Fintelekt Advisory Services and the Asian Bankers Association (ABA) held a hour long webinar on AML Compliance Priorities for 2024 on January 24, 2024, which gathered over 1,070 registered participants from more than 45 countries.

Fintelekt Advisory Services and the Asian Bankers Association (ABA) held a hour long webinar on AML Compliance Priorities for 2024 on January 24, 2024, which gathered over 1,070 registered participants from more than 45 countries.

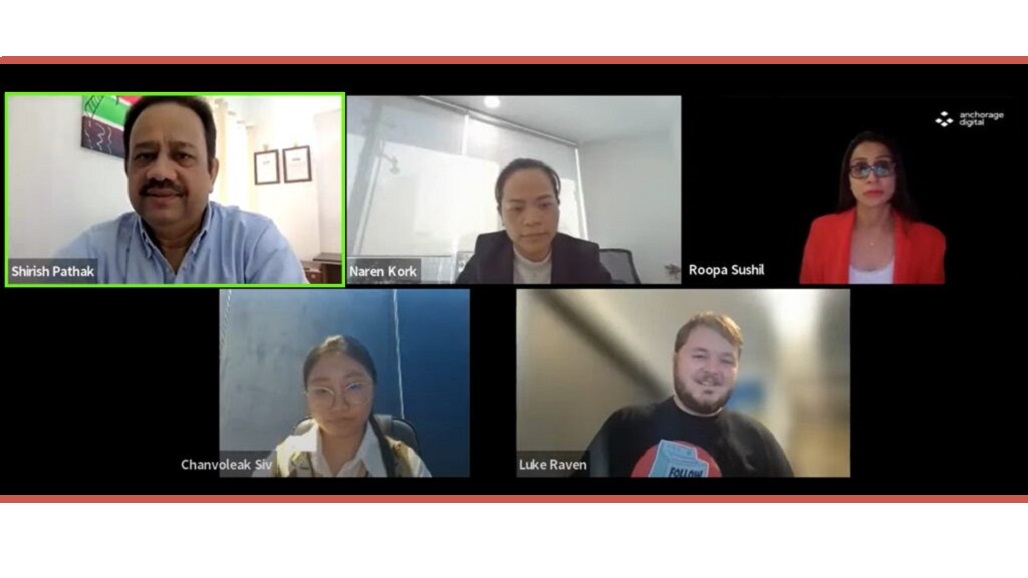

Shirish Pathak, Managing Director, Fintelekt Advisory Services hosted the webinar, which featured as speakers Naren Kork, Head of Compliance, SBI LY Hour Bank, Cambodia, Roopa Sushil, MLRO, Anchorage Digital, Singapore, Luke Raven, Senior Partner FCC, Bank of Queensland, Australia and Siv Chanvoleak, Head of Compliance, Woori Bank, Cambodia.

During the webinar, each speaker discussed their views on the outlook for the coming year for AML/CFT and their priorities for 2024. A summary of the discussion is as follows:

(1) Roopa Sushil, MLRO, Anchorage Digital, Singapore

Mr. Roopa Sushil noted that so far, the adoption of crypto across countries can be grouped into 3 buckets:

- Countries that have adopted licensing and registration rules and strict KYC requirements for consumers and institutions using a tech-neutral approach – that is, regulators using the existing laws applicable to traditional financial institutions for crypto.

- Countries that are creating comprehensive and facilitating legal frameworks specifically for the crypto industry.

- Countries have decided not to accept cryptocurrencies. These are characterised by no regulation or policies, and no guidance for the crypto industry.

He further pointed out that:

- There has been a renewed focus on crypto regulations in 2023 and serious policy making discussions around crypto market structure across different geographies.

- There is a realisation that crypto is here to stay, which has led to more regulatory framework and policies coming up to regulate this sector. This has culminated in increased confidence of investors in cryptos which in turn will result in more solid regulations and more regulated and safe digital asset custodians.

- In 2024, there is an expectation of more regulatory oversight, higher AML cost and expenses, and greater consumer protection measures which will be critical for building trust and stability for the crypto industry. The digital assets industry expects to work closely with regulators and other peers on proposed regulatory changes. Control frameworks, policies and procedures will need to be aligned to regulatory requirements.

(2) Luke Raven, Senior Partner FCC, Bank of Queensland, Australia

Mr. Luke Raven cited that:

- Australia has embarked on a structural revamp of AML/CFT regulation through a consultation process with the industry to make compliance easier and to focus on outcomes and effectiveness. The industry expects the reform package to include better tipping off provisions and to bring in regulation of gatekeeper professionals, among others.

- In 2024, KYC should be top of the mind for everyone. KYC is the solution to frauds and scams. Reporting entities should think beyond “who is your customer?” and know where his money is coming from. The customers KYC should match with what the customer is doing. This should be coupled with a holistic approach to fraud, money laundering and sanctions.

- There should be a focus on compliance effectiveness. When all the boxes in a compliance programme are checked (i.e. the basics are in place), there can be a focus on outcomes and effectiveness.

- Cooperation amongst public and private sectors is another priority area, since public sector alone cannot bring in the resources and sophistication required to tackle financial crime.

Mr. Raven remarked that “When we are super passionate about our jobs as AML compliance professionals, and when we do it well, we save lives!”

(3) Naren Kork, Head of Compliance, SBI LY Hour Bank, Cambodia

Ms. Naren Kork reported that:

- A big achievement for Cambodia was that it was removed from the FATF grey list in 2023. In the coming year, the banking sector’s priority is to continue to collaborate and engage with the regulator and the compliance community and ensure that the banking industry is updated on all aspects of money laundering and terrorist financing risks.

- There is a need to prioritise more engagement with business teams within the organisation to ensure that business decisions are taken with complete understanding of the money laundering and terrorism financing risks and requirements of law and regulation. Similarly, we need to focus on compliance effectiveness by first line of defence through implementation of controls and processes.

- In 2024, there will be a focus on proliferation financing including risk assessment and inclusion of more measures in customer due diligence. Beneficial ownership information is also a challenge since the country currently does not have a centralised database for BO information.

- Other priority areas include automation of technology and systems, digitalisation, data governance and accuracy of reports.

(4) Siv Chanvoleak, Head of Compliance, Woori Bank, Cambodia.

Ms. Siv Chanvoleak stated that:

- Cambodia was delisted from the FATF grey list due to significant progress and effectiveness. Banks have robustly implemented controls and carried out enhancements of AML/CFT systems such as screening, customer risk categorization, and transaction monitoring.

- For ongoing improvements, we need to keep ourselves updated on AML risks, and transaction monitoring parameters. We need to ensure controls and identification of suspicious transactions especially within new products and services and digitalization due to payment systems.

- Within commercial banks in Cambodia, regulators are highlighting the risk of proliferation financing, beneficial ownership identification, customer risk rating, PEPs, and are providing guidance on how to document and identify these risks before on-boarding a customer.

- In 2024, banks need to measure and improve AML/CFT programmes and work more on beneficial ownership, reporting of suspicious behaviour, PEPs, screening and documentation and recording of data. There is a need for a centralized record base to collect and store financial data in view of ML risks. Policy guidelines and processes should be consistent and standardised and gaps or loopholes must be closed.

Ms. Chanvoleak pointed out that “Criminals are always trying to find new ways to trap victims. We need to build robust controls, but we also need to address the question of how to prevent innocent customers from becoming the victim of frauds or scams or money laundering schemes.”

(5) Video Presentation

The recording of the webinar can be viewed at the Fintelekt website HERE.

It can also be viewed at the ABA Youtube Channel HERE.

Leave a Reply