Experience of Iran in Islamic Banking

(1) Preface

During the past few decades Islamic banking has grown dramatically in the world and many non-Islamic countries have welcomed it as an alternative banking system working in parallel to conventional banking and have authorized establishment of Islamic banks in their territory or Islamic banking departments within conventional banks observing Islamic banking principles and guidelines.

During the past few decades Islamic banking has grown dramatically in the world and many non-Islamic countries have welcomed it as an alternative banking system working in parallel to conventional banking and have authorized establishment of Islamic banks in their territory or Islamic banking departments within conventional banks observing Islamic banking principles and guidelines.

After the Iranian revolution, contrary to many Islamic countries which carry out both Islamic and conventional banking systems, such as GCC countries, as required by the Iranian constitution, all banks in Iran, both foreign and domestic, are obliged to exclusively observe and practice Islamic banking. Henceforth, there is no relationship or cooperation between conventional and Islamic banks in Iran. Notwithstanding, all Iranian banks are free to have correspondent banking relations with conventional international banks established outside of Iran.

(2) Iran Banking System

The history of banking commenced in Iran in year 1888 by the British when they established the Imperial Bank of Persia. Soon after, the Russians opened the Russian Loan and Development Bank. The first Iranian bank, Pahlavi Ghoshoon (today called Bank Sepah) was opened in year 1925.

Bank Melli Iran (meaning the “National Bank of Iran” in Farsi) was established in year 1928 and functioned as both a commercial and a central bank during the period 1931-1960.

In 1960, the Central Bank of Iran was established according to the Banking and Monetary Law, and accordingly Bank Melli Iran became merely a commercial bank.

It is noteworthy to mention that prior to the Islamic Revolution in February 1979, 36 banks (24 commercial and 12 specialized) with 8,275 branches operated in Iran. These 36 banks were composed of 4 government banks and 32 private banks (mostly joint venture banks between a foreign bank and a local bank) and all practiced conventional banking.

After the revolution, the Banking Nationalization Act and the Law for the Administration of Banks were established in 1979 and all domestic private banks and insurance companies were nationalized by the government. The post-revolution reduction in economic activity and financial resources required consolidation of the banking industry and banks to amalgamate. By 1980, this amalgamation, in conformity with the Banking Nationalization Act, had reduced the number of banks to 9 (6 commercial and 3 specialized) and the number of branches to 6,581.

The Usury-Free Banking Act was established in 1983 and the Monetary and Banking Act of Iran (MBAI) was amended according to Islamic banking regulations. Subsequently, foreign banks were only allowed to operate as Representative Offices in Iran.

In 2001, the Iranian Government moved towards liberalizing the banking sector in order to encourage the development of a more competitive and efficient industry. During this year 4 private banks received their commercial banking license from CBI and were established. Bank Pasargad was the fifth private bank to receive its license from CBI and was established in September 2005.

Currently Iranian banking system consists of Central Bank of Iran, banks and non-bank credit institutions (NBCIs). In total there are 39 banks and NBCIs of which 8 banks are state-owned (divided into 2 categories of 3 full commercial banks and 5 specialized banks operating in fields of agriculture, housing, industry and mines and export development), 17 banks are full commercial private banks and 4 banks are national banks that were privatized. Additionally, there are 2 Gharz-al-hasaneh banks and 5 NBCIs in Iran. Lastly, we have one joint Iranian and foreign bank, Iran & Venezuela, and 4 branches of foreign banks in together constituting the banking system.

The main laws governing Iranian banking system are:

- The Monetary and Banking Law of the country (passed in 1973); and

- The Law for usury-free banking (passed in 1983)

According to the Iranian laws and regulations, the regulating and supervising structure for banks and non-bank credit institutions in Iran is comprised of:

Central Bank of Iran (CBI)

CBI is responsible for formulating and implementing monetary and credit policies on the basis of the general economic policy of the country. The main objectives of CBI are to maintain the value of the national currency, to stabilize the balance of payments, to facilitate trade transactions, and to promote economic growth for the country.

Securities and Exchange Organization

All Iranian banks listed on the Tehran Stock Exchange (TSE) are required to comply with the Securities Market Law of Iran and the regulations issued by Securities and Exchange Organization.

Financial Intelligence Unit (Ministry of Economic Affairs and Finance)

Financial Intelligence Unit (FIU) is a body embedded in Iran’s Ministry of Economic Affairs and Finance supervising all transactions in the banking system to combat money laundring and financing of terrorism activities.

(3) Islamic Banking in Iran

Prior to the Islamic Revolution of Iran in 1979, all banking activities were in line with the conventional banking system but after the revolution according to article 4 of Iran’s constitution were unequivocally changed to the Islamic banking system: “All civic, penal, financial, economic, administrative, cultural, military, political, and other laws and regulations must be based on Islamic criteria. This principle governs all the articles of the constitution, and other laws and regulations. The determination of such compatibility is left to the Foqaha (Islamic Scholars) of the Guardian Council.”

In this regard, in September 1983 the Law for Usury (Interest) Free Banking was approved by the legislative power and came into effect on March 1984 in the Iran’s banking system. Accordingly, for the first time in the world Iran introduced a comprehensive interest-free banking system which is different from practice of Islamic banking in other Muslim countries. Most Islamic countries practice a dual banking system in which Islamic banks work alongside conventional banks providing a choice for clients. Alternatively, in many Islamic countries we witness conventional banks that have an Islamic banking department in their organization chart.

The main characteristics of Iran’s Usury-free Banking System are:

- Eliminating usury (interest) from all banking activities by using Islamic contracts (profit-sharing instruments, fixed-income contracts, attorney ship, …) instead of interest-based contracts between the bank and the client;

- Establishing a close link between the real sector and the monetary sector of the economy; and,

- Necessity to exert added supervision on the implementation of Islamic contracts.

(4) Law for Usury (Interest) Free Banking

As stated previously, the Law for Usury (Interest) Free Banking was approved and implemented in 1983. According to this law, the pillars of the Iranian Banking System, Mobilization of Resources, Formulating Modes of Financing, and Establishing New Instruments of Monetary Policy are as follows:

(4.1) The Objectives of Banking System

According to the Law for Usury (Interest) Free Banking, the main objectives of the Iranian banking system are:

(1) To establishment a monetary and credit system based on rightness and justice (as delineated by Islamic jurisprudence) for the purpose of regulating the sound circulation of money and credit to enhance the health and growth of the economy.

(2) To gain advantage of monetary and credit mechanisms, to engage in activities conducive to the attainment of the economic goals, policies and economic development plans.

(3) To create necessary facilities for the extension of Gharz-al-hasaneh (interest free consumer loans) among the general public through the absorption of non-interest bearing saving accounts and the mobilization thereof in provision of conditions as stipulated in the Constitution.

(4) To maintain the value of Iranian national currency, to establish stability in the balance of payments and to facilitate commercial transactions.

(4.2) Mobilization of Resources

Banks are authorized to accept deposits under each of the following titles:

(1) Gharz-al-hasaneh Deposits

In these kind of deposits, the relationship between the depositor and the bank is based on (non-interest bearing) lending and borrowing.

These deposits are divided into two categories:

(a) Current Gharz-al-hasaneh Deposits

This type of deposit is like a checking account in the conventional banking system. Resources deposited in the form of Gharz-al-hasaneh current accounts are regarded as bank resources and are used in profitable modes of financing, along with resources from investment deposits.

(b) Savings Gharz-al-hasaneh Deposits (interest-free savings accounts)

Resources deposited in the form of Gharz-al-hasaneh Savings Accounts by clients are used by banks to extend interest-free consumer loans (Gharz-al-hasaneh).

(2) Investment Deposits

There two types of investment accounts in Iran: (1) short term deposit similar to a regular saving account in the conventional banking system; and, (2) term deposits ranging from 3 months to 5 years.

The main distinction between these investment accounts with conventional banking is that the rate of return on deposit is not fixed at the beginning of the term. However, according to forecasted annual rate of return on mobilized funds, banks consider an advance rate of return for different kinds of deposit and at the end of the term of deposit, based on the real performance of the bank, the ultimate rate of return on annual basis shall be calculated and distributed among the depositors.

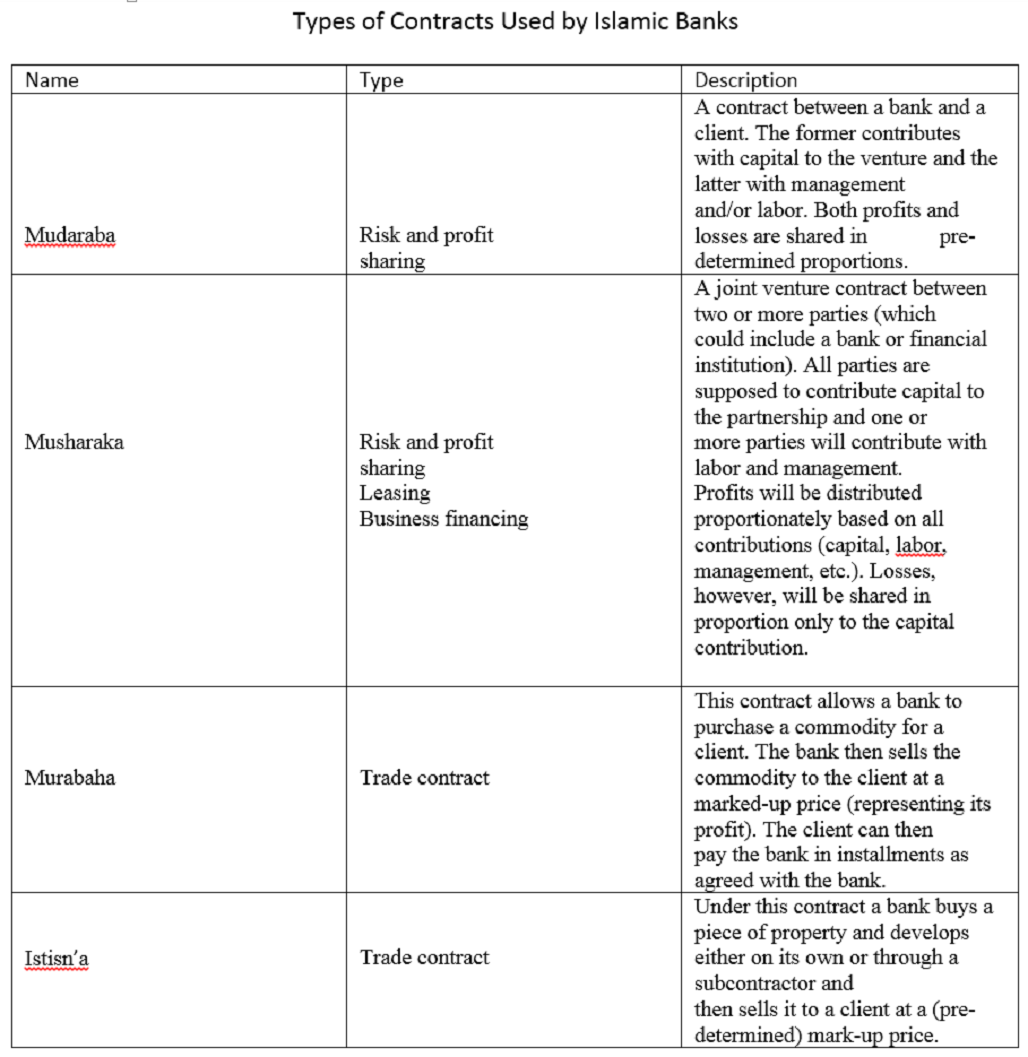

In these deposits, the relationship between the depositor and the bank is based on attorney ship used in Islamic contracts. In this regard, investment depositors give attorney to the bank to use their resources in profitable Islamic modes of financing like partnership, Mudarabah, hire-purchase, Murabaha (installment transaction), direct investment, forward dealings and Jualah transactions. At the year end, the profit accrued will be divided between the bank and customers based on their shares in providing the resources after deducting attorney fees belonging to the bank.

According to a separate binding agreement, the customer accepts to bear the loss of the business where the bank invests the funds. The objective of this agreement is to protect the bank in case of a future loss in the business where the funds were invested. Notwithstanding, the customer is free to insure his/her business to compensate against any potential loss.

The banks are also permitted to issue negotiable Certificate of Deposit for general usage or for a specific project(s).

Additionally, to term investment deposits, banks are authorized to issue general profit- sharing securities or specific securities for financing of specific projects.

(4.3) Modes of Financing

In order to eliminate “usury/interest” from the banks’ activities, different modes of financing were introduced in the Law for Usury (Interest) Free Banking:

(1) Interest-Free loans (Gharz-al-hasaneh)

(2) Fixed income modes of financing based on forecasted rate of return on underlying transactions

- Murabaha (installment sale)

- Hire-purchase

- Istisna

(3) Profit/loss sharing modes of financing

- Civil partnership

- Legal Partnership (equity participation)

- Mudarabah

(4) Direct investment by banks

As the above modes of financing are well-known, I do not explain them in this paper (Appendix).

(4.4) Instruments of Monetary Policy

For the proper functioning of the monetary and credit system, the Money and Credit Council is empowered to intervene in, and supervise, the monetary and banking activities by means of the following instruments:

(A) Setting a minimum and/ or maximum ratio of profit for banks in their partnership and Mudarabah activities (these ratios may vary for different fields of activity and economic sectors).

(B) Designation of various fields for investment and partnership within the framework of the approved economic policies, and the fixing of a minimum expected rate of profit for the various investment and partnership projects (the minimum expected rate of profit may vary with respect to different sectors of economic activity).

(C) Setting a minimum and maximum margin of profit, as a proportion to the cost price of the goods transacted, for banks in installment and hire-purchase transactions.

(D) Determination of types and the minimum and maximum amounts of commissions for banking services (provided that they do not exceed the expense of service rendered) and the fees charged for putting to use the deposits received by the banks.

(F) Determination of the minimum and maximum ratio in joint venture, Mudarabah, investment, hire-purchase, installment transactions, buying or selling on credit, forward deals, Jualah and Gharz-al-hasaneh for banks or any thereof with respect to various fields of activity.

In addition to the above-mentioned instruments, the Central Bank of Iran can use conventional instruments of monetary policy as far as they are not on the basis of interest (usury). Therefore, reserve requirement ratio, credit ceiling, and open market operation (based on Islamic securities) are available for usage in case of necessity to the policy makers.

(5) Islamic Interbank Market

Regulations on Iranian Rial (the Iranian national currency) interbank market were approved by the Money and Credit Council in 2004 and became operative in 2008 in Iran’s banking system.

The main functions of the Iranian interbank market are short-term financing of the Iranian banks and to be utilized as a channel of monetary policy.

Permissible modes of transactions in the Iranian interbank market are as follows:

- Depositing in other banks in the form of investment deposits;

- Purchasing or sale of debt instruments;

- Trading and transactions involving Participation Papers and Certificates of Deposits

(6) Islamic Banking in Iran and relationship with foreign banks

Several Iranian banks have branches abroad, but they are mostly engaged in trade finance activities. The activities of such branches are based on banking regulations and supervision of the Central Bank of Iran as well as the host country.

Several Iranian banks have branches abroad, but they are mostly engaged in trade finance activities. The activities of such branches are based on banking regulations and supervision of the Central Bank of Iran as well as the host country.

Henceforth, the branch can propose and deploy Islamic contracts subject to obtaining authorization from the regulator in host country and local regulations. But in reality, no significant effort has been made by Iranian banks over the past 40 years to establish true Islamic branches abroad and they mainly practice conventional banking in opening of accounts for clients and conducting trade finance activities. None of the branches of Iranian banks abroad have been successful in attracting local deposits and gaining market share in different lending activities.

(7) Sharia Council

According to Article 16 of Iran’s 6th Five Year Economic, Social and Cultural Development Plan, a Sharia Council was set up in the Central Bank of Iran in order to assure proper implementation of usury free banking operations in the banking system. The members of the Sharia Council are:

(1) Five Islamic Scholars to be designated by the Guardian Council

(2) Governor of CBI

(3) A lawyer and an economist to be designated by the governor of the CBI

(4) A CEO of one of the State-Owned banks to be designated by the Ministry of Economic Affairs and Finance

(5) A member of parliament (as an observer)

(8) Regulations based on Islamic banking

In addition to the Law for Usury Free Banking and its related regulations on Islamic banking, other regulations are compatible with Sharia and international standards.

As an example, according to the circular on capital adequacy ratio (CAR) issued by the Central Bank of Iran, Basel II, Basel III, and the Islamic Financial Service Board (IFSB) are bases of regulation on CAR.

In this regard, the “risk coefficient” of fixed-income modes of financing are lower than risk coefficient of profit/loss sharing ones.

(9) Performance of banks and NBCIs in Islamic Banking

All Iranian banks and NBCIs mobilize and allocate resources based on Islamic banking. As you are well aware, Iran is the world’s foremost country in terms of Sharia compliant assets.

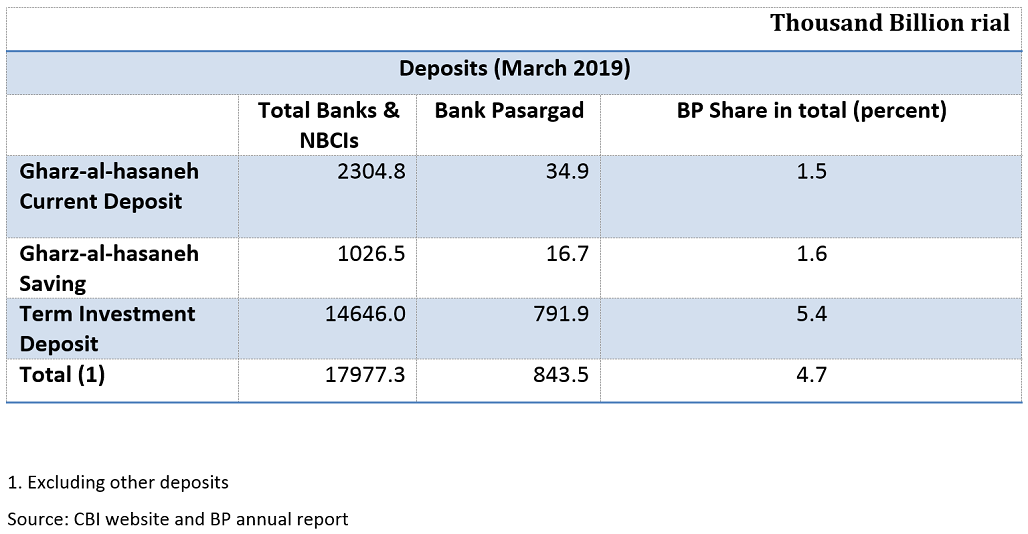

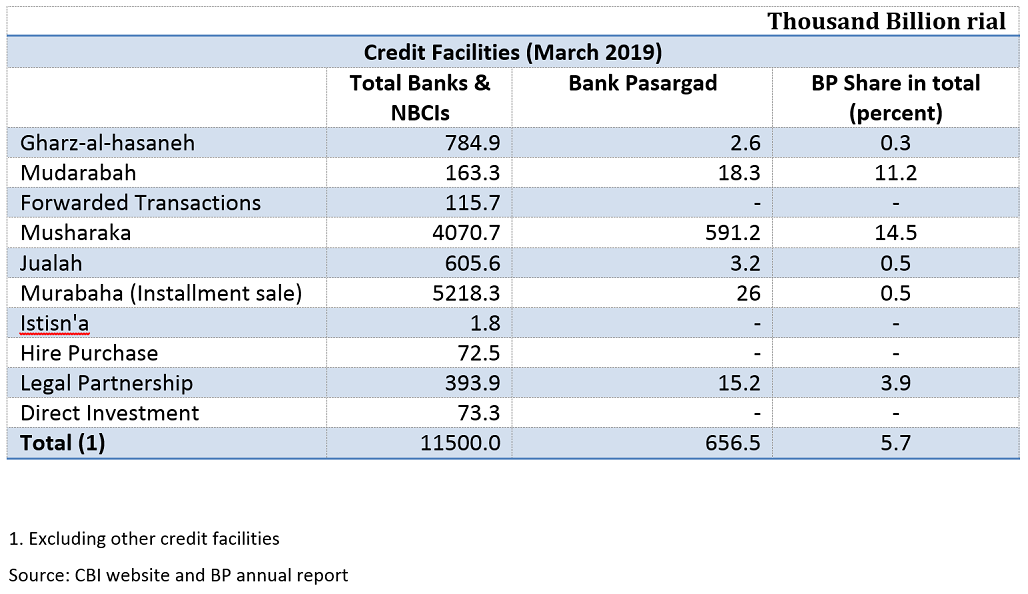

The following tables show the situation of deposits and credit facilities of banks and NBCIs, as well as Bank Pasargad as of March 20, 2019.

As shown in the above table, the share of profit-sharing modes of financing in Iran is 40 percent which is much higher than Islamic banks in other countries.

In addition to credit facilities extended by the bank, the bank acts as an agent for companies to issue Participation Paper on their behalf for financing of their projects. Moreover, banks issue credit cards for their customers based on Murabaha.

(10) Challenges and recommendations

Despite improvements in Islamic banking in Iran over the last decade, there are still some obstacles for sound implementation of all Islamic banking criteria.

At this point, I would like to share a few challenges we face in Iran with regards to implementing Islamic banking criteria and propose related solutions:

(1) It is now absolutely necessary to revise the Law for Usury (Interest) Free Banking Law. Iran’s Usury-Free Banking Law was formulated at a time when there were no private banks in the Iranian banking system, complexity of some Islamic contracts, lack of Islamic interbank market in the law, insufficient attention to international Islamic standards and new modes of mobilization and allocation of resources. No major revision has been made to the Usury-Free Banking Law after passing of more than 36 years.

(2) The Central Bank of Iran as the monetary policy maker is facing difficulties due to Islamic banking criteria in determining the rates for fixed-income Islamic contracts and for interfering in the market mechanism. Therefore, it is now necessary for the Money and Credit Council (monetary policy maker body) to allow the supply and demand forces to determine the “banks’ rates”.

(3) With regards to high tendency of Iranian banks toward profit-sharing modes of financing rather than fixed-income contracts, the following measures are presently required:

(a) As the Musharaka contracts have larger share in the banks, the supervision on these contracts must be enhanced.

(b) Not setting the rates by the Monetary and Credit Council for fixed-income Islamic contracts can reduce the share of Musharaka contracts in the market, which in turn limits the need for more supervision.

(4) As stated earlier, in reality, all Iranian banks’ branches abroad practice conventional banking and observe regulations of the host countries. We now need to establish true Islamic banking branches in each and every country in order to promote and maintain Islamic banking regulations at international level.

(5) There is insufficient interaction between Iranian banks and Islamic banks based in other countries. This is not acceptable in today’s world and needs to be remedied. Proper interaction and enhanced correspondent banking relations between Iranian banks and banks in other Islamic countries such as Malaysia, Pakistan, Saudi Arabia, Qatar, Bahrain, Oman, Kuwait as well as Islamic department of conventional banks needs to be promoted in future. Additionally, active participation in Islamic banking bodies like IFSB, AAOIFI . . . can contribute to Iran’s Islamic banking system.

(6) More attention needs to be paid to transparency, compliance and other international banking standards (both Islamic and conventional) in the Iranian banking system in order to erode doubts and uncertainties.

(7) Further and continuous training of their personnel in Islamic banking and more significant investment in research and product development is a necessity and should be pursued more vigorously by both the Central Bank of Iran as well as all Iranian banks. More particularly, we need to improve and upgrade the curriculums in our universities and assist them by funding research projects and attracting better faulties.

References:

1. Annual Report of Bank Pasargad, 1397

2. Central Bank of Iran Website

3. Law for Usury Free Banking, 1984

4. Monetary and Banking Law of Iran, 1972

5. Istvan Egresi, Development of Islamic Banking in Turkey, University of Targu Jiu, Economy Series, Issue 6 / 2015

6. Banking and Monetary Law of Iran, 1960

7. Sixth Five-Year Development Plan (2017 – 2021)

8. Wikipedia

Appendix

The content of his presentation can be accessed HERE.