Digital Transformation

Ms. Fathimath Farihath Waheed, Head of Cards & Payment Governance, and Mr. Badhurudheen Hassan, Head of Retail Banking & Cards from Bank of Maldives, Maldives introduced the measures it has implemented over the past year on its digital transformation journey, on the challenges it has met in driving change and how it overcame them, on its digital banking infrastructure and solutioning, and on its Fintech collaboration.

Introduction

Maldives, located in Southern Asia in the Indian Ocean, has an estimated population of about 550,000. It consists of 1,192 islands and is one of the world’s most geographically dispersed countries. Only 187 islands are inhabited.

The Maldives economy is largely dependent on Tourism and over 70% percent of the country’s GDP is attributed to revenue generated from the tourism sector. Due to the international travel restrictions as a result of the Covid-19 pandemic, tourist arrivals were impacted. However, since then, tourist arrivals have been on an increasing trend.

Commercial Banks

The Banking Sector in Maldives consists of 8 banks, of which 3 are locally incorporated and 4 are branches of foreign banks and 1 is a subsidiary of a foreign bank. All the banks are regulated by the Central Bank, the Maldives Monetary Authority.

Bank of Maldives

Bank of Maldives is the largest and leading financial institution in the Maldives. We are a full-service bank offering the complete spectrum of personal, business and corporate financial services as well as Shari’ah compliant Islamic Banking. We have a strong customer base of 310,000.

We have a strong presence in every island in the country with 35 branches across all 20 atolls, 81 Self Service Banking Centres, 139 ATMs, over 200 agents and a full suite of Digital Banking services.

Digital Banking Channels

- Bank of Maldives was the first to launch POS and Mobile POS Services in Maldives. Currently we have 8,000 POS Merchants across the nation.

- We were the first to launch Internet and Mobile Banking with 90% online penetration and we have about 2,229 E-commerce merchants.

- We were also the first to launch cash and cheque deposit machines

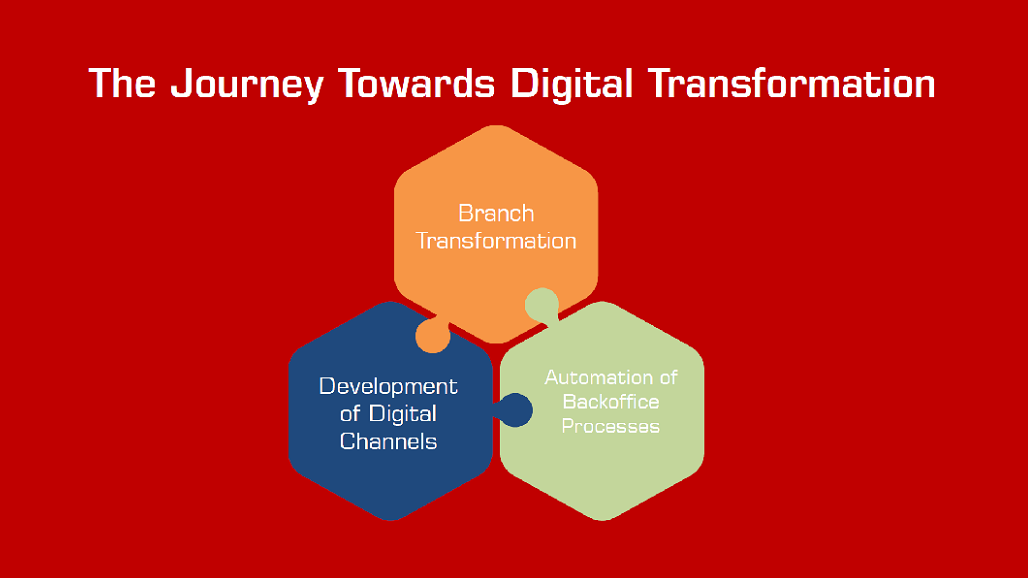

The Journey Towards Digital Transformation

Our strategic focus on digitilization continues despite the challenges from the Covid-19 pandemic, with steadfast focus on Branch Transformation, introduction of technological solutions and the automation of backend processes. We aspire to make all our services available digitally and allow customers to access the Bank wherever they are.

Branch Transformation

Over the recent years we have moved away from the traditional branch model from transactional services to a new branch model where the focus is more on relationships and sales. Our approach has been to encourage customers to engage in self-service banking and provide online alternatives for all personal banking needs. During the past three years there has been a considerable shift to online transfers and payments.

Development of Digital Channels

Our Mobile Banking app was launched in 2021 with a new look and features to provide customers with a safe, secure seamless banking experience. Additional self-service features were introduced on the app including the ability to check account numbers prior to transfers, card and account services as well as international money transfer services. We have also moved multiple services to our online channels, enabling online requests for all personal loans and providing key card services online.

In 2021, our online penetration was at 90% and transaction volume at approx. MVR200 billion, which is an 64% increase compared to 2019. We continue to develop and improve our online platforms and some of the additional features planned are; Digital Onboarding, E-KYC update, Expense Management, Bill Pay Services and Open Banking Features.

Automation of Processes

A key strategic priority is the automation of processes to deliver a faster and seamless customer experience. Currently we have implemented the Instant Account Opening process and the automation of TT Applications. Going forward we are planning to automate Pre-approved Credit Limits & Instant Disbursement, Customer Information Update, Card Renewal Process and Online Onboarding.

Open Banking

Maldives Payment System Development is a multi-phase initiative by the Maldives Monetary Authority to enable simple, fast and secure payments. The objective is to ensure that users are able to make and receive payments instantly irrespective of where they live or where they bank.

Key Features:

- All Maldivians including the unbanked will be able to send and receive money instantly

- Smart addressing service – Identifiers such as ID card, email, phone numbers and fingerprints can be used to execute payments

- Request to Pay/ Credit Transfer/ Bulk payments – Payment service providers will have access to the account-to-account domestic payments scheme, thus enabling digital and integrated payments services

Challenges in Digital Transformation Journey & Strategies to Overcome

- The lockdown measures during the Covid-19 pandemic led to the closure of the Bank’s branch network and a subsequent shift to digital channels. The key challenge for the Bank in implementing its digital transformation projects arose due to the drastic shift of the workforce to remote working arrangements. Nonetheless, the Bank leveraged the use of online and digital alternatives to provide key services to customers such as introduction of the loan moratorium application portal and an appointment portal for visiting branches and service centres.

- Given the scale and volume of its digitalization and automation projects, a structured and coordinated approach is required in order to prioritize and successfully implement key projects. The Bank adopts project management methodology in order to ensure this.

- Due to the limited talent pool in the country, it is a continuous challenge for the Bank to recruit skilled local IT developers. Given the Bank is moving towards a more digital space, it is essential we have developers that can cater to evolving technological advancements. We are exploring possibilities of establishing an Innovation Lab or Department to strategize development efforts including collaboration with Fintechs. In addition to this, we are looking at implementing an Agile leadership and working structure.

- Another challenge is the lack of infrastructure, regulations and laws in the country to support a digital nation. We are working with agencies and ministries to develop and gain access to digital registries which will enable us to further automate and speed up the verification process.

- Digitalization naturally creates potential cyber threats and requires additional layers of security. The Bank’s payment infrastructure is critical to the smooth functioning of the Maldives economy and a key strategic focus is therefore on IT resilience and cyber security.

- With the implementation of Open Banking, it is going to increase the competition from the Nonbank financial institutions. The Bank views the Open Banking system as an opportunity to provide additional services.

The summary report can be downloaded HERE.

The PDF presentation can be downloaded HERE.

The video presentation of the ABA Policy Advocacy Committee Meeting presentation can be viewed at the ABA YouTube channel.

Prepared for the Asian Bankers Association by:

Ms. Fathimath Farihath Waheed

Head of Cards & Payment Governance

Mr. Badhurudheen Hassan

Head of Retail Banking & Cards