![]() The Asian Bankers Association and Fintelekt Advisory Services jointly presented on June 10, 2020 a special webinar of the 2020 series on “Ultimate Beneficial Ownership Identification: Challenges and Best Practices.” The webinar convened a very large audience of close to 800 registrations from over 35 countries.

The Asian Bankers Association and Fintelekt Advisory Services jointly presented on June 10, 2020 a special webinar of the 2020 series on “Ultimate Beneficial Ownership Identification: Challenges and Best Practices.” The webinar convened a very large audience of close to 800 registrations from over 35 countries.

The webinar moderated by Shirish Pathak, Managing Director, Fintelekt Advisory Services, counted with the participation of two expert speakers who shared their knowledge and insights on the complex issue of ultimate beneficial ownership. The first speaker was Chua Choon Hong, Head of Compliance Solutions – APAC, Bureau van Dijk, A Moody’s Analytics Company, while the second speaker was Debmalya Maitra, senior Director – BFSI, Chokshi Group.

SUMMARY

The key points elaborated during Choon’s presentation were:

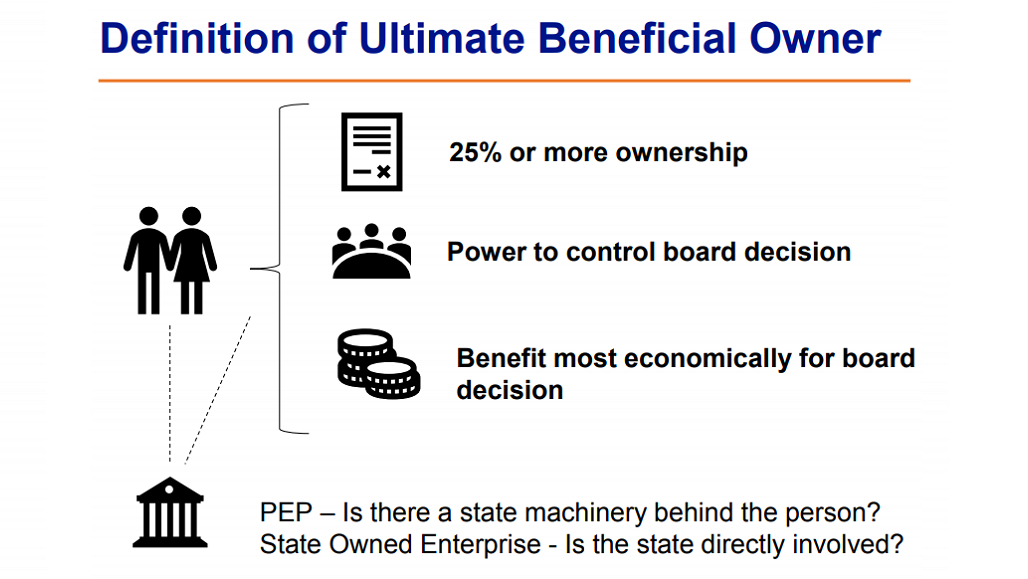

- The definition of UBO varies across countries and across institutions, but the key objective is to find out who owns, controls and benefits from Board decisions of companies.

- Governments around the world are planning to launch various stimulus packages to revive their economies. Banks and financial institutions must have visibility on beneficial owners so that the intended parties benefit from stimulus packages and tax breaks.

- There is a significant AML risk in cross-border transactions as banks depend on each other to do due diligence on counterparties. Banks need to understand who are the beneficial owners (BOs) from the originator of the funds through to its beneficiaries.

- It is recommended that while trying to understand BOs, banks should start with the greatest risk with the largest business value and then move to screen for high value corporate clients. They should create a risk-based approach process for the banks onboarding and transactions monitoring systems.

- Debmalya Maitra, Senior Director – BFSI, Chokshi Group spoke next about legal structure and components, misuse of corporate entities for illicit purposes, characteristics of a beneficial owner and FATF guidelines, common methods of misuse & red flag indicators, customer due diligence process and sources of information.

The key ideas discussed during Debmalya’s presentation were:

- A financial institution may have to test several levels in the legal structure of a company to determine who is the beneficial owner or who controls the entity.

- Lack of adequate, accurate and timely information on beneficial ownership is a major concern for financial institutions. Any delay in such information helps in disguising the identity of the BO, ascertaining the actual purpose and source and use of funds.

- Intermediaries providing services like registering companies, opening operating bank accounts, purchasing and managing property and other operational compliance related service on behalf of the owners/ controllers often become (sometimes unwittingly) a screen behind which a criminal can hide. Lack of regulations for intermediaries and lawyer’s privilege helps in obscuring the information.

- Periodic review of the risk profile is very important. A financial institution may not get all information that is required in one go, and there may be changes in the organization which need to be tracked on a continuous basis.

- The two presentations were followed by a question-answer session in which participants asked questions around practical aspects of UBO identification such as KYCC (Know Your Customers’ Customer), common tools in verification of customer details, determination of UBO in case of nominees or Special Purpose Vehicles or trusts, treatment of banks in sanctioned countries, etc.

RELATED MATERIALS

ABA has also made available for consultation the following webinar’s materials:

(1) The webinar’s presentations in PDF format can be downloaded HERE.

(2) The video presentation of the UBO webinar is available in the ABA Youtube channel.

Leave a Reply