Application of Data Analytics

The paper on Application of Data Analytics presented by Mr. Kenny Au, Head of Data Science & Governance Department, Technology and Productivity Division at The Bank of East Asia, Limited, explained the Bank’s experience and practices in the use of data analytics to achieve effective decision-making in the organization. The paper elaborated on how BEA applies data analytics to gain better customer insight, improved operations, more insightful market intelligence, agile supply chain management, data-driven innovation, and smarter recommendations and targeting, among others.

The paper on Application of Data Analytics presented by Mr. Kenny Au, Head of Data Science & Governance Department, Technology and Productivity Division at The Bank of East Asia, Limited, explained the Bank’s experience and practices in the use of data analytics to achieve effective decision-making in the organization. The paper elaborated on how BEA applies data analytics to gain better customer insight, improved operations, more insightful market intelligence, agile supply chain management, data-driven innovation, and smarter recommendations and targeting, among others.

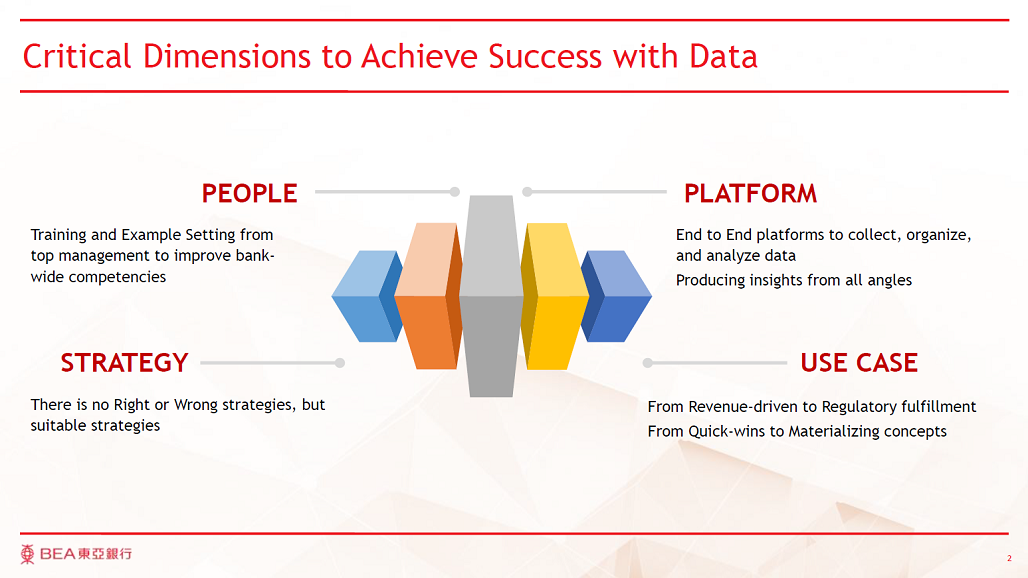

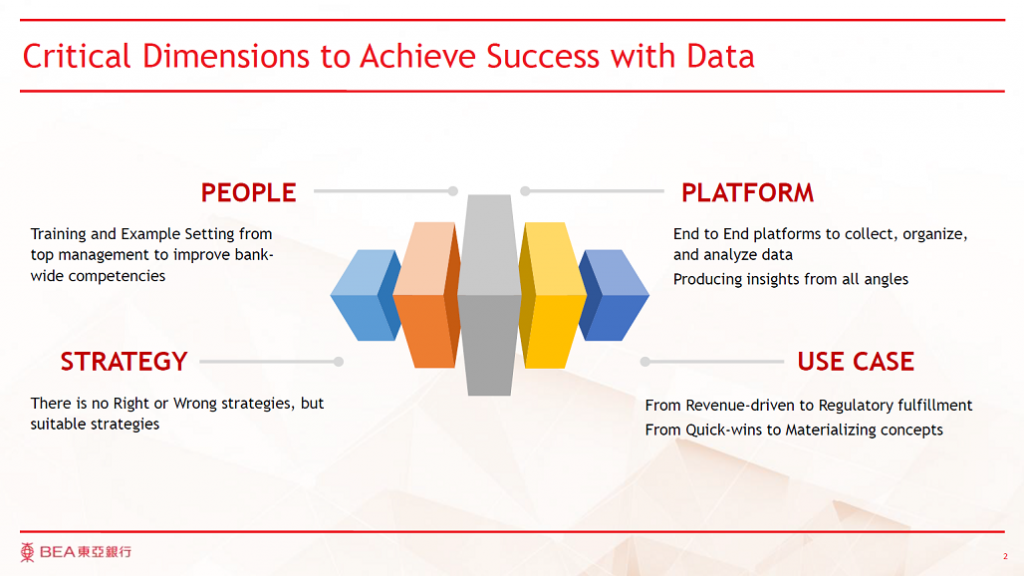

Mr. Au noted that with the rising awareness of the importance of data, organizations have begun to incorporate data analytics into their digital transformation journey. In the position paper, he pointed out that from data preparation, governance, to visual analytics, there are numerous theories and approaches used to achieve results. The paper discussed a structured approach, based on the People, Platform, Strategy, and Use Case, to show case a practical guide in applying data to an organization.

Following are the salient points raised by Mr. Au in the position paper:

PEOPLE — Data Literacy Empowerment

A series of industry recognizable training should prepare an organization for the necessary changes to become truly data driven. From top management to general staff, each hierarchy layers will be equipped with relevant levels of Data Literacy.

Data Leader (DL), including Board members, General Managers, and Head of Departments are expected to drive data culture, and support staff at all levels on both implementation and knowledge. Data Leaders will be setting visions and providing required resources for initiatives to come.

Citizen Data Scientists (CDS), usually nominate and selected by the Data Leaders, to promote data driven culture through enhancing technical capability over time.

Data Citizen (DC), open to bank-wide staff. Raising overall awareness as well as improved knowledge to think, speak, and act with data.

An ongoing Data Community will be created to ensure the productivity of use case generation, knowledge transfer and support of data usage.

External collaboration is encouraged to facilitate the training with required tools such as Data Visualization software.

PLATFORM — from Zero to Data Commercialization

In order to facilitate changes, specific foundations need to be constructed in parallel.

Storage: Traditional companies especially with a sizable operation often built their database gradually on a need basis approach. Databases are often designed and rolled out independently (silo), with a specific purpose, installed locally by different vendors. Naturally, a new storage infrastructure is required to match the need for safe, easy, structured, and stable access across the whole organization. Going Cloud is one inevitable option. Migrating existing data warehouse to cloud, prioritizing from front to back office will achieve just that.

Preparation: Although each data user is expected to prepare their own data. Nonetheless, group wide standards on Data Governance is a must. Setting up committees such as Data Council, to define rules and policies to uphold communication efficiency, data quality, and gate keeping security.

Process: Riding on good quality data source, AI and Machine Learning can take place. Users will be able to leverage Tagging Library, Visual Analytics to generate directions and insights which, in turn, helps decision makings.

STRATEGY — Data Adoption by Every Staff

A true data driven company requires every staff to engage in data. Roles and Responsibilities can first be separate Centralized Team from the rest of the non-data staff.

Centralized Team – Advanced analytics, modelling, and machine learning capabilities are expected to be developed by a centralized team led by the Data Team. They will act as a point of contact for the whole organization to provide guidance and support on both knowledge and practical initiatives.

Rest of Staff – A range of tools should be available for both senior and junior staff to access. For example, senior staff who needs to make management decisions on a daily basis can make use of Self-Service Market Place to be more informed and efficient.

USE CASE — Real-time Analysis

To ensure the practicality of the data journey, it is advised to go for a Use Case approach.

To gain trust and support from senior management, it is important to produce use cases that can bring in quick wins and return. Real-time analysis can be a useful option.

Example for banks:

- Significant account movement such as receiving a lump sum of cash

- Real-time analysis has performed to identify whether the cash deposit is:

- Fraud è which will be alerting relevant systems

- Legitimate transaction è provide simple recommendations such as investment advice if the cash came from selling a stock

In conclusion, Mr. Au pointed out the following on the foreseeable future of the data economy in banking:

Data will become more and more like a currency which can be used to monetize for both customers and banks, once the market has successfully tackled the “consent problem”.

Open Banking, where banks are sharing customer data (with consent) to third party service providers. They will be able to create products and services that can leverage looking at the whole picture of customers’ portfolios.

Open Finance, where banks are taking in alternative/external data (with consent) from third parties. This allows banks to create tailored financial products and services to individual customers with low costs.

He said that with the right preparation mentioned in previous sections, organizations should be able to take hold of the opportunities where data collection, preparation, analyze, and usage capability are fully ready.

Presentation & Position Paper

Mr. Au’s Presentation and Position Paper presented during the ABA Policy Advocacy Committee Meeting can be downloaded HERE.

Video

The video recording of ABA Policy Advocacy Committee Meeting can be viewed in the ABA YouTube.

Prepared for the Asian Bankers Association by:

Mr. Kenny Au

Mr. Kenny Au

Head of Data Science & Governance Department, Technology and Productivity Division