"Asian Banking: Roadmap for Recovery and Sustained Growth"

November 9-10, 2023, The Soaltee Hotel, Kathmandu

Summary Report of the Proceedings

I. Introduction

Some 400 bankers from Asia-Pacific, the Middle East and other regions – composed mainly of members of the Asian Bankers Association (ABA) led by ABA Chairman Mr. Eugene Acevedo, President and CEO of the Rizal Commercial Banking Corporation from the Philippines, and of the Nepal Bankers’ Association led by President Mr. Sunil KC, gathered in Kathmandu, Nepal on November 9-10, 2023 for the 39th ABA General Meeting and Conference.

Some 400 bankers from Asia-Pacific, the Middle East and other regions – composed mainly of members of the Asian Bankers Association (ABA) led by ABA Chairman Mr. Eugene Acevedo, President and CEO of the Rizal Commercial Banking Corporation from the Philippines, and of the Nepal Bankers’ Association led by President Mr. Sunil KC, gathered in Kathmandu, Nepal on November 9-10, 2023 for the 39th ABA General Meeting and Conference.

Held at the Soaltee Hotel, the 2023 ABA Conference was doubly significant as it was the first time that the ABA conducted its annual gathering of members in Nepal and the first face-to-face meeting since the onset of the Covid-19 pandemic in early 2020.

Focusing on the theme “Asian Banking: Roadmap for Recovery and Sustained Growth”, the two-day event was designed to provide another valuable platform for ABA members to meet and network with each other, as well as to exchange views with invited experts on: (a) current trends and developments in the regional and global markets that are expected to have a significant impact on the banking and financial sector of the region, and (b) how industry players can address the challenges – and take full advantage of the opportunities – presented by these developments.

II. Opening Ceremony

The Conference was officially opened with the traditional Nepalese lighting ceremony officiated by the special guests from the country’s regulatory authorities and representatives from the ABA and the NBA.

The Conference was officially opened with the traditional Nepalese lighting ceremony officiated by the special guests from the country’s regulatory authorities and representatives from the ABA and the NBA.

In his Welcome Remarks, NBA President Mr. Sunil KC expressed his hopes that the 39th ABA General Meeting and Conference, which he said is the first annual gathering of CEOs and other high-level officers of ABA members banks from Asian countries being organised in Nepal, will help form the long-term strategy on their effective role in helping members of the Nepal Bankers Association and local regulatory authorities to face the challenges in the Nepali banking sector.

In his Welcome Remarks, NBA President Mr. Sunil KC expressed his hopes that the 39th ABA General Meeting and Conference, which he said is the first annual gathering of CEOs and other high-level officers of ABA members banks from Asian countries being organised in Nepal, will help form the long-term strategy on their effective role in helping members of the Nepal Bankers Association and local regulatory authorities to face the challenges in the Nepali banking sector.

A Special Address was delivered by Mr. Maha Prasad Adhikari, Governor, Nepal Rastra Bank (NRB). Governor Adhikari said the country’s economy is in normal state despite various challenges but that it needed to be made further dynamic. Stating that the time has come to completely restructure the means and resources of the banking sector directly contributing to the economic growth, he stressed on the need of securing sustainable economic growth.

He expressed concern that the inflation rate in the country was still above the limit set by the central bank, although noting that some emerging markets and developing economies have likewise been facing high inflation. “The escalating war between Israel and Hamas in West Asia and the drawn-out Russia-Ukraine conflict have posed a challenge in keeping prices stable. As a result of this, many central banks have continued to adopt strict measures through monetary policy, which means we will have to grapple with high interest rate for long time.”

Governor Adhikari said that Nepali banks have made progress in short time and stressed on the need of developing the digital banking system. He pointed out the need of the Asian banks to make the management effective by internalizing the possible risks so as to prevent problematic loans from increasing. The NRB Governor said the rapid technological change has benefited the banking system a lot and this has been transforming banking while stressing on its sustainability.

Nepal Finance Minister Dr Prakash Sharan Mahat, who delivered the Keynote Address, urged banks from Asia to invest in Nepal, noting that there are immense possibilities for investment in Nepal and called on the chief executive officers of the banks from the Asian countries to pump investment in Nepal.

Nepal Finance Minister Dr Prakash Sharan Mahat, who delivered the Keynote Address, urged banks from Asia to invest in Nepal, noting that there are immense possibilities for investment in Nepal and called on the chief executive officers of the banks from the Asian countries to pump investment in Nepal.

“There is big opportunity for investment in Nepal for the private sector as well as for foreign investors. Hydropower sector has huge potentials for investment in the context of India pledging to purchase 10,000 megawatts power from Nepal in 10 years. Therefore, I urge you to invest in hydropower development without any inhibition. The government is committed to facilitating this,” the Finance Minister reiterated.

Stating that the government will promote green energy through policy measures, he said Nepal has set the target of achieving the zero-carbon emission goal by 2045 making all sectors of the economy carbon-free. Finance Minister Mahat said the World Bank and the Asian Development Bank have also expressed their commitment to invest in the mega hydroelectric projects in Nepal and assured the participating bank CEOs that the government will create an investment-friendly climate to attract foreign direct investment. He added that investment has been increasing in the hydroelectricity development sector in recent years. He stated that policy arrangements are being made by the government placing electricity production, small industries and agriculture in priority.

In his Closing Remark, Mr. Eugene S. Acevedo, Chairman, Asian Bankers Association, cited some of the significant trends and developments in the global market development that have important implications for the banking industry. He said that a combination of well-established forces and recent developments is reshaping banking. The global economy is becoming increasingly digitalised, and some of the emerging technologies have the potential to be truly transformative, even as they pose new challenges. At the same time, fintech innovators have emerged into the scene, equipped with capital and chasing scale ahead of financial returns, while new consumer trends continue to re-shape the evolving role of banks. Industry leaders recognize they need to accelerate change—not only to compete but to find new paths to growth – as they see the importance of developing and improving the resilience of the banking system.

In his Closing Remark, Mr. Eugene S. Acevedo, Chairman, Asian Bankers Association, cited some of the significant trends and developments in the global market development that have important implications for the banking industry. He said that a combination of well-established forces and recent developments is reshaping banking. The global economy is becoming increasingly digitalised, and some of the emerging technologies have the potential to be truly transformative, even as they pose new challenges. At the same time, fintech innovators have emerged into the scene, equipped with capital and chasing scale ahead of financial returns, while new consumer trends continue to re-shape the evolving role of banks. Industry leaders recognize they need to accelerate change—not only to compete but to find new paths to growth – as they see the importance of developing and improving the resilience of the banking system.

He therefore stressed that a strong banking sector will be needed for a strong recovery from the pandemic of the past three years, and for a sustainable growth going forward. “Banks must continue to focus on customers’ needs to help them recover from the impact of COVID-19. Equally, banks must adapt their operating models to drive efficiency and resilience. Furthermore, to avoid any increase in fraud or of cyber risk, banks should look to scale up their risk management capabilities to contend with surging credit requests, in a secure remote environment” he stated.

He called on ABA and its members to play a role to play in helping members address the challenges before us, underscoring the importance of networking to encourage greater interaction among individual bankers and banking sectors in the Asian region will be crucial to enable us to go forward. “We all have our own comparative strengths and our economies are highly complementary. Greater openness and deeper cooperation within the region will be crucial for the sustained fast growth of Asian economies. Deeper regional integration under the current circumstances can help us better leverage our comparative strengths,” he remarked.

III. Press Conference

A Press Conference was convened immediately after the Opening Ceremony with the participation of key officers of ABA and NBA led by ABA Chairman Mr. Eugene Acevedo and NBA President Mr. Sunil KC. During the Press Conference, the ABA and NBA officers fielded questions from invited representatives of both local and international media about the Conference, the ABA and the NBA.

IV. Host Bank Session

As in previous Conferences, the Nepal Bankers’ Association organized a Host Bank Session on the morning of Day One. Focusing on the theme “Reimagining Nepal’s Economic Growth”, the session featured speakers who shared their valuable perspectives on the future growth prospects of Nepal’s economy, what factors are expected to exert a significant influence its future growth direction, the challenges it faces, what policy measures should be set in place to mitigate their adverse impact, and the opportunities the country offers to both domestic and foreign investors going forward.

Chaired by Mr. Maha Prasad Adhikari, Governor, Nepal Rastra Bank and moderated by Mr. Sujeev Shakya, CEO, Beed Management, the speakers included:

Chaired by Mr. Maha Prasad Adhikari, Governor, Nepal Rastra Bank and moderated by Mr. Sujeev Shakya, CEO, Beed Management, the speakers included:

- Babacar S. Faye Country Representative for IFC in Nepal, World Bank Group

- Ms. Heidi Tavakoli, Deputy Head of Mission, British Embassy Kathmandu

- Mr. Ramesh Kumar Hamal, Chairman, Securities Board of Nepal

- Mr. Sunil KC, President, Nepal Bankers’ Association

A Special presentation was also conducted thereafter on Climate Risk by Ms. Amal-Lee Amin, Director of Climate Diversity and Advisory, British International Investment.

V. Special Session on “Connecting and Exploring Opportunities with ABA”

This special session featured Brief country presentations by selected ABA member banks on the economy and the financial markets in their respective countries, or on special programs, projects, products or services that have benefited their customer base or the community they serve and may be adapted by member banks from other countries

The country presenters were:

- Mr. Dilshan Rodrigo, Executive Director & Chief Operating Officer, Hatton National Bank

- Mr. Mostafa Beheshti Rouy, Senior Advisor to CEO & Board of Directors, Bank Pasargad

- Mr. Karl Stumke, CEO & Managing Director, Bank of Maldives

VI. ABA Policy Advocacy Committee Meeting

Chaired by Ms. Ma. Christina Alvarez, Senior Vice President and Head of Corporate Planning at the Rizal Commercial Banking Corporation, the meeting of the ABA Policy Advocacy Committee considered position papers prepared by representatives of ABA member banks and knowledge partners on policy issues of current concern to the banking sector.

Chaired by Ms. Ma. Christina Alvarez, Senior Vice President and Head of Corporate Planning at the Rizal Commercial Banking Corporation, the meeting of the ABA Policy Advocacy Committee considered position papers prepared by representatives of ABA member banks and knowledge partners on policy issues of current concern to the banking sector.

The presenters – who all made their presentations virtually – included the following:

- Ms. Pelin Ataman, Chief of Sustainability at the Banks Association of Turkiye, presented its Association’s paper on “Banking Sector from the Perspective of Climate Change and Sustainable Finance: Latest Trends in Turkiye.”

- Mr. David Kim, Head of Sustainability at the Bank of East Asia Ltd. shared information on the Bank’s efforts and initiatives to help achieve the UN Sustainable Development Goals (SDGs), how the Bank is addressing challenges in implementing its activities aligned with the SDGs, how the Bank is preparing for the effects of climate change, and programs and policies of local regulators and other pertinent organizations aimed at achieving the SDGs

- Mr. Shirish Pathak, Managing Director of Fintelekt Advisory Services Ltd., a Knowledge Partner of the ABA, will present a paper on “Global Factors Impacting AML Compliance in Banking.”

VII. ABA Election Committee Meeting & ABA Advisory Council Meeting

The ABA Election Committee convened on November 9 to review the results of the canvassing of votes conducted earlier by the ABA Secretariat as part of the election of the ABA Board members who will serve for the term 2024-2025.

The ABA Election Committee convened on November 9 to review the results of the canvassing of votes conducted earlier by the ABA Secretariat as part of the election of the ABA Board members who will serve for the term 2024-2025.

This was immediately followed by the ABA Advisory Council Meeting, which discussed policy issues of current concern to the Association, including the possible candidates for the position of new ABA Chairman and new ABA Vice Chairman, as well as possible host and venue of the 2024 ABA General Meeting and Conference.

VIII. Four Plenary Sessions

The Conference Proper was held on November which consisted of four plenary sessions addressing the following topics of current interest to the banking industry:

(1) Plenary Session One focused on “Global Market Trends Shaping the Future of Banking” and featured speakers who shared their perspectives on how to leverage on banking disruptors, the need for developing the right talent for the current market environment, the challenges posed by geopolitical risks, the impact of inflation and how rising interest rates are catalyzing product innovation, the renewed focus on branches, the new world of possibilities opened up by metaverse, the growing demand for the right talents in the banking sector, and emerging risks particularly in the wake of bank closures in the West.

(1) Plenary Session One focused on “Global Market Trends Shaping the Future of Banking” and featured speakers who shared their perspectives on how to leverage on banking disruptors, the need for developing the right talent for the current market environment, the challenges posed by geopolitical risks, the impact of inflation and how rising interest rates are catalyzing product innovation, the renewed focus on branches, the new world of possibilities opened up by metaverse, the growing demand for the right talents in the banking sector, and emerging risks particularly in the wake of bank closures in the West.

Moderated by Mr. Paul Bosbach, Executive Director, Head of Trade Finance and Home Markets Desk Asia, Erste Group Bank AG, the session featured the following speakers:

- Dr. Le Xia, Chief Economist for Asia, BBVA

- Mr. Abdul Abiad, Director, Macroeconomics Research Division, Asian Development Bank

- Mrs. Negin Tootoonchian, Head, Risk Management Department, Bank Pasargad

- Mr. Pekka Dare, President, International Compliance Association (ICA)

(2) Plenary Session Two addressed the topic on “Digital Transformation: Enabling Digital Trust and Adoption of AI.” The session pointed out that as digital banking grows in popularity, cybersecurity will become even more important. To protect customer data and prevent cyberattacks, banks will therefore need to invest in advanced cybersecurity measures. Invited speakers examined the need for banks to implement digital trust to prevent customer account takeover and credential thefts and how they can gain customer confidence with convenient digital trust solutions and services.

(2) Plenary Session Two addressed the topic on “Digital Transformation: Enabling Digital Trust and Adoption of AI.” The session pointed out that as digital banking grows in popularity, cybersecurity will become even more important. To protect customer data and prevent cyberattacks, banks will therefore need to invest in advanced cybersecurity measures. Invited speakers examined the need for banks to implement digital trust to prevent customer account takeover and credential thefts and how they can gain customer confidence with convenient digital trust solutions and services.

Moderated by Mr. Mostafa Beheshti Rouy, Advisor to the CEO and Board Member, Bank Pasargad, the session featured the following speakers

- Mr. Rajan Narayan, CEO, Cyberbeat Pte. Ltd.

- Mr. Dilshan Rodrigo, Executive Director and Chief Operating Officer, Hatton National Bank

- Mr. KuoChan Tseng, COO, Authme

- Ms. Neda Zendehdel. Head, Information Security Department, Bank Pasargad

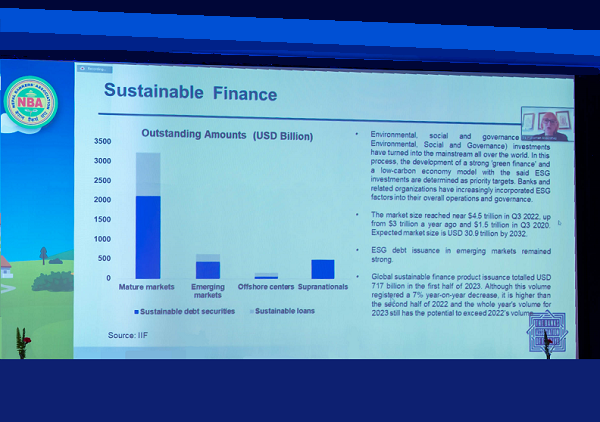

(3) Plenary Session Three tackled the topic “ESG Banking Strategy: Integrating Policy, Principle and Profit” The session noted that as the world grapples with environmental and social challenges such as climate change, social inequality, and governance failures, the importance of ESG considerations has never been more apparent. Invited speakers explored the key trends currently driving ESG, how a forward-looking ESG data and technology road map can help banks get ahead of growing regulatory and consumer demands, how banks that prioritize ESG are likely to be better positioned for long-term success as they can help to create a more sustainable and equitable future for all stakeholders.

(3) Plenary Session Three tackled the topic “ESG Banking Strategy: Integrating Policy, Principle and Profit” The session noted that as the world grapples with environmental and social challenges such as climate change, social inequality, and governance failures, the importance of ESG considerations has never been more apparent. Invited speakers explored the key trends currently driving ESG, how a forward-looking ESG data and technology road map can help banks get ahead of growing regulatory and consumer demands, how banks that prioritize ESG are likely to be better positioned for long-term success as they can help to create a more sustainable and equitable future for all stakeholders.

With Mr. Eugene S. Acevedo, ABA Chairman and President and CEO, Rizal Commercial Banking Corporation as Moderator, the session featured the following speakers:

- Dr. Sandip Shah, Chairman and Managing Director, Pashupati Renewables Pvt. Ltd.

- Mr. Rajendra Theagarajah, Chairman Emeritus, ABA

- Mr. Ehsanul Azim, Principal Investment Officer and Country Anchor, Financial Institutions Group, IFC

(4) Plenary Session Four was a CEO Forum on “Managing in Uncertainty and a Changing Environment.” The session noted that the business landscape is becoming more unpredictable than ever due to economic slowdown or disruptions, increasing competition, technological advancements, trade tensions, environmental concerns, political unrest, and social change. Many business leaders agree that it is a tough time to be leading any business right now — including banking. The session invited CEOs who shared their valuable perspectives on the different kinds of uncertainty a business might face and how to adapt to and overcome the challenges.

(4) Plenary Session Four was a CEO Forum on “Managing in Uncertainty and a Changing Environment.” The session noted that the business landscape is becoming more unpredictable than ever due to economic slowdown or disruptions, increasing competition, technological advancements, trade tensions, environmental concerns, political unrest, and social change. Many business leaders agree that it is a tough time to be leading any business right now — including banking. The session invited CEOs who shared their valuable perspectives on the different kinds of uncertainty a business might face and how to adapt to and overcome the challenges.

Moderated by Mr. Daniel Wu, Member, ABA Advisory Council, the session featured the following invited CEOs as speakers:

- Mr. John Berry, CEO and Secretary General, Qorus

- Mr. Raphaël Goué, CEO, Euracific Strategies

- Mr. Dorji Kadin, CEO, Bank of Bhutan

- Mr. Ashoke SJB Rana, CEO, Himalayan Bank Ltd.

IX. 39th ABA General Meeting Proper

During the 39th ABA General Meeting Proper, members were presented with: (a) the ABA Chairman’s Report summarizing the activities of ABA since the last General Meeting held in 2022, and (b) the results of the election of new Board Members for 2024-2025.

(a) Chairman’s Report

In his Chairman’s Report, Mr. Acevedo noted that over the past year, despite the limitations caused by geographic distance, resource availability, and of course the lingering pandemic, the ABA has continued to undertake activities to further enhance the value of the Association to our members and the Asian banking sector. “Many of you were involved in the conceptualization and implementation of these activities. I wish to thank you for your kind support and contribution in these efforts. Without your cooperation, we would not have achieved as much as we have in many of our past year’s projects.”

In his Chairman’s Report, Mr. Acevedo noted that over the past year, despite the limitations caused by geographic distance, resource availability, and of course the lingering pandemic, the ABA has continued to undertake activities to further enhance the value of the Association to our members and the Asian banking sector. “Many of you were involved in the conceptualization and implementation of these activities. I wish to thank you for your kind support and contribution in these efforts. Without your cooperation, we would not have achieved as much as we have in many of our past year’s projects.”

He proceeded to summarize the activity report in the following areas” (a) Preparations for the 39th ABA General Meeting and Conference; (n) Policy Advocacy; (c) Professional Development Program; (d) Information Exchange and Publications; (e) Membership recruitment efforts; and (f) ABA’s Financial Condition

(b) Election of New ABA Board Members

The ABA General Membership finalized the election of the new members of the Board of Directors who would serve for the next two years from 2024 to 2025. ABA Advisory Council Member Mr. Daniel Wu presented the following list of member banks – composed of 19 entities from 11 countries – that were voted into the Board:

The ABA General Membership finalized the election of the new members of the Board of Directors who would serve for the next two years from 2024 to 2025. ABA Advisory Council Member Mr. Daniel Wu presented the following list of member banks – composed of 19 entities from 11 countries – that were voted into the Board:

- Bank of Bhutan (Bhutan)

- The Bank of East Asia, Ltd. (Hong Kong)

- State Bank of India (India)

- EN Bank (Iran)

- Bank Pasargad (Iran)

- MUFG, Bank Ltd. (Japan)

- Mizuho Bank Ltd. (Japan)

- Sumitomo Mitsui Banking Corp. (Japan)

- Bank of Maldives (Maldives)

- Rizal Commercial Banking Corp. (Philippines)

- Hatton National Bank Ltd. (Sri Lanka)

- Bank of Taiwan (Taiwan)

- CTBC Bank (Taiwan)

- First Commercial Bank (Taiwan)

- Mega International Commercial Bank (Taiwan)

- Bangkok Bank, Ltd. (Thailand)

- Vietnam Bank for Industry and Trade (Vietnam)

- Vietnam Bank for Agriculture and Rural Development (Vietnam)

- Erste Group Bank (HK) (Austria)

The newly elected Board elected Mr. Morris Li, Chairman of CTBC Bank from Taiwan, as ABA Chairman for 2024-2025. Mr. Mostafa Beheshti Rouy, Board Member and Adviser to the CEO, Bank Pasargad of Iran, as voted as Vice Chairman.

X. Turnover Ceremony

A formal Turnover Ceremony was conducted immediately after the election of the new ABA Chairman and new Vice Chairman.

A formal Turnover Ceremony was conducted immediately after the election of the new ABA Chairman and new Vice Chairman.

During the Turnover Ceremony, Outgoing Chairman Mr. Eugene Acevedo first delivered his Valedictory Address. In his Address, Mr. Acevedo said that “despite the difficulties we all faced due to the pandemic since the onset of the pandemic in 2020, we continued to strongly support ABA’s vision of promoting cooperation among banks in the region and advancing the interests of the Asian banking sector. We remained committed to its objective of providing a forum – most of it online – for an effective exchange of information and networking among its members. Above all, I have become a stronger believer in the capacity of ABA to serve as a vehicle for member banks to develop long-term relationship and friendship, which is the binding force that will make the Association grow stronger in the years to come.”

The Incoming ABA Chairman and incoming Vice Chairman then took their Oath of Office, with ABA Advisory Council Member Mr. Daniel Wu administering the oath-taking ceremony. This was then followed with the symbolic turnover of the ABA flag by Outgoing Chairman Mr. Acevedo to the Incoming Chairman Mr. Li to symbolize the transfer of the mantle of leadership of the Association.

Mr. Li thereafter delivered his Acceptance Speech. He said that the ABA Chairmanship carries with it enormous responsibility and challenges. “Recognizing that the ongoing changes and uncertainties in the world market continue to have a significant impact on the region’s financial sector, I realize I have a daunting task ahead of me. As we’ve heard from our speakers during the past two days, the banking sector has entered a period of many new challenges and opportunities. A number of developments taking place in many of the advanced economies are having significant implications on Asia’s financial markets and the global economy as a whole”

Mr. Li expressed his hopes that during his term, ABA will continue to play a crucial role in the further development of the Asian banking sector. “Together, we will do our best to make ABA an even more effective forum for advancing the cause of the banking sector and for promoting regional economic cooperation. I believe we are in a position to do just that, given the vast and rich resources our membership can provide.”

Distinguished Service Awards were presented to Outgoing Chairman Mr. Eugene Acevedo and Outgoing Vice Chairman Mr. Oliver Hoffmann (accepted on his behalf by Mr. Paul Bosbach), for their outstanding accomplishments in pursuing the objectives of the ABA and promoting the interests of its members during their two-year tenure amidst extraordinary challenges and difficulties in the market environment.

A Plaque of Appreciation was also presented to Nepal Bankers Association for hosting the 39th ABA General Meeting and Conference in Kathmandu, and for the excellent arrangements made for the gathering and for their warm and generous hospitality to the delegates

XI. 61st & 62nd ABA Board of Directors Meeting

The ABA also convened the 61st and 62nd ABA Board of Directors’ meetings during which they discussed internal policy issues and took action on a number of important matters.

The ABA also convened the 61st and 62nd ABA Board of Directors’ meetings during which they discussed internal policy issues and took action on a number of important matters.

(1) 61st Board of Directors/ Meeting

The 61st ABA Board of Directors’ Meeting was essentially a Strategic Planning Meeting. Members of the Board discussed the future role and direction of the Association in the next five years and beyond, and the activities, programs and projects it needs to undertake and implement, to ensure that it continues to promote the interest of and to remain of value its members and the region’s banking sector as a whole, taking into account the new realities in the regional and global market environment.

The 61st ABA Board of Directors’ Meeting was essentially a Strategic Planning Meeting. Members of the Board discussed the future role and direction of the Association in the next five years and beyond, and the activities, programs and projects it needs to undertake and implement, to ensure that it continues to promote the interest of and to remain of value its members and the region’s banking sector as a whole, taking into account the new realities in the regional and global market environment.

The Board deliberated on a number of discussion issues that are expected to have a significant impact on the development and growth of the Association in the foreseeable future.

(2) 62nd ABA Board of Directors’ Meeting

The 62nd ABA Board of Director’s Meeting was convened by the newly-elected Board of Directors. During the meeting, the Board:

The 62nd ABA Board of Director’s Meeting was convened by the newly-elected Board of Directors. During the meeting, the Board:

(1) Adopted its 2024-2025 Work Program outlining activities over the next two years in the area of policy advocacy, information exchange, training and professional development, strengthening relationship with other regional and international organizations, and membership expansion.

(2) Formally admitted the International Compliance Association as its newest Associate Member

(3) Approved the following policy papers that were earlier discussed and finalized by the ABA Policy Advocacy Committee:

- Paper on “Banking Sector from a Perspective f Climate Change & Sustainable Finance: Latest Trends in Turkiye” prepared by the Banks Association of Turkiye

- Paper on “Promoting Cooperation in Achieving Sustainability Development Goals” prepared by The Bank of East Asia Ltd.

- Paper prepared by Fintelekt Advisory Services Ltd. “Global Factors Impacting AML Compliance in Banking”

(4) Approved the Proposed ABA Budget for 2024

(5) Agreed to confer the title of “Chairman Emeritus” to Mr. Daniel Wu, Member of the ABA Advisory Council, for having remained actively involved in the Association since his term as Chairman ended in 2018.

(6) Formally accepted the offer of CTBC Bank Ltd, under the Chairmanship of the newly elected ABA Chairman Mr. Morris Li, to host the 40th ABA General Meeting and Conference in Taipei in 2024 at a date and venue to be advised later.

(7) Approved the creation of a Planning Committee Meeting to meet and discuss preparations for the 40th ABA General Meeting and Conference in the early part of 2024.