The Asian Bankers Association (ABA) and BioCatch presented a webinar on “Combating Fraud, Scams & Money Laundering in 2023: A Behavioural Approach” on August 31, 2023. With more than 930 registered participants from 40 countries, the 69-minute webinar featured Edgar Zayas, Director of Global Advisory, who presented the latest technology approaches to prevent and combat crimes in banking operations. The session was moderated by Suresh Emmanuel, Chief Information Security Officer at Hatton National Bank.

SUMMARY

Mr. Zayas started his presentation with a brief history of the company’s origin in 2011 and its present customer base.

He proceeded to show a map of the global threat landscape, and explained how each major region of the world is affected by different threats. APAC appears to be attacked by call center, romance, and investment scams as well as impersonations. One critical link in all these different scams is the mule job.

Within Asia Pacific, there are also threat differentiations such as APAC-wide and ASEAN-specific. Zooming into the ASEAN area, money-siphoning apps (malware), social engineering scams, fraudulent loan applications, stole credentials scams, and money mules and laundering were further explained since they are more prevalent in the ASEAN region.

The presentation then delved into the process of collecting the behavioral data that could be used to address the threats. Mr. Zayas explained that banks can use behavioral insights to tackle all the different kinds of scams.

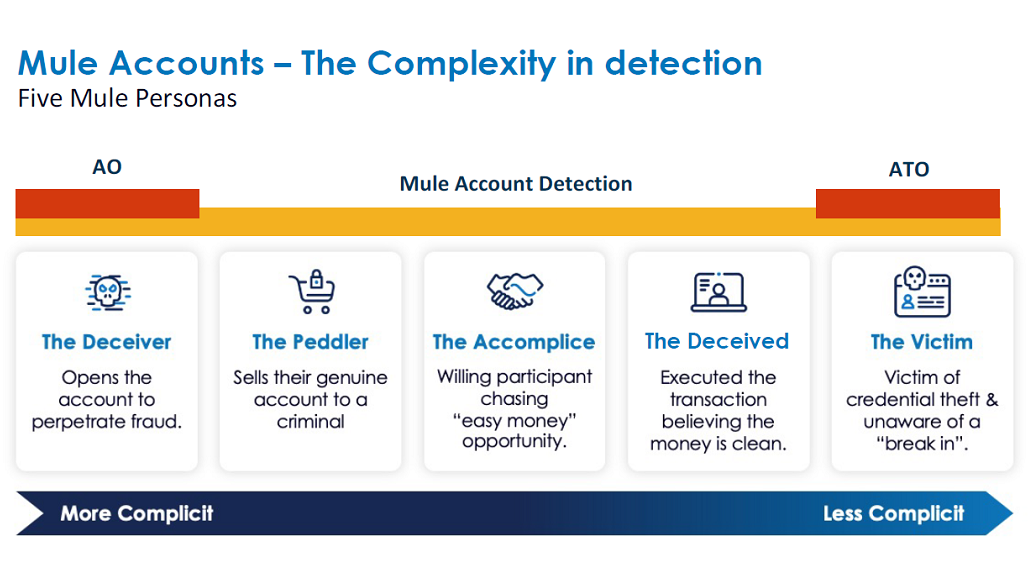

Cases based on age analysis at account opening, malware on account takeover, voice scam for social engineering scams, and the mule account detection were discussed as parts of the many scam combinations.

In conclusion:

- Social Engineering Scams at a high level are the same throughout the world spreading in variations from region to region.

- Tactics, Techniques and procedures (TTPs) – patterns of activities or methods associated with a specific threat actor or group of threat actors. These also vary but throughout a campaign / Fraud MO.

- One thing is consistent – Behaviors. Both the behavior of a victim and fraudster, the more it changes, the more it says.

- Physical biometrics (Face/Voice) can be cloned. Behavior remains unique and anonymous.

- Behavioral biometrics is not just a buzz word. it’s a must-have tool in your arsenal.

PRESENTATIONS & VIDEO

The PDF copy of all the presentations is available only to ABA members. The recording of the webinar can be viewed at ABA Youtube Channel below.

What role do fraudulent loan applications and stolen credential scams play in the threat landscape of the ASEAN region? Visit us Telkom University