Fintelekt Advisory Services and the Asian Bankers Association organized a webinar on Drug Trafficking Threat Assessment and AML/CFT Considerations on July 5, 2023. More than 1200 participants from 54 countries were registered.

Fintelekt Advisory Services and the Asian Bankers Association organized a webinar on Drug Trafficking Threat Assessment and AML/CFT Considerations on July 5, 2023. More than 1200 participants from 54 countries were registered.

Shirish Pathak, Managing Director, Fintelekt Advisory Services moderated the webinar, which featured speakers that included Fabrizio Fioroni, Advisor AML/CFT, United Nations Office on Drugs and Crime (UNODC), Nabil Dipatuan, Financial Intelligence Lead, UnionDigital Bank Inc., and Arun Ajayagosh, Senior Manager, Financial Crime Compliance (AML & Sanctions), Wall Street Exchange.

The webinar started with Fabrizio presenting an analysis of the drug market in Asia, and trafficking trends in heroin, metamphetamine and cocaine. He used Covid-19 as a milestone to understand how organised crime is operating and producing profits, and in turn laundering the profits.

Some key conclusions from Fabrizio’s presentation are:

- Opium cultivation for heroin is on the rise in Myanmar, reversing the downward trend observed since 2014.

- Majority of heroin seizures in the last few years are from the Mekong countries. Decrease in seizures observed in other countries in the region.

- The supply of Methamphetamine continues to increase, but seizures have decreased in East Asian countries.

- There has been growing priority placed on methamphetamine as the ‘primary drug of concern’ in the last decade.

- Prices of meth have decreased, but supply has grown.

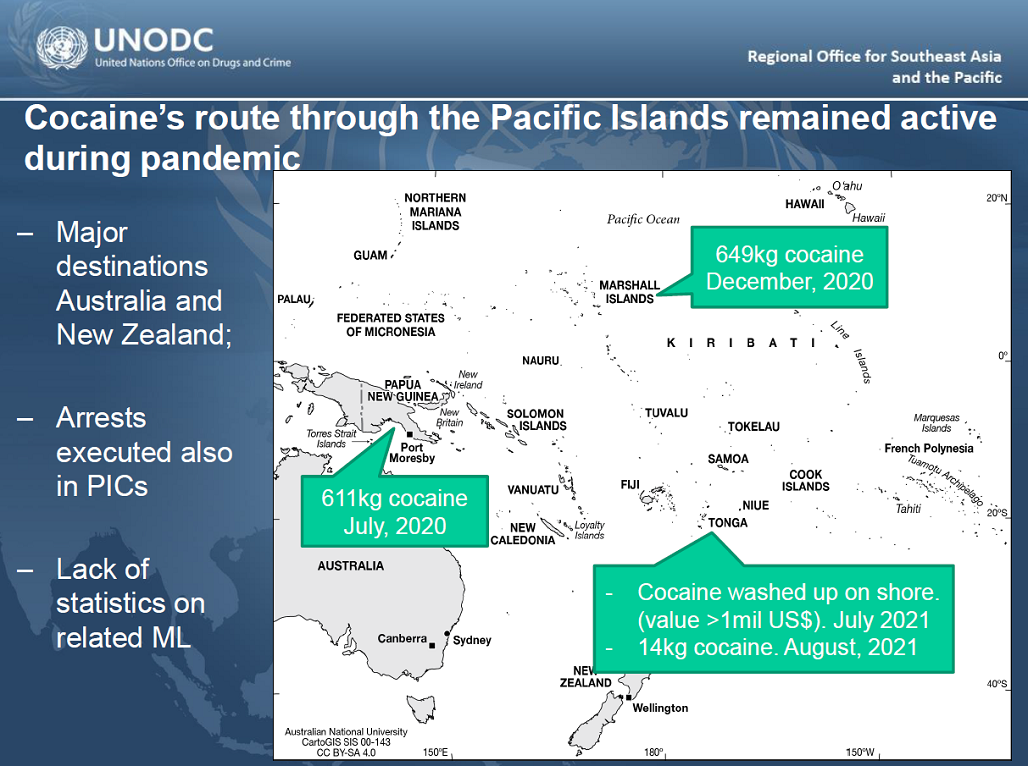

- Cocaine’s route through the Pacific Islands remained active during pandemic, with the major destinations being Australia and New Zealand.

- Three countries – Myanmar, the Philippines and Vietnam – are in FATF’s list of monitored jurisdictions and have challenges in addressing money laundering and terrorist financing. These weaknesses facilitate expansion in activities for criminal organisations.

- Mechanisms for investigating money laundering and confiscation of proceeds of crime are not effective in several Asian countries, which allows the system to be misused by criminals for laundering proceeds. The private sector is also impacted, since they do not receive proper feedback from the public sector.

The presentation by Fabrizio was followed by a panel discussion that focused on the practical aspects of detecting suspicious transactions involving drug trafficking.

Shirish: There are significant challenges in identifying the underlying predicate offence in transactions that appear suspicious. Often many crimes have similar red flag indicators and there may also be co-mingling. How can the analyst pinpoint transactions that involve illicit activity to be related to drug trafficking? Can you share your experiences on investigating such transactions and disambiguating the different typologies?

Nabil: Yes, red flag indicators for many offences are often similar, and co-mingling is a challenge. Transnational crimes may not be restricted to drugs or narcotics trafficking but may also involve human trafficking or illegal firearm trade. The organisation can invest in providing quality training and workshops – whether in house or external – to help analysts recognize red flags.

Some indicators of drugs related transactions are:

- Transactions with arrested, convicted, or suspect persons. Here, adverse media screening, whether manual, or automated, or a combination of the two is very useful.

- Customers or beneficiaries that receive funds from individuals or entities subject to asset freezes can also be investigated.

- Beneficiaries that receive funds from different places

- Recipients of large sums of money internationally or domestic, especially involving minors or students.

- Jurisdictions with increased involvement in drug trafficking

It is important to remember that there is often a combination of typologies involved, and these typologies as well as red flags are evolving from time to time. Hence, understanding the risks in your organisation’s channels, customers, etc. is very critical.

Nabil Dipatuan, Financial Intelligence Lead, UnionDigital Bank Inc.

Arun: One to many, or many to one transactions are often indicative of suspicious transactions. These need to be examined in the context of the corridor or jurisdiction in which the transactions take place.

Financial institutions rely on transaction monitoring systems to generate customer alerts. However, rule-based alerts are less effective if the characteristics of the crime are less specific, such as in the case of drugs trafficking. There is no one-size fits all approach.

In addition to transaction alerts, the AML team can review the typology strategically and combine it with open source information relating to specific typologies. A specific analytical approach is required that takes a holistic view of a specific type of crime which is taking place in a corridor or geography. It would be helpful to understand the characteristics of the underlying transaction and to compare with previously identified transactions, especially those in the case of convicted individuals referred by law enforcement agencies.

In case of drugs trafficking related transactions, it is important to know the source, transit and destination countries and have knowledge of the prices, market trends and fluctuations, since drug values can vary by location, supply and demand.

A special analytical approach that goes beyond the transaction alerts is required for identifying patterns in the case of typologies such as drug trafficking. This should involve the use of open source information and patterns identified from similar transactions of convicted individuals.

Arun Ajayagosh, Senior Manager, Financial Crime Compliance (AML & Sanctions), Wall Street Exchange

Fabrizio: There is unfortunately no formula that can be applied to understand the typology in the case of drugs or other type of crime. The market for drugs is largely cash based and hence there is a need for private sector financial institutions to train front line officers to understand the clients they deal with. There is also a need to go beyond the typical monitoring by bringing in open-source information.

There is also a need for building better relationships with the public sector. If reporting entities can have an early discussion with the public sector on suspicious transactions, there is an opportunity to facilitate the identification of drug trafficking and organised crime.

Another area is that of dual use goods. Those producing meth are also importing large amounts of chemicals, which may not necessarily be illegal. However, these may be controlled or listed chemicals, which need to have proper documentation.

Shirish: How can the AML monitoring system be fine-tuned in response to newer typologies and threats, so as to generate more relevant alerts, and in turn file more specific and useful suspicious transaction reports (STRs/SARs)?

Arun: Financial institutions should assess trends and patterns for existing and emerging typologies, coupled with an intelligence collection programme. Typology based information from reliable open sources need to be collated and all developments and trends with respect to a typology should be used to fine tune transaction monitoring system thresholds in an effective way.

Nabil: The organisation should continuously monitor their immediate risks exposure. They can start by monitoring advisories from their local regulators and FIUs for new and emerging threats and build those into their risk assessment. A timely and relevant risk assessment can help the firm to understand the evolving risks and effectively update the transaction monitoring system. Testing and optimisation should be carried out regularly.

Shirish: How is the UNODC contributing to awareness generation and capacity building within the private sector?

Fabrizio: For the private sector, the UNODC publishes reports and research that are in public domain and which provide a good overview of the market and are a good way to raise knowledge and awareness.

Further, the UNDOC usually provides technical assistance to the public sector to help with capacity building and technical assistance to implement effective AML/CFT mechanisms. These are also expected to be reflected in their relationships with the private sector through knowledge transfers.

Without knowledge coming from cases investigated and prosecuted by the relevant agencies, it would be very difficult for private sector financial institutions to build algorithms or processes that can monitor transactions. Public private partnerships are the best way to communicate and increase knowledge for better identification of patterns.

Fabrizio Fioroni, Advisor AML/CFT, United Nations Office on Drugs and Crime (UNODC)

Registered participants also received a PDF copy of the Presentation.

The recording of the webinar can be viewed at the Fintelekt website HERE.

It can also be viewed at the ABA Youtube Channel below:

Leave a Reply