Specific AML/CFL-Related Priorities for Banks Due to the Pandemic

The Covid-19 pandemic has exacerbated financial crime and led to heightened money laundering (ML) and terrorist financing (TF) risks for financial institutions across the globe. The Financial Action Task Force (FATF) which is the international standard setting body for AML/CFT published a report on Covid-19-related Money Laundering and Terrorist Financing in May 2020 and subsequently an update in December 2020. The report pointed to a significant rise in ML/TF risks, particularly in the areas of counterfeiting, fraud, cybercrime, property crimes and corruption on account of vulnerabilities due to lockdowns and supply chain disruptions.

The Covid-19 pandemic has exacerbated financial crime and led to heightened money laundering (ML) and terrorist financing (TF) risks for financial institutions across the globe. The Financial Action Task Force (FATF) which is the international standard setting body for AML/CFT published a report on Covid-19-related Money Laundering and Terrorist Financing in May 2020 and subsequently an update in December 2020. The report pointed to a significant rise in ML/TF risks, particularly in the areas of counterfeiting, fraud, cybercrime, property crimes and corruption on account of vulnerabilities due to lockdowns and supply chain disruptions.

Even as ML/TF risks increased during the pandemic, regulatory pressure on reporting entities did not abate, witnessed in continuing enforcement actions and an increase in Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) obligations. Regulators have stressed upon continuous risk assessments by reporting entities, improving the quality of suspicious transaction reports, and using technology to improve the efficiency as well as effectiveness of AML/CFT monitoring.

In this paper, I would like to discuss three themes that have taken on greater prominence during the pandemic: Anti-Corruption, Economic Sanctions and Financial Inclusion. I will discuss some of the key trends within these issues and the compliance tools available with banks.

(1) Anti-Corruption:

During the Covid-19 pandemic, governments have been burdened with providing urgent relief, facing disruption in supply chains, and dealing with new suppliers associated with pandemic-related support. The vulnerabilities and disruptions associated with the pandemic have resulted into greater opportunities for corruption.

The rise in corruption exposes banks and financial institutions to ML risks, as corruption proceeds need to be integrated with the formal financial system to be utilized for legitimate purposes. Proceeds of corruption are known to be laundered using complex corporate structures, through the creation of shell companies and by routing funds through offshore tax havens.

To fulfil their obligations in terms of identifying and detecting proceeds of corruption, banks should focus on KYC and enhanced due diligence on Politically Exposed Persons (PEPs) along with their family members and associates, influential persons and high net-worth individuals. Enhanced scrutiny of all new individual and business accounts especially receiving government subsidies or financial support, Not-for-Profit organizations and charities for donations and support during the pandemic must be undertaken. The identification of beneficial ownership, going beyond regulatory requirements, if needed, and building in red flag indicators and AML monitoring scenarios for corruption and bribery are some of the tools available with banks.

(2) Economic Sanctions

During the Covid-19 pandemic, the number and complexity of sanctions levied by the US, UK, Canada and European Union has continued to grow. Co-ordinated action has been witnessed for sanctions against countries such as Belarus and Myanmar. Sanctions have targeted issues such as trade, corruption, and human rights abuses. The risk of secondary sanctions especially by the Office of Foreign Asset Controls (OFAC) of the US Treasury continues, especially for engaging in transactions involving Iran and North Korea.

To combat the sanctions risk, a continuous and dynamic assessment of sanctions risks in all areas of the business is highly recommended. The sanctions risk is especially high for trade and cross-border remittances. Screening and trade surveillance will necessitate appropriate investments in technology and in creating a well-trained team that includes staff with knowledge and expertise in economic sanctions.

(3) Financial Inclusion:

According to a 2021 study, the proportion of unbanked population in Asia is 24 per cent. AML and anti-financial crime measures conforming to the FATF 40 recommendations have often created hinderances for certain sections of the population due to imposition of rigorous documentation and scrutiny. This has led to their exclusion from the formal financial system. De-risking of banks in developing economies by correspondent banks in more developed countries due to stringent AML/CFT regulatory requirements has also been responsible for exacerbating financial exclusion.

As this unintended consequence came to the fore, the FATF took note via a formal recognition of financial exclusion as an ML/TF risk in 2012 and introduced a risk-based approach that advised proportionality in AML/CFT measures. In 2020, the FATF has initiated a study to understand and mitigate these unintended consequences.

The impact of greater financial inclusion will be a decrease in gray markets for financial services and better reach and effectiveness of AML/CFT measures. Significant growth in mobile wallets and digital financial accounts during the pandemic has been seen in many countries such as Thailand, Indonesia, Vietnam, India and Bangladesh. Digital accounts have allowed governments to reach unbanked populations for relief and to provide government benefits, underscoring the priority of bringing unbanked populations into the financial system.

For the banking sector, financial inclusion poses a huge opportunity for offering digital financial services to the hitherto significant unbanked population. Better risk assessment can allow banks to take a risk-based view of financial inclusion accounts and apply suitable AML/CFT measures that do not penalize poorer sections of the population.

(4) Conclusion

Through the pandemic, banks should stay on top of the dynamic risk environment by identifying and mitigating the most critical areas of risk, using technology effectively and training and building staff knowledge.

Recommendations for banks’ response to the increasing risks and regulatory pressures during the pandemic will be discussed in greater detail during the presentation, which Fintelekt would encourage the ABA to promote to its member countries in the interest of developing a strong compliance regime in the region.

The presentation file can be downloaded HERE.

The video recording of ABA Policy Advocacy Committee Meeting can be viewed in the ABA YouTube.

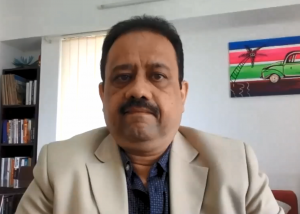

Prepared for the Asian Bankers Association by:

![]() Mr. Shirish Pathak

Mr. Shirish Pathak

Managing Director

Fintelekt Advisory Services