About the FCAP Programme

About the FCAP Programme

Fintelekt Certified AML/CFT Professional (FCAP) is a 2-day intensive course designed as a comprehensive and practical masterclass for aspiring and practicing AML/CFT professionals to learn and stay updated with the latest tools, techniques and developments in anti-money laundering (AML) and combating the financing of terrorism (CFT).

The FCAP programme was held at Hotel Aloft in Bangkok on 8th and 9th June 2023. Professionals from institutions across Asia from private as well as public sectors joined the programme.

Arpita Bedekar, Director – Strategy and Planning, Fintelekt set the context, explaining that FCAP was introduced in response to a pressing regional need for an advanced training and certification programme that can help demonstrate a commitment and contribute towards building a stronger AML/CFT regime in the institution, country as well as the global financial system.

Training Sessions – Day One

Supranee Satitchaicharoen, Director, Cooperation and Standard Development Division, Anti-Money Laundering Office (AMLO), Thailand delivered the first session, providing a background of the Anti-Money Laundering Office (AMLO) and its activities, and the expectations that it has from its reporting entities, which are common across most countries.

Supranee also explained the various initiatives taken by AMLO to counter recent typologies in AML/CFT and fraud. Participants were able to gain from an interactive session with a senior regulatory representative and understand the perspective with which supervision and enforcements take place within the AML/CFT regime.

Training Sessions – Day One

- R. Hariharan, Trainer, Fintelekt took over from Supranee and engaged the participants in an interactive discussion on key fundamental aspects of AML and CFT:

- Strategic understanding of AML/CFT risks and the risk-based approach: covering the need for a strong AML governance framework, balancing AML compliance and business priorities in accordance with the defined risk appetite of the organization and the consequences of non-compliance. The participants also studied the various elements involved in an enterprise-wide risk assessment (EWRA) and the effective application of a risk-based approach to AML/CFT.

- Correspondent banking risks: including evaluating and monitoring counterparty risks and MVTS considerations within correspondent banking.

- Screening and due diligence: including key sanctions risks and screening, politically exposed persons (PEP) risks and screening, adverse media monitoring and cross-border wire transfer screening.

- Ultimate beneficial ownership (UBO): and the risks associated with legal persons, corporate vehicles and arrangements and methods for establishing beneficial ownership and source of funds.

Training Sessions – Day One

Dr. Naomi Doak, Regional Coordinator, Counter Wildlife Trafficking, representing the Bangkok office of the Wildlife Conservation Society spoke to participants about regional trends in wildlife trafficking and environmental crimes including the growing nexus with organised criminal activity and emerging money laundering typologies in the region.

Group Work – Day Two

Participants were divided into six groups and were given a case apiece, which they had to analyse as a group. The trainer, Hariharan facilitated the discussions and provided inputs on how to go about analysing the case.

A group-leader from each group collated and presented the findings of the analysis conducted by their group, which was then summarised and concluded by Hariharan.

Training Sessions – Day Two

The post lunch session of Day Two of the FCAP programme were facilitated by T. R. Hariharan and covered the following topics:

- Evolving risks and their impact: on the AML/CFT function: Hariharan took the participants in detail through the risks from digital payments, fintechs and various types of payment intermediaries, use of third parties in delivery channels and risks from virtual currency, decentralized finance and NFTs. The session also included the latest regulatory guidance around the region and major updates from international bodies such as the Financial Action Task Force.

- Transaction monitoring: involves manual or electronic scanning of transaction based on certain parameters such as customer and beneficiary names, volume, value, country of origin or destination of transaction.

- Combating trade-based money laundering (TBML): which included an understanding of TBML techniques & latest typologies, trade due diligence measures to detect suspicious transactions and methods and best practices for combating TBML.

- Terrorism financing risk and detection: the terrorism financing process, cross-border risks, and recommendations by the Wolfsberg Group and the Financial Action Task Force on combating terrorism financing.

- Proliferation financing: its three stages, comparison with money laundering and terrorism financing, difficulties faced in identifying proliferation financing and proliferation financing risk assessments.

Participation

The FCAP batch in Bangkok was well attended by 21 participants from banking, money transfer, fintech, regulatory and supervisory institution across 9 countries in Asia, viz. Bangladesh, Bhutan, Cambodia, India, Singapore, Nepal, Philippines, Taiwan and Thailand.

List of Participating Institutions:

- Bangko Sentral ng Pilipinas

- Bank of the Philippine Islands

- Dutch-Bangla Bank

- Laxmi Capital Market

- Onchain Custodian

- Prince Bank

- State Bank of India

- T Bank

- Taiwan INSTO Technologies

- United Overseas Bank

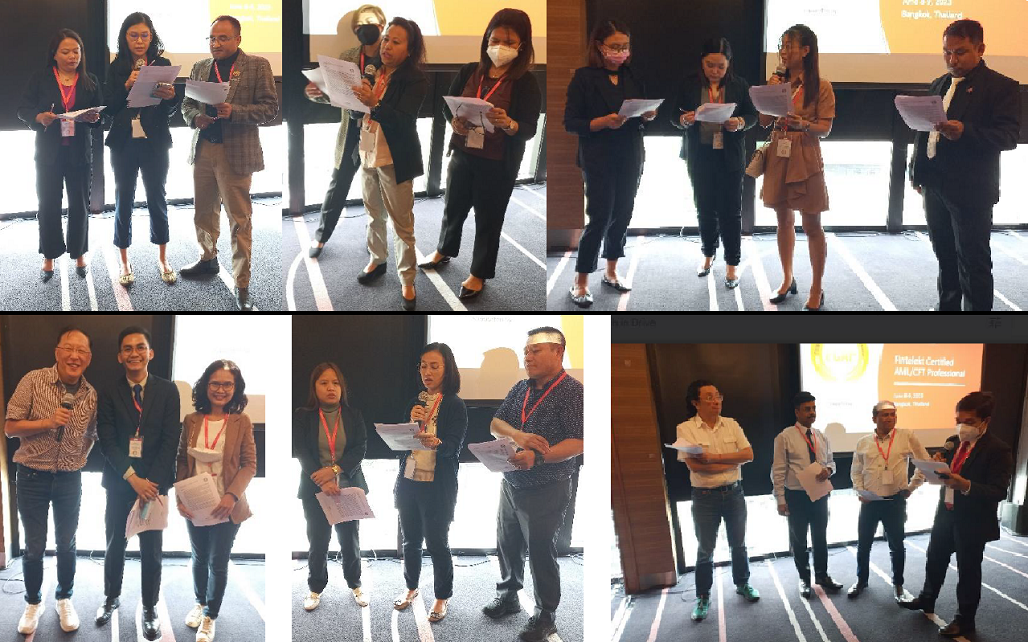

Certificate Distribution

The FCAP Certificate was awarded to all participants at the end of the programme in a certificate distribution ceremony. Arpita Bedekar, Director – Strategy and Planning, Fintelekt presented the certificates.

Leave a Reply