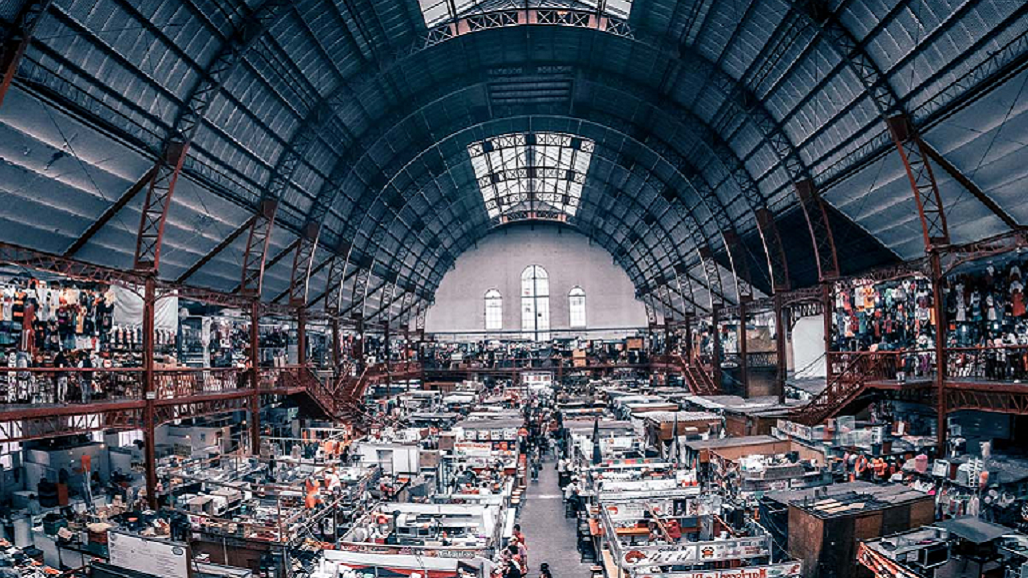

Photo: Unsplash

An image of a warehouse. In the post-COVID-19 world, there are three primary considerations a company should consider in supply chain site selection

Cost is no longer the most important aspect of supply chain site selection

The COVID-19 outbreak has been an ugly shock to the system for global manufacturers. Though experts have been warning about the risk of globally dispersed supply chains for years, few companies were truly prepared for the pandemic. Ultimately, companies with local or diversified supply chains have been most able to mitigate the impact. Others have been caught flat-footed. The majority (75%) of companies surveyed by the Institute for Supply Management said they have experienced disruption, and four out of 10 (44%) said they had no plan in place to address supply disruptions from China.

The COVID-19 outbreak has been an ugly shock to the system for global manufacturers. Though experts have been warning about the risk of globally dispersed supply chains for years, few companies were truly prepared for the pandemic. Ultimately, companies with local or diversified supply chains have been most able to mitigate the impact. Others have been caught flat-footed. The majority (75%) of companies surveyed by the Institute for Supply Management said they have experienced disruption, and four out of 10 (44%) said they had no plan in place to address supply disruptions from China.

Across industries, there are new and urgent conversations happening in boardrooms around how to improve mid-term resilience, and among manufacturers about whether to relocate plants — away from China in many cases — and how to put into place contingency labor and production plans that can survive future disruptions. Leaders, trying to wring some clarity from the chaos, are considering ideas for the reinvention phase of the pandemic response that can mitigate the impact of future black swan events.

Manufacturers will ultimately have to choose between two extremes: not doing anything — and hoping this will never happen again — or making investments in mapping and relocating supply networks to be better prepared if or when future disruptions occur.

Shifting Supply Chains

Of course, betting only on option one is a risky gamble. According to a Thomas survey, 31% of respondents are turning down or delaying orders. Twenty-eight percent said they were looking for alternative suppliers internationally, and another 28% said they were looking for new suppliers domestically. Any company that fails to protect its production will be at risk of losing future contracts and existing customers.

For example, if a pharmaceutical company locates all of its plants for a key medication in the Philippines and that country is subsequently hit by a catastrophic typhoon, it could knock out all manufacturing of the drug, leading to liability, loss of business and even loss of customers’ lives. However, if that company had already diversified and located even a portion of its facilities closer to home, it would have the ability to shift production and potentially avoid a shortfall.

This same scenario can repeat itself in disruptions of supplies for original manufacturer components or consumer goods. While the threat may not be life or death, it could be existential for manufacturers who are unable to resolve off-shoring risks. More than 80% of fashion brands have said they already planned to reduce sourcing from China, and many companies are reacting similarly to Wistron Corporation, an iPhone assembler that recently told analysts it plans to locate 50% of its capacity outside of China by 2021.

Prioritizing Site Resilience

Vital industries, such as pharmaceuticals or medical supplies, may have no choice but to diversify production. There is mounting public pressure in the United States to move essential production of pharmaceuticals and medical equipment closer to home, with several bipartisan bills already in play. Japan has also made moves in this direction, putting $2.2 billion of its COVID-19 economic stimulus package into supporting manufacturers who shift production outside of China.

In the post-COVID-19 world, a company should consider three topics when choosing a location: labor market, cost and ecosystem.

For many companies, this will mean a combination of possible solutions such as opening new, additional plants closer to consumers; expanding current plants in more favorable locations; closing existing plants and re-opening in a new location; and deprioritizing cost as the main factor in site selection — in favor of resilience.

Once a decision is made to move near-shore, one of the first questions will be, “Where should we locate?” Prior to COVID-19, Mercer’s site selection was typically based on these three criteria: cost of the labor force, cost of real estate and regulatory burden, and proximity to the existing supply chain.

Cost Is Not Overriding Concern

The convergence of cheap and plentiful labor with a low overall cost of doing business is how so many plants ended up in East Asia over the past decades. However, site cost can no longer be the only driver with the risk of disruption being as high as it is today.

In the post-COVID-19 world, what are the primary considerations a company should consider in choosing a location? There are three main considerations companies will likely prioritize: labor market, cost and ecosystem.

The labor market, or quality and composition of the workforce, should always come first. Companies should enhance their focus on workforce and labor planning, taking the time to thoroughly explore talent availability and labor quality in the areas under consideration.

Secondly, cost is not going to disappear as a critical component of this decision. Companies will be considering the comparative impact of labor costs — and other considerations like incentives and taxes — for each potential site.

And the last factor that will significantly grow in importance in the post-COVID-19 manufacturing world will be the ecosystem that provides structure and resilience to each potential plant, including infrastructure, community attractiveness, business climate and potential risks incumbent upon the available choices. How this ecosystem provides resilience in the face of shocks like COVID-19 will be of utmost importance.

Related themes: Boardroom Risk Mitigation Supply Chains

Matthew Stevenson

Matthew Stevenson

Partner and Leader of Mercer’s Workforce Strategy and Analytics Practice

Matthew Stevenson is a partner and leader of Mercer’s Workforce Strategy and Analytics practice, specializing in workforce productivity and strategic workforce planning.

Uniko Chen

Uniko Chen

Principal of Mercer’s Workforce Strategy and Analytics practice

Uniko Chen is a principal in Mercer’s Workforce Strategy and Analytics practice, specializing in workforce management practices and labor market conditions.

The original article can be read at Brink website HERE.

Leave a Reply