Activities to Meet Challenges in Implementing Regulatory Framework to Achieve Sustainability Goals

Paper Objective: To share the experience of RCBC in the implementation of the regulatory Sustainable Finance Framework and suggest ways of addressing challenges in achieving sustainability goals.

Paper Objective: To share the experience of RCBC in the implementation of the regulatory Sustainable Finance Framework and suggest ways of addressing challenges in achieving sustainability goals.

Introduction: The Philippine banking system is governed and regulated by the Bangko Sentral ng Pilipinas (the Philippine Central Bank or BSP). In April 2020, the BSP issued Circular No. 1085, referred to as the Sustainable Finance Framework. The Circular requires banks to integrate sustainability principles, including those covering environmental and social (E&S) risk areas, in their corporate governance framework, risk management systems, and strategic objectives. The Circular identifies corresponding duties and responsibilities of a bank’s Board of Directors and senior management. In addition, the Circular requires internal audit review as well as annual disclosure requirements on the bank’s sustainability strategy. The Circular provides a three-year transition period for banks to be fully compliant.

(I) Challenges in Implementing the Regulatory Framework:

1. Mindset: Integrating sustainability principles into a bank’s practices may be perceived as requiring incremental cost, in light of its associated capacity-building activities. This has become a challenge now more than ever given that survival and cost-cutting measures are deemed the more pressing concerns amidst the COVID-19 pandemic, placing sustainability as a lesser priority.

2. Execution: BSP’s Circular 1085 provides high-level sustainability directives, without details or guidelines on how to institutionalize E&S risk management systems. Capacity-building requirements and the transition period prescribed by the Circular are also uniform across all banks. These pose challenges as banks are at various stages in terms of awareness and management of E&S risks.

(II) Activities to Meet Challenges in Implementing the Regulatory Framework – RCBC’s Sustainability Journey:

3. Shift in Mindset: Sustainable practices do not bring about incremental costs. It is the reverse: Sustainable practices help prevent incremental costs.

3.a. Avoided cost of unsafe work conditions and client servicing methods: RCBC focused on the promotion of safe and secure work conditions and client servicing methods amidst the COVID-19 pandemic. Protecting the health and safety of employees and clients is an essential element of promoting sustainability, thereby preventing the cost of having a compromised work force and clientele.

- As early as January 2020, RCBC implemented its Pandemic and Infectious Disease Plan as part of the Bank’s Business Continuity Enterprise Plan. Clustering of business operations, adherence to government-directed health and safety protocols, and streamlining of operations were implemented as the Bank sought to defend its human resources against the health crisis.

- RCBC became a digital ambassador for its customers as they transitioned toward online banking, and for the unbanked and underserved Filipinos as they were finally given access to mobile digital banking. This digital transformation not only supported the BSP’s advocacy for financial inclusion, but more importantly, ensured the safety of RCBC’s customers while they continue to have access to the Bank’s products and services. Digital financial inclusion products (DiskarTech, Go Digital, and ATM Go) along with RCBC’s support for MSME loans have created sustainable opportunities across the Bank’s value chain.

3.b. Avoided cost of non-compliance / rectification works: RCBC has implemented its Environmental and Social Management System (ESMS) since 2011, under which all lending relationships/credits, both pipeline and portfolio, are vetted from an environmental and social risk perspective. The Bank’s ESMS Policy is a declaration of its commitment to sustainable development and management of E&S issues.

3.b. Avoided cost of non-compliance / rectification works: RCBC has implemented its Environmental and Social Management System (ESMS) since 2011, under which all lending relationships/credits, both pipeline and portfolio, are vetted from an environmental and social risk perspective. The Bank’s ESMS Policy is a declaration of its commitment to sustainable development and management of E&S issues.

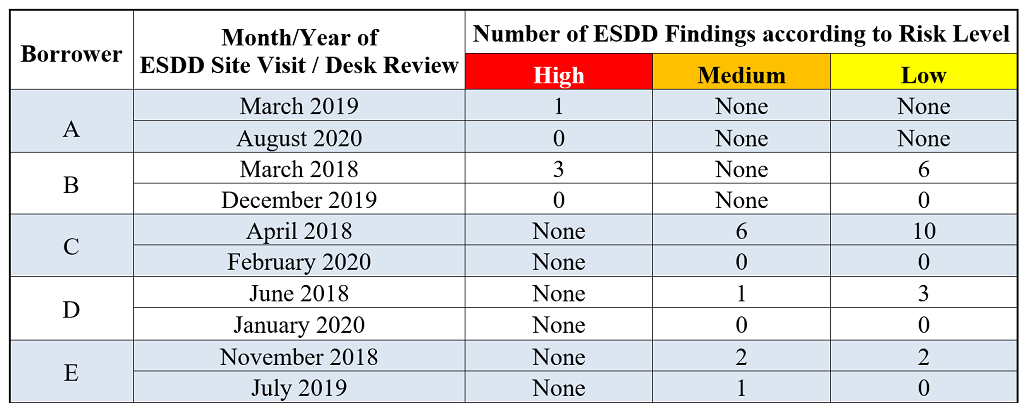

Part of the ESMS Policy is the conduct of Environmental and Social Due Diligence (ESDD) site visit / desk review on businesses with elevated E&S risks. RCBC’s ESDD activities have indicated beneficial influence in preventing clients from paying penalties or incurring additional operating costs that may result from non-compliance with E&S regulations and best practices. Below table shows examples of our borrowers’ cooperative response to our ESDD findings, as they reduce / eliminate the possibility of penalties or rectification works by the time the second cycle ESDD site visit / desk review (18-24 month cycle) was performed. Beyond the need to prevent costs, the cooperative response of these borrowers also affirms the influence that banks such as RCBC can have on its clients – we can lead them to develop or maintain projects that will not only result to profits or less costs but also bring about benefits to their environment and community:

3.c. Avoided cost of climate change and healthcare inadequacy: RCBC continues to pursue financing activities for green and/or sustainable projects to help address urgent environmental and social concerns, primarily clean energy and support for public health amidst the pandemic.

- In May 2021, Moody’s published a research note indicating that the major banks in the Philippines have the second-largest exposures to credit risks that are linked to environmental factors, particularly climate change. According to Moody’s, there are five sectors that are likely to put pressure on Philippine banks’ credit risk due to climate change, namely: mining, energy, oil and gas, surface transportation and logistics, steel and chemicals, and building and construction materials. The data of Moody’s disclosed that major Philippine banks have a total exposure of 22% to these five sectors, one of the highest in the Asia-Pacific region. Moody’s further noted that countries with inadequate health care systems (low patient coverage, few physicians, and insufficient facilities) are expected to be more vulnerable to climate shocks as these can drastically increase the demand for healthcare support and may lead to a collapse of the healthcare infrastructure.

- RCBC’s Sustainable Finance Framework of April 2019 articulates the Bank’s strategy to raise funds and lend to priority sectors that have clear environmental and social benefits. From 2019 up to the first quarter of 2021, RCBC has raised USD1.1B worth of green and sustainability bonds, with the most recent issuance (March 2021) being the largest at Php18B (~USD373M) – a deal that came together successfully despite the physical restrictions imposed by the pandemic. RCBC believes that it is important to continually impart the message on environmental and social responsibility. The pandemic brings with it a heightened awareness of the impact climate and social vulnerabilities can have on customers and on the banking sector. RCBC acknowledges that its long-term viability rests on how it contributes to creating a more stable climate for growth in a country which regularly ranks high in social inequality and vulnerability to climate change. The effects of climate change can be profound on the financial performance of a bank. RCBC’s bond issuances aim to raise awareness among peers and inspire other banks to follow suit in green / sustainable financing.

4. Formulating an Execution Strategy: Despite the Circular’s current limitations, banks4. can appropriately design a strategy toward attaining the Circular’s sustainability requirements.

4.a. Review of existing organizational capacities and practices versus the regulatory requirements: The provisions of BSP Circular 1085 are to be implemented in accordance with a bank’s size, risk profile, and complexity of operations. For a proper assessment of how the three-year road map can be developed, the following were applied by RCBC:

- Completion of a gap analysis: RCBC’s Risk Management team identified its current E&S risk assessment processes and capacities and mapped them against each requirement of BSP Circular 1085. The gaps identified from the exercise are subsequently plotted against a completion timeline within the three-year transition period allowed by the Circular.

- Collaboration with other units: Recognizing that certain gaps require cross-functional inputs, RCBC’s Risk Management team engaged other units within the Bank. This made possible a collaborative evaluation in determining if internal capacities are sufficiently in place, or if external assistance should be considered. As the Bank can be considered well-placed in complying with the Circular (with its ESMS since 2011 and own Sustainable Finance Framework issued in April 2019), collaboration has also been extended to RCBC’s subsidiaries in order to provide guidance and harmonized approach on these subsidiaries’ initial stages of integrating sustainability into their own frameworks and operations.

4.b. Forming alliances: For gaps that need to be addressed through the help of external parties, the following were considered by RCBC:

- Learning from established Sustainability promoters: In the course of RCBC’s internal research on sustainability, the Bank had the opportunity to learn from and connect with the following organizations which provided workshops without corresponding fees: Global Reporting Initiative, United Nations Development Programme, and World Wide Fund for Nature. RCBC continues to benefit from these initial connections. Interaction with these organizations has remained even after the workshops, given the continual learning and action needed in promoting sustainability.

- Alignment of Sustainability Objectives with the International Finance Corporation (IFC), a Shareholder: RCBC subscribes to IFC’s eight (8) Performance Standards as part of its implementation of its ESMS. This joint sense of accountability on sustainable practices has facilitated continued collaboration between RCBC and IFC. In January 2021, RCBC entered into an agreement with IFC, engaging IFC and 2 Degree Investing Initiative (2DII) to build capacities in the application and use of Climate Scenario Analysis. This advisory engagement is the first to be conducted by IFC and 2DII in Asia. The Climate Scenario Analysis will provide tools to assess and monitor RCBC’s portfolio sensitivity to transition risks, which will be integrated into the Bank’s stress testing results in compliance with BSP Circular 1085.

4.c. Participating in the Regulator’s Sustainability awareness programs

- In May 2021, the BSP issued its draft on the second-phase sustainability regulations which aim to provide granular expectations on the integration of climate change and other E&S risks in the credit and operational risk management frameworks of banks. RCBC provided comments to this BSP draft, allowing a participative exchange of views on the implementation of sustainability within the banking industry. In the same month, the BSP stated in a press release that it will engage banks in discussions during the three-year transition phase before the full implementation of Circular 1085.

- In various occasions in 2020 and 2021, the BSP invited banks to participate in the webinar series on Sustainable Finance in partnership with the United Kingdom (UK) Government’s ASEAN Low Carbon Energy Programme (LCEP). RCBC participated in the webinar series conducted in September 2020 and in July 2021, covering discussions on Sustainability Bonds, Climate-Related Financial Risks and their Disclosures, and Climate Scenario Analysis. Banks are encouraged to join and participate in these kinds of webinar series to gain insights on how to implement the requirements of BSP Circular 1085 as may be appropriate to their organization.

The presentation file can be downloaded HERE.

The video recording of ABA Policy Advocacy Committee Meeting can be viewed in the ABA YouTube.

Prepared for the Asian Bankers Association by:

Armi M. Lamberte

First Vice President

Portfolio Quality Division

Risk Management Group

Rizal Commercial Banking Corp.

Juan Gabriel R. Tomas IV

Senior Vice President

Risk Management Group

Rizal Commercial Banking Corp.