"Asian Banks: Achieving Sustainable Growth in the New Normal"

August 24-27, 2021 - Virtual

Summary of Proceedings

I. Introduction

Some 1,000 representatives from banks, regulatory authorities, multilateral financial organization, the academe, and bank service providers registered for the 37th ABA Conference held virtually on 24-27 August 2021. It was the first annual gathering of the ABA conducted in an online format due to the ongoing COVID-19 pandemic.

Carrying the theme “Asian Banks: Achieving Sustainable Growth in the New Normal”, the four-day online event was designed to provide another valuable platform for ABA members to meet to exchange views with invited speakers on: (a) current trends and developments in the regional and global markets that are expected to have a significant impact on the banking and financial sector of the region, and (b) how industry players can address the challenges – and take full advantage of the opportunities – presented by these developments.

Industry experts and bank regulators were invited to share their views on a number of important topics, including: “Responding to Challenges and Disruptions in a Changing Global Ecosystem,” “The Role of Technology in Sustainable Growth,” “Current Banking Trends and Their Implications on regulatory Policies,” and “Navigating the New World Order.

Conference’s Summary Report can be downloaded HERE.

II. Opening Ceremony (August 24, 2021)

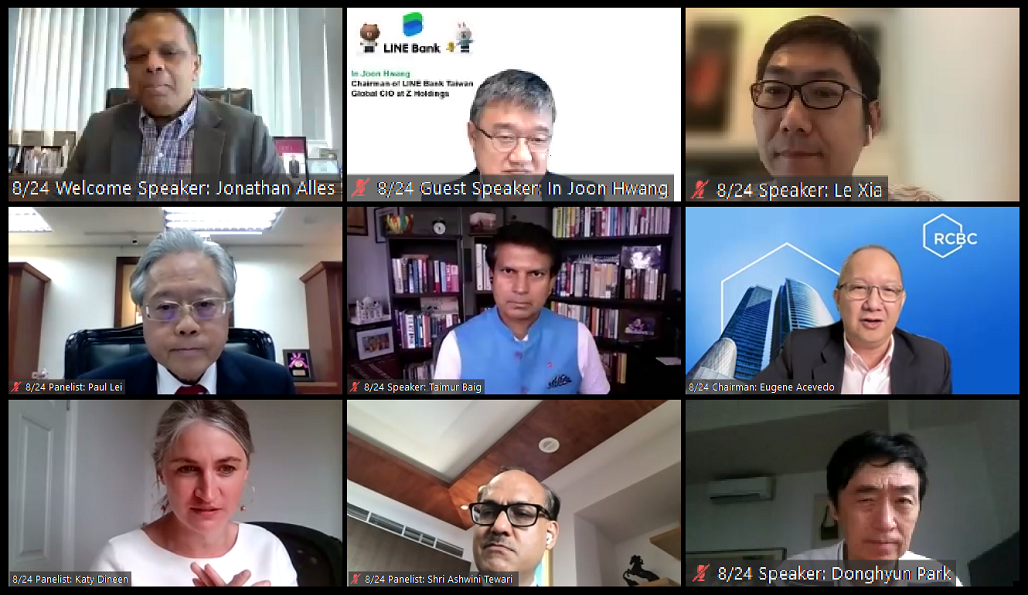

The Opening Ceremony was held on August 24 and featured ABA Chairman Mr. Jonathan Alles, Managing Director and CEO of Hatton National Bank (HNB) from Sri Lanka, who gave the Welcome Remarks, and Mr. In Joon Hwang, Chairman of Line Bank Taiwan, who delivered the Keynote Address.

In his Welcome Remarks, Mr. Alles said that the COVID-19 pandemic is damaging economies across the world, including financial markets and institutions in all possible dimensions, adding that the pandemic could substantially threaten the performance, survival, and growth of banks in developing countries, particularly in those where banks play a dominant role in the economy.

Mr. Alles pointed out that a strong banking sector will be needed for a strong recovery and that banks will need to continue playing a significant role in shaping the recovery and helping their customers rebuild their financial security and business health. This will require banks to refocus on really understanding their customers’ needs, and in parallel, adapting their operating models and ways of working to ensure the best efficiency and resiliency measures that will result in an agile organization, to help them weather the recovery. Providing support to governments and customers is crucial during the crisis, but this will require banks to deploy the tools they have developed since the 2008 financial crisis to lead a coherent, and extensive response to unchartered territory.

However, he said that the ABA will have a role to play in helping its members address the challenges before us, stressing that the importance of business networking to encourage greater interaction among individual bankers and banking sectors in the Asian region will be crucial to enable the banking industry to go forward.

In conclusion, Mr. Alles conveyed his appreciation to the ABA for managing to organize the Conference, along with other meetings, despite the difficult circumstances and challenges brought about by the Covid-19 pandemic, thereby allowing members to stay in contact with each other and share information and experiences to help them survive and recover from the health crisis. He also expressed his hopes that the situation in 2022 would have improved to allow next year’s Conference to be held face-to-face, and to be hosted hopefully by Hatton National Bank in Sri Lanka.

In his Keynote Address, Mr. Hwang shared his ideas and perspectives, based on his company’s experience and best practices, on how technology could help financial intermediaries to reach otherwise distant and diversified markets, particularly during these extraordinary times characterized by global disruptions which call for measures to ensure sustainable business growth. Among others, he cited the increase in digital payments while there has been a decline in bank branches, further noting the growing daily smartphone usage by age group, and the increasing supply and demand for Fintech services. This, he said, has led to the democratization of finance using technology and returning savings to the customers. Mr. Hwang also saw the new normal to be characterized by digital acceleration, User Interface (UI) and User Experience (UX) focus, continued innovation, and going beyond KYC.

III. Session One: “Responding to Challenges and Disruptions in a Changing Global Ecosystem” (August 24, 2021)

Session One, which followed immediately after the Opening Ceremony, focused on the topic “Responding to Challenges and Disruptions in a Changing Global Ecosystem.” Invited economists and experts shared their narratives on the challenges and disruptions brought about by the pandemic on their respective communities, and their efforts to find innovative solutions to adapt in the so-called new normal that has emerged from the pandemic.

The three speakers included Mr. Donghyun Park, Principal Economist, Macroeconomic Research Division, Asian Development Bank; Mr. Taimur Baig, PhD., Managing Director and Chief Economist, DBS Group Research; and Dr. Le Xia, Chief Economist for Asia, BBVA Research Dept. Joining the speakers during the panel discussion were Dr. Paul C. D. Lei, Chairman, Taiwan Cooperative Financial Holding Co. Ltd, and Chairman, Taiwan Cooperative Bank; Shri Ashwini Kumar Tewari, Managing Director (IB, T & S), State Bank of India; and Dr. Katy Dineen, Senior Associate, The Mizen Group and Assistant Lecturer, University College Cork. The session was chaired and moderated by Mr. Eugene Acevedo, President and CEO, Rizal Commercial Banking Corporation from the Philippines.

Before calling on the speakers, Mr. Acevedo first introduced the session by noting that, with the pandemic continuing its devastating impact on global markets, countries around the world are intensely focused on transforming their economic base and preparing for what appears to be a long, tough journey ahead.

In his presentation, Mr. Park analyzed Asia’s short-term economic outlook by sharing the latest economic trends of major countries, and indicated that in a still uncertain environment, risks remain tilted to the downside.

Dr. Baig, on the other hand, shared the DBS’s macro insights on pandemic’s costs and remedies. Considering the loss of output, rise in public debt, and the private sector’s balance sheet due to the impacts caused by the pandemic, he suggested that banks should take remedies, such as re-energising multilateralism; embracing regional pacts, supply chains, and tech platforms; and enhancing public sector transfers and spending on growth-critical areas with technology, among others.

Dr. Xia discussed the challenges facing the Asia-Pacific region amid the China-US tension. Stressing the fact that the China-US trade war has put Asian economies in a straitjacket, Dr. Xia looked into the strategies that both sides may implement in the future to develop their “compete not conflict” relationship, adding that how well the two countries handle their domestic affairs will play an important role in their performance in the bilateral competition.

Dr. Xia discussed the challenges facing the Asia-Pacific region amid the China-US tension. Stressing the fact that the China-US trade war has put Asian economies in a straitjacket, Dr. Xia looked into the strategies that both sides may implement in the future to develop their “compete not conflict” relationship, adding that how well the two countries handle their domestic affairs will play an important role in their performance in the bilateral competition.

During the panel discussion, Shri Tewari elaborated on the policies and measures that the Indian Government and financial regulator have adopted to mitigate the pandemic, including provision of free food grains for the below poverty line people, a six-month loan moratorium for businesses to recoup and providing liquidity support to select sectors, among others. In addition, the SBI also supported the government’s efforts by funding vaccinations of its employees, their families and other contractual people.

In the case of Taiwan, Dr. Lei introduced the regulatory measures that Taiwanese government put in place to encourage domestic banks to participate in various relief policies during the pandemic, as well as a Co-Inspiring Camp that Taiwan Cooperative Bank had established since 2018. Hosted personally by Dr. Lei, the Camp aims to conduct talent trainings and inspire creative thinking within the Bank, and it attracts the participation of some 400 employees and 500 to 600 creative proposals annually.

From an academic point of view, Dr. Dineen focused on the issues of trust and culture, such as the role of trust playing in driving the ‘downside tilt’ of risk perceptions and the role of trust between regulators and banks as well as customers and banks. Dr. Dineen also shared her work with Mizen and explained how culture within banks can facilitate appropriate conduct among employees.

From an academic point of view, Dr. Dineen focused on the issues of trust and culture, such as the role of trust playing in driving the ‘downside tilt’ of risk perceptions and the role of trust between regulators and banks as well as customers and banks. Dr. Dineen also shared her work with Mizen and explained how culture within banks can facilitate appropriate conduct among employees.

The three presentations of Session 1 can be downloaded HERE.

The video of the first day (Opening Remarks, Guest Speaker, Session 1) can be viewed here.

IV. Session Two: “The Role of Technology in Sustainable Growth” (August 25, 2021)

Focusing on the topic “The Role of Technology in Sustainable Growth,” Session Two featured speakers and panelists who pointed out that the emergence of new technologies has presented opportunities to make banking more innovative, more efficient, more inclusive, less costly, more supportive of small business, and more responsive to the changing needs of customers. They provided their views and perspectives on how technology enables sophisticated product development, better market infrastructure, implementation of reliable techniques for control of risks, and helps the financial intermediaries reach geographically distant and diversified markets.

The speakers included Mr. Ruchin Goyal, Senior Partner, Financial Institutions Practice, India and South Asia, Boston Consulting Group; Mr. Michael Araneta, Head of Advisory and Research, IDC Financial Insights; and Mr. Michael Lor, Senior Adviser, Asia Pacific, EFMA. The panelists who joined the three speakers during the panel discussion following their presentations were Mr. Neeraj Maskara, Partner, Technology Consulting Practice, Ernst & Young Advisory Pte. Ltd.; and Ms. Louise Vogler, Managing Director, Global Head of Banks and Broker Dealers Corporate, Commercial and Institutional Banking Client Coverage, Standard Chartered Bank. Chairing the session was Mr. Oliver Hoffmann, Managing Director, Head of Asia, Erste Group Bank.

a. Brief Introduction by Session Chairman Oliver Hoffmann

Session Two Chairman Oliver Hoffmann of Erste Group Bank talked about the role technology has played over the span of his own banking career. When he started his apprenticeship in Deutsche Bank in 1987, he remembered that using printed sheets and bulky table calculators on which they keyed in the numbers. At that time, very few people owned mobile phones, used telex machines instead of emails, and social media was nonexistent. He said that if we think about where technology has led us in over the 30 years since, if feels like an altogether different planet. The question, he notes, is where it will take us from here and how technology will continue to sustain growth.

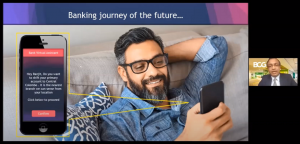

b. Presentation by Ruchin Goyal on the Banking Journey of the Future

According to Ruchin Goyal of Boston Consulting Group (BCG), banks have come a long way in the last many decades in terms of user technology. However, we have merely scratched the surface, and not only will there be more change, it will also come much faster.

According to Ruchin Goyal of Boston Consulting Group (BCG), banks have come a long way in the last many decades in terms of user technology. However, we have merely scratched the surface, and not only will there be more change, it will also come much faster.

In imagining what banking could be like in the future, Mr. Goyal says that taking a loan could be as easy as asking Alexa to play a song; changing personal details may become as easy as changing a profile on Facebook; and recommending products and offers are personalized for each individual, just like recommendations on Netflix.

To further illustrate this banking of the future, Mr. Goyal presented a sample user journey, noting that banking ultimately needs to address real user needs in people’s day-to-day lives. In this journey, user “Ranjit” from Colombo has his bank app proactively suggest shifting his primary account to the branch nearest the home he just moved into. Via Amazon Alexa, Ranjit is able to know his bank balance, pay his credit card bills by using voice biometrics and a password to authenticate, enable travel insurance, and activate international transactions on his bank card.

According to Mr. Goyal, underlying all these different user journeys are three pillars that traditional banks can use to enable these kinds of user experiences for their customers:

End-to-end digitization (E2E) – In the new world, it is less about what products banks can offer and sell to customers, and more about the customer journey. As the banking service is an integral part of a real-life user journey, E2E involves reimagining such journeys from scratch, and viewing them from two critical lenses: Internal E2E digital processes and external user experiences.

Data and Analytics at scale – Banks around the world are sitting on loads of data. Only about 34% of all data available to banks is used, 21% is not collected, and 33% is unused. In many markets around the world, fintechs are rising and getting huge valuations, due to investors believing that they are able to monetize data better than traditional banks. In reality, fintechs don’t have the same richness of data that banks do. Banks are able to get the best customer data possible because all transactions are routed through a bank. So, if they were to unlock the power of this data, they can create a huge amount of value both for themselves and their customers. To be able to do this, the banks need three critical things:

a. Outcomes (use cases)

b. Technology (data, digital platforms, tools)

c. Human (processes, capabilities, ways of working)

Personalization and digital sales – Personalization is a fundamental rethinking of customer interaction. As an example, Netflix’s personalization engine not only prioritizes the best content for a user to watch, but also shows the most relevant image that will make them choose the show. Traditional banks, by comparison, tend to do only basic segmentation — mass market, emerging market, affluent, private banking. Some are moving to personas beyond income, taking into consideration factors such as age or life-stage. But hyper personalization, as in Netflix, needs to be a segment of one where every customer is different. They are not merely defined by their age and income, but by their personal needs and behavior. Campaigns with this level of personalization are nearly unique at the customer level, with personalized messaging, creative and timing sent through relevant channels. This is all possible through the use of data.

Many technologies that already exist today can enable such user journeys. These include:

a. Intelligence (Artificial intelligence)- Intelligent predictive for efficient decision making

b. Security (tokenization)- secure transaction and authorization

c. Open ecosystems (APIs/micro services)- Access to open ecosystems of developers

d. Transfer mechanisms (Blockchain)- Applications for currency, cross-border and smart contracts

e. Smart processing (Robotics automation)- Artificial intelligence and automation in low value-added processes

f. Connectivity (Internet of Things)- Connected objects allow FIs to interact with them and their users

These technologies are maturing at a very fast pace, with the challenge being how to make use of these in the banking context to be able to provide delightful experiences for the customer. However, how banks can make it happen is not merely down to technology. It comes down to a simple framework of “head, heart, and hands”:

- Head – Envision the future and align on the big rocks. Define organizational agendas with a focus on people and make a human-centered case for change

- Heart — Inspire and empower your organization by doubling down on activating purpose and empowering culture in your people

- Hands — Execute and innovate with agility through reinventing ways of working and upskilling to build capabilities

c. Presentation by Michael Lor on Digital-first SME banking

According to Michael Lor of EFMA, the COVID-19 pandemic has caused a significant shift in the way we interact today, and even more so in the interactions between customers and their financial services providers. For many years, financial service providers have looked to digital innovation for personal customers, with innovative mobile apps and payment conveniences. However, digital readiness for the SME segment has generally been lackluster.

According to Michael Lor of EFMA, the COVID-19 pandemic has caused a significant shift in the way we interact today, and even more so in the interactions between customers and their financial services providers. For many years, financial service providers have looked to digital innovation for personal customers, with innovative mobile apps and payment conveniences. However, digital readiness for the SME segment has generally been lackluster.

During the pre-COVID era, SMEs were already experiencing many pain points, primarily related to the digital readiness of their banks and financial service providers. Specifically, SMEs did not really want to have to meet their bankers, but banks were not ready for this at the time. Now, with COVID, even fewer are inclined to visit the branches, which has made things more difficult for many banks and their SME customers.

SME banking is on the edge of a fundamental change, revealing the need for transformation. It is no longer just about providing financial services, but also non-financial and advisory solutions for SMEs. The winning models represent market positioning around being an integrated solution partner for SMEs and helping SMEs in their digitization.

This value position has certain enablers and in the new era the following will be the area of differentiation in SME banking:

a. Fintech collaboration with open banking

b. Cultivation of data

c. Adoption of changing needs and behaviors of SMEs

d. Recruiting design and technology-oriented profiles

e. More focus on artificial intelligence

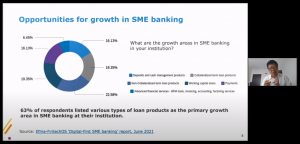

Transformative trends in retail banking are also shaping SME banking. Customers expect on-demand, digital offerings that can help manage every aspect of their business. In the Efma-FintechOS “Digital-first SME banking” report released in June 2021, 40 senior SME bankers across the globe were polled to gain a better understanding of the challenges they are facing and what is working best.

Ready and accessible financing underpins SME success. Securing a loan at the right time can be a key accelerator in the SME life cycle, which is why 63% of respondents listed various types of loan products as the primary growth area in SME banking at their institution. The nature of SMEs, however, often means a minimal credit history that leaves bankers with the never-ending problem of determining who is worthy of a loan. Banks everywhere are sitting on troves of data. The challenge is to tap into that data and provide the right loans at the right moment for their customers, providing a catalyst for growth.

As for competition, bankers see the most pressure coming from fintechs. By a considerable margin (60%), they listed payments as the area in which they see the most competition from fintechs. Payments is a space in which many successful fintechs have gotten their start. Immediate, simple, on-demand payments are quickly becoming the norm in both the retail and SME banking sectors. Banks who can’t provide straightforward and fast payments to their SME customers risk losing them to a fintech who can.

Digitalizing for the SME segment is more complicated, since their needs are much more varied and diverse. Banks’ lack of speed and attention towards the digitalization of the SME segment has created a gap for customers, which fintech providers have used to encroach in aggressively. The solution is partnering to meet the ever-evolving SMEs’ needs. Banks need to capitalize on their strengths, such as data, trust, strong capital and funding for credit, and match these with digital solution providers to deliver the tools businesses need to scale and grow:

- Bank + fintechs

- Bank + payment providers

- Banks + banks

- Banks + big techs

Examples of such partnerships include Dutch bank ABN AMRO working with digital SME funding platform News 10, WhatsApp-based payment channel Tikkie Zakelijk, and online support platform Doorpakken; Russia’s Bank Otkritie working with Singapore-based fintech TAIGER to provide a seamless payment solution; Mastercard teaming up with learning app vCita; UK-based Nationwide investing in business banking technology provider BankiFi; and the Square Banking suite of financial tools for SMEs.

d. Presentation by Michael Araneta on the Big Areas of Tech Investments and its Implications

Mr. Michael Araneta talked about how his organization, IDC Financial Insights, looked at the drivers for IT and technology-related spending for financial services. The research he presented is a conglomeration of several initiatives to understand why we are spending on technology, what we are spending on, and what the implications are for banks as that spending continues.

Mr. Michael Araneta talked about how his organization, IDC Financial Insights, looked at the drivers for IT and technology-related spending for financial services. The research he presented is a conglomeration of several initiatives to understand why we are spending on technology, what we are spending on, and what the implications are for banks as that spending continues.

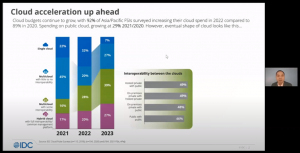

Mr. Araneta said that the biggest technology spending area of note for 2021 to 2022 is cloud. According to IDC Pulse Cloud Surveys, cloud budgets continue to grow, with 92% of the surveyed Asia Pacific financial service institutions (FSIs) increasing their cloud spend in 2022, compared to 89% in 2020. Public cloud spending is growing at 29%, which is the highest it has ever seen, and the highest in terms of growth. Perhaps the biggest driver for FSI spending on cloud is access to innovation — it is about the ability of the cloud to support scale and its reliability in supporting the growth in digital transactions.

Additionally, there is a big inflection point in the types of cloud being used. Looking at projections for 2023, single cloud usage is only 7%, multicloud with little to no interoperability is 27%, multicloud with some interoperability is 39%, and hybrid cloud with full interoperability is 27%. This emphasizes that the future of clouds is greater openness to the use of cloud service providers, instead of being beholden to one or two companies, multiple cloud service providers and their propositions. Applications would need to work in different environments and be able to shift from one cloud to the next with great interoperability and seamless capability.

Another area that is important to discuss is open banking, particularly its resurgence or reacceleration. Despite the COVID-19 pandemic forcing focus on stability and bearing the brunt of its resulting downcycle, open banking is slowly and steadily coming up in a big way. Markets as diverse as Hong Kong, South Korea, Taiwan, Philippines are revisiting open banking.

Open banking is significant because it breaks down the traditional notions of banking, providing 1) greater openness to collaborate, 2) platforms for data monetization, and 3) frictionless financial services. These underscore how open banking is not just a regulatory-led initiative, but is a transformational initiative for many organizations and the industry at large. Spending associated with open banking includes API and API management, security, collaboration platform, alternative data, and data management.

The ultimate theme that drives technology spending for 2021 and in the leadup to 2022 is ensuring stable, reliable, and resilient financial services. An intensification of trends seen in 2020 that shows progress in 2021, is financial services that simply deliver, which then has implications on other areas of technology spending such as: security, uptime, BCP, fraud management, and risk analytics.

Ultimately, this leads us to understand that all this spending on technology is being done, first, to ensure the prevention of all adverse scenarios, whether these may be related to security, availability, reliability, and compliance. Equally important is the need for consistency of views, operations, and data across various environments – whatever environment that is. Last is the ability of institutions to have visibility of what is happening through greater use of intelligence, and transparency of response.

In conclusion, and to recap: technology spending has never been more unique, especially from the perspective of growth despite an economic downcycle. The three big trends actually portray financial services and banking as changing for good: One involves choice, with many institutions opting for the open cloud framework, where the choices of cloud environment will be based on the type of banks and initiatives that are being pursued. The second involves greater openness and collaboration in open banking, while the third is the pursuit of stability and reliability. These three trends, ultimately, are how we are changing as an industry.

e. Panel Discussion — Louise Vogler

Q: What role would you attribute to technology/digitization in making financial products and services more accessible, particularly for SME’s and in emerging economies?

Q: What role would you attribute to technology/digitization in making financial products and services more accessible, particularly for SME’s and in emerging economies?

From our perspective as a banking practitioner in this market, there are four areas where we see tech driving change and benefitting access to financial services for SMEs:

- Development of new products and services

- New and innovative market infrastructure (i.e., blockchain for payment processing)

- Risk management (i.e., using data and AI in assessing credit)

- Client access (i.e., onboarding)

Of those areas, two that are really interesting for SMEs is improving the ability to onboard SME clients and accelerating the ability to approve credit and finance. Particularly with regard to SMEs and microenterprises in emerging markets, banks’ access to data, and the accessibility and transparency of such data is, historically, not good. Being able to use tech to help banks make better quality decisions, therefore, is a benefit for SMEs in the region. Additionally, technology is also able to reduce the costs of onboarding and client maintenance through automation and algorithmic driven solutions.

As an example, Standard Chartered in India launched SOLV, a closed-loop B2B e-commerce platform that is an integrated commercial and credit working capital finance marketplace. SOLV brings together small retailers with domestic suppliers in India, along with logistic providers and participating banks and financial services providers. This platform reflects the positive impact of technology in three ways:

1. It helps accelerate speed of onboarding and activating of platform participants

2. Through the platform, data visibility improves and financing decisions from the financial service providers is quicker

3. More efficient inventory management due to data visibility reduces the end-to-end costs of domestic trade transactions.

In summary, technology acts as a really powerful enabler and makes it easier for under-serviced or under-banked companies in emerging markets to access the financial services that they need.

Q: Standard Chartered has partnered with a number of fintechs, mostly in the financing and payments area. Can you share with us some examples? Based on your actual experience, what are the key points to look out for to make a partnership between a large established bank and a (mostly) much smaller new fintech company successful?

For a successful partnership between a big, well-established institution like a bank and an innovative fintech, it’s important to take note of two things: the goals and the process.

With fintechs that are typically fast-moving and innovative, there is a need to keep things as simple as possible. But in large banks like Standard Chartered, there needs to be a balance between preserving the integrity of risk processes (i.e., financial crime compliance requirements and AML sanctions), as well as being quick to market and speed and making sure things are kept simple. So, for the process side, it is important to make sure from the outset that there is an alignment, particularly with the risk control philosophy to avoid a mismatch in expectations. Banks, especially established ones, tend to play an important positive role in their fintech partners in educating around global financial crime prerogatives, which is ultimately a win-win for the overall integrity of the global payment systems.

With regard to goals, it is crucial that both sides agree on the key goals of the partnership upfront, prior to designing a proof of concept. It’s also important to design key metrics that parties can jointly agree on, to have a measure what success looks like.

Some other examples of Standard Chartered’s partnerships with fintechs in the region include:

Collaboration with Sunrate Solutions in China to support Chinese importers in making outward payments to overseas suppliers using a one-stop intelligent payment solution.

Partnership with Linklogis in Guangdong province for a deep-tier supply chain financing solution using blockchain technology and leveraging on the Digital Guangdong platform.

Partnership with Indonesian e-commerce giant Bukalapak to offer digital banking services to be hosted on Nexus, Standard Chartered’ s banking-as-a-service platform

Collaboration with China’s Ant group on Trusple platform which is digital cross-border trade and trade finance platform using AntChain, Ant Group’s blockchain-based technology solution

f. Panel Discussion — Neeraj Maskara

Q: Given the increasing role of new or emerging technologies for growth in banking, which ones would you see as the most important ones – or potentially the most successful ones?

Q: Given the increasing role of new or emerging technologies for growth in banking, which ones would you see as the most important ones – or potentially the most successful ones?

There are three different agendas or lenses through which to look at these emerging technologies:

The growth agenda is primarily driven by the goal of elevating and differentiating customer experience for financial institutions. An example of a common priority among banks is seamless digital onboarding. Newer areas include password less authentication, such as the use of biometrics to replace usernames and passwords. Conversational banking is another topic that is becoming more prevalent. Essentially, this involves servicing clients where they prefer to communicate and transact, from acquisition to onboarding to advisory to execution — the issue being, how do banks take that entire experience to WhatsApp, WeChat, or any other preferred platform to provide the most seamless banking experience. Hyper personalization is another ever-prominent theme that is going to affect the top and bottom line as well as customer retention probability for most banks. Additionally, there is a lot of focus on digital assets as an important product line and offering to include for banks, sustainable investments, and financing.

The protect agenda can best be exemplified by three themes: a) Fincrime is ever-rising and a necessary battle that most banks will continue to fight; b) Cybersecurity cannot be understated, and is becoming front and center on the agenda; and c) aspirational themes such as compliance automation and outsourcing, and looking at compliance by design from first to third line of defenses.

The future-proofing agenda includes themes such as cloud adoption, moving to microservices architecture and to low-code based applications for faster time to market, as well as embracing those practices more than technologies to be able to compete and thrive in the marketplace.

In sum, there is a myriad of solutions and choices available, and prioritization and alignment to the business is key in terms of rationalizing and defining the strategy, the roadmap, operating model, and most importantly, ensuring a very de-risked execution.

Q: Specifically for Asian banks, how can they make best use of technologies like blockchain and 5G to serve their clients?

With 5G, the fundamental opportunity is mainly to move the data faster, with higher capacity and greater bandwidth. Particularly for edge computing and near band communications, this presents a revolutionary advantage on how data can be transferred from point-to-point and in real time.

Blockchain, on the other hand, is fundamentally a platform that allows a decentralized, immutable, secure, and transparent ledger of records. This provides an opportunity to lower the cost of reliably managing and reconciling records, for example, and potentially reducing the cost of service for various traditional practices.

Many financial institutions in Asia are looking at these new emerging technologies cautiously and keeping them at arm’s length. But a few are incubating innovative use cases and starting to put it as a major area of focus in their technology and innovation roadmap. Though still in the early stages of this transformation, there are some compelling opportunities to apply these tech developments, one of which is the opportunity to serve the underserved and underbanked.

In Asia, perhaps more than in any other region, there is still a large percentage of potential target customers, whether on the SME or consumer side. The use of technologies like 5G can open up opportunities such as remote ATMs, remote POS systems, digital payments as a norm, cashless payments from farm to market, and many more.

With blockchain, things like deep tier supply chain finance, digital onboarding, or eKYC verifications start becoming really important. Products for digital assets and sustainable investments and lending are also important areas for the application of blockchain technologies, being the fundamental architecture for digital assets. Edge processing is yet another area where we will start seeing 5G and blockchain really coming to life, with ultra-high-speed transaction payment and processing. Additionally, there are opportunities to use technologies like AR and VR for remote client service or virtual tellers, which will require a faster broadband and larger data package to be transferred via 5G to be successful.

Q&A Session

Q: Michael Araneta mentioned how the choice of partners is a key factor for success — how can the banking industry be assured that the fintechs, cloud providers adhere to acceptable standards?

Q: Michael Araneta mentioned how the choice of partners is a key factor for success — how can the banking industry be assured that the fintechs, cloud providers adhere to acceptable standards?

Michael Araneta: Many of the standards that we need for open banking, collaboration, or even cloud have already been set cross-industry. In terms of the use of these technologies, they have also been defined at the industry level. The standards are pretty much robust and can be used readily by institutions. What we would like to encourage, however, is that the banks maintain some form of governance around how these standards are used and whether the partners that we are inviting to participate in our growing ecosystem adhere to those standards.

Q: The Banking Journey of the Future which you described in your presentation sounds fascinating – but will it be a dream for customers and a nightmare for (traditional) bankers? Will we all be replaced by AI and IT experts?

Q: The Banking Journey of the Future which you described in your presentation sounds fascinating – but will it be a dream for customers and a nightmare for (traditional) bankers? Will we all be replaced by AI and IT experts?

Ruchin Goyal: I think the short answer is no —not all will be replaced; the bankers certainly will not be replaced by robots. But will there be more need for robots, robotic process automation, AI, advanced technologies — absolutely yes. As far as a need for different skills, there is a huge amount of talent out in the market. The banks need to figure out why the best talent, in terms of the advanced technologies, should join them, given the many options. They need to make it an attractive value proposition. With regards to traditional bankers: they will still be required, but they need to upskill and understand a little bit of technology. This is because they are important to make sure the technology that is coming in can be tailored and customized to solve the real banking needs of customers. To sum, the type of people that will be required, in terms of skills, will be different, but it will still require people. Banking is a very people-centric business — I don’t think that will change in the short term.

Q: You showed a number of international banks successfully partnering with fintechs and other providers. Do you have an example of a bank in Asia doing the digital SME offer really well?

Q: You showed a number of international banks successfully partnering with fintechs and other providers. Do you have an example of a bank in Asia doing the digital SME offer really well?

Michael Lor: We have banks like Alliance Bank in Malaysia, they have their BizSmart SME Solution. BCA has also worked and collaborated with a lot of fintech. Union Bank in the Philippines has also worked tremendously with a lot of fintechs, as has DBS. Somehow, you will see that in this region, there are some banks that are a little bit more progressive and have started to do a lot of these things with partners now. Yet there are also still a lot of banks today that are wondering, “what happened?” For those who are members of EFMA and interested in even more examples, the online portal does contain a lot of case studies detailing these collaborations and how they went on.

The three presentations of Session 2 can be downloaded HERE..

The video of Session 2 can be viewed here.

Session Three: “Current Banking Trends and Their Implications on Regulatory Policies” (August 26, 2021)

The Session Three featured government regulators and other experts who addressed the topic “Current Banking Trends and Their Implications on Regulatory Policies” The speakers and panelists expounded on their efforts in reviewing their own supervisory processes and reinforcing the core bank supervisory pillars of governance, risk management, capital adequacy and planning, liquidity management, and compliance with laws and regulations in response to the rapid changes in the banking and finance industry, and what their impact is on the industry in the years ahead.

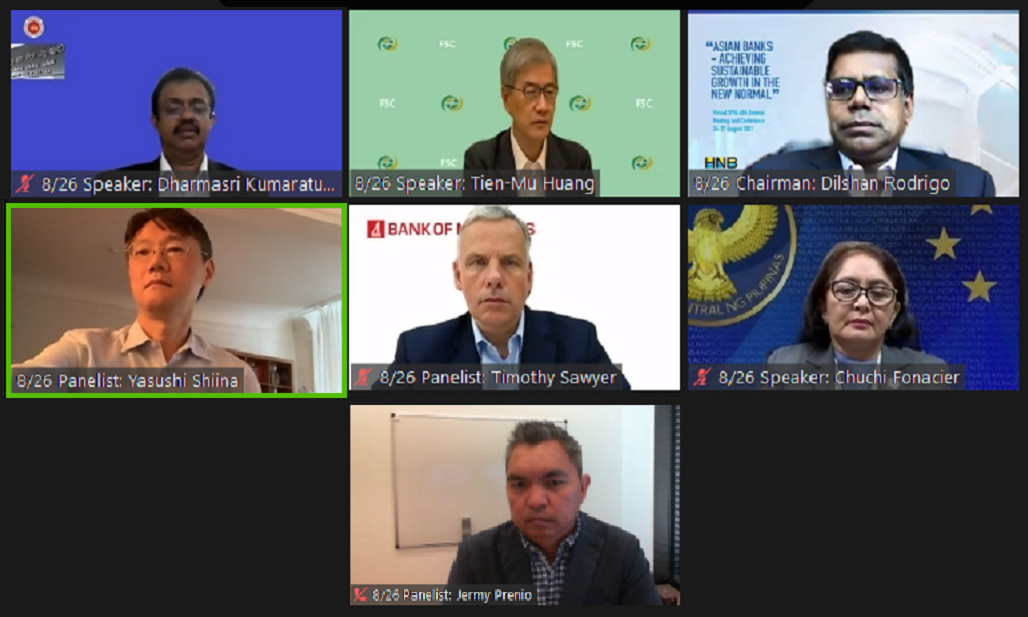

The regulators who made presentations during the session included Dr. Tien-Mu Huang, Chairperson, Financial Supervisory Commission, Republic of China (Taiwan); Ms. Chuchi Fonacier, Deputy Governor, Financial Supervision Sector, Bangko Sentral ng Pilipinas; and Mr. Dharmasri Kumaratunge, Director, Payments and Settlements, Central Bank of Sri Lanka. Joining them during the panel discussion that followed their presentations were Mr. Timothy Sawyer, CEO, Bank of Maldives; Mr. Yasushi Shiina, Senior Representative from the Financial Stability Board; and Mr. Jermy Prenio, Senior Advisor, Financial Stability Institute, Bank for International Settlements. The discussions were chaired and moderated by Mr. Dilshan Rodrigo, Chief Operating Officer, Hatton National Bank.

Dr. Tien-Mu Huang’s presentation focused on building a more resilient, innovative, sustainable and inclusive financial system in Taiwan, and the global issues for regulators on low interests’ environment, demographic shift, the impact of climate change, fintech innovation after the coronavirus pandemic.

Ms. Chuchi Fonacier’s presentation focused on the Philippine Central Bank’s view on the rapid changes in the banking industry. Ms. Fonacier highlighted four important aspects and experience in the industry, 1) the swift actions, taken by BSP to assist banks and clients to deal with the unforeseen pandemic, 2) a snapshot of how banks have weathered the pandemic, 3) the key strategic reform areas of BSP specifically on risk governance, supervisory approaches, digital innovations and sustainability principles, and 4) other initiatives in the Philippines.

Ms. Chuchi Fonacier’s presentation focused on the Philippine Central Bank’s view on the rapid changes in the banking industry. Ms. Fonacier highlighted four important aspects and experience in the industry, 1) the swift actions, taken by BSP to assist banks and clients to deal with the unforeseen pandemic, 2) a snapshot of how banks have weathered the pandemic, 3) the key strategic reform areas of BSP specifically on risk governance, supervisory approaches, digital innovations and sustainability principles, and 4) other initiatives in the Philippines.

Mr. Dharmasri Kumaratunge’s presentation focused on Current Banking and their Implications and Regulatory policies in Sri Lanka, and how has health and stability of the banking sector been affected by the ongoing COVID-19 pandemic in 2020 and 2021. Mr. Kumaratunge also mentioned that Payments Value Chains have been linking with FinTech and other sectors in Sri Lanka, and that more banking and non-banking sectors are more focused on Blockchain and AI technology now.

During the panel discussion, Session Chairman Mr. Rodrigo asked Mr. Timothy Sawyer, CEO of Bank of Maldives, on the extent to which regulators in the Maldives has been consistent with the approaches mentioned and how has this impacted the Bank’s embracing digital and managing climate change, which is important for a small island nation like Maldives. Mr. Sawyer replied that while COVID has been the major focus in the last year or so, Bank of Maldives and the regulators have been also been tackling the issue of diversity and inclusion, and increasingly on climate change challenges.

During the panel discussion, Session Chairman Mr. Rodrigo asked Mr. Timothy Sawyer, CEO of Bank of Maldives, on the extent to which regulators in the Maldives has been consistent with the approaches mentioned and how has this impacted the Bank’s embracing digital and managing climate change, which is important for a small island nation like Maldives. Mr. Sawyer replied that while COVID has been the major focus in the last year or so, Bank of Maldives and the regulators have been also been tackling the issue of diversity and inclusion, and increasingly on climate change challenges.

Mr. Jermy Prenio identified the regulatory issues which he thinks would have greater implications for banks worldwide. He noted that the common themes cited by the three speakers were innovation in the financial system, the use of AI and cyber security, climate risks, financial inclusion, and the continuing impact of COVID-19 pandemic. Among these, he cited climate risk and the use of AI and their impact on banks as being important going forward. In terms of climate risk, supervisory authorities are increasingly taking action to require financial institutions to be prepared for its potential impact, particularly on how banks do their business and how they will be supervised in the future.

Mr. Yasushi Shiina addressed the question on whether the FSB’s global financial regulatory reforms, including Basel 3, and G-SIBS (high quality accounting standards, and provisioning practices), are aligned with the expectations on the bank’s role in supporting the economy? Mr. Shiina stressed that a sound banking system is a precondition for sustainable economic growth and the resilience of the entire financial system. The said that the FSB has been enhancing and strengthening the resilience of financial institutions including banks and the financial system as a whole. The regulatory reform will not only help strengthen banks’ resilience but also support the economy.

Mr. Yasushi Shiina addressed the question on whether the FSB’s global financial regulatory reforms, including Basel 3, and G-SIBS (high quality accounting standards, and provisioning practices), are aligned with the expectations on the bank’s role in supporting the economy? Mr. Shiina stressed that a sound banking system is a precondition for sustainable economic growth and the resilience of the entire financial system. The said that the FSB has been enhancing and strengthening the resilience of financial institutions including banks and the financial system as a whole. The regulatory reform will not only help strengthen banks’ resilience but also support the economy.

In conclusion, chairman Mr. Rodrigo cited a few key takeaways from the session, including: (a) the importance of collaborating between regulators better and ensuring that they learn from each other to implement some of the initiatives for respective countries; (b) given the financial landscape and the constant changing and increasing demand of supervisory mandate, there is a need to continuously train, educate and upgrade the skills of the officers and staff to remain competent and prepared; and (c) it is important for financial regulators and bankers to coordinate and communicate with each other on policies to address emerging challenges and take advantage of opportunities..

The three presentations of Session 3 can be downloaded HERE.

The video of Session 3 can be viewed here.

Session Four: “Navigating the New World Order” (August 27, 2021)

The Session Four was a CEO Roundtable on “Navigating the New World Order”. It featured CEOs and other high-level experts who shared their experiences and views on their efforts to reinvent their organizations in order to mitigate the impact of global disruptions, such as the Covid-19 pandemic, and ensuring sustainable growth, by creating innovative solutions through the use of new business models, new pricing structures, greater outsourcing, investment in and new approaches to using technology, and more effective uses of data, among others.

The panelists included Mr. Jonathan Alles, Managing Director/CEO, Hatton National Bank Mr. Wick Veloso, President & CEO, Philippine National Bank; Dr. Nasir Salari, Senior Lecturer and Course Leader, Bath Spa University; Mr. Teodor Blidarus, CEO and Co-Founder, FintechOS; and Ms. Chih Shan Luo, Director, FinTech Space. The panel discussion was moderated by Mr. Wolfram Hedrich, Partner, Financial Services Advisory, Ernst & Young.

In his Opening Remarks, Mr. Hedrich pointed out that whenever a crisis hits, it is of paramount importance to be able to evaluate potential financial outcomes and posit the appropriate management actions to dampen the downside consequences and assure resilience of the company. However, when Covid-19 began in early 2020, most banks struggled to execute coherent responses to downside risks, resulting in heightened market uncertainty due to delayed management responses to the pandemic.

To kick off the panel discussion, Mr. Hedrich asked the panelists to reflect on the past year and a half and the lessons they each learned from the pandemic and how it affected their organizations. For Mr. Veloso, who also represented the Bankers Association of the Philippines, Mr. Hedrich also asked him to share some of the actions the Philippine government has taken, and how the banks dealt with those, and with the pandemic still raging, what would the Association expect the government to do differently going forward.

Mr. Hedrich also observed that Covid-19 certainly tested the resilience of many organizations, with many of them reacting to the challenge in a multitude of ways. Noting that the pandemic is unfortunately not the only crisis that organizations will be facing, he asked the panelists what they think are the lessons that can be drawn from the experience; what are the long-term, more fundamental lessons learned which will make them more resilient not just against a pandemic but more generally against other global disruptions they may be facing in the future, particularly in terms of new ways of working, new value propositions and business models, and changes to customer experience.

With regard to the new working environment where work-from-home remains a key component, Mr. Hedrich requested the panelists to share their thoughts and insights on how banks and other institutions can use data analytics to use this new normal of working; whether there is data-driven approach to enhance productivity in times of mixed home/office work environments, and how will such a technology enable an organization to weather disruptions better in the future. He also asked the panelists on what thy think is the right mix/arrangement for working in a bank will look like, and what will this mean for the branch networks, for example.

Mr. Hedrich further asked the panelists to share their thoughts – based on the experience, practices, and strategy of their respective organizations – on what other changes in business models, value propositions and use of technology can help banks and other organizations more resilient, and how, for instance, to make best use of data to find new solutions to problems such as managing customer data (moving away from traditional CRM systems).

With regard to the challenges brought about by the rapid pace of digitization and the changes in operating in the new norm – such as cyber risk, data privacy, and data biases – the panelists shared some of their experiences in, for example, their engagement with law enforcements agencies and how cybercrime impacts their digitization strategy; what they expect from their FinTech partners on the matter of data security; what does good data governance involve; and what do partners in an FS ecosystem focus on to ensure the resilience of the system.

The video of Session 4 can be viewed here.