Asia‘s website.

Leave a Reply