East & Partners third and final Research Note in this three-part series explores corporates’ behavioural responses to the COVID-19 crisis versus how they navigated previous periods of financial instability. The insights are presented by regional business banking product market across Australia, Asia and Europe.

East & Partners third and final Research Note in this three-part series explores corporates’ behavioural responses to the COVID-19 crisis versus how they navigated previous periods of financial instability. The insights are presented by regional business banking product market across Australia, Asia and Europe.

This research note evaluates the impact of the current global COVID-19 pandemic on corporate’s foreign cashflows in Europe compared to that of the 2008 Global Financial Crisis (GFC). Similarly to the GFC, the coronavirus pandemic has been a global phenomenon limiting normal global market operations to some degree.

Europe in particular is one of the world’s largest global trading hubs and accounts for 15 percent of global trade volume. The impact of financial crises on European business’ ability to manage tightening foreign cash flows and liquidity is a major threat to growth and stability.

Liquidity Crunch

The main trigger for the current corporate liquidity crunch is different to the GFC. In 2008, irresponsible lending and risk management in the global banking system amplified the impact of the subprime mortgage lending and collateralised debt obligation (CDO) shock in the United States (US). This had a domino effect on bank’s liquidity in Europe as interbank loans between the US and Europe fell flat.

In today’s crisis, the issue of liquidity has primarily stemmed from business closures and limited social contact which has supressed revenues, hampered productivity, increased unemployment and reduced corporate cash buffers.

Today’s corporate liquidity issue can undoubtedly coalesce with other mitigating factors to become a bank credit quality risk, matching the GFC. If banks continue to extend lines of credit to corporates, they will encounter even greater challenges than simply failing to make an adequate return on investment given the prevailing low interest rate environment or if corporates default. This makes the COVID-19 crisis the biggest risk to the European and global financial system in modern history, particularly if business productivity does not swiftly recover post COVID-19.

“Output in both the Euro area and the European Union (EU) is not expected to recover its pre-pandemic level in 2022”

European Union’s Executive Commission

How long do corporates expect before a full recovery is made from the crisis? East & Partners upcoming Global Insight Report details expectations of the Top 100 revenue ranked corporates in eight countries globally, including the United Kingdom (UK) and Germany in Europe.

Direct interviews with CFOs and corporate treasurers uncovered vastly different levels of forward dated confidence and sentiment, in some cases anticipating for the crisis to be over by early Q1 2021 and in others as late as Q3 2021, contingent on a vaccine distribution touted as “the largest logistics effort in the world since World War II” according to Deakin University’s Centre for Supply Chain and Logistics Senior Research Fellow, Dr Roberto Perez-Franco.

It is essential that trade barriers are reduced through greater action from the World Trade Organisation (WTO) and that corporates are fully equipped to manage extreme currency fluctuations when trading with foreign markets as this will help increase liquidity and stimulate growth.

Exchange Rate Volatility

Over the past ten months currency markets have displayed extreme volatility due to uncertainty stemming from rising COVID-19 cases. As a result, business valuations have fallen flat as currency fluctuations make cashflow predictions increasingly difficult.

Even for domestic businesses that sell only to local customers, they may also experience cash flow issues derived from exchange rate volatility because most of the raw materials they purchase are priced in foreign currency. In these instances, it has become essential for corporates to understand the underlying impact of currency volatility on their balance sheets and the risks to valuations and financial reporting.

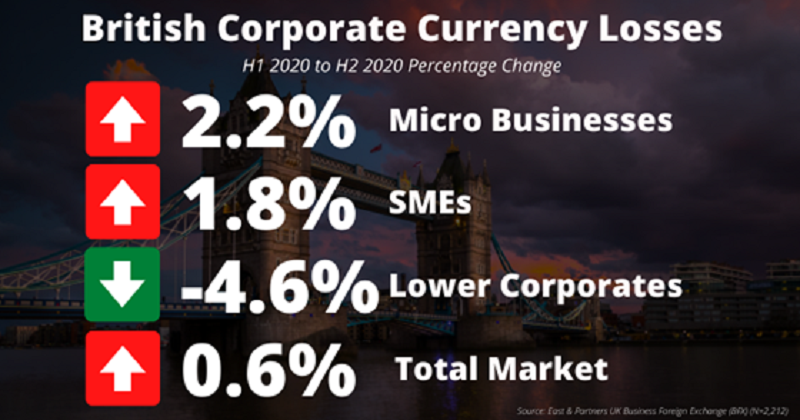

East’s Global Business Foreign Exchange (FX) programme confirms that in the UK, importers and exporters with revenues between £20 – 100 million (Lower Corporates) posted forecasts that significantly undershot Sterling (GBP) against the US Dollar (USD) for June 2020. In contrast, businesses with revenues between £1 – 5 million (Micro) nominated forecasts that exceeded the GBP/USD exchange rate.

Source: East & Partners UK Business Foreign Exchange (BFX) (N = 2,212)

Volatility has made it difficult for British firms to predict future exchange rates on major currency pairs. Similar hurdles were also present in the 2008 financial crisis, however, sterling gradually stabilised against majors within the space of a year. This made trade and foreign cash flows easier to manage and predict. How quickly major currencies will stabilise post the current pandemic remains unclear.

Business Valuation

Ultimately the implications of business’ currency losses on corporate liquidity are immense. It diminishes the value of monetary assets, raises potential liabilities and reduces cash flow. This can have a considerable impact on business valuations making it difficult for investors to purchase corporate bonds and equity. Since the beginning of the pandemic, stock market valuations in Europe have fallen by a resounding 32.2 percent.

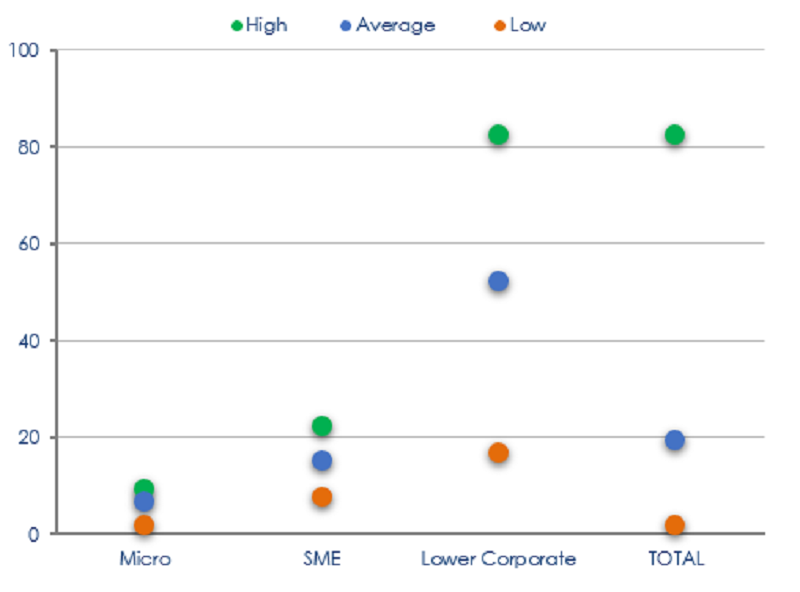

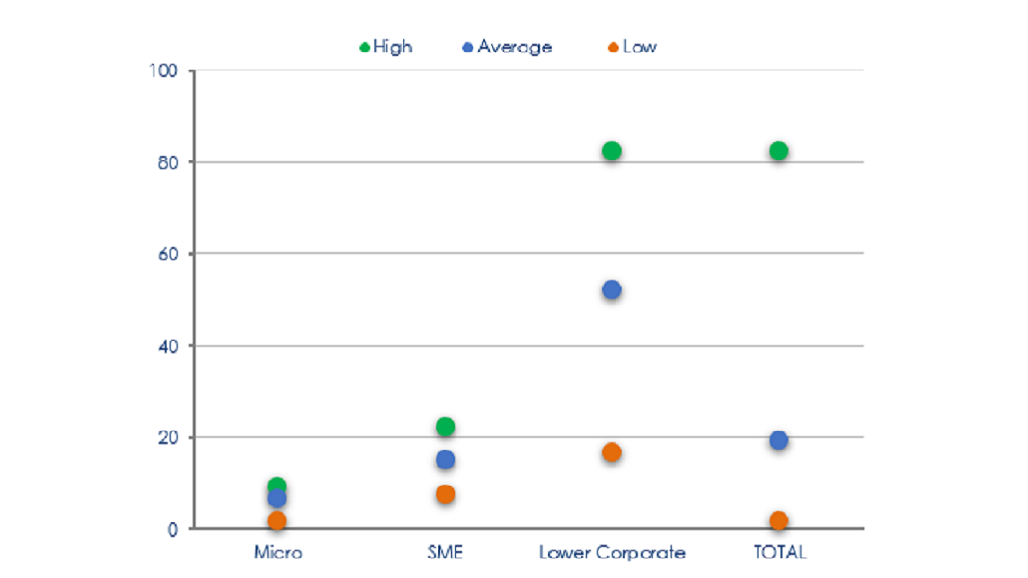

Currency Loss Value – H2 2020

Average Currency Loss Reported (GBP Thousand)

Source: East & Partners UK Business Foreign Exchange (BFX) (N = 2,212)

However, since the announcement of the COVID-19 vaccine markets have become discernibly bullish. Once the vaccine has been widely distributed, businesses in the UK and Europe can project future cash flows in anticipation of ‘business as usual’.

Consequently, this has raised expectations on corporate liquidity and, in the short run, has inflated business valuations. In the United Kingdom, the FTSE 100 jumped nearly five percent after the announcement of the vaccine. Other European stock market indices have also displayed similar bullish reactions.

The Future ahead

Corporates have depended heavily on their financial providers to support them with flexible working capital solutions and lending facilities driven by technology and innovation. Virtual accounts, open accounts distributor finance and other products are examples currently deployed by corporates to improve liquidity – all of which must be harnessed through digital documentation and execution technology.

This contrasts the approach taken in the 2008 crisis where corporate liquidity was mainly managed through traditional methods such as credit lines.

The long-term impact of a liquidity crunch will depend on how quickly businesses can recover from this historic event.

East & Partner’s upcoming Global Insight Report will provide addition insights around corporate’s experience with their primary bank’s response to COVID-19 in areas such as balance sheet finance and liquidity solutions.

Other areas that the report will cover are:

- Influence on Banking Provider Selection by Product

- Primary Provider Wallet Share Impact

- Lead Offering Needed to Navigate COVID and Switching Driver

- Key Digital Functionality Accessible Now

- Key Digital Functionality Urgently Required

- Most Important Value Add from Relationship Management

- And more…

East & Partners can assist corporations on their strategic business development plans in 2021 and beyond or sign up here to read more from East & Partners.

Leave a Reply