Photo: Petras Malukas/AFP/Getty Images

(Photo: Giant letters, reading the word “blockchain,” are seen in this picture. More companies are using blockchain technology to address inefficiencies across insurance in Asia-Pacific.)

This is the final article in a weeklong series on insurtech.

While Asia-Pacific’s enterprise blockchain ecosystem for insurance is nascent, budding startups and the incumbents increasing their involvement can elevate their chances of success by learning from other global initiatives.

While Asia-Pacific’s enterprise blockchain ecosystem for insurance is nascent, budding startups and the incumbents increasing their involvement can elevate their chances of success by learning from other global initiatives.

In Asia-Pacific this year, several initiatives already have a strong foundation—an Indian insurer consortium along with Cognizant announced a policy solution for data sharing, Vesl has led a trade credit insurance initiative, and Suncorp and Cognizant have worked on a claims management system.

As more companies use blockchain technology to address inefficiencies across insurance in Asia-Pacific, they will benefit from having three core aspects in place—the right network or consortium of participants, a good use-case fit for blockchain technology and the correct blockchain platform for that use case.

Have the Right Network

Blockchain technology is a team sport. Just as a phone is only as valuable as the number of other phones to call, the more participants on the blockchain network, the more valuable the network becomes for all industry participants.

Involving diverse organizations from the start ensures that the blockchain network can address the requirements of all participants along the digital insurance value chain. Without an appropriately wide network, initiatives might recreate the digital islands and data silos that exist today or only address part of a market, instead of offering a holistic platform for a wide range of participants.

For example, B3i and RiskBlock are strong insurance networks in the enterprise blockchain space. B3i is one of the largest insurance consortiums, comprising roughly 60 percent of the insurance market globally, with a focus on Europe. Their first prototype was a property catastrophe excess of loss contract focused on handling reinsurance contracts. RiskBlock is a consortium of 30 insurers, brokerages and reinsurers serving customers in the U.S. It is operated by The Institutes, a firm that provides education for the risk-management and property and casualty (P&C) insurance industry. RiskBlock-led initiatives cover areas such as proof of insurance, subrogation, data sharing and risk registries, and parametric insurance. The breadth of participants in each network means that these efforts can be implemented industry-wide.

The Insurwave platform is another good example of a strong network for its particular use case, given that it operates across an interconnected network of brokers, clients, insurers, reinsurers, and other third parties. The platform will capture information about shipments, risks and liability, and aim to transform how easily and flexibly these companies manage risks and interact with each other.

It is worth noting that an initiative involving many participants must find the right operating model. Without an effective governance structure in place within the consortium, traditional competitors might not be incentivized to cooperate, or a software vendor may not have the flexibility to execute and drive the initiative forward. Fortunately, there have been many successful consortia to use as models for approaches.

Address a Genuine Business Problem

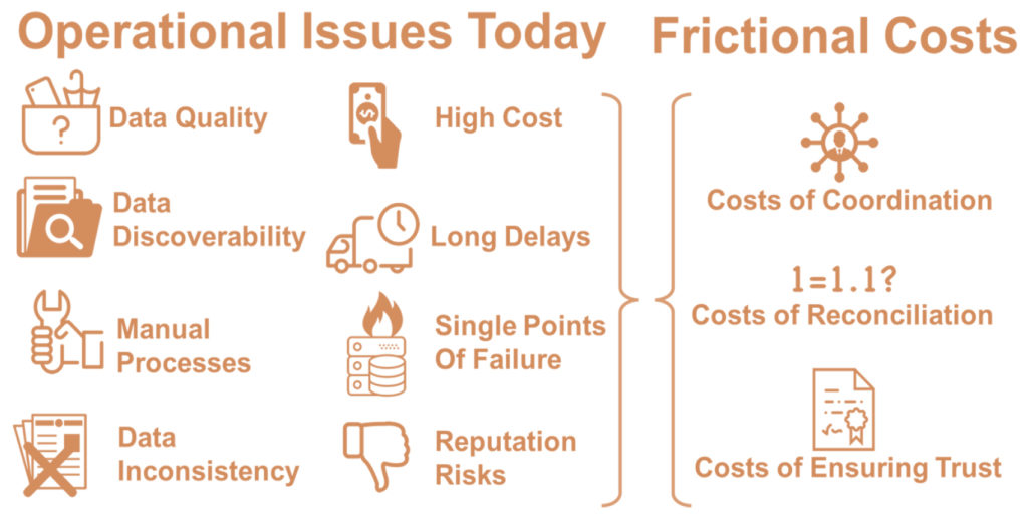

Initiatives must have an inherent business or technical reason for using blockchain technology that aligns with the technology’s strengths. Generally, good use cases aim to streamline cross-firm interactions. Currently, the way firms interact and collaborate with their counterparties in the insurance market introduces several common frictional costs. Minimizing these can reduce expense ratios for all parties.

Source: R3

In the Italian P&C market, for instance, a consortium of participants recognized the difficulty of submitting rates and coming to agreement within commercial property insurance.

The group decided on a blockchain-based marketplace because centrally operated databases give a single party access to all the data. The central-database approach is especially problematic for brokers, who directly handle client information. Decentralization of the process through blockchain technology has an inherent business advantage in stronger data privacy for counterparties.

Similar use cases might occur where a centralized entity may be rent-seeking, form innovation-killing monopolies, or operate less efficiently than a decentralized architecture (see more examples from a recent paper on corporate KYC).

At the end of the day, if the use-case choice is not well-suited for blockchain technology, the decision-makers within participating firms will not extend the necessary resources to put it into production.

Choose the Right Platform

Today, public blockchains and attempted enterprise forks of public blockchains struggle to meet the requirements of regulated enterprises. This is because their architecture was originally intended for a different purpose: For example, bitcoin was intended to be a censorship-resistant cash and Ethereum was intended to be a globally unstoppable computer.

This intention manifests in the architecture decisions of these platforms, such as the public broadcasting of all information, a lack of a developed identity layer, and limitations with scalability resulting from the existing consensus processes. For a blockchain system to go into production, a blockchain platform must be built from the ground up with the requirements of regulated institutions in mind.

ChainThat, a startup that creates blockchain-based insurance applications, built a technical insurance accounting and settlement solution. A recent paper by ChainThat, Modernizing Commercial and Specialty Insurance Accounting with Blockchain Technology, goes into greater depth about some of the streamlined processes that can be modeled between firms by using blockchain technology.

In particular, Corda’s architecture is built to address complex cross-firm workflows, data privacy and integration, all key aspects of ChainThat’s application:

Corda’s peer-to-peer approach to data privacy is unique in the blockchain space.

Corda allows peer-to-peer messaging using standard AMQP, which is an open standard for moving business messages between organizations or applications, eliminating the need for an external messaging solution for confidentiality requirements.

Corda is built for integration with existing systems and writes data to a relational database, which can be easily queried—through database engines such as H2, SQL or Oracle.

Corda easily connects to existing core insurance platforms like Duck Creek or Guidewire through APIs.

The wrong blockchain platform choice can be fatal or extremely high-cost for an early-stage independent software vendor startup. For more mature and resourceful incumbents, a mistaken blockchain platform decision can drain resources and discourage the C-suite from further blockchain initiatives.

Conclusion

Reforming insurance at an industry level is a difficult, broad and ambitious effort. But the cost of the industry-wide inefficiencies to all firms makes these efforts worth these challenges. Having the right network, use-case choice and blockchain platform are the three foundational indicators of success. As activity in Asia-Pacific develops, initiatives that have these foundations in place are best-positioned for success.

Related themes: Blockchain Disruption

Ryan Rugg

Ryan Rugg

Global Head of Insurance for R3

Ryan is the global head of insurance for R3 and leads the company’s insurance strategy to drive business growth. She is responsible for the strategic design, development and commercialization across the ecosystem of blockchain innovation within the insurance industry. In 2017, she launched the Center of Excellence for Insurers and Reinsurers in partnership with ACORD.

Kevin Rutter

Kevin Rutter

Research Lead at R3

Kevin Rutter is R3’s research lead, based in New York. R3’s research team provides thought-leadership for the blockchain space across capital markets, payments, insurance, identity, trade and other applications. Prior to R3, he was a trader in equity derivatives markets with Peak6 Investments.

This article was originally published in Brink Asia website.

Leave a Reply