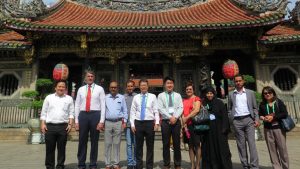

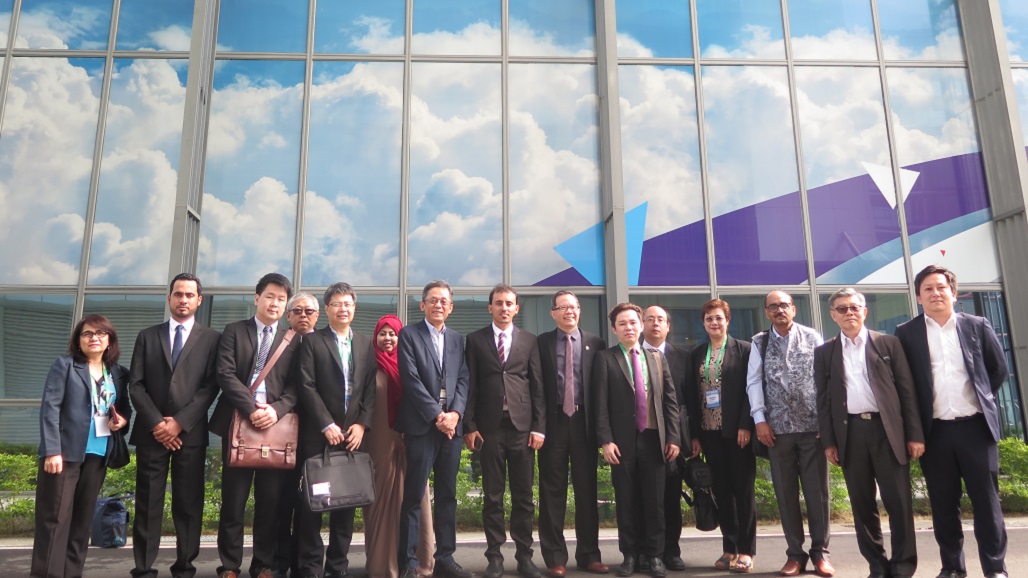

Taiwan – The ABA jointly organized with the Association of Development Financing Institutions in Asia and the Pacific (ADFIAP) the “International Study Tour on MSME Development Programs and Policies of Taiwan” on October 30 to November 3, 2017 in Taiwan. A total of 13 participants from 6 Asian countries composed mainly of senior officers and managers of banks and financial institutions involved in every facet of SMEs/MSMEs development.

From a market that was considered too difficult to serve, micro, small and medium enterprise (MSME) banking has now become a strategic target of banks due to business development and income opportunities that abound, specifically in the cross-selling of products and services. In many developing countries, MSMEs serve as engines of economic growth and development. It constitutes the majority of business enterprises that are vital for employment generation and poverty reduction.

From a market that was considered too difficult to serve, micro, small and medium enterprise (MSME) banking has now become a strategic target of banks due to business development and income opportunities that abound, specifically in the cross-selling of products and services. In many developing countries, MSMEs serve as engines of economic growth and development. It constitutes the majority of business enterprises that are vital for employment generation and poverty reduction.

National development finance institutions (DFIs), including microfinance institutions (MFIs) are the primary source of support to MSMEs both in terms of financial and technical assistance. However, constraints such as inherent risks, high transactional cost and lack of funds, among others, still exist and impede the full potential of the development of the microfinance sector.

With this as background, the study tour program was developed with particular experience of Taiwan since its government has invested substantial capital and human resources in the promotion and development of the MSME sector.

The program’s objectives

- To expose participants to international best practices of specialized DFIs/financial institutions by showcasing the host country’s current approaches and strategies to address the various issues that confront MSME financing and development.

- To deepen the participants’ knowledge and understanding of MSME management;

- To provide a platform for exchanging views and ideas on MSME development and the important roles that DFIs play in the promotion of MSME development in their respective countries; and,

- To enhance the participants’ capabilities in providing better consultancy and advisory services for MSMEs.

- By the end of the program, participants were expected to have a better understanding of MSME financing and development programs and policies and their role in poverty reduction.

The training methodologies

The 5-day program starting October 30 to November 3 was structured to give a more relevant and practical perspective on Taiwan’s experience in MSME financing and development by incorporating different avenues of learning through lectures/briefings, visits to policy-makers, institutional visits to conduits of MSME funds, project visits and sharing of experiences by participants coming from different countries in the Asia-Pacific region.

The 5-day program starting October 30 to November 3 was structured to give a more relevant and practical perspective on Taiwan’s experience in MSME financing and development by incorporating different avenues of learning through lectures/briefings, visits to policy-makers, institutional visits to conduits of MSME funds, project visits and sharing of experiences by participants coming from different countries in the Asia-Pacific region.

The program aspired towards providing a fuller understanding of the significant roles that financial institutions and relevant government agencies play in the development of a country’s economy and its poverty alleviation efforts.

The participation fee was US$1,650 per participant which included lunch and snacks for five days, learning materials, program-related trips, and certificate of attendance. Airfare and hotel accommodation was on participant’s account. There was a great deal: +1 free for every three registered participants from the same institution.

Leave a Reply