Given the ruinous business costs of COVID-19 and the failure of public health authorities to effectively respond to COVID-19, we should explore whether there was more the business community could have done to manage its own risks.

Given the ruinous business costs of COVID-19 and the failure of public health authorities to effectively respond to COVID-19, we should explore whether there was more the business community could have done to manage its own risks.

The COVID-19 pandemic demonstrates how vulnerable companies are to systemic risk events — and how limited our normal business risk management approaches are in these situations. In January 2019, the World Economic Forum (WEF) and the Harvard Global Health Institute published a white paper about how businesses should prepare for a pandemic. It recommended a number of steps companies can take to prepare for infectious disease risks.

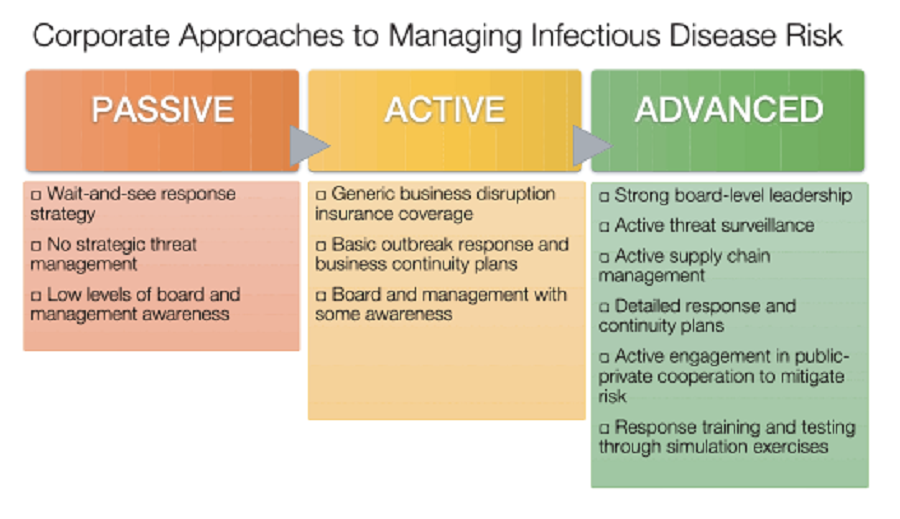

As shown in the chart below, “advanced” recommendations included strong board-level leadership, active threat surveillance and active supply chain management.

These are all pretty conventional business-centric risk management strategies.

COVID Is a Systemic Risk

Unfortunately, even the advanced strategies have turned out to be totally inadequate in mitigating the business impacts of COVID-19. That is because a pandemic like COVID-19 represents a systemic risk, requiring systemic preparedness and a systemic response. Traditional business risk management doesn’t deliver either.

In all fairness to business decision-makers, the responsibility of preparing for and responding to a pandemic has always rested with public health authorities. Given the ruinous business costs of COVID-19, however, and the failure of public health authorities to effectively respond to COVID-19, we should explore whether there was more the business community could have done to manage its own risks.

The problem with COVID-19 has not been a lack of dedication and expertise among health professionals; rather, it’s the chronic shortfall in the political and budgetary prioritization of pandemic preparedness. Such preparedness need not have been overly costly; by one estimate, the global cost of being prepared for a pandemic like COVID-19 works out to $1-$2 per person. That’s a trivial amount, in hindsight.

Business Needs to Advocate for Better Policies

Are there tools other than the typical risk management measures suggested in the WEF white paper that the business community could have used to ensure that pandemic preparedness was prioritized, funded and implemented? Sure.

The business community could have been a powerful advocate for pandemic preparedness in policy and budgetary decision-making. With the exception of the pharmaceutical industry trying to sell its products, it’s fair to say that business involvement in advocating for pandemic preparedness has historically been very limited.

While systemic risk management has not historically been seen as a business priority, COVID-19 has exposed a material business risk that has been ignored. COVID-19 is a wake-up call for businesses to recognize that they have a legitimate risk management interest in promoting readiness for systemic risks like COVID-19.

Apply the Principles to Climate Change

A more proactive role for the private sector should not be limited to the systemic risk posed by a pandemic. Climate change, for example, comes immediately to mind. Climate change is a veritable petri dish for future systemic risk events including, coincidentally, pandemics. Even as we live through the COVID-19 crisis, scientists are publishing reports of ancient viruses discovered in melting glaciers. They may turn out to be the tip of a viral iceberg to which we have no natural resistance.

Pandemics are just one of many systemic risk events that could be triggered by climate change. Others include:

A drought that triggers an expanding geographical conflict over water supplies. Conflicts over water in the Middle East, for example, have been suggested for years as a potential flash point for the next world war.

Simultaneous droughts in three of the world’s breadbaskets, disrupting food production, food prices and, ultimately, the global economy and political stability. That is the exact scenario used by Lloyd’s of London for its seminal systemic climate change risk report in 2015.

An extreme event that triggers large-scale environmental migration, exacerbating regional tensions and conflicts.

Systemic risk events like these, caused or worsened by climate change, could manifest at virtually any time. The likelihood of such events is also increasing as climate change progresses.

Strong Business Case for Tackling Systemic Climate Risks

The literature looking at systemic business risks associated with climate change is growing rapidly. The Bank for International Settlements’ recent report on so-called green swans, for example, argues for a proactive role for banking in anticipating and mitigating climate change-induced systemic risks.

The business risk management rationale for engaging at all levels in working to tackle climate-related systemic risks is even more solid than is the case for COVID-19. First, business activities in the power, transportation and building sectors account for a large fraction of the greenhouse gas emissions over time that are causing the climate to change. Unlike COVID-19, business is actively contributing to likelihood and severity of systemic risk events.

Second, imagine if investigative reporting were to reveal that business interests had actively interfered with pandemic preparedness by lobbying against the necessary funding and could therefore be causally linked to the COVID-19 pandemic. There would be public outrage — and rightly so. Yet when it comes to climate change, business interests have a long history of obfuscating the nature and severity of the problem. Some business interests continue to oppose the adoption of policies and measures needed to mitigate climate change, as is well documented through the work of InfluenceMap in the United Kingdom.

Voluntary Initiatives Cannot Scale

But wait, you may say. Haven’t thousands of companies around the world committed to help tackle climate change through initiatives ranging from reducing their carbon footprints to adopting science-based targets, internal carbon pricing and going carbon-neutral? Certainly.

These and other measures, however, represent corporate social responsibility initiatives. Voluntary initiatives like these cannot scale to the systemic change required to mitigate climate change. As a climate change mitigation strategy, they represent “greenwishing,” at best, and “greenwashing” at worst.

Mitigating climate change and, thus, the business risks of future systemic climate risk events requires a rapid transition to a low-carbon economy.

That, in turn, requires a broad suite of policies and measures to guide business behavior in that direction. When it comes to policy advocacy for a rapid low-carbon transition, however, the business community is missing in action. Notwithstanding numerous CEO expressions of support for climate policies, for example, U.S. Senator Sheldon Whitehouse recently noted, “I am involved in a number of secret climate conversations with some of my Republican colleagues, but they can’t find a single corporation that will come out and say ‘I’ve got your back.’”

Get Engaged in Climate Policy

The failure of decision-makers to be prepared for the COVID-19 pandemic, after years of warnings from public health experts, will go down in history as an epic policy failure. In hindsight, and given the catastrophic business costs of the pandemic, it also reflects a failure of business risk management foresight and initiative.

There are lessons to be learned. Looking forward, business decision-makers need to recognize the growing business risks of climate change-induced systemic risk events. Given the role of business interests in contributing to climate change and the efforts to impede climate policy responses, whole sectors could lose their social license to operate.

Although it requires stepping outside their business comfort zones, companies should focus much more intensively on growing their climate policy footprints than on shrinking their carbon footprints. That’s what business risk management calls for in an era of climate change calls.

Related themes: Boardroom Risk Mitigation

Dr. Mark Trexler

Dr. Mark Trexler

CEO of The Climatographers@ClimateRoulette

Dr. Mark Trexler has advised companies around the world on climate change since 1991. He currently focuses on climate change decision-making support through the Climatographers and the Future Strategies Group, and is a visiting scholar at The George Washington University.

The original article can be read at Brink website HERE.

Leave a Reply