The Asian Bankers Association (ABA) and the Association of Credit Rating Agencies in Asia (ACRAA) jointly held a successful webinar on Advancing ESG Agenda: Net Zero Emission Supply Chain Through Carbon Footprint (CFP) on 19 October 2023.

Moderated by Mr. Atsushi Masuda, Chairman of ACRAA, Counselor for International Affairs, Japan Credit Rating Agency (JCR), the webinar featured as speakers a Japanese government official, a petrochemical company staff, a commercial banker and a rating agency representative. Over 440 bankers from 35 countries registered for this special webinar.

We present the Summary of the speakers’ presentations below.

SUMMARY

(1) The first presentation on Carbon footprint and net zero emission target for the entire supply chain by Mr. Tomoki Sano, Deputy Director, Environmental Policy Division, Industrial Technology and Environment Bureau, Ministry of Economy, Trade and Industry (METI) discussed the purpose of achieving green transformation in Japan.

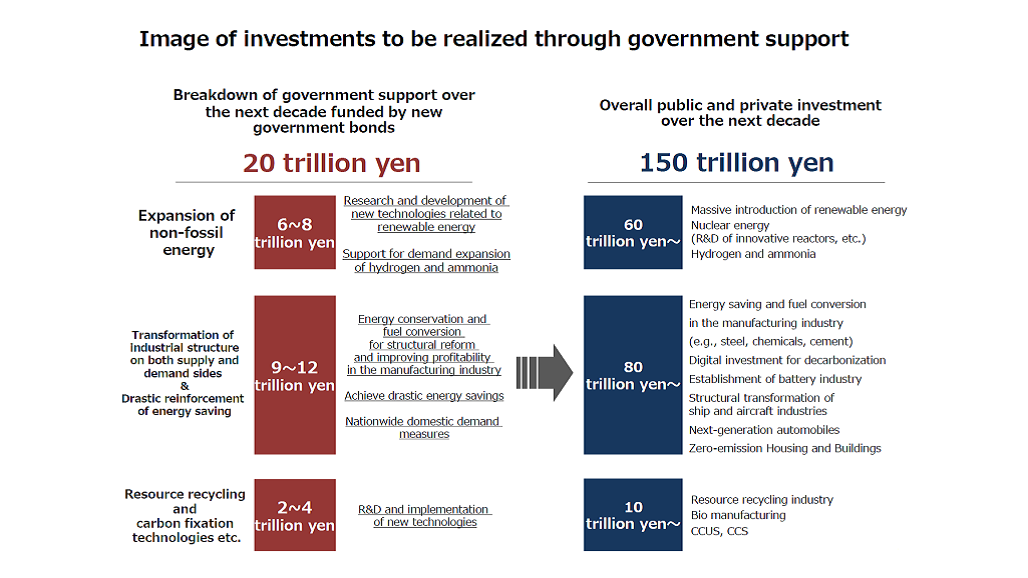

According to some estimates, economies headed to achieving carbon neutrality have reached 94% of the world’s GDP as of 2023, thus the importance of promoting investments towards this global trend.

Since Japan is heavily dependent on imported fossil fuels, the risks associated with this structure have especially become apparent after the Russian invasion of Ukraine.

He argued that to achieve long-term sustainable growth, it is important for Japan to transform its economic and industrial structure based on clean energy (=Green Transformation.)

Furthermore, since the importance of transition finance is starting to be understood globally; in the G7 Hiroshima Summit held in 2023, the G7 highlighted the importance of transition finance for the first time.

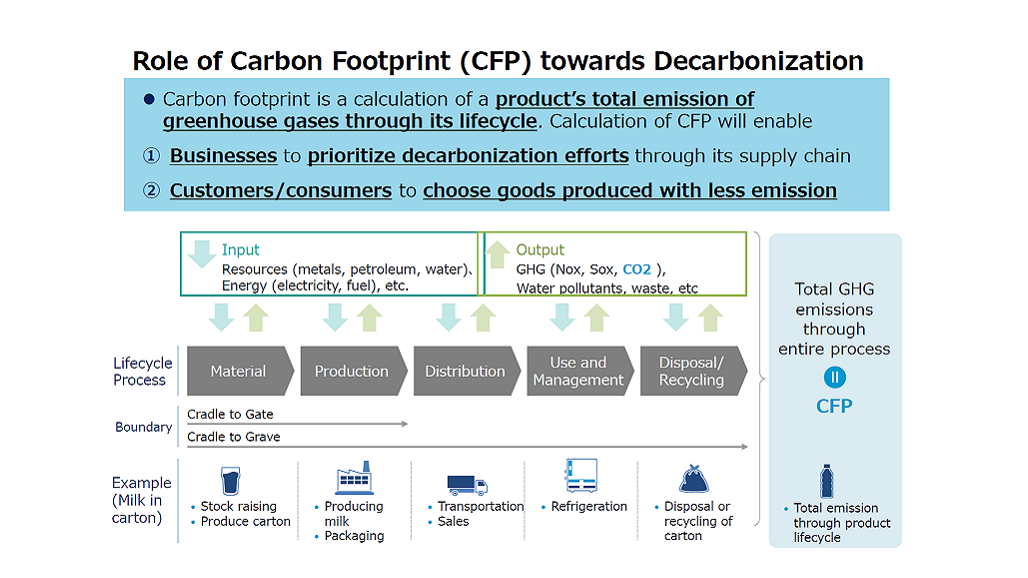

Concerning the role of Carbon Footprint (CFP) towards Decarbonization, he explained that Carbon FootPrint is a calculation of a product’s total emission of greenhouse gases through its lifecycle. He proposed that the calculation of CFP will enable businesses to prioritize decarbonization efforts through its supply chain.

The final objective is that customers and consumers will choose goods produced with less emission.

For this reason, the purpose of CFP for businesses is that various stakeholders surrounding businesses should request the calculation and disclosure of CFP amidst increasing interests for climate change.

Mr. Sano highlighted that CFP is increasingly becoming a factor for business competitiveness and that the future policy directions based on the “CFP Guideline” will accelerate businesses’ efforts to calculate and understand their CFP, and lead to procurement of low-emission products, thereby leading to fewer emissions across the product supply chain.

Mr. Sano concluded with the forecast that to promote such change, Japan will undertake the more serious policies.

(2) The second presentation on Outline of carbon footprint and sustainability link loan framework by NAGASE & CO., Ltd. featured Mr. Yasuyuki Aizawa, Corporate Sustainability Office Manager of NAGASE & CO., LTD.

He started his presentation on the 190 years history of this traditional trading firm. It was then followed by an explanation on what is CFP.

According to him, CFP is a method of evaluating the environmental impact of CO2 based on the framework of life cycle assessment.

He mentioned that actually, CFP is calculated at the Product-level vs. Corporate-level. The methodology is built on ISO 14067 and some influential international CFP guidelines launched recently.

Mr. Aizawa presented a successful case to the audience where NAGASE and its partners successfully created the world first data linkage of carbon emission in the laptop PC suppler chain (Tier 0 to 3.)

It is said that 70% of the chemical suppliers are working on CFP.

Furthermore, he argued that CFP is an effective way to assess the environmental impact of chemicals. Collecting primary data is critical to moving toward carbon neutral.

In the chemical industry, the development in the three dimensions, methodology, tools and engagement have spurred suppliers to work on carbon footprints.

He forecasted a further drive carbon transparency in the chemical supply chain, which is essential to creating incentives especially for SMEs.

Nagase’s new SLL framework is extensive and its expertise covers not only Tier1 suppliers but also suppliers behind them (Tier2, Tier3…).

(3) The third presentation on Business management support for zero emission by financial institutions featured Mr. Naoya Orita. Vice President/Head of Sustainable Finance Japan, Sustainable Business Division, MUFG Bank, Ltd.

Mr. Morita initiated his presentation expressing MUFG’s Commitment to Carbon Neutrality and MUFG Declaration of Carbon Neutrality.

In fact. MUFG has been supporting its clients’ decarbonization and launched a collaboration with Zeroboard Inc., offering services for more than 1,800 companies.

This project led to the development of new business fields through visualization of customer’s GHG emissions and the entire supply chain, development of finance schemes, partnerships with solution providers, etc.

Mr. Morita also explained that Sustainability Linked-Loan (SLL) is a financing method with flexible use of funds that links the borrower’s Sustainability KPI performance with loan terms.

Loan terms such as interest rates are linked to the achievement of the SPT (Sustainability Performance Targets.)

These loans allow flexible use of funds while publicizing sustainability commitments externally. Furthermore, borrowers are incentivized by changes in loan conditions, such as preferential interest rates, depending on the level of achievement of the SPT, so the borrower can strengthen its commitment to achieve sustainability goals.

(4) The fourth and final presentation on How to evaluate the alignment of Supply Chain Finance Framework with Sustainability Linked Loan Principles featured Ms. Atsuko Kajiwara, Managing Executive Officer, Head of Sustainable Finance Evaluation Group.

She explained how to evaluate the alignment of Supply Chain Finance Framework with Sustainability Linked Loan Principles.

Ms. Kajiware spoke about the abundant experience in valuation (900 evaluations provided) and the participation of her organization in standards development as a member of the government council and study committee.

In the following image, she explained how sustainability linked loans (SLL) work:

She explained that the process of evaluation rests in the effort to capture the impact through the value chain, thus companies, suppliers and consumers share common challenges in reducing CO2 emission.

She proposed creating a system to reduce CO2 emissions throughout the supply chain as an integrated system.

Copies of the full presentations were available to ABA members.

The recording of the webinar can be viewed at the ABA YouTube channel HERE.

Leave a Reply