Background

1. The track record of the European cross-border fund product UCITS is impressive. Established over two decades ago and with over 5000 funds available for distribution in Asia (2009), it is the most popular cross border innovation on the market. Initiatives taken in the past by Asian organizations and international asset managers to set the stage for a regional home-grown product of this nature have been hampered by a lack of investment opportunities in Asian equity and bond markets, liquidity issues and the various stages of economic and regulatory development of countries in the region, making it near impossible to promote an asset management framework of this dimension.

2. The Asian crisis in 1997, led to a number of collaborative efforts to promote and develop Asia’s financial markets and to improve its regulatory framework. Following the credit crisis in 2008 with many international investors looking for better market opportunities and emerging Asian countries growing significantly in the post crisis period, the idea of developing a similar passport scheme for Asian funds to meet specific regional requirements gained momentum. The rise of Asia’s middle class consumer spurred demand for innovative and locally manufactured products. Asia’s large elderly population with its growing pension needs could also benefit from a collective funds scheme of this nature. With increased cooperation between the fund management industry and banking organizations in Asia, the concept of a regional passport for investment funds is no long just on a wish list.

Objectives

Objectives

3. At the meeting of the ABA Policy Advocacy Committee in July 2011 in Colombo it was proposed with the assistance of Dr. Parrenas to explore the possibilities of promoting a regional funds passport scheme to bring ABA’s work on capital market development to a higher level.

4. This paper examines some of the developments in the Asian bond market and work undertaken in promoting the establishment of a regional funds passport system. Furthermore a case study on the development of financial markets in Thailand has been incorporated into this paper. The ultimate aim is to establish a multilateral framework facilitating the cross-border selling of Asian investment funds among participating nations and increasing cooperation between regional regulators.

Description of the Funds Passport Scheme (based on UCITS)

5. The idea behind a funds passport vehicle is to facilitate the marketing and sale of investment funds across a region. This concept was initiated in Europe over 25 years ago with the establishment of UCITS (Undertakings for the Collective Investment of Transferable Securities). The UCITS Directive (1985) allowed investment funds once registered in a single member state to be easily marketed across all other jurisdictions of the European Union.

6. UCITS have however evolved in complexity and are no longer simple mutual funds. The implementation of UCITS II and UCITS III (2003) opened a plethora of new possibilities for funds allowing for derivatives on financial indices, closed-end funds, fund of funds and hedged funds increasing the inherent risk of UCITS significantly. The latest UCITS IV regime (July 2011) refines the Directive further by allowing a single master fund in one country and the setting up of smaller feeder funds in other EU countries or for different types of investors with the aim of promoting larger investment funds that would benefit from economies of scale. With this latest initiative, investment funds are required to publish a Key Investor Information Document (KIID) giving investors a clearer picture of the fund and making it comparable with other funds.

7. Investors are prone to easily accept standardized and regulated products such as UCITS. However the increased level of sophistication of this regime today, have raised concerns about the suitability of such a model for retail investors and whether the rules governing UCITS actually serve their goal. The Madoff investment scandal in 2008 leading to large losses in UCITS compliant funds was a painful reminder that regulation alone is not enough. In setting the stage for an Asian funds passport scheme however many lessons can be learnt from the development of the UCITS framework.

State of Asian Markets today

8. Whilst much has been achieved in Europe and USA in capital market development the position in Asia has been woefully inadequate. Pension coverage in the USA and Europe is estimated to be around 80% and 60% respectively, whilst in Asia not surprisingly only 15%.

| % of Global Population | Funds under Management | ||

| Asia | 60% | 13% | |

| EU | 13% | 35% | |

| USA | 7% | 52% | |

The pension systems in many emerging Asian economies are underfunded and in their current form inadequate to meet the needs of the region’s rapidly increasing elderly population. Early retirement ages and the weakening of the family support mechanism provide additional financial pressure to these pension systems. Asians traditionally relied on their children to support them in their old age with many generations living under one roof. However social changes that accompany economic development have created smaller family units less conducive to support the extended family.

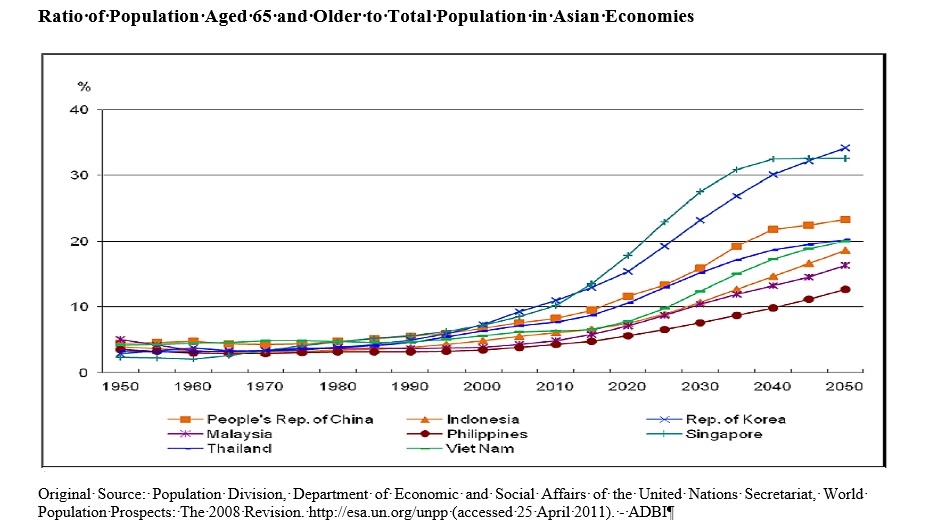

A key factor in Asia’s economic development in the recent decades has been the rapid expansion of its young labour force which has significantly contributed to regional economic growth, better distribution of wealth and greater savings. This regional dividend is seen however as coming to an end and Asia’s elderly population is expected to grow by over 20% in the next two decades.

Original Source: Population Division, Department of Economic and Social Affairs of the United Nations Secretariat, World Population Prospects: The 2008 Revision. http://esa.un.org/unpp (accessed 25 April 2011). – ADBI

Notwithstanding above the case for strengthening Asian Bond Markets is strong given the following factors.

- Large savings pools and economies of scale

- Potential for increasing investor choice and diversification – Intra Asia and globally

- Retention of fund management jobs and expertise within Asia

9. In the wake of the 1997 Asian financial crisis, regional policymakers and international organizations recognized the importance of developing the bond market in Asian economies to increase the efficiency of the financial system and promote regional growth.

10. Some causes for the crisis were:

- Lack of a regulatory framework for the banking sector with poor standards of governance and accountability.

- Over-reliance on bank borrowing

- Funding of domestic long term projects through short term foreign currency denominated loans which created currency and maturity mismatches.

11. Since then and propelled by the global sub-prime crisis in 2008, progress has also been made on a regulatory level with many developing nations adopting the Basel Capital Accord.

12. The benefits of promoting an efficient bond market were to:

- Reduce currency risk and maturity risk

- Diversify sources of borrowing and reduce counterparty risk

- Provide alternative channels of financing private and public investments

- Increase investor confidence and product choice

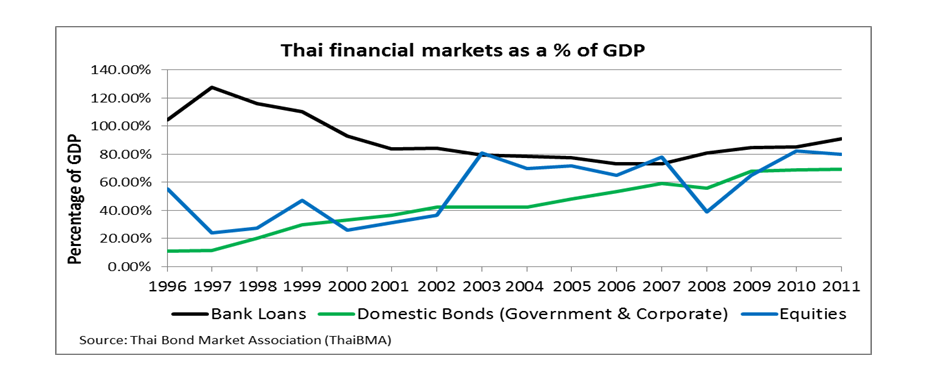

13. Whereas emerging Asian equity markets are well established and have been dominating

the global market in performance over the last few years, the level of development of the bond markets still vary significantly from one jurisdiction to the other. This is mainly due to the different stages of economic development and unique features of each country’s financial structure.

14. A number of initiatives have been made by international organizations to promote the Asian bond market by developing the government and corporate bond sectors together with the banking system. Some of these collaborations have been highlighted below.

A. The Asia Pacific Economic Cooperation (APEC)

15. A project which APEC began in 1998 with the assistance of the World Bank and the Asian Development Bank aimed at developing a bond market for APEC member countries was intensified in 2002 with the development of securitization and credit guarantee markets with efforts further intensified in 2003 by increasing cross-border talks and bi-lateral cooperation.

APEC members include Australia, Brunei Darussalam, Canada, Chile, China, Hong Kong, Indonesia, Japan, Malaysia, Mexico, New Zealand, Papua New Guinea, Peru, Philippines, Republic of Korea, Russia, Singapore, Taipei, Thailand, United States and Vietnam.

B. The Association of South East Asian Nations + China, Japan and Korea (ASEAN+3)

16. The Asian Bond Markets Initiative (ABMI) launched in 2002 by members of ASEAN+3 and strongly supported by the Asian Development Bank, had the primary aim of developing efficient and liquid bond markets in the region with a better utilization of “Asian savings for Asian investments”. The establishment of a Credit Guarantee and Investment Facility (CGIF) fund to extend credit for the issuance of corporate bonds in the Asian region was one of the objectives of this program with the intention of spearheading market activity in the primary corporate bond segment.

Further Milestones:

17. In 2005 the ABMI roadmap proposed a new framework which collated and shared information on bond market development, promoting self-assessment by member countries based on feedback from market participants and the launch of a study on an Asian currency basket bond.

18. These initiatives were further enhanced in 2007 by exploring new debt instruments, promoting the securitization of loan credits and receivables and the promotion of an Asian MTN program.

19. In 2008 the roadmap was to include promoting the issuance and facilitating the demand of local currency denominated bonds, improving the regulatory framework and infrastructure for the bonds markets.

Note: ASEAN+3 member countries include Brunei Darussalam, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, Vietnam plus China, Japan and Korea.

C. The Executives’ Meeting of East Asia and Pacific (EMEAP)

20. Another initiative to develop financial markets was the establishment of bond funds by the EMEAP to facilitate the introduction of investment trusts.

Asian Bond Fund (ABF1 and ABF2)

21. The Asian Bond launched by the central bank forum EMEAP comprising of 11 member countries is managed by BIS (Bank of International Settlement). It was the first bond fund to be launched in Asia (2003) promoting cooperation between regional central banks and encouraging the bond market development of EMEAP member states.

EMEAP Members: China, Hong Kong, Indonesia, Korea, Malaysia, Philippines, Singapore and Thailand. Additional Members: Australia, New Zealand and Japan.

ABF1

22. The original ABF referred to as ABF1 was denominated in US dollars with seed money of $1bn received from the 11 EMEAP member central banks. The fund invested in dollar bonds issued by eight governments and quasi-government organizations of the member countries.

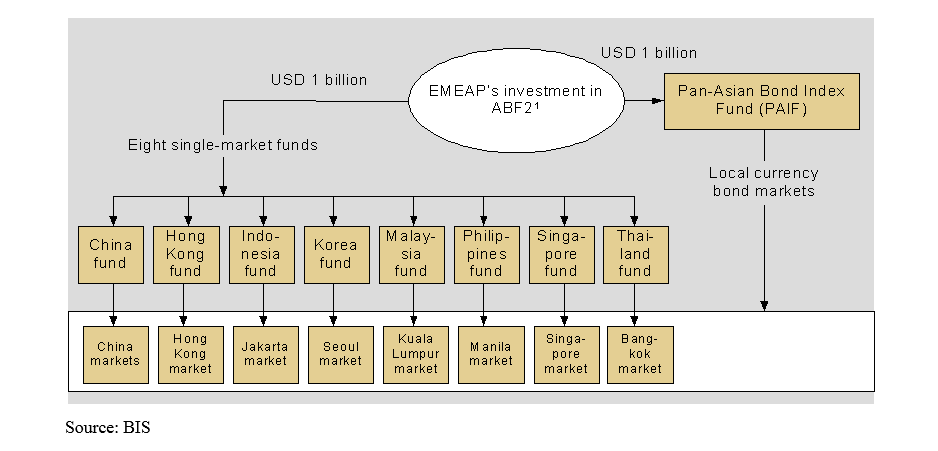

23. The second stage of the Asian Bond Fund (ABF2) was launched in 2005 with an initial capital of $2bn and invested in local currency bonds also issued by governments and quasi-government organizations of the eight EMEAP member countries mentioned above. Under the ABF2 umbrella nine separate bond funds were formed.

The PAIF fund manager is State Street Global Advisors and custodian bank is HSBC.

ABF2

- The Pan Asia Bond Index Fund (PAIF)

- Eight single market bond index funds

24. As a result of these collaborative efforts Asian Bond markets have developed considerably in the past 10 years but still lags behind the developed markets. More progress is needed especially in the development of the Asian corporate bond market which is still at an infancy stage or non- existent in some emerging countries.

24. As a result of these collaborative efforts Asian Bond markets have developed considerably in the past 10 years but still lags behind the developed markets. More progress is needed especially in the development of the Asian corporate bond market which is still at an infancy stage or non- existent in some emerging countries.

Building blocks and critical success factors for the development of an Asian bond market

- Efficiency and further liberalization of emerging markets

- Improved regulatory standards and corporate governance

- Policies promoting liquidity, tax reforms for investors

- Long term capital flows to emerging economies from the developed Asian countries

- An internationally recognized clearing system

- Vulnerability of Asian equity markets and currencies to global market volatility

- Increased market literacy and broader investor base

- Financial integration in regional markets

- Greater responsibility of emerging economies in growth of global economy

The development of an Asian funds passport

25. A report published by State Street estimates the growth capacity of Asia’s $3.9 trillion (2009) in collective fund assets to be over 10% in 2014 for selected emerging markets and as much as 15.3% for regional giants such as China. In spite of the lack of a common Asian currency or regional authority such as the European Union, the consensus is that financial innovations with a solid regulatory framework such as the EU funds passport vehicle score high on investor confidence and developing a passport scheme for Asian funds would provide international investors with a wider array of off-shore products in otherwise inaccessible markets. Such a scheme would also increase cooperation between Asian regulators, facilitate cross-border marketing of local products and lead to integration of the fast growing emerging Asian economies into the regional framework. The Australian government has also shown its growing interest in the establishment of an Asia region funds passport scheme to support its expansion plans into global markets.

26. In order for the asset management industry to grow however, efficient and diversified equity and bond markets are pre-requisites. So promoting the development of these markets is key to the development of the asset management industry in the emerging economies.

The benefits:

- Fast growing emerging economies would have access to cheaper capital to fund their expansion plans, diversification of savings and investments from pension funds can fund demand

- Cross border products would allow asset managers to access a larger pool of investors and achieve economies of scale

- Investors would have a broader and cheaper array of financial products to choose from, giving them access to smaller markets and local expertise

- Growth in the asset management industry would lead to more job opportunities and retain expertise and talent in Asia

Critical factors:

- Setting up a level playing field promoting less developed Asian markets

- A solid regulatory framework

- Cross border cooperation in the development of fund products which focus on Asia rather than just the domestic market

- Increase investor awareness and dissemination of information

- Developing technology tools to facilitate product implementation

Case study – Thailand

27. The decision to select Thailand as our country case study is to highlight the development of Thailand’s financial sector being a story of growth with unprecedented initiatives for change and adjustment in the aftermath of the 1997 Asian financial crisis. The case study also provides an overview of Thailand’s regulatory policy known as the Financial Sector Master Plan (FSMP) which highlights the country’s ability to manage economic and market shocks effectively. With this analysis we hope to share some of the lessons learnt with other nations wishing to develop their financial markets to a higher level.

Background

28. With the influx of Japanese capital in the late 1980s and early 1990s, Thailand had a manufacturing-led economic growth supported by inexpensive labour, liberalized foreign investment policies and developments in the private sector. During this period commercial banks played an important role in mobilizing funds though bank deposits with little activity seen in the domestic bond market.

29. Following the Asian crisis in 1997 with investor confidence at a low, the country’s financial system went through a major restructuring program to reform the local regulatory framework, strengthening corporate governance of banks and implementing initiatives to reduce reliance on banks and external sources of funding.

30. In the midst of extensive political unrest, Thailand enjoyed a solid export driven growth from 2000 to 2007 only to be severely hit by the global economic crisis in 2008 cutting exports drastically in most sectors. In 2010 exports rebounded and the country’s GDP growth of 7.6% during the year made it one of the fastest growing economies in Asia. Despite the polarized political situation, business and investor sentiment remained positive and the stock market continued to grow. The historic floods in 2011 that inundated more than two-thirds of the country’s 77 provinces, disrupting supply chains on a global scale also highlight the major role played by Thailand in the world economy.

31. In spite of these setbacks, the projected economic growth rate for the country in 2012 and 2013 are 5.5% and 7.5% respectively (Bank of Thailand, April 2012). The short-term outlook for the country is favourable however significant risks still remain due to the uncertainties of the world economy.

Regulatory and policy decisions

1999 – 2003 Emergency measures which included closing down insolvent companies, recapitalizing viable companies and introducing debt restructuring mechanisms. Building blocks for formation of the Financial Sector Master Plan.

2004 – 2014 Financial Sector Master Plan (FSMP) – A medium term development and reform program to create a more transparent and internationally competitive financial market.

Phase I (2004-2009) involved increasing efficiency of the financial sector by

- Restructuring the licensing system of commercial banks (prior to this multiple types of licenses were issued to financial institutions).

- Limiting operations of foreign banks and number of new entrants to the banking sector.

- Bank of Thailand (BOT) empowered as the sole regulator and supervisor of financial institutions.

- Establishment of a committee to promote micro financing, with government owned special institutions (SFIs) to play a greater role in lending to the underserved sectors.

- Increasing access to financial services amongst the unbanked and for small enterprises by providing incentives to banks on the risk weights assigned for certain types of loans when determining their capital requirements thus freeing funds for the extension of credit to the undeveloped sectors.

- Improving consumer protection through formation of the Deposit Protection Act (DPA). The aim is to replace the blanket deposit guarantee system with a limited deposit guarantee, increasing the responsibility of banks and reducing the public cost of the deposit insurance system.

- Banks required to update deposit and lending interest rates on their websites on a daily basis and submit this information to BOT. Consumers can then compare rates across banks by accessing the BOT website.

Phase II (2010-2014) to concentrate on:

- Reducing system-wide operating costs caused by distressed assets arising from the 1997 financial crisis

- On improving financial competitiveness of banks by allowing them to expand their product lines and branch into other business areas such as mutual funds and venture capital management.

- New and existing foreign bank subsidiaries will be allowed to open up to 20 branches from 2012 with the aim of increasing competitiveness of domestic commercial banks.

- Strengthening of risk management practices in financial institutions

Stage of development of Financial Markets

Bond Market

32. Thailand’s capital markets have come a long way. In 1994 the “Bond Dealers Club” (BDC) was set up to promote the secondary market for debt securities and introduced an electronic bond trading system for the first time in the Thai bond market. After receiving the Bond Exchange license from the SEC, BDC was renamed in 1998 as The Thai Bond Dealing Centre (ThaiBDC). A major reform by the ThaiBDC in 2005 was to centralize the trading platform at the Stock Exchange of Thailand (SET) providing trading information, bond data, reference yields and market and regulatory news on both the primary and secondary market through its websites.

33. To strengthen its role as a self-regulatory organization and information center, the ThaiBDC changed its status in 2005 to a licensed securities related association under the SEC Act and was named the Thai Bond Market Association (ThaiBMA).

34. As part of its commitment to promote best practices and assist in the development of the bond market, the ThaiBMA developed several key financials such as government bond yield curves and benchmark bonds. It has also initiated additional data techniques such as zero coupon, credit spreads, bond analysis and Value-at-Risk (VaR) for bond investment and portfolio management.

35. The Thai bond market can be categorized into three segments: government securities, corporate bonds and foreign bonds. The proportion of foreign bonds is very small and around 1% of the total domestic bond market. The corporate sector began issuing bonds in 1992 with approval required from the SEC prior to a corporate bond issuance and with credit ratings being a pre-requisite for all bond offerings with some exceptions.

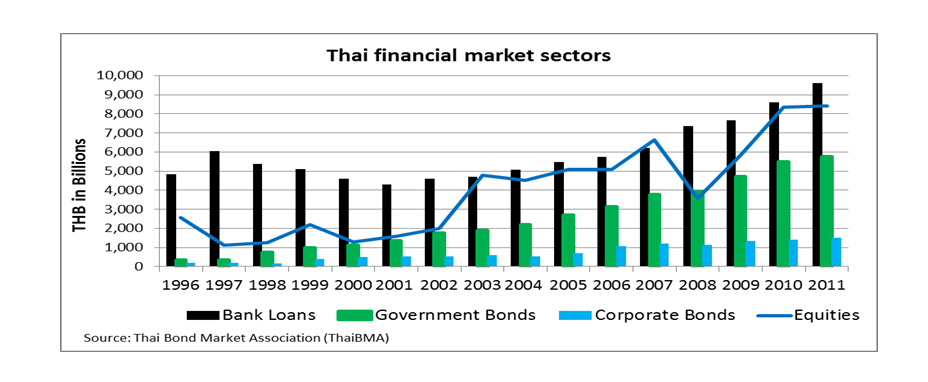

36. Following the 1997 economic crisis, the Thai government successively issued treasury bonds to finance the resulting budget deficit increasing the value of the bond market from THB 547 billion in 1997 to THB 1,883 billion at the end of 2001. Trading on the secondary market also increased substantially in the same period contributing to a robust bond market. The domestic bond market (government and corporate) at the end of 2011 was THB 7,327 billion.

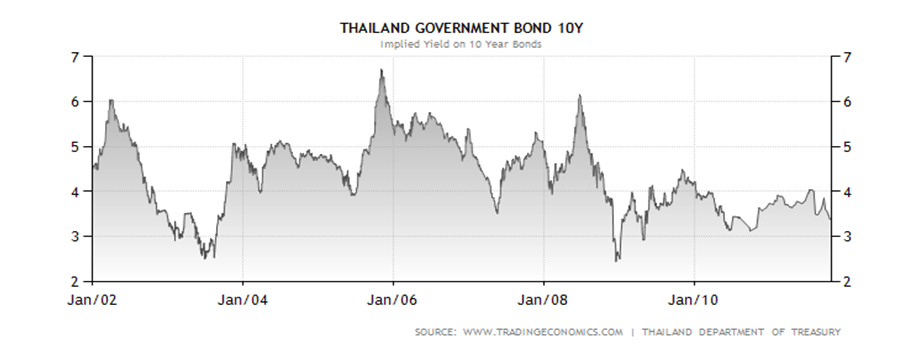

37. From 2000 until 2011, the yield on 10Y Thailand Government Bonds averaged 4.6% reaching a record high of 6.7% in late 2005. A record low of 2.4% was reached in 2008 mainly as a result of the global financial crisis. The yield required by investors to lend funds to governments reflect inflation expectations and the likelihood that the debt will be repaid. Since 2008, the yield on Thailand’s 10Y Government Bonds have rallied and are on an upward trend.

37. From 2000 until 2011, the yield on 10Y Thailand Government Bonds averaged 4.6% reaching a record high of 6.7% in late 2005. A record low of 2.4% was reached in 2008 mainly as a result of the global financial crisis. The yield required by investors to lend funds to governments reflect inflation expectations and the likelihood that the debt will be repaid. Since 2008, the yield on Thailand’s 10Y Government Bonds have rallied and are on an upward trend.

38. The ratio of Thai domestic bonds to GDP shows an increasing trend since the 1997 crisis although the issuance of corporate bonds remains relatively small. In 2011 government securities made up around 80% and corporate bonds around 20% of the domestic bond market. The ratio of the value of the bond market to GDP was 70% at the end of 2011, whereas the value of corporate issuance was only 14% and still needs developing.

38. The ratio of Thai domestic bonds to GDP shows an increasing trend since the 1997 crisis although the issuance of corporate bonds remains relatively small. In 2011 government securities made up around 80% and corporate bonds around 20% of the domestic bond market. The ratio of the value of the bond market to GDP was 70% at the end of 2011, whereas the value of corporate issuance was only 14% and still needs developing.

39. Local currency denominated foreign bonds made their debut in 2005 when the Asian Development Bank issued domestic bonds to the value of 4 billion Baht. In the same year under the Asian Bond Market Initiative (ABMI), the Japan Bank for International Cooperation issued a 5 year Thai bond for 3 billion Baht, the first bond to be issued by a foreign government on the Thai capital market with the aim of financing business operations of Japanese companies in Thailand.

39. Local currency denominated foreign bonds made their debut in 2005 when the Asian Development Bank issued domestic bonds to the value of 4 billion Baht. In the same year under the Asian Bond Market Initiative (ABMI), the Japan Bank for International Cooperation issued a 5 year Thai bond for 3 billion Baht, the first bond to be issued by a foreign government on the Thai capital market with the aim of financing business operations of Japanese companies in Thailand.

Equity Market

40. The stock market is one of the most important sources for companies to raise capital for business development. The liquidity that a stock exchange provides gives investors the confidence and ability to buy and sell securities with relative ease compared to other investments such as real estate or bonds.

41. The capital market in Thailand developed in two stages. The privately owned stock market known as the Bangkok Stock Exchange (BSE) began operating in 1962. Activity at the BSE was rather poor and stocks performed badly. The BSE finally ceased operations in the early 1970s. The general view is that the BSE did not succeed because of limited investor understanding of the equity market and also due to a lack of official support.

42. In 1974 the Securities Exchange of Thailand was formed and started trading in 1975. In 1991 its name was changed to the Stock Exchange of Thailand (SET). In 1997, in line with other regulatory reforms carried out after the crisis, the SET implemented new cap and floor price limits for trading and also introduced a circuit breaker system to reduce unusual volatility in the market which might cause investor panic. In addition to the SET index and sub-indices, the SET also calculates industry and sector indices.

Exchange Rates

Exchange Rates

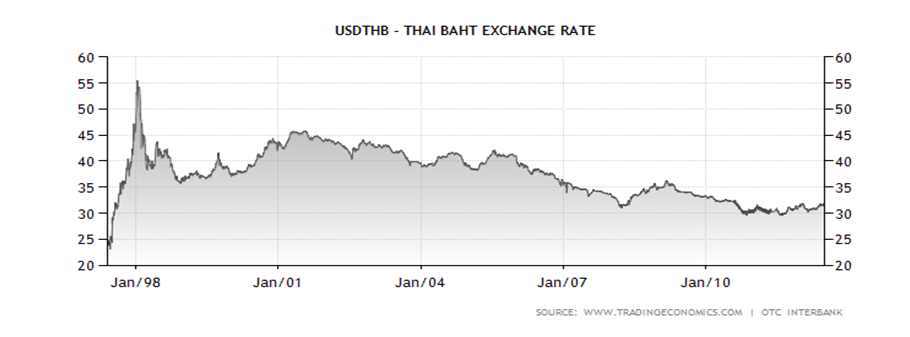

43. Historically from June 1997 to June 2012, the USDTHB reached an all-time high of 55.50 in January 1998 and a record low of 23.15 in June 1997. The current exchange rate is approx. THB 31.87 to the USD (June 25th 2012). Most significant is that despite the collapse of its currency in 1997, Thailand’s economy remained sound

Development of Investment Funds

Development of Investment Funds

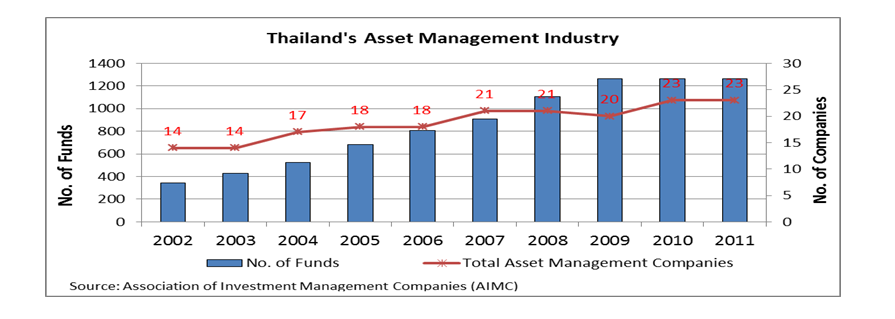

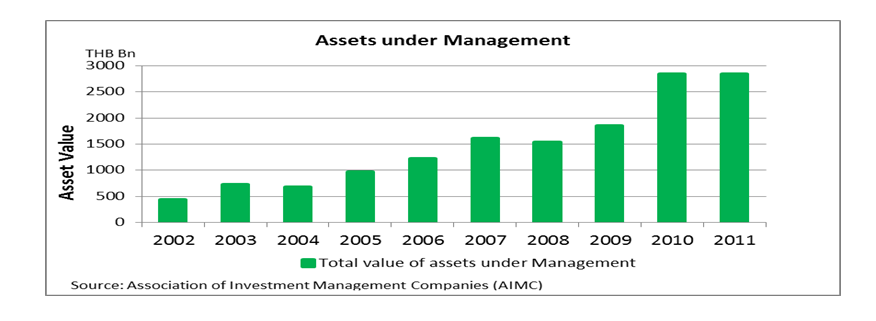

44. The development of the Thai asset management industry began in 1975 by the formation of the Mutual Fund Company which was controlled by the Thai Government and the International Finance Corporation (IFC). In 1992 the mutual fund industry was liberalized leading to a rapid increase in the number of funds available. In 2002, there were 346 funds under management, in 2011 the number increased to 1,265 funds. Assets also grew substantially from THB 435 billion in 2002 to THB 2,846 billion in 2011.

45. Today mutual funds dominate the market, followed by a smaller proportion of investments in private and provident funds. The major types of mutual funds offered in Thailand are fixed income, equity, balanced and property funds. Fixed income funds have the largest amount of assets under management at THB 1.23 trillion in 2010 in comparison to equity funds with assets of 261 billion under the same period. The local demand is for short-term money market funds, domestic fixed income and a growing interest for foreign debt from Asian countries like Korea and to some extent from China.

Challenges

Challenges

- Less variety of locally developed investment funds, more sophisticated funds offered by foreign-owned asset managers

- Mutual fund products more short term and offered as alternative to deposits leading to insufficient wealth at retirement

- Standard regulatory requirements for retail and high net worth individuals hamper potential to generate more income

Derivative Trading

46. The Thailand Futures Exchange (TFEX) formed in 2003 allows the trade of derivatives such as futures, options and options on futures on permitted underlying assets as approved by the SEC.

Pension system

47. The world’s population is ageing and Thailand is no exception. Like other Asian nations Thailand faces a rapidly ageing population ratio putting pressure on the country’s existing pension plans this in spite of the impressive measures taken recently in restructuring the entire pension system (2011).

Thailand has however over the past 15 years systematically developed its pension system along the lines of the World Bank Model.

- Pillar 1 comprises of a Social Security Fund (SSF) a mandatory benefit defined state pension system for the private sector and temporary government employees with some previous arrangements for civil servant which are being phased out.

- Pillar 2 comprises of a defined contribution Government Pension Fund (GPF) for civil servants Also company pension plans can be set up on a voluntary basis in the form of provident funds. For some types of employees setting up a provident fund is mandatory. The National Pension Fund (NPF) introduced in 2011 is another mandatory defined contribution pension scheme for private sector employees with the ultimate goal of stimulating retirement savings further and supplementing a worker’s old-age pension.

- Pillar 3 is a voluntary savings scheme in the form of mutual retirement funds that enjoys tax exemptions.

Key Learnings

- Promote liquidity in bond market and establishment of a secondary market

The Thai government issued a significant amount of debt instruments following the 1997 Asian financial crisis promoting liquidity and reducing reliance on banks and external sources of funding. At the end of 2011, the outstanding value of domestic bonds totalled THB 7,327 billion of which around 80% were government bonds.

The secondary market takes place through the OTC market or through the Bond Electronic Exchange (BEX), the latter is used for retail trading activities. Liquidity is provided by authorized dealers.

- Maintain stable currency

Thailand adopted a floating exchange rate policy in 1997, with market forces and economic data determining the value of the Baht. However in the case of extreme currency volatility in the market, the Bank of Thailand will intervene to stabilize the Baht. The Bank also maintained a policy to control excessive foreign exchange outflows which was relaxed to allow direct investment and portfolio investment abroad within permitted limits.

- Improve standards in corporate governance and risk management

Thailand has significantly improved the financial viability of its banks by addressing non-performing loans (NPLs) and implemented Basel II with effect from January 2009. Thai banks are required to maintain a minimum CAR of 8.5% under Pillar 1. Pillar 2 was implemented in 2009 with banks required to develop an internal capital adequacy assessment process (ICAAP) by the end of 2010. The BOT started the supervisory review and evaluation process (SREP) in 2011. Information is disclosed by banks since 2009 for Pillar 3. The Bank of Thailand has already indicated plans to implement the Basel III regime in 2013.

The Securities and Exchange Commission (SEC) and the Stock Exchange of Thailand (SET) have become more proactive in enforcing regulations, protecting the rights of minority shareholders and enhancing rights of shareholders. In 2002, the SET established a Corporate Governance Centre to offer advisory services to listed companies and in order to improve investor confidence in Thai capital markets.

- Establish effective market trading systems

The Thai Securities Depository Company, a subsidiary of the Stock Exchange of Thailand (SET) has implemented systems to provide the following services to its members: securities and fund registrations, securities depository, security clearing and settlement and back office services. The trading platform implement by the Thai Bond Market Association (ThaiBMA) at the SET provides trading information, bond data, reference yields and news on both the primary and secondary markets.

- Increase market literacy

The Securities and Exchange Commission (SEC) and the Stock Exchange of Thailand (SET) publish information on their web sites in order to educate investors about financial investments. They also provide training courses with the objective of familiarizing local investors with new products. The Financial Consumer Protection Centre (FCC) opened in 2012 by the Bank of Thailand plays an educational role, creating consumer financial awareness and understanding of their rights and responsibilities. It is also geared at addressing consumer complaints about the services of financial institutions.

- Broaden investor and issuer base

Regulatory developments allow non-residents to issue debt securities (Thai local currency bonds) and qualified local institutional investors to invest in foreign securities. Furthermore non-residents can invest in government bonds without any restrictions regarding repatriation of investment and return.

- Enhance existing pension system

The pension system based on the World Bank’s 3 Pillar Model was enhanced further and restructured in 2011 in order to stimulate additional funds being set aside for retirement.

Conclusions and Recommendations

Conclusions and Recommendations

48. Recent events in the US, Europe and Asia have demonstrated not only how important bond markets are but how important liquidity, transparency and efficiency are to the health of these markets. Thailand’s success story in developing an active capital market despite many obstacles faced (natural disasters and economic setbacks) is a good case study of ‘evolution’ and ‘growing pains’ for other Asian nations. Whilst much has been achieved in Europe and USA in capital market development, the position in Asia has been rather inadequate. Asian economies need to take a lead role in the establishment of local and regional cross border products, to provide foreign and domestic investors with a broader range of financial instruments which in turn will contribute to the development of their local markets and spearhead regional economic growth and integration.

49. Although it seems feasible to promote a funds passport for the more developed Asian countries where stable equity and bond markets exists, for the emerging economies with small treasury markets and non-existent corporate bond markets, development initiatives should be first on the agenda. The work done so far to promote Asian bond markets needs to continue and be intensified with promotion of bond markets in the non-member countries of these initiating organizations. Also governments together with asset managers need to look at ways of growing and promoting the local fund management industry. Countries which have a product structure in place need to promote bi-lateral talks with other smaller nations providing them with technical assistance to develop local and cross border products. The ABA can play an important role by initiating the dialogues for the Asian region in collaboration with governments of its member countries.

References

- Asian Development Bank – Asia Capital Markets Monitor (August 2011)

- Donghyun Park & Gemma B. Estrada, Developing Asia’s Pension Systems and Old-Age Income Support , ADBI Working paper series (April 2012)

- Guonan Ma, BIS- Opening markets through a bond fund: The Asian Bond Fund II presented at the APEC Seminar in 2005

- HYUN Suk and JANG Hong Bum – Bond Market Development in Asia (2008)

- Philip Turner, BIS Papers No 11 – The development of bond markets in emerging economies (June 2002)

- Price Waterhouse – Asia Region Funds Passport, the future of the funds management industry in Asia (2010) and web site http://www.pwc.com

- Rafael Consing – Creating an Efficient Asian Bond Market – The Private Sector Perspective (2003)

- State Street – Vision Focus: Asian Funds Passport to Growth (December 2010)

- ASEAN web site – http://www.asean.org/15030.htm

- Financial Services Council web site http://www.fsc.org.au/

- The Thai Bond Market Association web site http://www.thaibma.or.th/

- The Bank of Thailand web site – Press Release on the International Monetary Fund (IMF) web site http://www.bot.or.th/

- The Association of Investment Management Companies web site http://www.aimc.or.th/

- Nathaphan and P. Chunhachinda – Determinants of Growth for Thai Mutual Fund Industry, International Research Journal of Finance and Economics, Issue 86 (2012)

- Asia Focus July 2010 – Country Analysis Unit of the Federal Reserve Bank of San Francisco on Financial System Reform in Thailand

- Bank of Thailand – Thailand’s Financial Sector Master Plan Handbook website http://www.bot.or.th/Thai/FinancialInstitutions/Highlights/

- Bank of Thailand web site – http://www.seacen.org/GUI/pdf/publications/bankwatch/2012/16-BOT.pdf

- Thailand Investment Review – BOI October 2005