HNB's Adoption of RPA & AI to Reshape its Banking Operations

I. Background

HNB commenced its Digital Transformation Journey in 2013, in 4 stages.

(1) Creating a sense of urgency and board mandate

(2) Driving a Hub and Spoke Model (Branches repositioned for frontline activities supported by 6 centres of excellence (credit underwriting, credit underwriting and disbursement, operations, collections, contact centre and staff loans)

(3) Driving Digital Products across business segments – Retail and Wholesale Banking.

(4) Driving Centralisation, Automation, Process Improvement, Outsourcing initiatives across the bank

II. Objectives

(1) How RPA and AI fits in to HNBs Digital Transformation Journey

(2) Insights on adoption and implementation

(3) Benefits derived

(4) Challenges faced and how overcome

(5) Way Forward

III. How RPA and AI fits in to HNBs Digital Transformation Journey

The 6 centres of excellence ensured the bank benefited from 3 key areas, known as 3 Ss.

(1) Standardisation: Ensuring activities performed in a uniform manner across the bank with requisite controls in place.

(2) Speed: SLAs and TATs developed from the perspective of the client end to end journey, tracking FTR and Cycle Times at every stage.

(3) Specialisation and Skills: Tasks split in to distinct parts, and a structured training and job rotation program to enhance knowledge and expertise. This enabled certain functions to be carried out by non permanent staff supporting headcount rationalization and cost optimization efforts.

HNB benefited significantly from economies of scale as a result of these efforts, resulting in number of staff in branches being rationalized and productivity and efficiency levels of centers. HNB benefited from a significant improvement in productivity and efficiency indicators among peers and industry from laggard to lead in the 5 years 2015 to 2019.

Despite this the potential to introduce technology to achieve quantum leap improvements in productivity and efficiency levels in the Centralised Functions was becoming apparent due to several factors

(1) High turnover among non-permanent staff

(2) Technology adoption restricted to workflow systems and excel

(3) Difficulties in replacing staff attrition as a conscious strategy

(4) Growing awareness of potential for Robotics and AI

IV. Insights on adoption and implementation

(1) Driving awareness and training: Multiple workshops were created with domain experts and staff to demystify RPA technology among staff at all levels in Centralised Functions

(2) Setting up Project Teams with accountabilities: Clear role cards provided to Project Sponsor, BT specialist, IT liaison and consultant.

(3) Developing pipeline and prioritization process: Ensure stakeholder involvement in developing pipeline and prioritization based on effort, value and complexity.

(4) Partner selection based on POC to Pilot: Limited domain experts and inadequate use cases resulted in usual procurement process not being followed.

RPA implementation has resulted in operational efficiencies, exponential productivity improvement, speed, controls and ability for the business to better engage their customers. All processes are first optimized using Lean/Six Sigma/BPR principles prior to automation to ensure process optimization precedes automation.

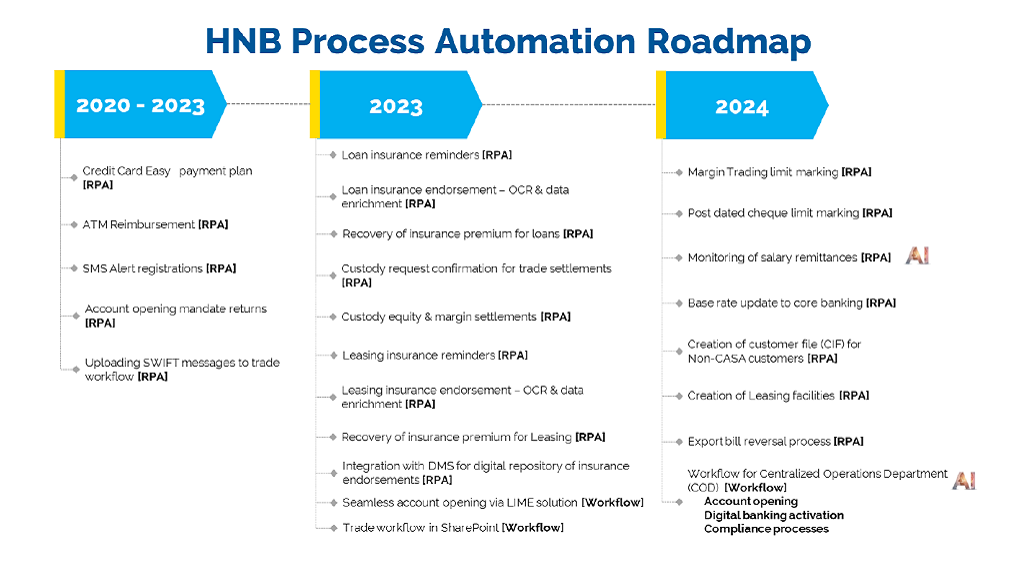

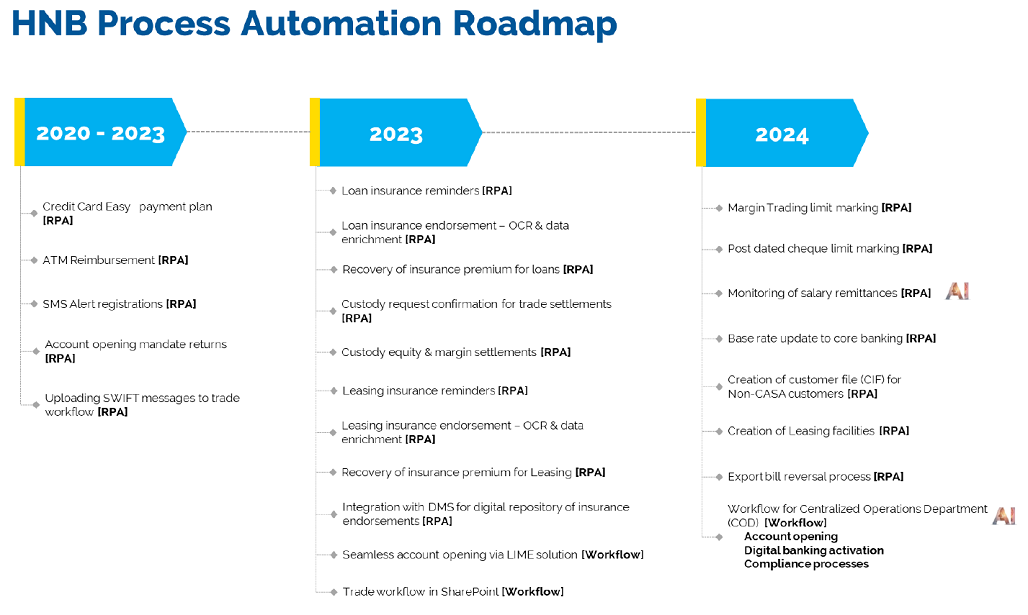

As a result of the benefits realized, more processes were identified as candidates for RPA, leading to the implementation of 10+ RPAs including the recent implementation at the custody and trustee services department and insurance renewal processes at the Credit Administration department.

Automation of customer facing processes at the Custody department resulted in a competitive advantage and new benchmark amongst the local banks by repositioning the service delivery timelines to T+0 against the existing practice of T+1. Furthermore, the custody department was able to save 3 hours’ worth of processing time with the RPA executing the process in 13 minutes, resulting in a productivity improvement of 98% overall. The teams are now able to focus on customer related activities to improve the service quality and delivery timelines. 6 RPAs were deployed into the Insurance renewal process for end-to-end automation where digital reminders are sent to the loans and leasing customers of the bank. The OCR based end to end automation deployed for leasing insurance renewal resulted in 24 hours saving per day in total across the branch network with a productivity increase of approximately 180% in the end-to-end process.

Recognition of HNB’s efforts by the Asia Technology Excellence Awards under ‘Sri Lanka Technology Excellence awards for Robotics in Banking’ held in September 2023 is testament to the progress made and HNB’s commitment to driving RPA implementation.

V. Challenges faced by HNB during RPA implementation

Below are some of the key challenges faced during the implementation of RPA at HNB:

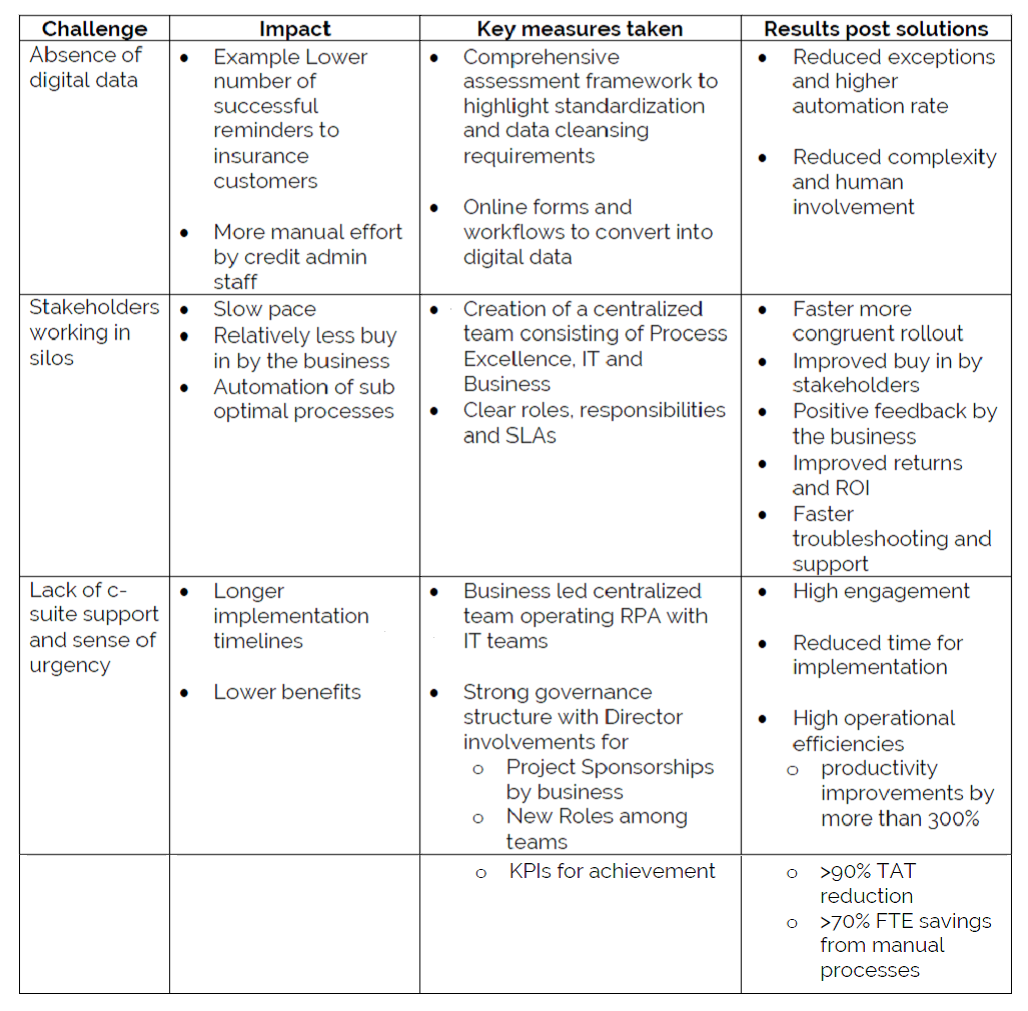

- Absence of digital data availability and poor-quality data

Many application forms are still maintained in physical form in the industry and the acceptance of digital signatures is still in its infancy in Sri Lanka. The typically low success rate of Optical Character Recognition (OCR) for physical forms is a critical challenge faced by the banks in Sri Lanka. Currently account opening, fix deposit and credit applications are accepted physically with customer signatures. This has posed challenges in automating these processes end to end using RPA. Furthermore, when automating insurance renewals, the project teams observed challenges in data accuracy which would require data cleansing exercise for successful automation without errors. As a part of the learnings, HNB is now evaluating the quality of data and standardization requirements as a part of the assessment exercise as a proactive measure.

- Stakeholders working in silos

RPA was initially purely handled by the IT team. However, the level of engagement and support was low by the business teams due to lack of understanding of RPA and how it can help business teams achieve exponential returns. Due to this challenge, the bank observed significantly lower returns with some projects even taking years to be implemented. A dedicated centralized team was formed in 2021 consisting of Process Excellence, IT roles and the business to drive RPA in the organization. As a result, we have witnessed significant operational efficiencies and much lower implementation timelines by the creation of the said structure.

- Need for an RPA governance framework

Another key reason for lower level engagement support by c-suite and c-1 was due to the absence of a strong governance structure and KPIs for process automation. This has led to challenges in establishing key roles amongst the teams for commitment and compliance.

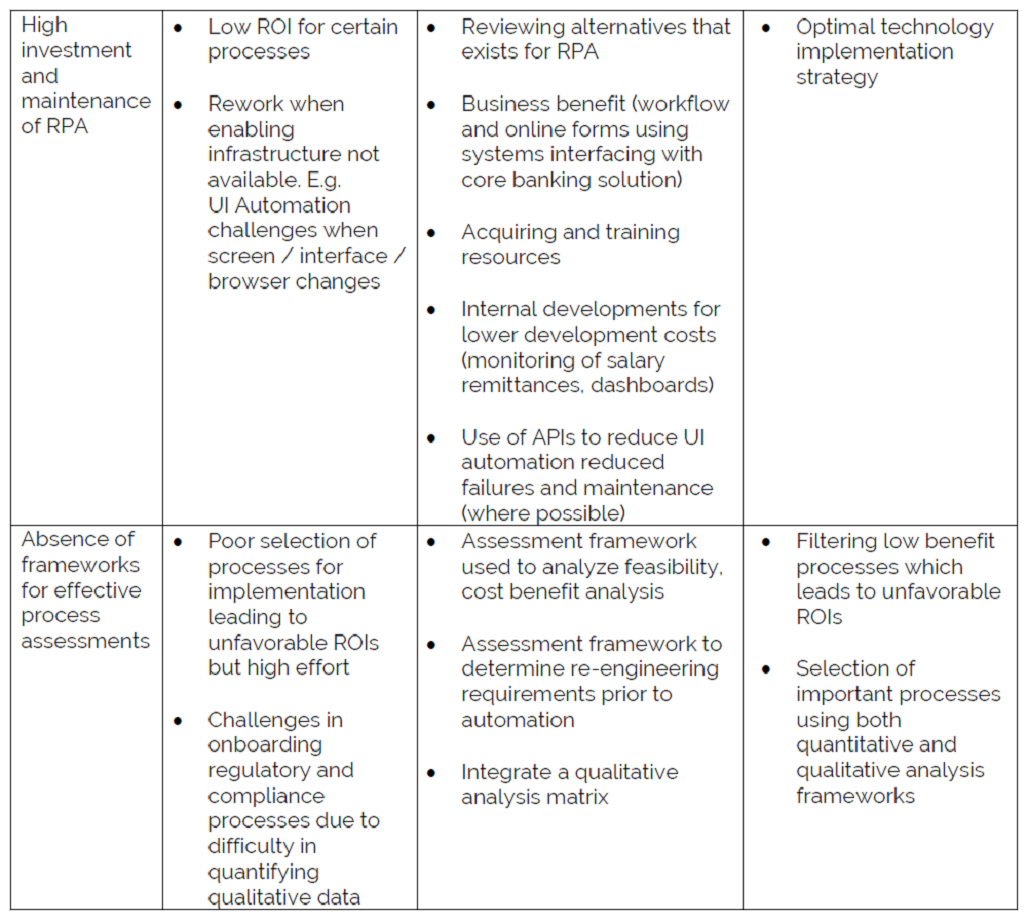

- High investment and maintenance of RPA

RPA is a high investment technology solution with front end automation which needs frequent maintenance for uninterrupted operation. Further, it was observed that many other technologies can address similar automation needs using back-end automation. This has posed challenges in automating certain processes. due to reduced ROI

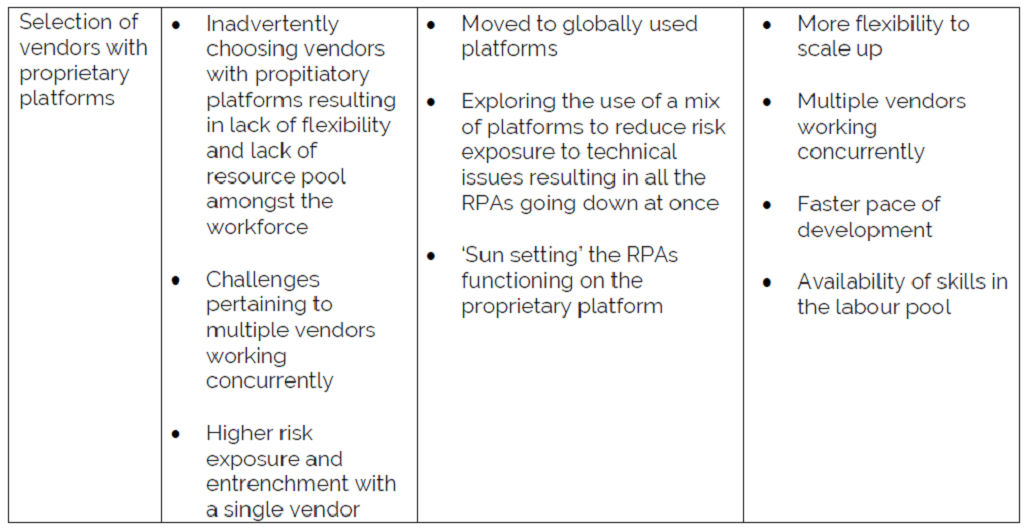

- Selection of vendors

The inadvertent selection of vendors using proprietary platforms resulted in many challenges, especially during scaling up as multiple vendors could not collaborate in the development process and the organization became entrenched with one party. There was also an inherent challenge in recruiting people with knowledge about the platform amongst the general workforce, making it harder to carryout internal development and changes.

- Absence of frameworks for effective process assessments

Whilst some automation predominantly lends itself to productivity and efficiency improvements, certain processes are associated with regulatory and compliance requirements. The absence of a qualitative benefit analysis model in the initial stage was a constraint when selecting such processes as they typically had lower ROIs. This necessitated the development of a comprehensive RPA selection matrix to allow the inclusion of critical processes which had qualitative benefits without deselecting or reprioritizing them.

VI. Way forward – Use of Intelligent Automation and AI

Use of AI and Integration with RPA, and use of block chain technology are some of the critical and important steps for Hatton National Bank to consider as a part of its digital transformation strategy for the future. The use of AI and intelligent automation will help reduce the need for human intervention in automated process, further improving efficiencies and increasing staff capacity to take on other activities.

HNB has currently tested the use of AI and machine learning by automating many processes using big data and algorithms to generate management information to analyze trends and patterns for decision making. Analytics have been adopted for various business segments operations, margin trading, asset quality in order to benefit from slicing and dicing portfolio to support decision making. In addition, we developed Predictive models for impairment stage movements for Retail Business lines that significantly assists in recovery efforts. This is being extended for SME sector where the need is significantly higher.

Prepared for the Asian Bankers Association by:

Christopher Thuraisingham & Nuwanka Perera

Christopher Thuraisingham & Nuwanka Perera

Hatton National Bank