The Asian Bankers Association (ABA and the Rizal Commercial Banking Corporation (RCBC) jointly organized a Short-Term Visiting Program (STVP) focusing on the theme “Financial Inclusion: The Philippine and RCBC’s Experience” held on June 14 – 15, 2023 at the RCBC Plaza, Makati City, Philippines.

The Asian Bankers Association (ABA and the Rizal Commercial Banking Corporation (RCBC) jointly organized a Short-Term Visiting Program (STVP) focusing on the theme “Financial Inclusion: The Philippine and RCBC’s Experience” held on June 14 – 15, 2023 at the RCBC Plaza, Makati City, Philippines.

The primary objective of ABA’s short-term visiting program is to provide our member banks, particularly those from less developed countries, the opportunity to study and undergo training on specific aspects of the operations and facilities of the host banks and learn from their experience and best practices. The idea is to enable the participants to: (a) enhance and upgrade their technical skills and knowledge in specific business areas, in the distinct and peculiar social, economic, and business environment of the host country, and (b) gain first-hand knowledge of the operations, systems and work procedures of the host bank’s various line departments.

Background

The theme and topic were chosen by ABA and RCBC after noting how the Philippines has made a lot of headway in pursuing its financial inclusion strategy dating back in 2015 when it formally launched a national strategy.

In 2020, the Philippines’ vigorous efforts received recognition from the Economist Intelligence Unit (EIU), the research arm of The Economist Group, as one of the global leaders in financial inclusion — receiving a rank of 8th worldwide, and 2nd in Asia. This recognition rated countries around the world based on five (5) aspects, namely: government and policy, stability and integrity, products and outlets, consumer protection, and infrastructure. The EIU study also recognized how the Philippines’ pursued initiatives under financial inclusion that helped tremendously in easing the negative impact of the COVID19 pandemic.

With a robust and advanced enabling environment provided by the Central Bank of the Philippines, RCBC wholeheartedly embraced financial inclusion as one of its key differentiations from the other big players in the financial industry sector. Its financial inclusion initiatives such as Diskartech and ATM GO implemented by the Digital Enterprise and Innovation Group earned accolades from several award-giving bodies, locally and internationally.

Led by its forward-looking and trailblazing President & CEO and current ABA Chairman Eugene S. Acevedo, RCBC has successfully embedded in its DNA why embracing financial inclusion is critical not only to the growth of the bank but more importantly for the welfare and development of the country, especially those belonging to the unbanked and underserved, marginalized and vulnerable sectors.

Program Objectives

With financial inclusion as the theme, the 2023 STVP aimed to provide participants the opportunity to have first-hand knowledge on:

(a) How enabling regulatory environment encourages financial institutions in tapping new markets and opportunities found at the base of the pyramid,

(b) Enhance and upgrade knowledge and skillsets on how to pursue the market segments at the base of the pyramid,

(c) Gain first-hand knowledge of the operations, systems, and work procedures of the host bank’s business units in charge of implementing its financial inclusion strategy, and

(d) Interact with partners on the ground on how financial inclusion impacts the lives of the consumers/clients.

The two-day STVP was also envisioned as a platform for participants to exchange views and experiences on the significance of financial inclusion in their respective countries, the opportunities and challenges being encountered, and what ABA can do to support its members to further promote its advancement in the Asian region.

A total of 11 representatives from four ABA members from four countries (Iran, Vietnam, Taiwan, and the Philippines), one representative from the Monetary Authority of Maldives, and one representative from a fintech company participated in the program. A complete list of participants is contained in Annex 1.

Following is a Summary Report on the two-day program:

JUNE 14, 2023

Welcome Remarks from ABA

The first day began with Welcome Remarks from ABA Deputy Secretary Mr. Amador Honrado Jr. After formally welcoming the participants and thanking RCBC for co-organizing the program, Mr. Honrado gave brief background on the ABA and its activities, which he said include holding annual Conferences, information exchange, policy advocacy, and relationships with other regional and international organizations.

Mr. Honrado pointed out that one of the most important activities of the ABA, however, is its Professional Development Program which includes training courses on banking and finance conducted with our member banks such as the RCBC, as well as with leading training institutes in the region.

He said that a major challenge currently faced by many bankers in the Asia-Pacific region is increased competitiveness in the world market brought about by continuing globalization, market deregulation in many economies, the continued rapid advance in technology, and the entry of new participants in the industry such as the Fintech companies. To equip its members with the tools and skills to adequately meet the challenges they are confronted with, the ABA has placed emphasis on organizing training courses for its members.

One such training course is the Short-Term Visiting Program, Mr. Honrado said. The primary objective of ABA’s short-term visiting program is to provide ABA member banks, particularly those from less developed countries, the opportunity to study and undergo training on specific aspects of the operations and facilities of the host banks, and learn from their experience and best practices. The idea is to enable the participants to: (i) enhance and upgrade their technical skills and knowledge in specific business areas, in the distinct and peculiar social, economic and business environment of the host country, and (ii) gain first-hand knowledge of the operations, systems and work procedures of the host bank’s various line departments.

In conclusion, Mr. Honrado expressed his hopes that the program would help open up opportunities for new businesses and business relations and long-term friendships among the participants.

Welcome Remarks from RCBC

After making a brief introduction on RCBC, Ms. Maria Cristina Alvarez, First Senior Vice President and Head of Corporate Planning Department at RCBC, said that these are exciting times for promoting financial inclusion. She pointed out that new regulation has enabled participants in the financial system to reach out to more of the unbanked and technology is able to reduce the cost of capturing the market segments in the periphery.

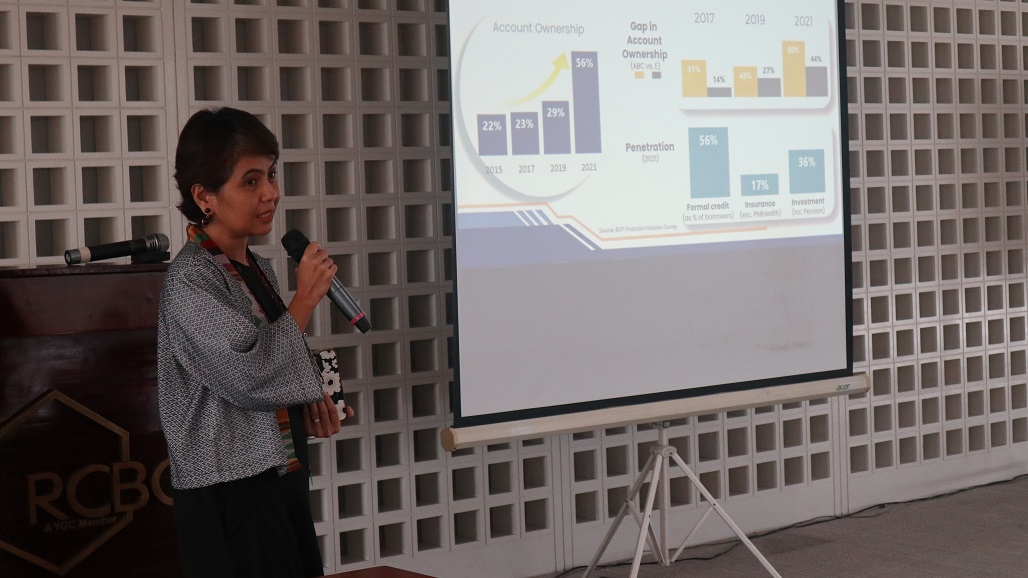

Ms. Alvarez noted that based on the 2021 Financial Inclusion Survey of the Bangko Sentral ng Pilipinas (BSP) – the country’s central bank – the number of unbanked Filipino adults dropped to 34.3 million (44% of total adult population) in 2021 from 51.2 million in 2019, or a reduction of 16.9 million. starting 2021.”

She said that there are still continuing challenges for financial inclusion plans and goals. She therefore expressed her hopes that as the speakers share experiences and all participants exchange ideas and views, the participants and their respective organizations can prepare for the future needs and help more of the under-served.

Financial Inclusion: The Philippine Experience and BSP’s role in Providing an enabling regulatory environment

Ms. Ellen Joyce Suficiencia, Director, Financial Inclusion Group, Center for Learning & Inclusion Advocacy, Bangko Sentral ng Pilipinas (BSP) made a presentation entitled “Moving the Mission Onwards: BSP’s Role in Providing an Enabling Environment for Financial Inclusion”.

Among the major points Ms. Suficiencia cited in her presentation included the following:

(a) Financial inclusion means Filipinos, rich and poor, can use financial services as tools to:

- Pursue life goals

- Build financial resilience

- Transact safely, efficiently, and conveniently

(b) Key financial inclusion indicators show improvement (with account ownership increasing from 22% of the population in 2015 to 56% in 2021) but much remains to be done.

(c) Financial resilience tools, especially among poor, remain limited (e.g., family or friends are the main source of funds for 41% of the population while only 9% obtain their loan from bank, employer or private lender)

(d) The Philippines’ National Strategy for Financial Inclusion (NSFI) 2022-2028 aims to:

- Reduce disparities in financial inclusion

- Improve financial health and resiliency

- Increase access to finance of the MSME and agriculture sectors

- More financially capable and empowered consumers

(e) To achieve the desired outcomes, the NSFI identified priority initiatives around the following:

- Improving financial and digital infrastructure that facilitate cost and credit risk reduction, and wide-scale DFS adoption

- Expanding market and tools for risk protection, including social insurance and pension

- Enhancing the regulatory environment and capacities to promote innovation, competition, and consumer protection across all FSPs

- Strengthening capabilities of FSPs that are mission-driven and strategically positioned to serve rural and low-income communities

- Addressing demand-side issues through financial literacy and enterprise capacity building support

(f) BSP’s Financial Inclusion Themes cover mainly: (a) Harnessing digital technology for inclusion; and (b) Supporting the development of MSME and Agri financing ecosystem. The priority targets among the underserved and unserved segments are the: (a) low-income population consisting mainly of farmers and fisherfolk and the informal sector workers, and (b) Micro, small, and medium enterprises such as start-ups and agribusinesses

(g) BSP is pursuing two phases of digital financial inclusion, namely:

- Digital Financial Inclusion 1.0, which consists of building the digital payments ecosystem to achieve accelerated account ownership and usage.

- Digital Financial Inclusion 2.0, which consists of building the innovation platforms to achieve a contextualized, welfare-enhancing financial services for all

(h) Initiatives being taken by the BSP toward Sustainable MSME and Agri Financing include the following:

- Strengthening the Credit Infrastructure through: (a) Credit Risk Database and (b) Advocacy for enhancing guarantee and agri-business insurance

- Promoting Innovative MSME and agrifinancing through movable asset financing development

Interactive Workshop on the State of Financial Inclusion in the Countries of the Program Participants

Moderated by Mr. Raymundo (Bong) Roxas, President of Rizal Microbank, the interactive workshop aimed to provide the participants the opportunity to share information on the following issues:

(a) Does your country have a national financial inclusion strategy? What enabling regulations does your country have to promote financial inclusion?

(b) What is the state of financial inclusion in your country?

(c) How is your bank/association embracing financial inclusion as seen in your bank strategies and activities? What opportunities and challenges do you see in pursuing financial inclusion as a bank strategy?

Agribank

The participants from Agribank highlighted the following in their presentation:

State of Financial Inclusion in Vietnam

Accessibility to Financial Services:

- Incessantly improve the legal framework; perfect mechanisms and policies to protect financial consumers.

- Develop networks and diversify distribution channels of financial products and services.

- Develop financial services based on digital technology application platform.

- Active implementation by Credit institutions of training programs to improve financial knowledge for people and firms.

State of using financial service by the end of 2022:

- Nearly 75% of adults have a bank account; 3.71 million Mobile Money accounts have been opened, of which more than 70% are opened in rural, remote and isolated areas.

- Non-cash payment in the economy: more than 6.6 billion transactions; via Internet channel: more than 1.1 billion transactions; via mobile phone channel: nearly 4 billion transactions; via QR Code method: nearly 6 million transactions; via POS: more than 564 million transactions; there are about 18.8 million accounts and cards opened with eKYC.

National Financial Inclusion Strategy of Vietnam

General Objective:

- All people and enterprises have safe and convenient access to affordable financial products and services

Specific Objectives:

- Diversify financial products and services to enhance access to financial products and services for people with no or limited access to such products and services.

- Promote digital technology application and innovation in design and distribution of simple, convenient, easy-to-use and affordable financial products and services.

Opportunities and Challenges in Pursuing Financial Inclusion in VIetnam

Opportunities

- Agribank has a favorable financial infrastructure for financial inclusion deployment (Branch network is nationwide, covering rural, mountainous and island areas)

- Agribank has the strength to become a leader in providing financial inclusion services in rural areas

- As a 100% state-owned bank, Agribank has government support in implementing the bank’s financial inclusion strategy.

Challenges

- Vietnam is still essentially a cash economy. A significant proportion of Vietnamese people, especially in rural and mountainous areas, do not have access to formal financial services.

- Lack of specific regulations and guidance from the government and SBV in supporting financial institutions to fulfill their role in promoting financial inclusion

- The database on the quantity, quality and frequency of using financial services of the population has not been fully and timely updated, making it difficult for bank to make accurate assessments and forecasts as well as build appropriate strategies.

Taiwan Academy of Banking and Finance

Following are major points cited by the representatives from the Taiwan Academy of Banking and Finance (TABF)

State of financial inclusion in Taiwan

(a) High financial access

(b) Diversified microfinance

(c) Wide digitalization of financial services

(d) Emphasis on financial education

National Strategy for Financial Inclusion in Taiwan

(a) Digital banking services / Electronic payment

- Build a digital financial environment.

- Increase the electronic payment and digital wallets ratio

(b) Financial-friendly services

- Provide disabled groups accessible financial services

- Develop guidelines for financial-friendly services.

- Encourage banks to set up new branches in rural areas.

(c) Microfinance products(MFI)

- Cater to the financial needs of low-income individuals, small businesses, and underserved communities by providing microcredit, microinsurance, and other tailored financial services.

(d) Financial Education strategy

- Enhance general financial literacy , and design financial education incentives for schools, financial institutions , and other organizations.

Opportunities and challenges in pursuing financial inclusion as a strategy

(a) Opportunities

- Market Expansion

- Social Impact

- Risk Mitigation

- Regulatory advantages

(b) Challenges

- Limited Financial Resources

- Operational Complexity

- Risk Assessment and Management

- Regulatory Compliance

Monetary Authority of Maldives

The representative from the Monetary Authority of Maldives highlighted the following in his presentation:

State of financial inclusion in Maldives

(a) Financial Sector is in the nascent stage of development with limited resources.

- 8 Commercial Banks

- 5 Insurance Companies

- 3 Other Financial Institutions (OFIs)

- As of 2022, there are 55 bank branches and 182 ATM and 8,768 POS terminals and 331 cash agents across the Maldives

(b) High bank account penetration – around 90% of the total adult population have access to a bank account.

(c) Data suggests that financial usage and efficiency are relatively low.

(d) A significant gender gap exists in access and usage of financial services.

National Financial Inclusion Strategy of Maldives

(a) At present, there is no formal unified national plan or strategy to promote financial inclusion in the Maldives.

(b) Multiple initiatives undertaken, but they are fragmented and lack coordination.

(c) MMA’s strategic plan prioritizes the formulation of National Financial Inclusion Strategy (NFIS) for Maldives

(d) The formulation of NFIS underway and is planned to be launched during the last quarter of 2023

Enabling regulations/initiatives of Maldives to promote financial inclusion

(a) SME Development Finance Corporation established as a specialized financial institution providing financial products and ancillary services to MSMEs and entrepreneurial start-ups.

(b) MMA has established Credit Information Bureau – facilitate lenders to assess risk, thereby enabling those with a good credit history easier access to credit.

(c) MMA is currently developing the National Payment System for the Maldives.

(d) Financial Consumer Protection regulation is currently being drafted.

Opportunities and challenges in pursuing financial inclusion as a bank/organization strategy in Maldives

(a) Challenges

- Geographical distribution

- Low level of financial literacy

- Lack of comprehensive disaggregated data

- Lack of comprehensive financial consumer protection framework

- High cost of finance

- Gender gap

(b) Opportunities

- High accessibility and use of internet and mobile phones

- Digital transformation

- Growing youth population

RCBC’s Financial Inclusion Strategy and Initiatives

Mr. Michael Christopher C, Cruz, Vice President, Digital Enterprise and Innovation Group, RCBC, made a presentation on RCBC’s Financial Inclusion Strategy and Initiatives, highlighting the following: (a) Rationale; (b) Status of financial inclusion initiatives (ATM GO, Diskartech, etc.); (c) Conceptualization & Design (target market, products & services, organization structure, risk management, IT Support); and (d) Opportunities and Challenges. The main theme of his presentation was “Elevating livelihoods and lives through the Power of Digital.”

Among the points highlighted by Mr. Cruz in his presentation included the following:

(a) In 2019, 51.2 million Filipinos were unbanked, making the country having the lowest banking penetration in Southeast Asia at that time (with low awareness, low usage and low investment). Only 1 in 10 Filipino adults used mobile phones and Internet for financial transactions in 2019.

(b) However, the number of unbanked Filipinos jumped in three years, from 26% in 2019 to 56% in 2022. Visa’s annual online consumer payments attitudes study in 2022 indicated that 60% carry less cash in their wallets and 84% tried going cashless. The pandemic was the turning point for digitization of Philippine finance.

(c) The implementation of BSP’s InstaPay and PESONet National Retail Payments system demonstrated that Filipinos are more than ready to embrace digital

(d) The vision of a digital Philippines in 2023: 50% of retail payments and 70% of adult Filipinos will be formally banked.

(e) RCBC’s Digital Thrust is grounded on Sustainable Development and Nation-Building

- Multi-channel Digital Strategy that caters to the full spectrum of Philippine society

- RCBC DiscarTech is a pioneer in offering savings, investments and protection options though one tap)

- Through ATM Go, RCBC achieved nationwide coverage in less than two years

- MoneyBela (Barangay Banking) is a “phygital” innovation using sustainable e-trikes to bring banking to 42,000 barangays nationwide

- RCBC’s financial ecosystem supports the government from the national down to the barangay level in promoting financial inclusion which is essential to the economic development of the Filipinos and of the country

Rizal Microbank Financial Inclusion Initiatives

Mr. Joseph Daniel N. Lumain Assistant Vice President, Rizal Microbank, Inc., a Thriftbank of RCBC, made a presentation on Rizal Microbank as a Financial Inclusion Initiative of RCBC. In his presentation, Mr Lumain made a brief introduction on Rizal Microbank and its journey as a microfinance arm of RCBC, and the expected future direction of the organization.

Among the points Mr. Lumain highlighted included the following:

(a) Since 2010, Rizal Microbank has focused on delivering the needed financial services of the MSME players in the country.

(b) There is a great poitential in servicing MSMEs in the Philippines:

(c) MSMEs comprse 99.5% of total enterprises in the country. To date, it has generated 5.67 millioonm jobs ot 64.6% of te total employment in the Philippines

(d) In terms of value-added, MSMEs contributed 35.7%. They also account for 25% of the total export revenue. It is estimated that 60% of the exporters in the country are MSMEs

(e) Characteristics of the underserved MSMEs:

- Minimal formal financial records

- Lack of IDs and legal permits

- Minimal real estate properties and fixed assets

(f) Instead of expecting MSMEs to abide by the traditional bankijng standards, Rizal Microbank has crafted its policies and product design based on the realities of MSMEs:

- Reconstructing cash flows for clients

- Utilizing credit information systems

- Tailor-fitting collateral requirements

- Addressing gaps in financial literacy

(g) To expand access and usage:

- Rizal Microbank shifted to cloud-based core banking system in 2019, the first thrift bank to do so.

- Channels were expanded through accrediting merchants with local communities to accept transactions related to account opening, deposits, withdrawals, bills payments and loan applications

(h) With its vision of being a leading thrift bank empowering MSMEs in the Philippines, Rizal Microbank has set the following five-year objectives:

- Establish a nationwide distribution network of 50 branches, supplemented by 1,000 cash agents and appropriate mobile banking applications and platforms

- Register 10,000 active customers

- Deliver and manage a P3.0 billion loan portfolio

- Maintain a single-digit past due ration comparable to the industry’s performance

- Post a double-digit return-on-equity

JUNE 15, 2023

On Day 2 of the Program, officers and staff of RCBC, Rizal Microbank, and ABA accompanied the program participants for a field trip to Tanauan City, Batangas located some 1.5 hours by car south of Makati City, to briefly visit the local branch of Rizal Microbank and thereafter to meet with some of the bank clients with businesses located in the city’s public market.

The field visit aimed to provide participants how ATM GO & Rizal Microbank Bangko Nang Bayan work on the ground by interacting with agent-partners, and how small loans positively impact the lives of micro and small entrepreneurs,

Visit to Rizal Microbank branch in Tanauan City, Batangas

The participants met the officers and staff of the Rizal Microbank branch in Tanauan City, Batangas where they had an opportunity to learn more about the operations of the branch, such as how they identify potential clients, their methods for marketing the products and services of the bank branch, the cost structure of their various products and services, how they compete with other financial services providers in the area, the manner by which they obtain key financial records of the clients, and their system for collecting loan amortizations, among others.

Field Visit to Bank Clients

The group then proceeded to visit three of the bank clients in the city. These included the following:

Sonia G. Reyes, Owner of Reyes Store

Mrs. Sonia G. Reyes started her grocery store business some 27 years ago in Tanauan City. Currently, she is also engaged in the retail and wholesale of fertilizer and feeds products. For the past 22 years, she has also been in the trucking business with 22 trucks.

Mrs. Reyes and her husband have been clients of Rizal Microbank for almost 12 years. She is considered one of the valued clients in microfinance who have handled her account efficiently, with no record of late payment. Since she started borrowing from Rizal Microbank in September 2020, she has availed loans totaling some PHP8.05 million.

Norania S. Mira-ato, Owner of Nora Cellphone Store and Norania Sari-sari Store

Norania Sari-sari Store is engaged in the retail and wholesale of cellular phone products and cellular phone merchandise. In 2000, Mrs. Mira-ato started selling merchandises along the sidewalk of Tanauan public market, with PHP15,000 as initial capital. She eventually acquired stall rights inside the public market which generated more sales for the business.

In 2019, Mrs. Mira-ato opened “Ainah Electrical Trading”, a general merchandise business that was registered using the name of her daughter. The store currently offers various products such as hardware supplies, plastic wares, catering supplies, packaging supplies and baking supplies, with usual mark-ups ranging from 30% to 35%.

As of today, the client has already acquired rights to 12 stalls, five of which are used for the cellphone store, and the remaining 7 are used for the general merchandise business. Mrs. Mira-ato has availed loans amounting to PHP3 million since she started borrowing from the Rizal Microbank in September 2009.

Baisa G. Macabinta, Owner of Princess Cellphone Shop

In 2000, Mrs. Baisa G. Macabinta started her cellphone shop business in Bagunbayan, Tanauan City. With a business permit and other legal documents, her business is open 9 hours, 7 days a week, recording an average daily sales of PHP25,000. In 2020, she started a general merchanding business where she sells plastics, tupperwares, and dishwashing liquid. Mrs. Macabinta has availed a total of 2 loan cycles amounting to PHP350,000.

Participants Debriefing

After completing the field visit, the group went back to RCBC headquarters in Makati City for lunch, followed immediately thereafter by a participants debriefing. Moderated by Mr. Bong Roxas, the debriefing session aimed to provide the participants the opportunity to share the concepts and ideas they learned from the presentations, as well as the concepts and ideas that they intend to apply in their respective institutions and probably recommend to relevant government agencies in their countries for possible implementation.

Distribution of Certificates of Attendance

At the end of the debriefing session, Certificates of Attendance were distributed to the participants by Ms. Alvarez and Mr. Honrado.

Closing Remarks from the ABA

On behalf of the Asian Bankers Association, ABA Deputy Secretary Mr. Amador Honrado thanked all the speakers who generously shared their valuable time and expertise on the various topics presented in this year’s Short-Term Visit Program on Financial Inclusion hosted by RCBC.

Mr. Honrado also expressed his appreciation to the officers and staff of RCBC for their support of this important training activity of the ABA, and for the preparations and all the work put in to make this year’s program substantially meaningful.

Lastly, he conveyed ABA’s sincerest gratitude to all the workshop participants for their presence and their stimulating discussions and enlightening commentaries on the topics presented. He expressed his hopes that they have learned much from the two-day program and that it has opened up new horizons and new opportunities for them, and thanked them for helping uthe ABA and RCBC meet the objectives of the program.

He also expressed his hopes that their participation has given them the opportunity not only to benefit from the presentations, but also to establish strong relationships with their colleagues from RCBC and other participating countries, thereby making their trip worthwhile. He congratulated them for completing this year’s program, and wished them success in all their undertakings. He wished them all a safe and pleasant trip to their respective countries, and said he looked forward to seeingthem at this year’s 39th ABA General Meeting and Conference to be held on November 9-10, 2023 in Kathmandu, Nepal.

Course Evaluation by Participants

To help improve the program for future offering, the participants were requested to complete a Course Evaluation Form designed to seek their comments on the following items:

(a) Course Design Materials

(b) The Program Speakers

(c) Program Management

(d) Over-all Program Rating

The participants were requested to rate the above-mentioned items on a scale of 1 – 5, with 1 being the lowest.

A summary of the responses of the 9 participants who completed the Course Evaluation Form is as follows:

(a) All the respondents rated the Course Design Materials largely as “5” in terms of the organization of the program content, the ease in understanding the materials, and enabling participant involvement.

(b) The five speakers received ratings of “5” in terms of the adequacy of their preparation for the program, their knowledge of the subject matter, their delivery of the contents, their encouragement of trainees’ participation, in the discussion, and their ability to answer participants’ questions.

(c) All the participants rated as a “5” the pre-registration and services and program support. However, the meals and training venue largely received a rating of “4.”

(d) Every participant gave the program an overall rating of “5”.

Leave a Reply