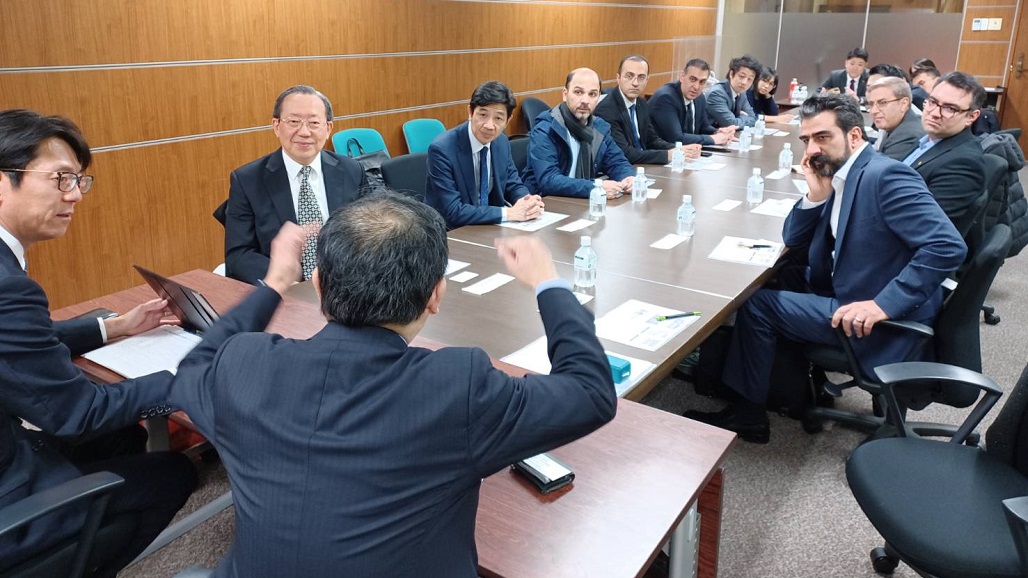

Sumitomo Mitsui Banking Corporation (SMBC) successfully hosted a Short-Term Visiting Program held on February 20-21, 2024 at its headquarters in Tokyo, Japan, with 12 representatives from seven ABA member banks in attendance.

Sumitomo Mitsui Banking Corporation (SMBC) successfully hosted a Short-Term Visiting Program held on February 20-21, 2024 at its headquarters in Tokyo, Japan, with 12 representatives from seven ABA member banks in attendance.

During the first day of the two-day program, SMBC officers shared their experience, expertise, and best practices on various aspects of banking operations, particularly in the areas of Global Banking, Retail Banking, SMBC’s Sustainability Initiatives, and an overview of the Japanese Economy and Financial Market. Field visits were also conducted on the second day, with the participants visiting SMBC Nihombashi Branch, The Bank of Japan, and the Japanese Bankers Association.

February 20 Program

Mr. Kazuya Ikeda, Managing Executive Officer, General Manager, Staretgic Planning Dept., Global Banking Unit, gave the Welcome Remarks. Mr. Ikeda said that maintaining strong relationship with other Asian banks is important to SMBC, thus the bank values its ties with the Asian Bankers Association (ABA).

Mr. Kazuya Ikeda, Managing Executive Officer, General Manager, Staretgic Planning Dept., Global Banking Unit, gave the Welcome Remarks. Mr. Ikeda said that maintaining strong relationship with other Asian banks is important to SMBC, thus the bank values its ties with the Asian Bankers Association (ABA).

He stated that the Short-Term Visiting Program, the second one organized by SMBC since joining the ABA (with the first one held in 2013), would not only enable the participants to gain information from the speakers but also allow them to expand their networks.

Mr. David Hsu, Secretary-Treasurer of ABA, gave a brief introduction on the ABA and its activities. He highlighted that the primary objective of ABA’s Short-Term Visiting Program is to provide member banks the opportunity to study and undergo training on specific aspects of the operations and facilities of the more advanced host banks such as SMBC.

The Bank officers who made presentations on the first day included the following:

Mr. Tsuyoshi Yamaguchi, General Manager, Strategic Planning Group, Global Banking Unit, gave a brief rundown of the two-day program, provided some house rules, and requested each participant for a brief self-introduction. He then proceeded to make a presentation on SMBC – its history, its current operations, and its future policy directions and growth strategy. He also served as the Moderator of the morning session.

Mr. Tsuyoshi Yamaguchi, General Manager, Strategic Planning Group, Global Banking Unit, gave a brief rundown of the two-day program, provided some house rules, and requested each participant for a brief self-introduction. He then proceeded to make a presentation on SMBC – its history, its current operations, and its future policy directions and growth strategy. He also served as the Moderator of the morning session.

Mr. Takashi Masatoki, Group Head, Strategic Planning Group, Strategic Planning Dept., Global Banking Unit; Mr. Takuya Omura, Joint General Manager, Asia Growing Markets Dept; . and Ms. Reiko Mori, General Manager, Global FIG Dept., shared SMBC Group’s Medium-Term Management Plan, an overview of its Global Business Unit and the Business Strategy of the Global Business Unit, including its efforts to achieve a multi-franchise strategy and the strengthening of its overseas business;

Ms. Chivers Yoko, General Manager, Sustainable Solution Dept., explained the SMBC Group’s Sustainability Initiatives, including an overview of its transition plan to realize net zero, enhancement of phase-out strategy for the coal sector, efforts to reduce portfolio GHG emissions, supporting customers’ transition and innovation, providing decarbonization support tools using digital technology, and participating in a variety of public and private initiatives.

Ms. Chivers Yoko, General Manager, Sustainable Solution Dept., explained the SMBC Group’s Sustainability Initiatives, including an overview of its transition plan to realize net zero, enhancement of phase-out strategy for the coal sector, efforts to reduce portfolio GHG emissions, supporting customers’ transition and innovation, providing decarbonization support tools using digital technology, and participating in a variety of public and private initiatives.

Mr. Bohan Zhang, Economist, Planning Dept., Global Markets & Treasury Unit, provided an overview of the Japanese economy and financial market, highlighting the domestic situation in Japan, key takeaways on the overseas economy, and an economic and financial market forecast for 2024-2025.

Mr. Nobuhiko Satake, General Manager, Planning Dept., Retail Banking Unit, elaborated on SMBC Group’s Retail Business, providing an overview of the business environment, Medium-Term Management Plan, the Bank’s Olive Concept aimed at building a digital-based retail business, and the Group’s Hybrid Channel Strategy, wealth management business, and payments business and consumer finance.

Mr. Nobuhiko Satake, General Manager, Planning Dept., Retail Banking Unit, elaborated on SMBC Group’s Retail Business, providing an overview of the business environment, Medium-Term Management Plan, the Bank’s Olive Concept aimed at building a digital-based retail business, and the Group’s Hybrid Channel Strategy, wealth management business, and payments business and consumer finance.

Mr. Kazuhiro Fukuda, Executive Officer and Deputy Head of Global Banking Unit, delivered the Closing Remarks on behalf of SMBC, thanking the participants for their presence in the program and expressing his hopes that they have learned from the presentations about the Bank and its various banking operations and strategies.

Mr. Amador Honrado, Deputy Secretary of ABA, in his Closing Statement expressed his appreciation to the officers and staff of SMBC for their support of this important training activity of the ABA. He also hoped that the program has given the participants the opportunity not only to benefit from SMBC’s experience and expertise, but also to establish strong relationships with their colleagues from SMBC and other participating countries.

Mr. Junya Takagi, Joint General Manager, Global FIG Dept., served as Moderator for the afternoon session; The first day ended with a presentation of Certificates of Attendance to all participants by Mr. Takagi and Mr. Hsu.

During the course of the first day, the participants were given a tour of the premises of SMBC head office.

February 21 Program

The second-day program consisted of the following activities:

Visit to SMBC Nihombashi Branch

The program participants visited the Nihombashi Branch of SMBC where they were given a briefing by the branch officers on SMBC’s channel strategy, particularly on the three concepts followed by the Bank in reforming its branch operations.

These concepts essentially include: (a) changing the way the Bank serves its customers; (b) changing the administrative processes; and (c) changing the store formats.

The visiting participants learned that in the old branches, staff were situated behind long counter, with back-office staff seated at desks two or three rows further back, and consultation booths were located next to the counter.

In the new, next-generation branches, back-office functions are now centralized into outside centers to free up space in the branch for customers. The large lobby has (a) advanced ATMs which can handle tax payments, (b) large spaces for customers to proceed with their business using tablet devices; (c) open consultation booths, and (d) a Premium Zone, with private rooms for consulting services. The current medium-term management plan for branches – mainly involving digital-real hybrid operations – was also shared by the Nihombashi branch officers.

Visit to the Bank of Japan

Following the visit to SMBC Nihombashi Branch, the participants proceeded to the Bank of Japan, where they were given a tour of the important sections of the historical premises while being given information on the history of the operations of Bank of Japan and its current functions and organization.

Following the visit to SMBC Nihombashi Branch, the participants proceeded to the Bank of Japan, where they were given a tour of the important sections of the historical premises while being given information on the history of the operations of Bank of Japan and its current functions and organization.

They were also given access to the Bank of Japan’s original underground vault, where they were shown the vault doors, the original floor, walls and ceiling, and the facilities of the vault. They also had the opportunity to examine the bank notes that are produced by the Bank.

Visit to the Japanese Bankers Association

From the Bank of Japan, the participants visited the Japanese Bankers Association (JBA) and met with its officers led by Mr. Masaaki Misawa, Deputy General Manager, Planning and Coordination Dept.

Mr. Misawa briefed the visiting ABA member banks on the activities of JBA and its role in promoting the interest of its members and the Japanese banking industry as a whole, including its recent initiatives and international relationships.

The ABA visitors expressed their hopes of working more closely with JBA in bringing Asian banks together for advancing the cause of ABA member banks and of the

banking and finance industry in the region and promoting economic cooperation.

About SMBC

About SMBC

SMBC was established in 2001 through the merger of The Sakura Bank, which originated from the Mitsui Family and was founded as Mitsui Bank in 1876, and The Sumitomo Bank, which originated from the Sumitomo Family and was founded in 1895.

It is the second-largest bank in Japan in terms of total assets and market capitalization. Along with MUFG Bank and Mizuho Bank, SMBC is referred to as one of Japan’s three major megabanks.

SMBC Group operates in over 40 countries and maintains a presence in all International Financial Centres as the 12th biggest bank in the world by total assets. It is one of the largest global financial institutions in project finance space by total loan value.

Leave a Reply