“Reshaping the Asian Financial Landscape”

November 14-15, 2019, Makati Shangri-la Hotel, Manila

Summary Report of Proceedings

I. Introduction

1. Some 180 bankers from Asia-Pacific, the Middle East and other regions – composed mainly of members of the Asian Bankers Association (ABA) led by ABA Chairman Mr. Jonathan Alles, Managing Director and CEO of Hatton National Bank from Sri Lanka – gathered in Makati, Philippines on November 14-15, 2019 for the 36th ABA General Meeting and Conference. Hosted and organized by Philippine National Bank (PNB) under the leadership of its President and CEO Mr. Wick Veloso, the 2019 ABA gathering was held at Makati Shangri-la Hotel . It was the second time that PNB hosted an annual gathering of ABA members, 24 years after the Bank organized one in 1995.

1. Some 180 bankers from Asia-Pacific, the Middle East and other regions – composed mainly of members of the Asian Bankers Association (ABA) led by ABA Chairman Mr. Jonathan Alles, Managing Director and CEO of Hatton National Bank from Sri Lanka – gathered in Makati, Philippines on November 14-15, 2019 for the 36th ABA General Meeting and Conference. Hosted and organized by Philippine National Bank (PNB) under the leadership of its President and CEO Mr. Wick Veloso, the 2019 ABA gathering was held at Makati Shangri-la Hotel . It was the second time that PNB hosted an annual gathering of ABA members, 24 years after the Bank organized one in 1995.

II. Opening Ceremony

2. This year’s Conference carried the theme “Reshaping the Asian Financial Landscape.” The two-day event provided another valuable platform for ABA members to meet and network with each other and to exchange views with invited speakers on: (a) current trends and developments in the regional and global markets that are expected to have a significant impact on the banking and financial sector of the region, and (b) how industry players can address the challenges – and take full advantage of the opportunities – presented by these developments.

3. The Keynote Speech was delivered by Mr. Peter B. Favila, Monetary Board Member, Bangko Sentral ng Pilipinas (BSP), who spoke on the topic “Paradigm Shifts and Economic Gains.” Mr. Favila explained that the topic basically encapsulates the state of the Philippine economy in recent years, noting that from being a consumption-led and agriculture-centered economy, the Philippines has progressively transitioned into an investment-led and an increasingly service-driven and digitalized nation.

3. The Keynote Speech was delivered by Mr. Peter B. Favila, Monetary Board Member, Bangko Sentral ng Pilipinas (BSP), who spoke on the topic “Paradigm Shifts and Economic Gains.” Mr. Favila explained that the topic basically encapsulates the state of the Philippine economy in recent years, noting that from being a consumption-led and agriculture-centered economy, the Philippines has progressively transitioned into an investment-led and an increasingly service-driven and digitalized nation.

“Change is good as long as we make good of that change. And we have been gradually reaping and at the same time nurturing the fruits of our endeavours,” he added. He especially cited the country’s high GDP growth in recent years, the stable inflation environment, liquidity and credit conditions that have remained supportive of the country’s growth requirements, sustained soundness of the country’s financial sector, and an external sector that has remained a pillar of strength for the economy.

He also pointed to an increasing recognition of the potential leverage on technology to enhance the conduct of central banking operations, with the BSP continuing to adhere to a regulatory framework which strives to strike the right balance between financial technology and regulation, while leveraging on safe, innovative and affordable financial instruments and channels that serve as the gateway to greater financial inclusion.

In conclusion, Mr. Favila said that the Philippine holds a lot of promising investment opportunities, stressing that “The structural transformation that we are seeing now supports our view that the Philippines provides a value proposition that is not short-lived, but is actually anchored on a dynamic track record of a durable, resilient, and sustainable growth.”

4. PNB President and CEO Mr. Wick Veloso in his Welcome Statement said that the Conference has given delegates the opportunity to listen to and exchange views with their peers from various financial organizations on various topics of current concern to the banking industry, including: how digitalization and sustainability trends are changing the banking financial landscapes worldwide, global economic outlook, financial inclusion, and the digital financial ecosystem.

4. PNB President and CEO Mr. Wick Veloso in his Welcome Statement said that the Conference has given delegates the opportunity to listen to and exchange views with their peers from various financial organizations on various topics of current concern to the banking industry, including: how digitalization and sustainability trends are changing the banking financial landscapes worldwide, global economic outlook, financial inclusion, and the digital financial ecosystem.

He called on the delegates to take full advantage of this opportunity to think how they can move forward to promote a more inclusive banking by using digital technology. However, Mr. Veloso pointed out that there are still so much more questions to tackle. “For example, in the Philippines, we found out that a sizeable percentage still prefer passbooks because it helps them save. How do we convert these individuals into making their mobiles their preferred banking device? Better yet, how do we integrate new-age technology, and sustainable financing down to the personal level so even the ordinary citizen can feel its benefits?”

He further noted that “the rise of financial technology has threatened the very fabric of our industry. Should we see them as rivals aiming to cannibalize the banks, or do we see them as potential partners who can reach a far greater audience?” Mr. Veloso encouraged everyone to actively participate and collaborate in order to learn from each other and design substantial solutions.

“I trust that this conference will help us strengthen our relationships, increase our knowledge, stimulate ideas, and reinforce our commitment to create a brighter tomorrow for the Asia and the Pacific banking industry” he concluded.

5. ABA Chairman Mr. Jonathan Alles in his Opening Statement said that the ABA Conference in Manila was being held at a time of profound and complex changes in the economic and financial landscape. World economic growth has remained in the positive territory, yet it has been weighed down by factors such as sluggish international trade and investment, rising protectionism, and the continuing trade war between major economies such as the US and China.

However, on the other hand, these tensions are prompting Asia-Pacific economies to become closer. Opportunities are also arising from the redirection of trade and production in the global value chain. In addition, the global economy is becoming increasingly digitalised, and some of the emerging technologies have the potential to be truly transformative, even as they pose new challenges.

Amidst these developments, Mr. Alles stressed the importance of business networking to encourage greater interaction among individual bankers and banking sectors in the Asian region will play a very significant role as we go forward. Mr. Alles pointed out that “We all have a shared future just like passengers sitting on the same boat. We therefore need to help each other to address challenges on the basis of consultation and coordination and pursue common development. We need to share our insights, build consensus and contribute to promoting development and prosperity in Asia and the world.”

Amidst these developments, Mr. Alles stressed the importance of business networking to encourage greater interaction among individual bankers and banking sectors in the Asian region will play a very significant role as we go forward. Mr. Alles pointed out that “We all have a shared future just like passengers sitting on the same boat. We therefore need to help each other to address challenges on the basis of consultation and coordination and pursue common development. We need to share our insights, build consensus and contribute to promoting development and prosperity in Asia and the world.”

Chairman Alles stressed the need to jointly break new grounds in innovation-driven development, pointing out that, after years of fairly fast growth, Asian countries now face the challenge of shifting from old drivers of growth to new ones, and must rely on innovation to foster the latter.

III. The Four Plenary Sessions

6. The Conference consisted of four Plenary Sessions that featured eminent speakers from both government and the private sector shared their views and insights on the following timely and relevant topics:

Plenary Session One focused on the topic “Global Economic Outlook: What Lies Ahead for Asian Banks.” Invited experts and panelists shared their valuable perspectives and insights on key factors shaping the global economy in the year ahead, the risks and opportunities offered by these factors, and what their implications are for banks and their business strategies.The speakers included Ms. Priyanka Kishore, Head India and South East Asia Economics, Oxford Economics; and Dr. Le Xia, Chief Economist for Asia, BBVA Research Department. The panelists were Mr. Paul Tang, Chief Economist, Economic Research Department, Strategic Planning and Control Division, The Bank of East Asia Ltd., and Mr. Michael McGauran, Financial Services Strategy Consulting Partner, PricewaterhouseCoopers, Singapore. The session was moderated by Wolfram Hedrich, Partner at Oliver Wyman and Executive Director at Marsh & McLennan Companies Asia Pacific Risk Center.

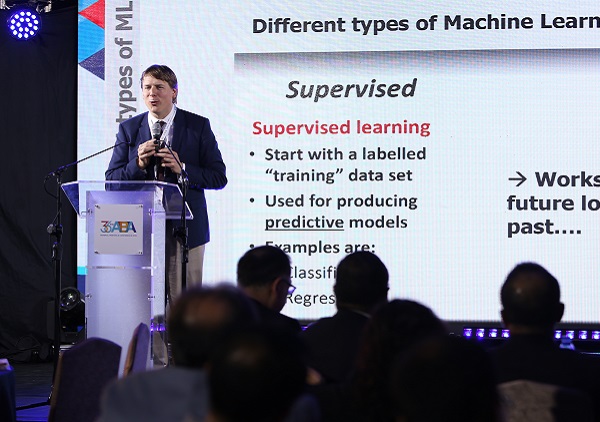

Plenary Session One focused on the topic “Global Economic Outlook: What Lies Ahead for Asian Banks.” Invited experts and panelists shared their valuable perspectives and insights on key factors shaping the global economy in the year ahead, the risks and opportunities offered by these factors, and what their implications are for banks and their business strategies.The speakers included Ms. Priyanka Kishore, Head India and South East Asia Economics, Oxford Economics; and Dr. Le Xia, Chief Economist for Asia, BBVA Research Department. The panelists were Mr. Paul Tang, Chief Economist, Economic Research Department, Strategic Planning and Control Division, The Bank of East Asia Ltd., and Mr. Michael McGauran, Financial Services Strategy Consulting Partner, PricewaterhouseCoopers, Singapore. The session was moderated by Wolfram Hedrich, Partner at Oliver Wyman and Executive Director at Marsh & McLennan Companies Asia Pacific Risk Center.- Plenary Session Two addressed the topic “Financial Inclusion: Banking the MSMEs.” Invited speakers and panelists examined how banks can harness technology for deeper and wider financial inclusion, how governments in the region can put in place legal framework and regulatory mechanisms to facilitate the empowerment of MSMEs, and how banks can initiate more inclusive institutional partnerships to make MSMEs commercially sustainableThe featured speakers were Mr. Isaku Endo, Senior Financial Sector Specialist, Finance, Competitiveness and Innovation, The World Bank; and Dr. Jeremy Sosabowski, CEO and Co-Founder, AlgoDynamix UK. The panelists included: Mr. Eugene S Acevedo, President and CEO, Rizal Commercial Banking Corporation; Ms .Pia Roman-Tayag, Managing Director, Center for Learning and Inclusion Advocacy, Bangko Sentral ng Pilipinas; and Ms. Corazon Conde, Head, Consulting Group, Association of Development Financing Institutions in Asia and the Pacific (ADFIAP). Serving as moderator was John Berry, Special Adviser, EFMA.

- Plenary Session Three focused on “Is Asia Ready to Go Cashless?”. Experts elaborated on their views on the benefits of the rapidly rising Internet and smartphone penetration and their implications for society on one hand, and the costs in terms of the loss of privacy and the risk of fraud of cybercrime, on the other; 4 what governments in the region are doing to enable them to rapidly advance towards the use of electronic cash; and whether Asia is ready to become a truly cashless society in the foreseeable future.The session featured as speakers Mr. Jirayut Srupsrisopa, Co-Founder and Group CEO, Bitkub Capital Group Holdings Co. Ltd; and Mr. James Stickland, President and CEO, Veridium; The panelists included Mr. Shee Tse Koon, Managing Director – Singapore Country Head, DBS Bank; Mr. Rajan S. Narayan, CEO, Cyberbeat Pte. Ltd.; Mr. Paolo Azzola, Chief Operating Officer and Managing Director, PayMaya; and Mr. Frederic Levy, Chief Commercial Officer, GCash. The session was chaired by Mr. Marcus Langston, Regional Head Asia, Euromoney and Asiamoney,

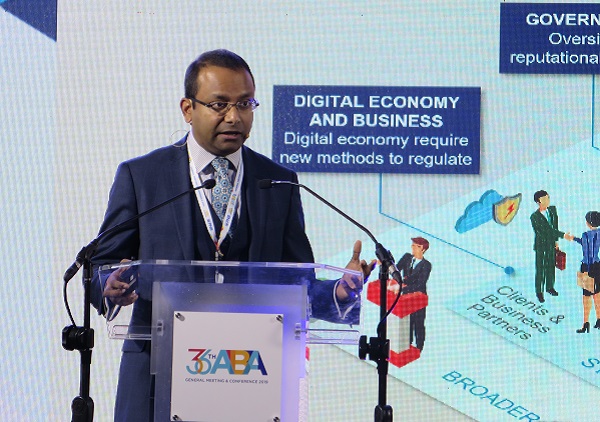

Plenary Session Four addressed the issue on “The Role of Regulator in Developing an Effective Digital Ecosystem”. Representatives from government and the private sector examined various issues resulting from the development of digital banking and how they are currently being addressed by the banking sector and, more importantly, by regulatory and supervisory authorities. The session speakers included Ms. Chuchi Fonacier, Deputy Governor, Financial Supervision Sector, Bangko Sentral ng Pilipinas; Dr. Shahab Javanmardy, CEO, FANAP Holding Company; Mr. Darmashri Kumaratunge, Director of Payments and Settlements, Central Bank of Sri Lanka; and Mr. Subas Roy, Partner, Digital Technology and Operations, and Finance and Risk Practice, Oliver Wyman, and Chair of the International RegTech Association. The session was moderated by Mr. Jonathan Alles, ABA Chairman and Managing Director/CEO of Hatton National Bank.

Plenary Session Four addressed the issue on “The Role of Regulator in Developing an Effective Digital Ecosystem”. Representatives from government and the private sector examined various issues resulting from the development of digital banking and how they are currently being addressed by the banking sector and, more importantly, by regulatory and supervisory authorities. The session speakers included Ms. Chuchi Fonacier, Deputy Governor, Financial Supervision Sector, Bangko Sentral ng Pilipinas; Dr. Shahab Javanmardy, CEO, FANAP Holding Company; Mr. Darmashri Kumaratunge, Director of Payments and Settlements, Central Bank of Sri Lanka; and Mr. Subas Roy, Partner, Digital Technology and Operations, and Finance and Risk Practice, Oliver Wyman, and Chair of the International RegTech Association. The session was moderated by Mr. Jonathan Alles, ABA Chairman and Managing Director/CEO of Hatton National Bank.

IV. Special Sessions: Discover ABA, Host Bank and Special Presentation

7. As in previous years, the two-day event also featured the following sessions:

a. “Discover ABA” session – This session featured presentations by ABA member banks and Knowledge Partners aimed at providing delegates the opportunity to obtain more information on the economy and the financial markets in the countries of the presenting organizations, or on special programs, projects, products or services of the presenting organizations that have benefited their customer base or the community they serve and may be adapted by member banks from other countries. Among the topics covered by the various presenters included: (i) Sustainable Financing (Association of Credit Rating Agencies in Asia); (ii) Financial Inclusion (Bank of Maldives); (iii) Microfinance (Rizal Commercial Banking Corp.); (iv) AML/CFT Compliance (Fintelekt Advisory Services); and (v) Digital Transformation Strategy (CTBC Financial Holding Group)

a. “Discover ABA” session – This session featured presentations by ABA member banks and Knowledge Partners aimed at providing delegates the opportunity to obtain more information on the economy and the financial markets in the countries of the presenting organizations, or on special programs, projects, products or services of the presenting organizations that have benefited their customer base or the community they serve and may be adapted by member banks from other countries. Among the topics covered by the various presenters included: (i) Sustainable Financing (Association of Credit Rating Agencies in Asia); (ii) Financial Inclusion (Bank of Maldives); (iii) Microfinance (Rizal Commercial Banking Corp.); (iv) AML/CFT Compliance (Fintelekt Advisory Services); and (v) Digital Transformation Strategy (CTBC Financial Holding Group)

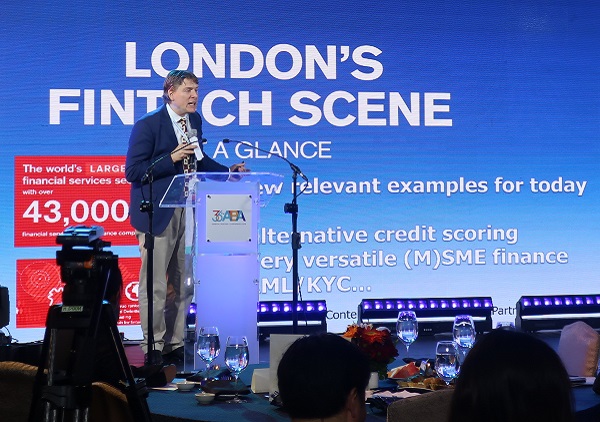

b. Host Bank Session – This session was organized by the host organization Philippine National Bank and featured experts who shared their perspectives on timely and relevant topics including : (i) Digital Innovation: 5 Challenges and Opportunities from the Perspective of a Philippine Bank (Mr. Wick Veloso, President and CEO, Philippine National Bank); (ii) Global Trends in Retail Banking Innovations (Mr. Michael Lor, Senior Advisor, Asia Pacific EFMA); (iii) Digital Distribution (Mr. John Berry, Special Adviser, EFMA); and (iv) Forecasting Risk in Financial Markets Through Artificial Intelligence (Dr. Jeremy Sosabowski, CEO & Co-Founder, AlgoDynamix UK).

c.  Special Presentations Session – This session invited experts who made presentations on: (i) Office of Foreign Assets Control: Essentials for Non- US Financial Institutions (Mr. Nicholas Turner, Registered Foreign Lawyer (New York,USA), Clifford Chance); (ii) Cybercrime and Cybersecurity (Mr. Wolfram Hedrich, Partner at Oliver Wyman and Executive Director at Marsh & McLennan Companies Asia Pacific Risk Center); and (iii) Trade Misinvoicing: Detection and Solutions (Mr. Daniel Neale, GFTrade Specialist).

Special Presentations Session – This session invited experts who made presentations on: (i) Office of Foreign Assets Control: Essentials for Non- US Financial Institutions (Mr. Nicholas Turner, Registered Foreign Lawyer (New York,USA), Clifford Chance); (ii) Cybercrime and Cybersecurity (Mr. Wolfram Hedrich, Partner at Oliver Wyman and Executive Director at Marsh & McLennan Companies Asia Pacific Risk Center); and (iii) Trade Misinvoicing: Detection and Solutions (Mr. Daniel Neale, GFTrade Specialist).

The session also featured a simulated, table-top cyber “war game” that enabled the delegates to discuss among themselves the appropriate steps to take in the event of a cyber attack. The tabletop game was facilitated by Mr. Charles Bretz, Director of Payment Risk, Financial Services Information Sharing and Analysis Center). The whole session was chaired by Ms. Daniela Laurel, Anchor, One News & Bloomberg TV Ph and Finance Professor, PhD., MBS.

V. Policy Advocacy Committee Meeting

8. The ABA also convened a meeting of the ABA Policy Advocacy Committee during which a number of ABA member banks and ABA Knowledge Partners presented papers on various policy issues of current concern to ABA members, including the following:

A paper that considered alternative benchmarks following the non-availability of LIBOR in 2021 and how banks can prepare for it.

A paper that considered alternative benchmarks following the non-availability of LIBOR in 2021 and how banks can prepare for it.

A paper recommending measures that banks and governments in the region can undertake, individually and collectively, to promote blended financing.

A paper on the experiences of financial institutions in South Asia and Southeast Asia in facing the cross-border challenges of AML/CFT compliance requirements.

A paper sharing Hatton National Bank’s experience in achieving digital transformation, and summarizing the results of a survey on the level of preparedness of banks in achieving digital transformation.

A paper sharing the initiatives of the Japanese Bankers Association for sophistication of payment system.

VI. 57th & 58th ABA Board of Directors

9. During its Makati gathering, the ABA also convened the 57th ABA Board of Directors’ Meeting during which they discussed internal policy issues and took action on a number of important matters, including the following:

9. During its Makati gathering, the ABA also convened the 57th ABA Board of Directors’ Meeting during which they discussed internal policy issues and took action on a number of important matters, including the following:

The Board approved the proposed Budget for 2020.

The Board endorsed the various recommendations from the ABA Advisory Council with regard to: (i) membership recruitment programs and policies; (ii) ABA support to be given to member banks that offer to host the annual Conferences; (iii) member banks that are behind in their membership fee payments; and (iv) participation fee for non-member banks attending training programs conducted by the ABA with member banks and knowledge partners.

The Board endorsed the policy papers presented during the meeting of the ABA Policy Advocacy Committee.

The Board formally approved the admission of two new members, namely, Sanima Bank from Nepal as Regular Member and Mitra Innovations from Sri Lanka as Associate Member.

The Board formally approved the holding of the 37th ABA General Meeting and Conference in Sri Lanka in November 2020, with Hatton National Bank as the host organization.

The Board formally approved the holding of the 37th ABA General Meeting and Conference in Sri Lanka in November 2020, with Hatton National Bank as the host organization.

The Board endorsed the preparations being made by Hatton National Bank for the 37th ABA General Meeting and Conference to be held in Negombo, Sri Lanka, and approved the creation of a Planning Committee with the mandate to finalize preparations for the Conference.

The Board approved the Resolution to present a Plaque of Appreciation to the Philippine National Bank for hosting the 36th ABA General Meeting and Conference, for the excellent arrangements for the event, and for its warm and gracious hospitality extended to the ABA members, speakers and panelists, and other delegates and guests.

VII. Gala Dinner

10. During the Gala Dinner, the ABA presented an Award to the best presentation made during the “Discover ABA “ session. The Award was won by Mr. Raymundo Roxas, president of Rizal Microbank, who made a presentation on “RCBC’s Experience in Microfinance.

10. During the Gala Dinner, the ABA presented an Award to the best presentation made during the “Discover ABA “ session. The Award was won by Mr. Raymundo Roxas, president of Rizal Microbank, who made a presentation on “RCBC’s Experience in Microfinance.

The other presenters included six representatives from the Association of Credit Rating Agencies in Asia who spoke on their respective experiences in Sustainable Financing”, Mr. Mohamed Shareef, Deputy CEO of Bank of Maldives (BML) who spoke on BML’s Journey Towards Financial Inclusion; Mr. Shirish Pathak, Managing Director of Fintelekt Financial Services, who spoke on “AML/CFT: What Do Regulators Really Expect from Banks”; and Mr. Titan Chia, Chief Technology Officer, CTBC Financial Holding Group who made a presentation on “CTBC’s Digital Strategy: Creating Value from Digital Transformation.” 15 November 2019 36th ABA General Meeting and Conference Shangri-la Hotel, Makati City, Philippines.